The recent boom in subscription-based businesses led the Financial Accounting Standards Board (FASB) and International Accounting Standards Board (IASB) to develop new accounting standards, ASC 606 and IFRS 15, to regulate and standardize revenue recognition.

Companies must now follow a five-step approach:

1. Identify the contracts with a customer.

2. Identify the performance obligations in the contracts.

3. Determine the transaction price.

4. Allocate the transaction price to the contract’s obligations.

5. Recognize revenue as you satisfy the relevant obligations.

It seems simple enough, but translating these accounting practices to a recurring billing model can become complicated quickly. This blog will walk you through five best practices that enable compliance with ASC 606 and IFRS 15, so you can expertly handle revenue recognition without the headache.

If you’d like an introduction to the topic or want to refresh your memory, check out our previous blog on revenue recognition for subscription billing before continuing. The following advice will help you tackle some of the more advanced aspects of accrual accounting.

Interested in a specific best practice for maintaining compliance with ASC 606 and IFRS 15? Skip ahead by clicking on the topic below.

- Create a deferred revenue adjustment account

- Allocate variable consideration using an estimate

- Offset bad debts on revenue recognition schedule

- Perform routine revenue analysis

- Satisfy disclosure requirements

1. Create a deferred revenue adjustment account

One of the most important aspects of the five-step approach to revenue recognition is always to recognize revenue after satisfying the contract’s performance obligation(s). Recognizing the entire contract amount upfront before you’ve delivered the service counts as claiming unearned income.

If you claim unearned income, you could face hefty penalties for non-compliance and tricky situations if customers decide to complain, cancel their subscription, or ask for refunds. Maintaining an accurate revenue deferral schedule via an adjustment account is ideal for mitigating this risk.

What is an adjustment account?

An adjustment account is a summary account in the general ledger that records internal events rather than business transactions.

Why do you need a deferred revenue adjustment account?

Creating an adjustment account to track deferred revenue allows you to accurately recognize revenue as you fulfil the performance obligation(s) and treat unearned income as a liability.

Example: Using an adjustment account for flat-rate annual subscription

Company A has secured an annual subscription with a client at a flat rate of $18000, and that the client will pay the total upfront. Company A cannot recognize the full $18000 until the service has been provided, so the amount must be evenly divided across the term of the contract: one year.

For the first month, Company A can only recognize $1500 and the remaining $16500 must be booked in the deferred revenue account. For each subsequent month, Company A must credit the deferred revenue account and debit the sales account $1500.

2. Allocate variable consideration using an estimate

Subscription services often implement pricing models where the quantity or price will fluctuate. Usage-based billing and bundling are particularly common pricing models that require SaaS companies to account for variable consideration.

How to estimate the value of variable consideration

To maintain compliance with ASC 606 and IFRS 15, you’ll need to record an estimate of the amount considered. At the end of each reporting period, you must revise the estimates and adjust any resulting changes to the transaction price. Detailed below are two methods commonly used for estimating the value of consideration.

Method 1: Expected value

The transaction price is determined by summing the probability-weighted amounts of a range of possible outcomes. This method is most appropriate when the reporting entity has many contracts with similar characteristics, such as when a company implements the portfolio method of aggregating customer contracts.

However, companies are not obligated to use the portfolio practical expedient. Management is responsible for making reasonable estimates and applying them to numerous similar contracts such that the aggregate value of revenue must equal the sum of the expected amounts from the individual contracts.

Method 2: Most likely amount

The transaction price is decided as the most likely amount to be received. The best use case for this method is when there are only two possible outcomes because the expected value method is likely to return a significantly different value than the possible outcomes.

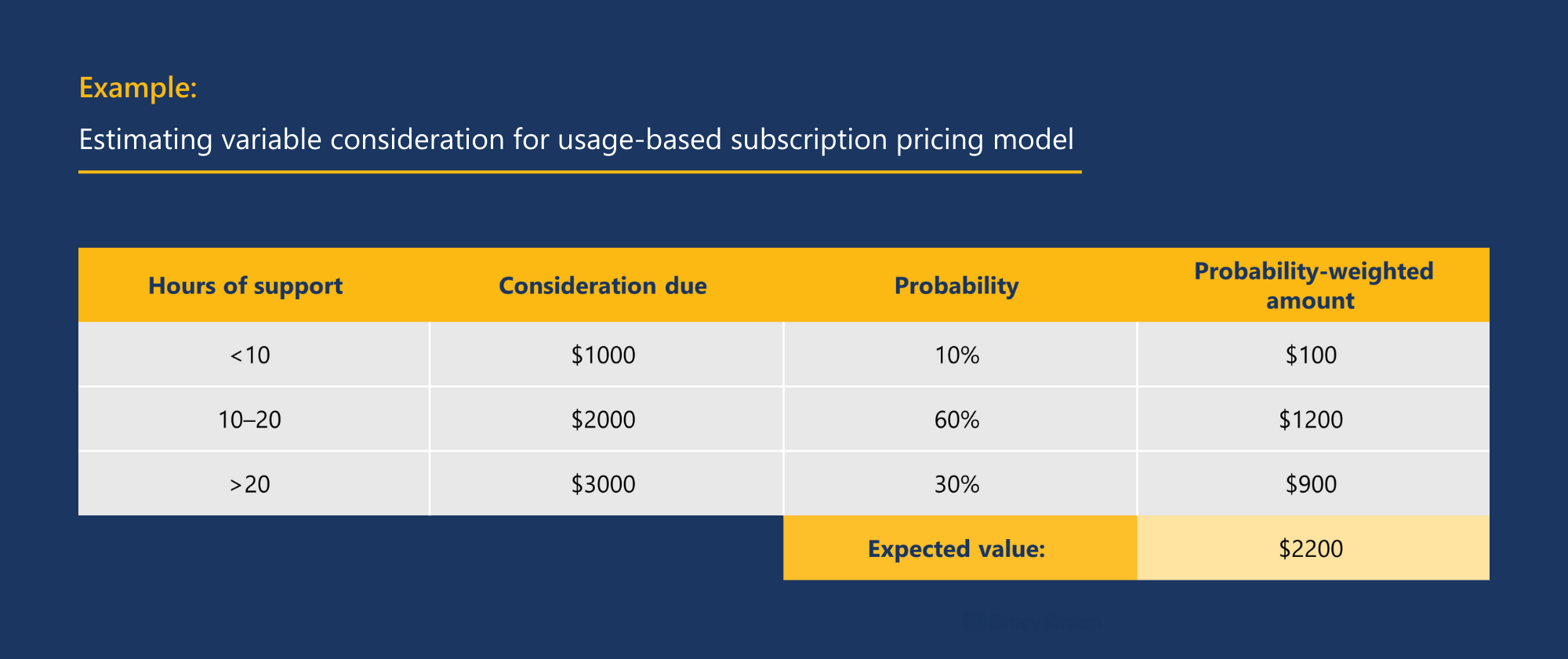

Example: Estimating variable consideration for usage-based subscription pricing model

Company B offers a support plan with three usage tiers. They charge $1000 if a customer uses under 10 hours of support, $2000 if the customer uses 10–20 hours, and $3000 if the customer uses over 20 hours of support over the contract term.

Company Y is interested in purchasing this support plan. Company B has worked with Company Y for many years and knows that they have a 10% chance of using under 10 hours, a 60% chance of using 10–20 hours, and a 30% chance of using over 20 hours. By summing the probability weighted amounts, they determine the expected value of the contract will be $2,200.

What is the constraint on variable consideration?

The value of the estimated consideration can only be included in the transaction price “to the extent that it is probable that significant reversal … will not occur” (606-10-32-11).

Determining whether the estimate must be constrained involves significant judgement and must include assessment of the likelihood and magnitude of revenue reversal. Many companies will consider this constraint while calculating the estimated variable consideration.

Recommended reading: What you need to know about ASC 606 for SaaS companies

3. Offset bad debts on revenue recognition schedule

There are many reasons why customers are unable to pay for goods and services, even after the due date. Bankruptcy, trade disputes, and fraud are a few cases where the amount owed is irrecoverable. So, what do you do if a customer doesn’t pay?

When a customer has not paid even after repeated dunning letters, the amount is deemed uncollectible and written off as bad debt. The amount is adjusted against your monthly recognized revenue during reporting to ensure that your receivables are not overstated in the financial statements.

Example: Full write-off for unpaid subscription

You have entered an annual contract of $24,000 with a customer for a subscription service in the month of January. Unfortunately, in May it is determined that the customer cannot pay the amount despite repeated dunning requests.

In your financial statement, you will add a credit entry that zeroes out the receivables balance and a debit entry to ensure that the irrecoverable revenue is not recognized in the income statement.

4. Perform routine revenue analysis

Performing routine revenue analysis will provide you with a deeper understanding of the distribution of earned and deferred revenue across different channels, allowing you to make data-driven decisions and maintain accurate accounts.

Especially in a transaction with multiple deliverables, it’s vital that you implement tools, like multiple element revenue allocation (MERA), to separately track and evaluate each revenue stream.

What is included in a typical revenue analysis?

A typical revenue analysis for a subscription business breaks down revenue sources into three channels; subscription revenue, revenue share from partnerships, and referrals. Within subscription revenue, you can further classify data based on a metered or fixed rate by subscription, customer, and plan.

Recommended reading: Calculating subscriber churn metrics for SaaS companies (with examples)

5. Satisfy disclosure requirements

Financial statement disclosures are more rigorous under ASC 606 and IFRS 15 than under previous revenue standards. The image below outlines the different annual revenue disclosure requirements for public companies.

Why do companies need to submit disclosures?

To bring transparency and clarity to your financial statements, disclosure requirements entail gathering additional explanatory information that covers the amount, uncertainty, timing, and overall nature of cash flow associated with contracts with customers.

What are private companies exempt from disclosing?

Private companies are not obligated to provide certain disclosures, and the requirements for interim periods are significantly pared down.

It is not mandatory for private companies to disclose:

- Disaggregated information

- Segment reporting data

- Reasons for significant changes in contract balances

- Reasons for timing of performance obligations and payment terms

- Any qualitative or quantitative information about contract costs

- The aggregate amount of the transaction price allocated to the remaining performance obligation(s) and when the company expects to recognize that amount as revenue

- Whether the company has used any ASC 606 or ASC 340-40 practical expedients related to determining whether a significant financing component exists and the capitalization of incremental costs to obtain a contract

Maintain compliance with Subscription Billing Suite

No matter which subscription pricing model you implement or how frequently your bill your customers, a robust subscription management solution can make all the difference when handling complex revenue recognition.

Keeping track of deferral schedules and appropriately handling revenue allocation can become increasingly difficult if you’re relying on manual processes. Subscription Billing Suite ensures that your accounts are accurate, and your invoices delivered on time.