When managing complex recurring billing payments, many focus on the nuts and bolts of invoicing and give little thought to the importance of payment gateways or portals. Companies need to streamline the billing process from head to toe, including payments. Giving your clients secure access to their payment information is essential to a successful strategy.

Ignoring the importance of payment gateways may not impact teams immediately, but most will eventually feel the pressure. As the number of users grows, finance teams need to manage more than a handful of clients, a previously serviceable customer base can quickly become unmanageable. Standards start to slip. Human errors creep in, dunning rises, and coordinating billing becomes increasingly tricky.

It’s not uncommon for overwhelmed teams to send out late or incorrect invoices and fail to update billing information. But how can a payment gateway change that? The answer is simple: by giving clients access to a secure, trusted platform where they can update their payment information, you encourage them to take ownership of the payment process.

There will always be exceptions, but gateways and portals, significantly reduce the time teams need to spend chasing down monthly payments, freeing up your team to focus on more strategic initiatives or to assist customers who might need assistance. If you’re serious about implementing modern pricing models, then payment gateways are critical to your go-to-market strategy.

Why do I need a payment gateway for recurring billing?

In a world where customers are used to logging their details in various portals and automating payments, companies that do not offer an adequate gateway or portal may seem obsolete, low-tech, or old-fashioned. It can lead to customer frustration as they need to call or email you directly to update information, and it can increase the stress for a finance team that is ill-equipped to deal with calls and emails from a growing user base. Most customers are also inclined to feel more secure sharing payment details in a trusted portal than over email or phone.

The pushback we often hear about implementing payment gateways is that it’s a lot of bother when teams can call up or email customers directly about billing. This attitude fails to account for the pressures of scaling operations and the preferences of many users. In essence, it’s an attitude that dismisses the importance of serving the customer first.

A checklist for choosing your payment gateway

1. Integrates with comprehensive recurring billing capabilities

Your payment gateway must offer you and your users the ability to manage recurring billing in all its complexity. The software used to manage billing processes needs to link directly to the payment gateway to avoid bottlenecks; this is called an integrated payment gateway. It’s better to avoid hosted payment gateways where finance teams must transfer data between multiple systems as they’re separate. As you can imagine, this quickly leads to problems and errors over time.

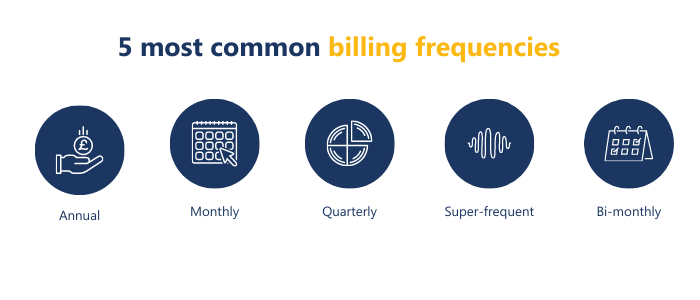

Users may only see the gateway, but the background engines must be in tune to ensure that billing is accurate across all systems. That way, payments can be safely automated once the invoice is sent out (weekly, monthly or annually, depending on the billing frequency) without having to double- and triple-check details between systems.

2. Accounts for a variety of payment cards and methods

Companies must consider the kinds of cards a payment gateway supports, particularly for cross-border customers. Supporting Amex, Visa, and Mastercard transactions is the bare minimum, and it’s worth investigating what payment types are most common where you do business.

It’s essential that recurring billing is as convenient as possible for your users. For instance, do customers in a territory frequently use a debit or prepaid card? What other kinds of payments are common? Though it might only be possible to service some payment methods or cards, companies should seek to strike a balance by at least covering the more popular options in a region.

3. Merchant account where payments are stored for approval

A merchant account is a temporary retailer account where payments are stored pending approval. Most payment gateways will use this security measure before transferring the payment to the final bank account. This gives the customer’s bank time to run any checks for unusual payments and helps banks cancel out errors like accidental double payments. It’s a payment portal feature that provides an extra level of security. Some gateways process payments immediately, and this can lead to a higher processing fee.

4. Supports multiple currencies

Even if you do not do business internationally, you need to know who your customers might be. Many companies may receive cross-border payments even if they do not necessarily sell into other markets. We live in a world where many people live and work away from their home countries; many of these people end up paying for services and products in their home countries—whether that’s trying to cover medical bills for a loved one or sending a birthday gift.

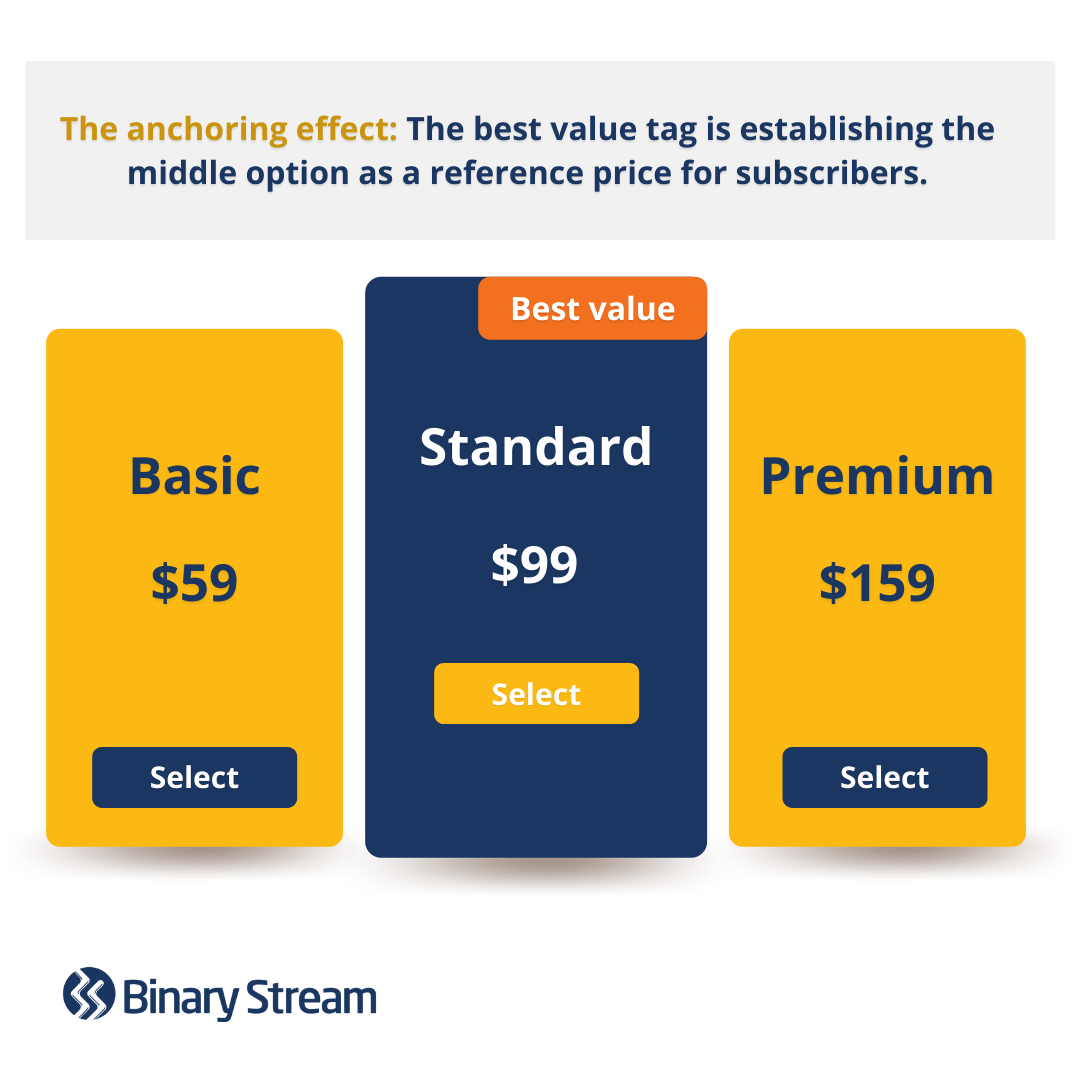

Your payment gateway or portal should support various currencies so that users can understand their bills quickly and without any hidden surprises. It could be shocking for users in other countries to see the final payment if they thought the currency was their own. This is particularly true for Canadians shopping on US sites that appear to be in dollars. They may assume that these are Canadian dollars if they don’t check. They might leave the payment gateway once they realize the actual cost or cancel the subscription. This is partly because of anchoring or referencing, a concept in pricing psychology, which means that the perceived value of your product has been assigned to the initial assumed cost, and they’re no longer willing to pay more. It’s easy to avoid this by simply displaying the correct currency throughout the payment process.

5. Offers comprehensive 24/7 customer support

Some payment gateways offer little customer support, which means your users don’t get the customer care they need when they most need it. Users are often anxious when trying to sort payment errors, so you need to make sure there’s a team on hand that will be ready to help when issues arise. Sending emails or submitting support tickets can add a layer of frustration when customers are already stressed. Look for gateways that offer meaningful technical support, such as 24/7 chat or a helpline, so your users can resolve any issues that might arise.

6. Clean UX is critical as recurring payments mean recurring usage

If you plan to invest in a recurring billing payment gateway, you must consider each option’s usability. The more frequently a customer needs to access your payment gateway, the more likely it is that any failures in UX will become an ongoing frustration. We all know the pain of trying to make payments on systems that are not up to industry standards, and if we had to do so frequently, we might likely abandon ship and find a new service provider. Retaining happy subscribers means you need to pay more for better functionality. For instance, double check it’s easy to download invoices or change billing information.

7. Clear and transparent communication around vendor fees

Providing a payment gateway for your customers will cost, but there should be no hidden fees or charges. Any vendor you partner with should be open and transparent about all expenses that might arise, and you should receive a clear overview of the costs you will incur by investing.

The standard fees you should expect are interchange fees and transaction fees. Other expected costs may include everything from flat fees to chargebacks and IRS reports fees to non-sufficient funds (NFS). If you’re unfamiliar with payment processing charges, this could become an overwhelming list, so it’s essential to communicate directly with your vendor and get clear answers about costs and fees.