Many companies perform a range of monthly lease-related transactions; rent, property insurance fees, tenant improvement allowances, common area maintenance (CAM) charges, and sublease payments are just a few examples that require accurate accounting. The ideal lease management process involves a consistently up-to-date lease portfolio with custom real-time reports and scalable accounting practices to maintain compliance.

So, what happens if you mismanage your leases? The short answer is wasted time and lost revenue. If you want to reposition your company to better align with the ideal management process, you’ll need to dig to discover why your team is struggling. This blog walks you through seven common lease administration mistakes that hold companies back and teaches you how to diagnose and fix poor property lease management.

Interested in a one of the lease administration mistakes? Click on the topic below to skip ahead.

- Losing track of critical dates

- Delayed and inaccurate payments

- Missing or incomplete lease documentation

- Neglecting to review building operating expenses

- Rushing the tenant vetting process

- Poor data management

- Overlooking non-compliance

1. Losing track of critical dates

As your lease portfolio expands, manually keeping track of critical dates to prevent payment penalties can become an impossible task. The average lease length varies internationally; therefore, failure to terminate a lease within the timeframe established in the agreement could result in an unintentional renewal and a hefty fee for breaking the renewed lease.

And while tasks like building maintenance and property inspections don’t have hard deadlines, if you are not performing routine maintenance duties, you could end up with a fine for outdated building codes or safety violations. Many counties are starting to enforce accessibility laws, so it’s best to ensure that your building has features like wheelchair ramps and braille signs.

2. Delayed and inaccurate payments

Managing lease payments may seem simple but can become increasingly complex as your portfolio expands. Adhering to strict payment due dates for real estate taxes, CAM charges, and property insurance fees is non-negotiable. Delayed and inaccurate payments are unprofessional, costly, and erode tenant-landlord relationships.

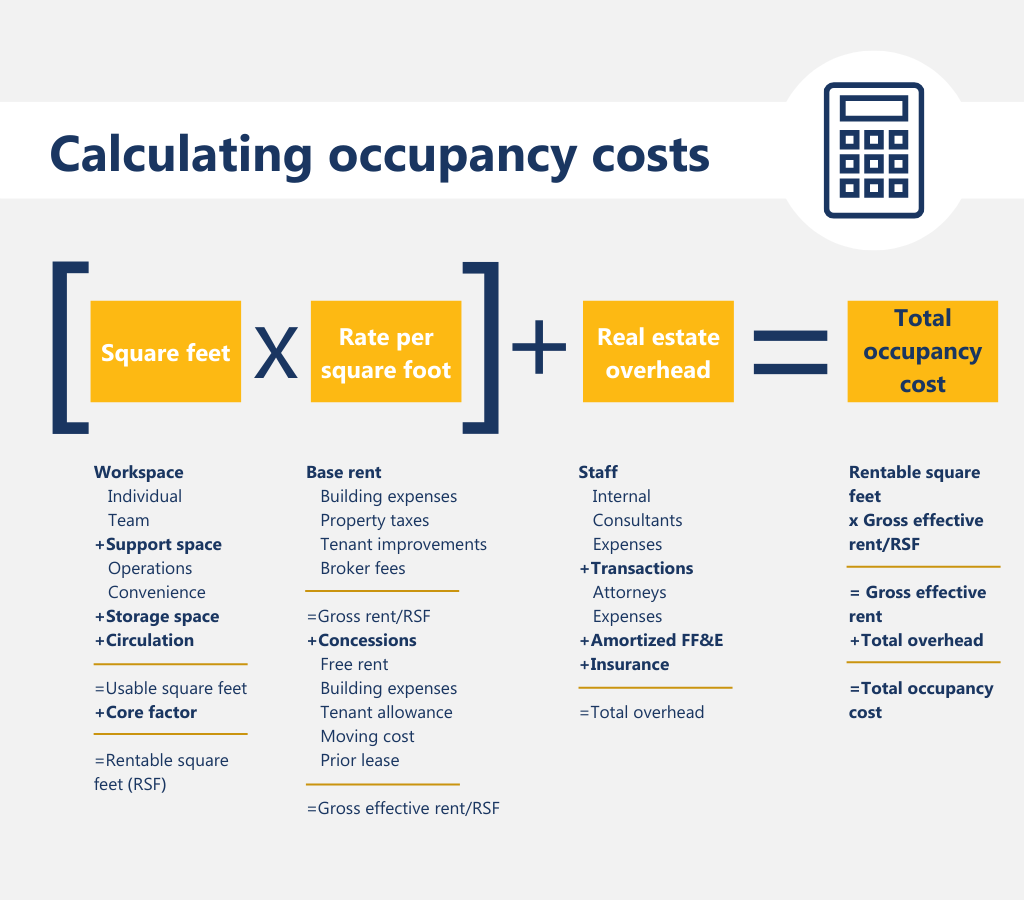

The right software will allow your company to reduce risk by automating labour-intensive manual processes and delivering a higher degree of accuracy. Equipped with a set of highly flexible tools, companies can properly calculate occupancy costs and allocate complex lease payments based on percentages, metering, square footage, or indices to streamline the lease process from start to finish.

3. Missing or incomplete lease documentation

Losing documents or partially filling out paperwork is one of the more easily preventable, yet still serious record-keeping mistakes commonly made by lease administrators. You must keep lease agreements, eviction notices, and move-in or move-out forms on file. It’s also advisable to separate lease-to-purchase and lease agreements, as the combination can result in confusion over who owns the property and who leases it. These documents will be indispensable if you ever need to go to court.

Watch out for two particular clauses in lease agreements: term dates and rentable square feet. This information is often incomplete or outdated, and clerical errors that provide conflicting evidence might confuse all parties down the line, resulting in undesirable consequences.

For example, if a lease states that the term is five years but includes dates that are for four years, the tenant may vacate the property before the lessor is prepared to refill it, leading to months or years of lost potential revenue.

Additionally, the exact rentable square feet for new builds are often unknown until the project is complete. However, the lease agreement must be updated before reconciliation when that information becomes available, as operating expenses are calculated using the rentable square feet.

Read more: 5 ways to maximize your property lease management strategy

4. Neglecting to review building operating expenses

Reviewing your building operating expenses is critical to understanding the cash flow associated with each property. Still, this process quickly goes out the window when companies relax their lease management practices. Overbilling by landlords, missed reimbursements, erroneous CAM charges, over or under-spending on building repairs, and tax errors are more common financial blunders that quickly stack up, impacting the bottom line.

Reviewing building operating expenses provides an opportunity to catch these errors, allowing you to recoup some of your revenue. Many companies that disregard the review process do so because they lack control over their lease management and view it as a time-consuming exercise. Fortunately, this is one of those mundane tasks that lease management software automates.

5. Rushing the tenant vetting process

Whether it’s merely an oversight or desperation, filling properties by rushing the tenant screening process could cost you more than a vacant property. Missing or poorly handled conduct-related terms and restrictions combined with lax qualifications is a recipe for delinquency and high tenant turnover.

Tenants need clarity when it comes to the guidelines and your relationship. It’s often not enough to make a phone call or drop by when something goes wrong. The lease agreement must include how the tenant uses the space, their responsibilities, and whether they are allowed to assign their lease or sublet their space to a third party. Signage, verbal communication, and occasional reprimands hold little weight compared to written and signed acknowledgements from each tenant.

6. Poor data management

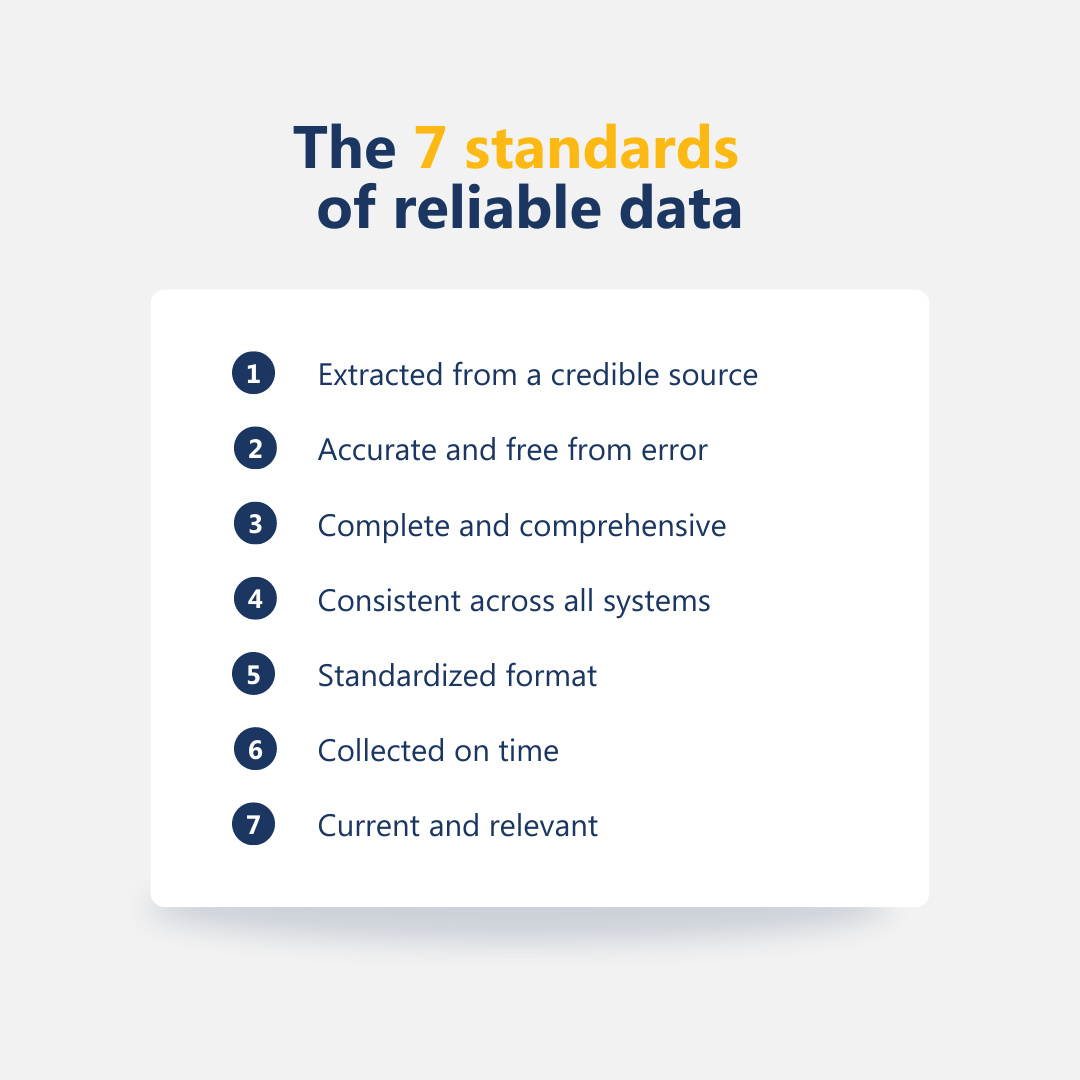

Organizations need a well-rounded view of all lease-related data, which can become challenging to maintain as your company grows. Not properly integrated data, updates that aren’t uniform across teams, and discrepancies between documents are common mishaps plaguing companies that rely on paper filing systems or a mishmash of spreadsheets and documents to store their information.

Poor data management can also result in too many vacancy days and unnecessary leasing delays, which increases the necessity of costly tenant inducements or generous tenant improvement allowances to attract new tenants.

Implementing a centralized data management system is integral to forecasting your cash flow, managing your lease portfolio, and preparing for compliance. You need to be able to create custom reports based on the data in your system and facilitate the ability to pull key real-time reports on property analysis, vacancy, delinquency, rent roll, and lease details.

7. Overlooking non-compliance

Accounting standards are constantly evolving to keep pace with global innovation, so you must remain up to date with standards like GASB 87, ASC 842, and IFRS 16. Misinterpreting compliance regulations or, worse, ignoring new standards could result in hefty penalties.

As private companies start to embrace the new lease accounting rules, they can learn from what went wrong with public companies’ implementations—the process will take more time and resources than expected. The number of leases you may need to record on company balance sheets could dramatically increase, and from the outset, other departments need to be involved as they may be affected by the changes.

Maintaining compliance is easier when you compile your lease information into one easy-to-access database rather than scattered across various documents and spreadsheets. Modern companies optimize this process by integrating their accounting software with their lease information.

Finding a solution to lease administration mistakes

Implementing a robust solution enables your company to get ahead of these common lease administration mistakes. With software that fits your business requirements, you can access better data management for granular visibility and enable smoother compliance with accounting standards.

Property Lease Management digitalizes your lease portfolio, allowing you to manage complex charges and reconciliation at multiple levels of property with easy-to-use wizards. You can also automate manual processes to ensure that you never miss a critical deadline or lose important documentation. Your finance department will be freed up to focus on budgeting and data mining for strategic insights.