IFRS 10 is an accounting standard set by the International Accounting Standards Board (IASB), providing guidance for companies with multiple entities to remain compliant when consolidating their financials. It’s similar to ASC 810 (the US GAAP accounting standard for financial consolidation) but differs in some key areas. Although, it’s important to note that both will usually result in the same conclusions.

Companies that need to prepare financial statements under IFRS rules must pay close attention to the guidelines set out under IFRS 10. This blog serves as an aid for your team to understand the complexities introduced by the accounting standard.

If you have more general questions or need a refresher on the topic, check out our complete guide to financial consolidation before you continue reading this blog.

The objectives of IFRS 10 for consolidated financial statements

When it comes to IFRS 10, it’s best first to understand the objectives set out under the accounting standard. Put simply, IFRS 10 establishes principles for presenting and preparing consolidated financial statements when an entity controls one or more other entities.

Here are the key objectives of IFRS 10

- Requires an entity (the parent) that controls one or more other entities (subsidiaries) to present consolidated financial statements.

- Defines the principle of control, and establishes control as the basis for consolidation;

- Sets out how to apply the principle of control to identify whether an investor controls an investee and must consolidate the investee.

- Sets out the accounting requirements for the preparation of consolidated financial statements.

- Defines an investment entity and sets out an exception to consolidating particular subsidiaries of an investment entity.

Financial consolidation is based on identifying control

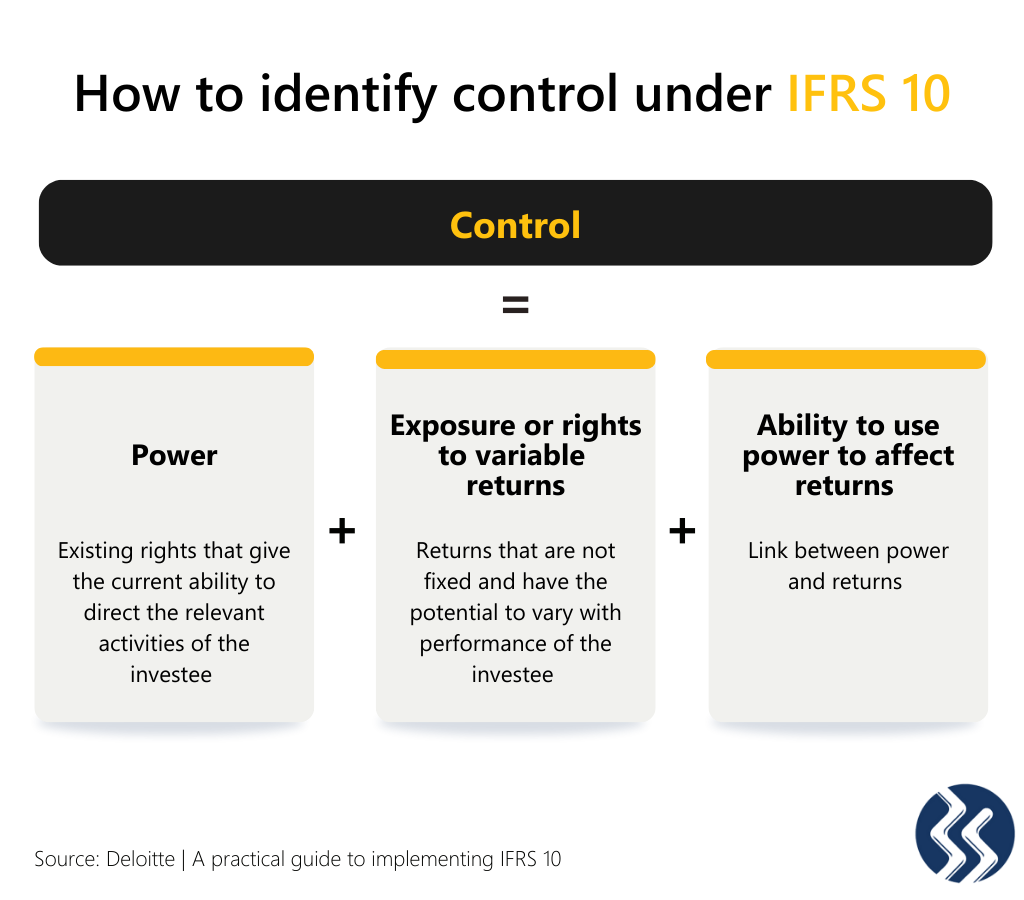

If you’re consolidating financial statements under IFRS 10, then the model is based on an investor’s control of an investee. Control is defined in the IFRS guidelines as follows, “An investor controls an entity when it is exposed, or has rights to variable returns with its involvement with the investee and has the ability to affect those returns through its power over the investee.”

Therefore, to control an entity, the investor must possess all three of the following elements:

- Power over the entity, which is defined as having existing rights that allow the investor to direct relevant activities of the entity, resulting in a significant effect on the entity’s returns

- Exposure or rights to variable returns from involvement with the entity

- Ability to affect investor’s returns through power over the entity

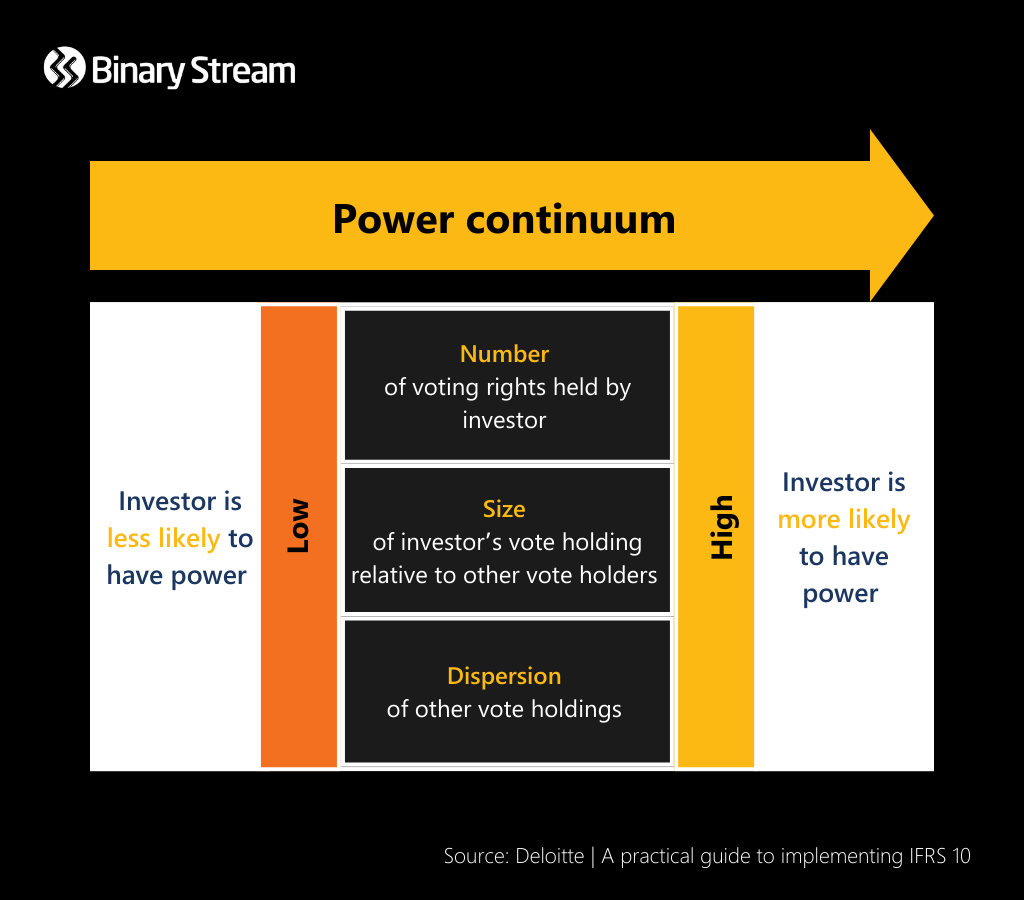

Assessing whether an investor has power over an entity

When a company is trying to identify which entities have control, they should consider each entity’s rights. Power usually arises from an entity’s rights, such as voting rights, the right to appoint key personnel, the right to decisions within a management contract, and removal rights.

An investor without a majority of voting rights may still possess sufficient substantive rights that grant it power (i.e. de facto power). While substantive rights relate to the practical ability to direct relevant activities, protective rights relate to fundamental changes to the activities of the entity or apply in exceptional circumstances. It’s important to note that protective rights do not result in power or control.

When determining if an investor’s voting rights are adequate to grant it power over an entity, leadership must consider the effect of the voting rights on the power continuum. If the decision is not clear, they must also take into account the following facts and circumstances outlined in IFRS 10:

- Voting patterns at previous shareholders’ meetings

- Whether the investor has the practical ability to direct the relevant activities unilaterally (e.g., the investee and the investor have the same key management)

- Whether the investor has a special relationship with the investee (e.g., the investee depends on the investor to fund a significant part of its operations)

- Whether the investor has a large exposure to variable returns (which may be an indicator that the investor had an incentive to obtain rights sufficient to give it power)

Assessing the link between power and exposure

Often an investor has greater incentive to obtain rights that reward power over an entity as it handles increased exposure to variable returns resulting from its involvement with that entity. Returns are not necessarily positive and can be negative, or a mix of both positive and negative. Some examples of returns include remuneration, cost savings, scarce products, proprietary knowledge, dividends, etc. Crucially, the magnitude of the returns does not factor into whether the investor holds power.

Key to determining if an investor has control is whether there is a link between power over an investee and returns. An investor that cannot benefit from its power over an entity does not have control. Likewise, an investor does not have control if it cannot use its power to direct activities that significantly impact the entity’s returns.

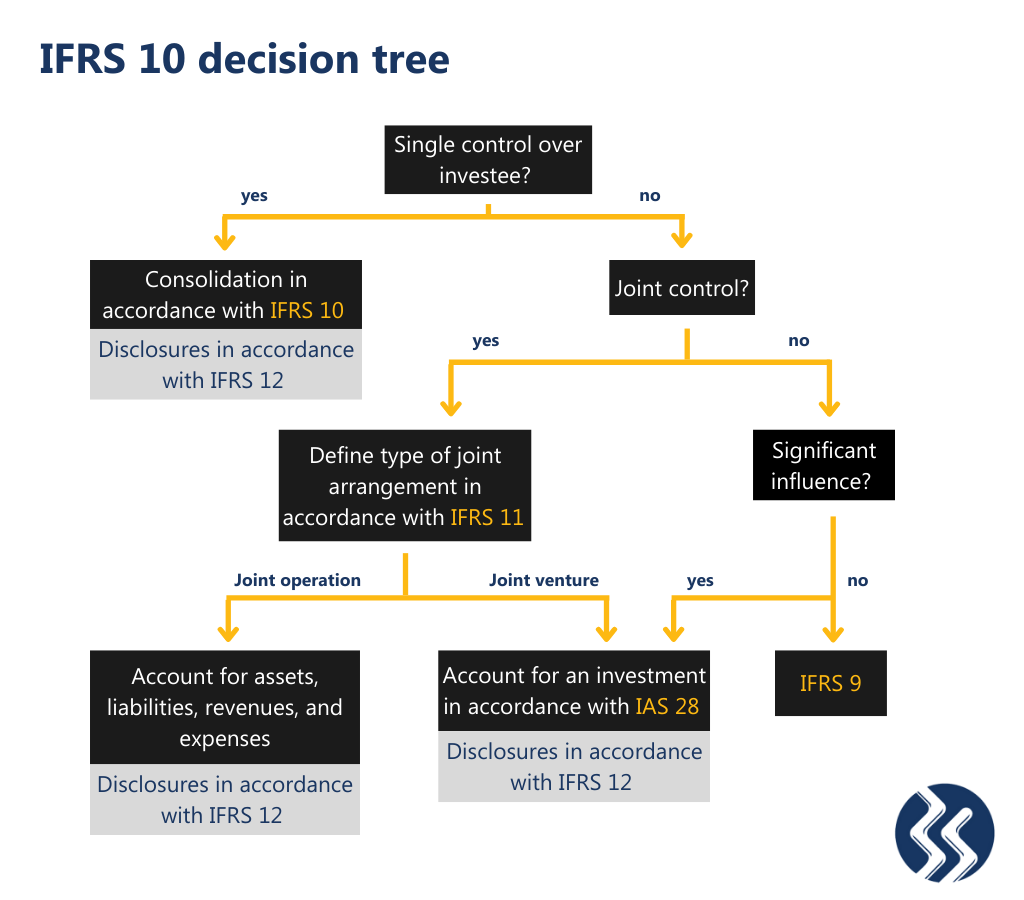

When leadership determines that an entity does not have control, the requirements of IFRS 11 and IAS 28 must then be considered to examine whether an investor has joint control, significant influence, or no governance over an entity.

The decision tree for IFRS 10

The following decision tree allows you to assess if IFRS 10 is the accounting standard that best suits your needs.

When is a parent company exempt from providing consolidated financial statements?

According to IFRS 10, a parent company is exempt from presenting consolidated financial statements if it meets all the following conditions:

- It is a wholly-owned subsidiary or is a partially-owned subsidiary of another entity and its other owners, including those not otherwise entitled to vote, have been informed about, and do not object to, the parent not presenting consolidated financial statements

- Its debt or equity instruments are not traded in a public market

- It did not file, nor is it in the process of filing, its financial statements with a securities commission or other regulatory organisation for the purpose of issuing any class of instruments in a public market, and

- Its ultimate or any intermediate parent produces financial statements available for public use that comply with IFRSs, in which subsidiaries are consolidated or are measured at fair value through profit or loss in accordance with IFRS 10.

Disclosures for financial consolidation

Disclosures are not specified in IFRS 10; however, the required disclosures can be found in IFRS 12 ‘Disclosure of Interests in Other Entities’. The accounting standard states that “a reporting entity should disclose significant judgements and assumptions made in determining whether it controls, jointly controls, significantly influences or has interests in other entities.”

Guidance for preparing consolidated financial statements under IFRS 10

We recommend reading the IFRS 10 guidelines in full. Here is a summary of just some of the critical areas the guidelines cover:

- Elimination of intra-group transactions and the parent’s investment.

- Introduction and adherence to uniform accounting principles.

- Financial statements used in the consolidation must all have reports issued with the same date.

- Accounting for losing control of a subsidiary.

- Accounting for changes in ownership interests where control is retained.

- Allocating comprehensive equity and income to subsidiaries.

Choose accounting software built to handle the complexities of IFRS 10

When it comes to compliance for financial consolidation, most companies will face a few challenges. You must invest in software that can appropriately meet the demands of accounting for multiple entities under IFRS regulations. Why not check out Multi-Entity Management, a solution built to help your company simplify processes and streamline financial consolidations.