Expansion is the new normal in the hospitality industry. With constant disruption, it’s not enough to stay afloat. Yet, hotels and restaurants face a demanding and often fickle customer base and challenges such as escalating operations costs, seasonal demand, and high staff turnovers. So how can anyone expect to expand in such an environment? The answer is simple. They can’t unless they build a sustainable financial framework for growth. Start with accounting processes, streamlining operations, and cutting costs so that expansion plans won’t collapse the administrative side.

With the escalation of customer expectations, few industries face more disruption in the coming years. Pandemics, fluctuating economies, and the advent of new technologies contribute to mass shifts in what customers require. There’s now a sizable difference between the average customer’s expectations and what’s on offer from the average hotel, restaurant, or resort. Financial transformation is key to sustainable expansion, yet many in the industry are reluctant to invest.

Many are wary of financial transformation in hospitality. It can be an expensive and time-consuming process with a low success rate. Yet, wide-scale digital transformation begins with the finance department. Sage recently reported that 70% of CFOs are now responsible for technological change. It is no longer an issue confined to the IT department and needs to be discussed at the highest levels of your organization to ensure longevity.

This blog covers a series of best practices and resources that will help you build the financial backbone necessary for success in the shifting world of hospitality.

Below is a list of topics covered. Click your area of interest to skip ahead.

- Shifting focus from expansion to financial management

- Defining financial transformation for hospitality

- Benefits of financial transformation for hospitality

- 7 ways leadership can prepare teams for the shift

- Checklist of best practices for hospitality transformation

- Partner with technology providers that know the industry

Shifting the focus from expansion to robust financial management

Hospitality faces a significant problem: expand or disappear. Typically, hotels and restaurants will grow in several ways: open new locations, expand to new territories, adopt new ways to deliver services, launch loyalty programs, and create new bespoke services.

Companies need to implement robust accounting processes that can comfortably sustain future growth to expand sustainably. It’s impossible to accomplish any of your expansion goals without a financial backbone that allows for accurate analysis, reliable forecasting, and timely information. Teams need real-time reporting to support strategic decisions with insights, analytics, and reliable data.

Beyond this, billing is a core component of an industry that often relies on 24/7 booking capabilities. Customers expect billing to be accurate and immediate for hospitality services and anything less than that is not adequate. Expanding operations without the necessary financial tools can be challenging and result in issues with payments and billings.

Other examples of the problems that might surface include fines for non-compliance, bottlenecks, and inaccurate reports. Problems that end up impacting not only your team’s productivity but also the level of customer service you can provide. Hospitality is an industry defined by service, and stressed-out teams will not be able to meet customer expectations, let alone exceed them. After all, this is an industry where exceeding expectations is the hallmark of a good customer experience.

Defining financial transformation for hospitality

Financial transformation in hospitality relies on adopting cloud-based technology in tandem with an agile mindset and processes to optimize performance, impact the bottom line, and improve productivity across the organization. It often centers around implementing a comprehensive ERP to help streamline and centralize workflows and allow access to crucial information. Its core functionality should be transforming financial management processes companywide to enable strategic forecasting, and allow for sustainable hospitality expansion.

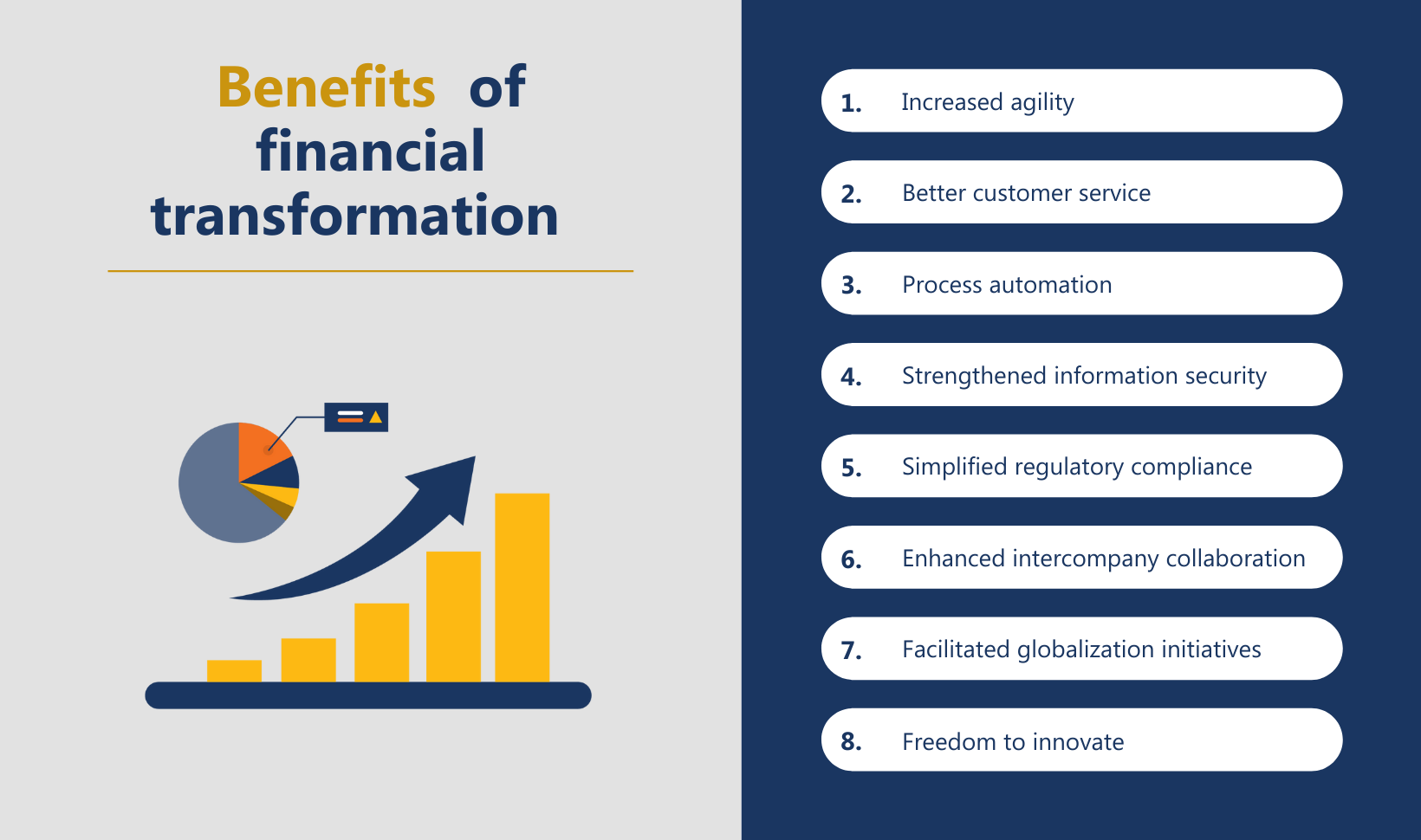

Benefits of financial transformation for sustainable hospitality expansion

The benefits of financial transformation for hospitality expansion are extensive. Some of the core ones include increased agility, better customer service, automation of time-consuming processes, strengthened data security, simplified compliance, enhanced collaboration, and freedom to innovate and expand.

7 ways leadership can prepare teams for the shift

In a recent McKinsey Global survey, only 3% of the respondents who had begun a transformation in recent years managed to sustain change. That does not mean transformation is impossible; just that many fail to take the necessary steps to ensure success on a journey that will always start with leadership. Sticking to the following tips should help leadership navigate the challenges:

- Prioritize clear, regular communication that includes all major developments

- Tie key performance metrics to your financial transformation at all levels

- Assess digital maturity and adjust strategic plans to improve upon current capabilities

- Adopt an agile mindset to encourage collaboration across your organization

- Break the process into small, actionable and achievable portions

- Build a custom financial transformation roadmap with room for change

- Appoint change ambassadors across various departments to lead the charge

Checklist of best practices for hospitality transformation

Many hospitality companies outsource their financial transformation, allowing consultants to manage the journey. Although these types of advisors are helpful for identifying solutions and helping identify templates for success, a truly successful transformation begins and ends internally. Not only do you need to engage your team at every level of the organization, but you will need to follow the best practices for financial transformation if you want to build a roadmap to successful hospitality expansion.

Many hospitality companies outsource their financial transformation, allowing consultants to manage the journey. Although these types of advisors are helpful for identifying solutions and helping identify templates for success, a truly successful transformation begins and ends internally. Not only do you need to engage your team at every level of the organization, but you will need to follow the best practices for financial transformation if you want to build a roadmap to success.

- Establish your position on the digital maturity scale and set goals accordingly

- Conduct a thorough audit of your current financial management and workflows

- Audit workflows and update data management and security practices and protocols

- Educate your team on the financial transformation challenges they will face

- Define what success means for your company and set realistic KPIs based on this

- Prepare your leadership team to take ownership and drive internal change from day one

- Choose a financial transformation framework that meets the demands of your team

- Amplify your efforts with a robust internal communications and education campaign

- Understand that any major technological change requires a significant cultural change

- Invest in scalable financial management solutions that allow for future expansion plans

- Focus on cloud-based solutions that integrate fully with your current tools and processes

- Shift to an agile mindset and adopt processes that are specific to your industry’s demands

- Create meaningful ways to track performance and measure the success of transformation

Partner with technology providers that know the hospitality industry

Finding the right solution can be tricky when many of the larger hospitality companies do not publicize the software and tools that help them succeed. Still, it’s wise to look for teams and consultants that understand the nuances and demands of the hospitality industry. Relevant recommendations should speak to many of the core challenges you’re facing. Even when non-disclosure agreements mean that a consultant can’t share the name of a company or brand, they will still be able to speak directly to how they can support your growth. It should also be possible for you to speak to those they’ve partnered with before and ask questions. Additionally, if you’re speaking with various consultants, it’s wise to have a list of questions on hand.

Recommended questions for technology providers and consultants

- Can you define the length of an average implementation?

- Would you describe an implementation you recently achieved in the hospitality industry?

- What usually complicates or slowdowns the process?

- How do you resolve issues when they arise during the implementation?

- What kind of training and ongoing support do you offer?

- Typically, what kind of growth or expansion can the system handle?

- Does your solution integrate with other solutions?

- Can we speak to a similar company that worked with you recently?