Operating leases and finance leases are two of the most common types of contracts that companies use today. Understanding the differences between them is critical to commercial success, and anyone running a company should carefully weigh their options when considering contract agreements.

There are several different ways to distinguish between operating leases and finance leases, and this blog will not only define each lease type but outline the key differentiators between the two.

Defining operating leases vs finance leases

What is a finance lease?

A finance lease (a capital lease) is a commercial leasing arrangement where a finance company legally owns an asset, and the user rents it for an agreed-upon period. In this contract, the leasing company, typically the finance company, is referred to as the lessor, while the asset user is called the lessee.

Upon entering this agreement, the lessee gains operational control over the asset and assumes all associated risks and benefits of ownership. From an accounting perspective, the lease grants the lessee the economic attributes of owning the asset. The lessee records the asset as a fixed asset in their financial records, while the interest portion of the lease payment will be logged as an expense.

Criteria for a finance lease under GAAP

To meet the criteria for classification as a finance lease under US GAAP, the lease contract must satisfy at least one of the following conditions:

- The asset’s fair market value equals or exceeds the present value of the lease payments.

- The lease term is over 75% of the asset’s useful life.

- The lessee can buy the leased asset at a price lower than fair value.

- At the end of the lease, legal ownership of the leased asset transfers from the lessor to the lessee.

Criteria for a finance lease under IFRS

With the IFRS, a lease is considered a finance lease if it meets all of the following criteria:

- Throughout the lease period, the lessor retains legal ownership of the asset.

- The lessee takes on the risks and rewards related to the asset.

- Legal ownership transfers from the lessor to the lessee after the conclusion of the lease term.

How a finance lease operates

A finance lease essentially functions as a business rental agreement, involving the following steps:

- The lessee chooses business asset necessary for doing business.

- The lessor, typically a finance company, acquires the asset.

- A legal contract is established between the lessor and lessee, granting the lessee usage of the asset for the agreed-upon lease period.

- The lessee makes a series of payments for the asset’s use.

- The lessor recoups the asset cost along with interest.

- Upon lease agreement completion, the lessee may opt to take ownership of the asset.

Regarding accounting, a finance lease significantly impacts a company’s financial statements. These leases are treated as ownership rather than rentals, affecting interest and depreciation expenses, assets, and liabilities. Due to capitalization, a company’s balance sheet shows increased assets and liabilities, while working capital remains unchanged.

The debt-to-equity ratio, however, rises. Expenses related to a finance lease are divided into interest expenses and principal value, akin to a bond or loan. Some payments are reported under operating cash flow, while others fall under financing cash flow, leading to an increase in operating cash flow for companies involved in finance leases.

Contents of a finance lease

Finance leases are customized based on the specific needs of both lessor and lessee. Despite variations, most finance leases typically include:

• Names of both parties, designating as lessor and lessee

• The asset being leased

• Total asset price

• Economic life of the asset

• Interest rate

• Principal and interest payment schedule

• Associated penalties and fees

This lease document can be intricate, and it’s advisable to consult a business or financial services lawyer to ensure the agreement is accurately drafted with all essential information.

Examples of finance leases

Finance leases are employed across various industries, particularly when a company requires expensive equipment but wants to preserve cash flow and avoid a large upfront payment. Some examples of assets leased through finance arrangements include: land, plant equipment, heavy machinery, ships, aircraft, buildings, and patents.

What is an operating lease?

An operating lease is a leasing arrangement in which the lessor permits the lessee to utilize an asset for a brief period in exchange for periodic payments, without transferring ownership rights of the asset.

From an accounting standpoint, leases are categorized as operating under ASC 842 if none of the five criteria for finance leases are met. In business, operating leases enable lessees to treat the leased assets as regular fixed assets while conducting their operations. However, this is only for a limited period, as the assets are ultimately returned to the lessor with some remaining useful life. The lessee essentially rents the asset to facilitate the normal operations of their business.

Operating leases are lease agreements where the terms do not resemble a purchase of the underlying asset. For instance, there is no transfer of ownership at the end of the lease, and the leased asset may be used by someone else after the lease term concludes. If none of the five criteria used to classify a lease apply, it is considered an operating lease.

These leases are employed for the temporary rental of assets and encompass conventional rental relationships. Previously, before the implementation of the new lease accounting standards, these leases were expensed outright, and neither the leased asset nor the associated liabilities were reflected on the balance sheet. Now, irrespective of whether a lease is operating or finance, both an asset and a liability must be recorded on the financial statements.

Criteria for an operating lease under ASC 842

An operating lease is recognized under ASC 842 if it does not meet any of the following five criteria for finance leases:

- Ownership transfer | The lease agreement does not transfer ownership of the asset to the lessee by the end of the lease term.

- Purchase option | The lease agreement does not contain an option for the lessee to purchase the asset at a price significantly lower than its fair value.

- Lease term | The lease term is less than 75% of the asset’s expected economic life.

- Present value of lease payments | The present value of the lease payments, excluding any portion for optional renewals, is less than 90% of the asset’s fair value at the commencement of the lease.

- Specialized nature of asset | The asset is of such a specialized nature that it is not expected to have an alternative use to the lessor at the end of the lease term.

How an operating lease operates

In an operating lease arrangement, the lessor allows the lessee to use an asset for a limited duration in exchange for periodic payments. However, ownership rights of the asset remain with the lessor, and there is no transfer of ownership at the end of the lease term. The lessee treats the leased asset as a regular fixed asset, incorporating it into their business operations. Ultimately, the asset is returned to the lessor, typically with some useful life remaining.

Contents of an operating lease

An operating lease typically includes the following key elements:

- Names and details of both the lessor and lessee

- Clear identification and description of the asset being leased

- Duration of the lease agreement

- Specified amounts and schedule of periodic payments

- Any special terms, conditions, or restrictions pertaining to the use of the leased asset

- Determination of who is responsible for the maintenance and upkeep of the asset

- Any provisions for renewal or termination of the lease

- Stipulations regarding insurance coverage for the leased asset

Examples of operating leases

Operating leases are commonly used for assets that have a limited lifespan or that are specialized and not expected to have alternative uses. Examples of assets frequently leased through operating agreements include: office space, vehicles, equipment, technology, and retail space.

Compliance for operating leases vs finance leases

Compliance for finance leases

Under IFRS accounting standards, if the risks and rewards are fully transferred, it is a finance or capital lease. Sometimes this can be hard to determine, so the IASB outlines it as if one of the following criteria apply:

- Lessee has the option to purchase the asset at a lower price than its fair value at a future date (often the end of the lease term). This option is usually presented at the beginning of the contract.

- The lease term is a significant portion of the asset’s useful economic lifetime (often 75% or more).

- The net present value (NPV) of the minimum lease payments is at least 90% of the asset’s fair value.

Compliance for operating leases

Before the introduction of IFRS 16, numerous operating leases were recorded off the balance sheet. However, this changed, and all leases must now be treated in the way that finance leases are treated under IAS 17 except for those that meet the practical expedient for low value/short-term leases. Lessors are required to show a lease receivable and a future flow in income for each lease. To get a more thorough understanding, read our blog on the changes to accounting for operating leases under IFRS 16.

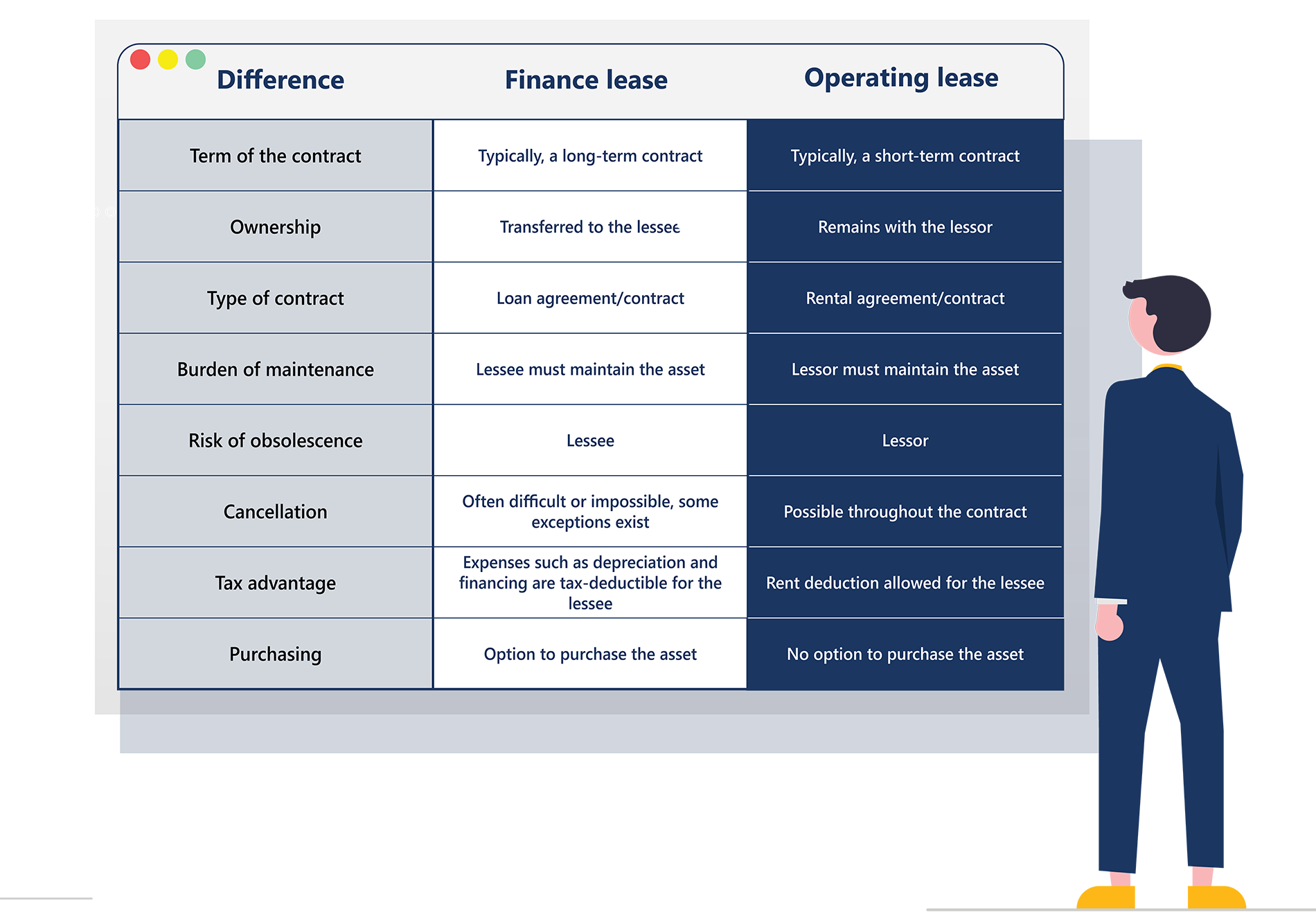

Key differences between operating leases and finance leases

Property lease management software

Whether you’re working with operating or finance leases, the administrative burden can overwhelm companies that do not have the right software. Investing in purpose-built property management software will be essential to effectively managing operating and finance leases and enabling your company to remain compliant.

In conclusion

Understanding the differences between operating and finance leases is essential. Every company’s demands are different, and fully understanding the compliance demands and risks can help you decide which option works best for you, whether you’re the lessee or lessor.