Most hospitality companies are fraught with the challenges of effective financial management in a world where disruption is the new normal. Smooth accounting operations are essential for sustainable growth and scalability in this industry. Those that fail to adopt best practices and tackle the issues with lean, agile solutions are likely to be buried by tedious manual processes and an inability to make strategic moves in a fast-paced, constantly changing world.

Making decisions based on gut feelings is no longer viable. With data becoming increasingly crucial for stakeholders and investors, investments now depend on access to accurate forecasting and reports. Risk management is another motivator for those revamping financial systems. No accounting team wants to stifle the growth of their company, yet, modern compliance standards are increasingly demanding, and there’s a degree of transparency required by regulators that is impossible to maintain with outdated solutions.

Many finance teams are weighed down by manual processes, struggling to consolidate multiple entities, keep up to date with leasing requirements, and spend most administrative time on balance sheets and reporting. Often this work involves a degree of correction that should not be necessary when technology can automate many of the workflows that lead to the most common errors on financial statements and reports. Keeping up administrative workloads often leaves little time for teams to adapt to the subscription economy or implement innovative, competitive strategies.

This blog covers the everyday financial management challenges hospitality faces, with simple solutions suggested for each one. Before you jump in, give your finance function a health check with this simple questionnaire.

1. Maintaining secure, reliable financial data management across all entities

The challenge

Given the sheer amount of financial data flowing through the average hospitality company, it’s no surprise that one of the biggest concerns accounting teams faces is keeping data clean and free of error while maintaining the security of sensitive information. The bigger a franchise or organization, the more complex things can get, with companies needing to adopt systems that can handle the workload of increased intercompany transactions without causing severe bottlenecks.

With data now at the heart of strategic decision-making, the need for effective data management is a critical component of healthy growth. It’s not uncommon for audits or data breaches to slow down productivity for weeks, if not months, a risk most cannot afford to take. Hospitality companies can overcome this financial challenge by introducing several measures to maintain secure, reliable data across all entities and departments.

Suggested solutions

- Automate time-consuming processes wherever possible and reduce manual data entry

- Introduce standards and processes that ensure accuracy from data input to normalization

- Perform regular audits and data checks to maintain data quality at the highest level

- Centralize data management to avoid introducing errors during data transfers

- Develop consisting accounting rules and naming conventions across all entities

- Invest in solutions with high levels of security and control to maintain data integrity

- Pay particular attention to data management and security during mergers and acquisitions

2. Consolidating financial statements accurately across multiple companies

The challenge

Effective financial management in the hospitality industry often requires accounting teams to produce consolidated financial statements that allow leadership to get an overview of overall performance across the entire enterprise. Of course, this ties into the challenge of maintaining reliable and secure data, but it’s a separate concern with its nuances.

Parent company accounting teams often face significant roadblocks when it comes to consolidating financial information. They may not have access to data from all entities, and other groups may forward reports in inappropriate ways (email, excel files, etc.). Not only does this make it challenging to obtain the necessary data, but it can introduce issues of fraud and data manipulation when the parent companies do not have a clear view of financial processes across all entities.

It’s possible to solve this issue by investing in a centralized accounting system specializing in consolidated financial statements. Building a robust financial backbone is essential to sustainable progress when it comes to solving the financial management challenges hospitality faces.

Suggested solutions

- Ensure the parent company has centralized access to finances from all entities

- Invest in a centralized ERP that specialized in consolidating financial statements

- Implement appropriate access controls given the sensitive nature of finances

- Outline consolidation requirements and implement practical tools across all companies

- Automate workflows for all entities to reduce the possibility of data manipulation

3. Proving compliance with changing global accounting standards

The challenge

Expectations around data governance and global compliance have never been higher. Most hospitality franchises will be subject to different rules and regulations that govern their accounting practices. Staying on top of fluctuating regulations can strain even the highest performing teams, especially when accounting teams need to maintain compliance for everything from recurring revenue and financial consolidation of multiple entities to lease accounting standards.

It can be a headache, so it’s often best to nominate team members to stay on top of requirements, brief the team on any changes and rewrite data management policies to reflect these when necessary. It’s also wise to invest in a solution built to handle the complexities of modern compliance, so your team can avoid the risk of hefty fines.

Suggested solutions

- Nominate team members to maintain knowledge of global accounting standards

- Invest in ERP accounting systems built to handle the complexity of financial compliance

- Partner with software companies that demonstrate knowledge of compliance standards

- Enable your team by creating the transparent processes necessary for effective audit trails

4. Replacing obsolete, on-premise financial management systems

The challenge

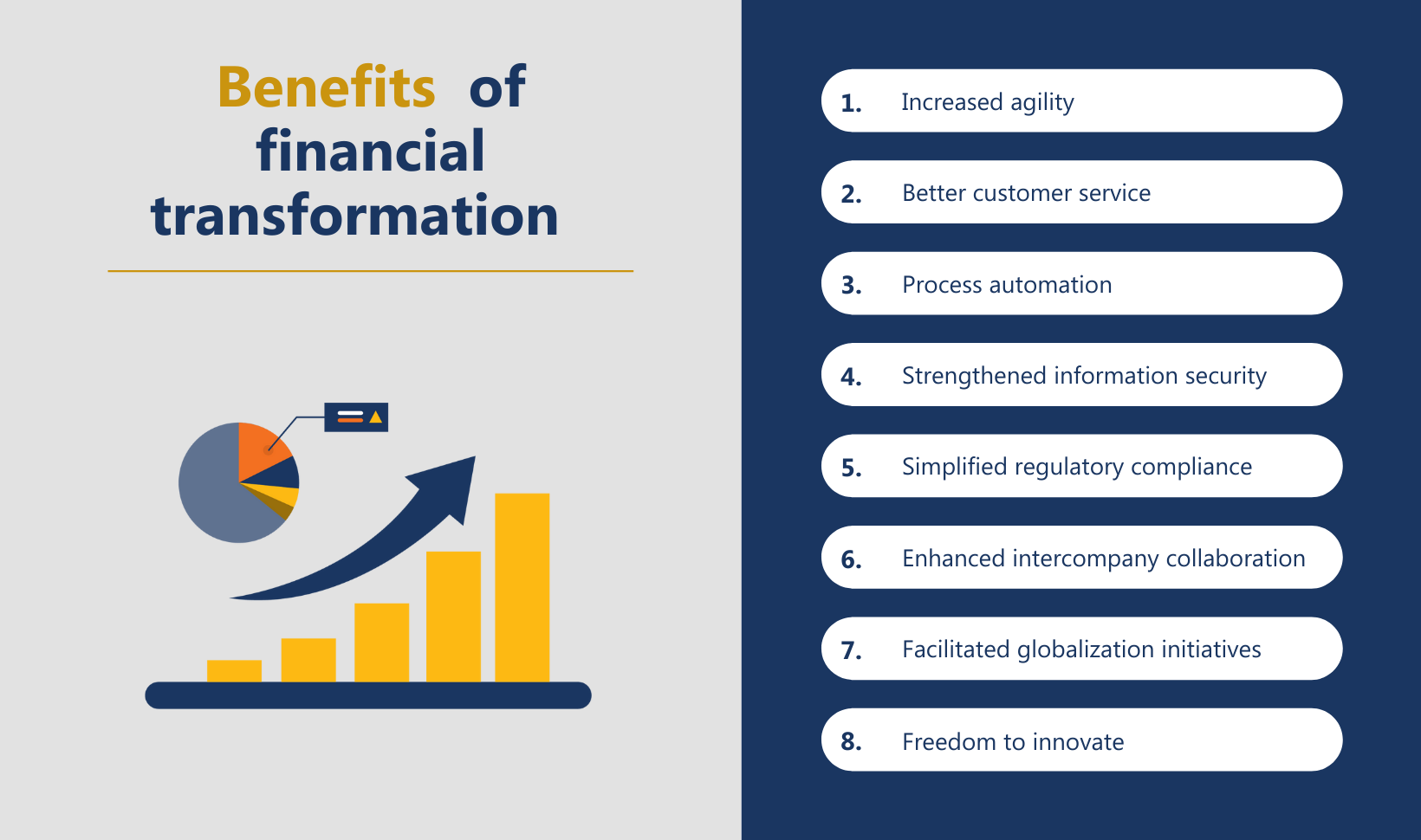

The struggle to achieve financial transformation is not unique to the hospitality industry. Across the world, companies face the challenge of introducing agile workflows and replacing legacy, on-premise systems with more comprehensive financial management systems. Add to this the rate of failure of the average transformation, and it’s no wonder that accounting teams can be reluctant to undergo the upheaval.

Many issues arise because finance manages the entire transformation in a silo, without any effort made to spread the workload across the whole organization. It’s a process that touches on and involves every corner of operations and will require a company-wide effort. The solutions below include a collection of resources to help you navigate the major shifts and challenges of financial transformation.