When finding the right solution for your subscription billing needs, many face the dilemma of whether they should build or buy. A quick Google will give you multiple takes on the pros and cons of each, often leaning more heavily towards the “buy” answer. However, each approach has good reasons, and what works for one company won’t always be the best solution for the next. In this blog, we will focus on the nuances of the dilemma, addressing the core challenges that face companies where billing efficiency is critical to overall performance.

One of the critical steps in making the right choice for your company is to gain a comprehensive understanding of what a subscription billing solution can do. What are the features your company needs to make operations run smoother? And even, do features you don’t know about exist that can make your team’s life easier? Many companies are surprised at the sheer depth of modern billing solutions and their effectiveness in removing bottlenecks and facilitating best practices. If you want to get a complete overview of what a subscription billing system should be able to do, check out our ultimate checklist for subscription billing solutions. It provides an exhaustive list of features that might help you successfully navigate the decision about whether it’s better to build vs. buy recurring billing software.

Consider the time required for full implementation when deciding between building or buying a subscription billing solution. Building a custom solution from scratch can be a time-consuming process, involving development, testing, and debugging. Depending on the complexity of your requirements, it could take several months or even longer to complete.

On the other hand, purchasing a pre-built solution typically offers faster implementation, as the software is already developed and ready to deploy. This can significantly reduce the time it takes to get your billing system up and running, allowing you to start realizing benefits sooner. However, it’s essential to weigh the trade-offs between time to market and customization options to ensure the chosen solution aligns with your company’s needs and timeline.

When assessing each option in line with business requirements, it’s crucial to distinguish between feature bloat and essential features. Feature bloat refers to unnecessary functionalities that may complicate the system without adding significant value to your business operations. On the other hand, identifying necessary features ensures that your subscription billing solution meets your specific needs and supports your core business processes effectively.

To determine what constitutes feature bloat versus necessity, engage stakeholders across departments to understand their workflows and pain points. This collaborative approach can help prioritize features that streamline operations, enhance efficiency, and contribute to overall business success. Additionally, consider scalability and flexibility, as the chosen solution should be able to adapt to future growth and evolving business requirements without unnecessary complexity. Once you have a clear picture of what you’re looking for, it’s time to build a roadmap to help with the migration to a new solution.

Tailoring an existing subscription billing solution to meet unique business requirements is essential for maximizing its effectiveness. While pre-built solutions offer a range of features, they may not perfectly align with every company’s specific needs. Building a custom solution provides the opportunity to incorporate tailored functionalities that address unique challenges and support distinctive business processes.

By working closely with developers and stakeholders at the solution provider’s company, it’s possible to build workflows that are customized to fit exact requirements, resulting in a more efficient and seamless billing process. Additionally, customization allows for greater flexibility and scalability, enabling the system to adapt to changing business demands over time. However, it’s essential to balance customization with considerations of development time, cost, and ongoing maintenance to achieve the optimal solution for your organization.

Determining when you can expect to see a return on investment (ROI) from your subscription billing solution is crucial for making an informed decision. The timeline for ROI realization can vary depending on factors such as the cost of implementation, the efficiency gains achieved, and the overall impact on business operations. With a pre-built solution, ROI may be realized relatively quickly due to faster implementation and immediate access to essential features.

Conversely, building a custom solution may involve a longer initial investment of time and resources but could lead to greater long-term ROI by precisely addressing your unique business needs. Factors such as increased efficiency in billing processes, reduced error rates, improved customer satisfaction, and the ability to scale operations can contribute to ROI over time. By conducting a thorough cost-benefit analysis and considering both short-term and long-term impacts, you can better understand when to expect ROI from your chosen subscription billing solution.

Considering how you will maintain the subscription billing system and associated processes is vital for long-term success. Whether you build or buy a solution, ongoing maintenance is necessary to ensure the system remains efficient, reliable, and aligned with evolving business needs. With a pre-built solution, maintenance typically involves regular updates and patches provided by the software vendor. It’s essential to stay informed about these updates and implement them promptly to keep the system secure and up to date.

Additionally, training staff on any new features or changes to processes is crucial for maximizing efficiency and minimizing disruptions. For a custom-built solution, maintenance may involve monitoring system performance, addressing any issues or bugs, and implementing enhancements or updates as needed. Establishing clear maintenance protocols and allocating resources for ongoing support and development will help ensure the continued success of your subscription billing system in the long run.

Security should be at the forefront of discussions when considering a subscription billing solution. Whether building or buying, ensuring the security of sensitive customer data and financial information is paramount to maintaining trust and compliance with regulatory requirements. When evaluating options, inquire about the security measures implemented by the software provider or development team.

This includes encryption protocols, access controls, data storage practices, and compliance with industry standards such as PCI DSS (Payment Card Industry Data Security Standard). Additionally, consider factors such as vulnerability management, regular security audits, and incident response procedures to mitigate risks effectively. Prioritizing security in your decision-making process will help safeguard your business and customer data from potential threats and breaches, enhancing overall trust and credibility in your subscription billing operations.

Subscription billing software continues to grow as a market, as recurring revenue strategies take precedence across many industries. It’s become clear that SaaS pricing models are no longer confined to the software world; many industries, from healthcare to automobiles, are migrating to a more customer-centric billing approach. As a direct result, invoicing and payment management have increased in complexity.

Expectations regarding customer service are at an all-time high, and those who fail to provide adequate subscriber billing and payment processes are becoming obsolete. It doesn’t matter what industry you’re in. Customers anticipate a seamless billing cycle with maximum flexibility. This sets a standard that few companies are equipped to meet without investing in subscription billing software that can lighten the load. Below we’re going to walk you through the core product features you need to handle the complexity of modern billing.

Jump ahead by clicking the topic most relevant to you:

Subscription management software (or recurring billing software) allows companies to implement complex subscription billing models effectively. This type of software has a wide range of features that enable companies to scale their subscription services through automating billing and invoicing, managing subscriber contracts, and facilitating comprehensive reporting and audits. It allows you to effectively manage your subscribers’ journey through the entire customer lifecycle, reducing bottlenecks, human error, and improving the overall billing experience for all involved.

Software companies have jumped at the opportunity to build solutions to help manage this complexity. Still, not all solutions are created equal, and many lack the features you will require to scale and grow your subscriber base sustainably. Ensure you get the most value and efficiency for your money and understand the variability between solutions by asking the right questions and looking for key features.

If you’re in the market for a solution, this blog provides a comprehensive list of features (organized by functionality area) you should look for when investing in streamlining your billing processes.

Subscription billing software goes beyond the accounting team, affecting every facet of a company, from customer care to product development. A robust solution offers valuable data and clarity, empowering businesses to make strategic, informed decisions. This checklist aims to provide companies with the clarity required to navigate the intricacies of modern billing, helping them find a tailored solution that meets their unique needs and fosters unprecedented growth.

From customizable billing options to automated renewals and the flexibility to support both free trials and intricate discounts, each feature contributes to a holistic and efficient subscription billing system. Below is a short list of the most critical features you need to look for in solutions:

One of the most complex aspects of subscription management is revenue recognition and deferrals. It’s essential to invest in software that can automate these processes across all contracts so that your team doesn’t sink time into managing these manually. For a comprehensive guide to revenue recognition for subscription billing, read this blog.

Customers have come to expect options when paying for their subscriptions. To remain competitive, companies need to implement both annual and monthly billing options. You may also find yourself experimenting with different pricing models until you find the right fit for your product. The software you select should be flexible when it comes to managing recurring billing and pricing management, so that your team can tweak strategies to best serve your subscribers.

Recurring billing faces challenges, like losing about 2% of customers monthly due to expired credit cards. Other issues, like failed payments from spending limits or cancelled cards, add to this problem. Dunning management is the way to recover these losses by communicating with customers. Despite its negative image, modern dunning can improve customer experience and boost monthly revenue. Not only that, but dunning can be automated, preventing revenue leakage without using any valuable resources.

With modern subscription billing, payment gateways play a pivotal role in ensuring a seamless and secure recurring revenue experience. To maximize the benefits of subscription-based models, businesses must prioritize certain features in their payment portals. From PCI-DSS compliance to user-friendly interfaces. Automation of payments, easy subscriber information updates, effective dunning features, and the flexibility to transact in preferred currencies round out the key elements for an optimal payment portal experience, providing your subscribers with the peace of mind they seek.

Not all software is created equal, and one of the significant differentiators you should look out for is features that enable compliance. No solution can guarantee compliance with accounting standards like ASC 606, but they should provide the tools you need to facilitate compliance with accounting standards. It’s likely that the list of features will mention revenue recognition, ASC 606, or otherwise indicated awareness of tax and compliance requirements. If you do not see this mentioned in the list of features, it’s unlikely that the software will be audit friendly.

The integration of software systems is paramount to the efficient functioning of a business. Ensuring a seamless flow of subscriber data and financial insights is critical for maintaining a healthy bottom line. The features required for optimal integration with existing systems go beyond user interfaces and cloud-based reporting; they delve into the very backbone of a company’s operations. From compatibility with existing ERPs and a user-friendly interface to proven integration history and expert support, the checklist for full integration aims to provide a comprehensive overview of support you will require for a smooth transition to using subscription billing software.

Comprehensive implementation support and training are pivotal elements in ensuring the seamless integration of subscription billing tools into the heart of a business. Ongoing training and support, coupled with access to learning tools and user guides, empower users to harness the full potential of the software.

In the dynamic business landscape, safeguarding your revenue is paramount for long-term success. Revenue leakage, the subtle but significant loss of income, can erode profits and hinder growth if left unchecked. In our ever-connected world, understanding the importance of preventing revenue leakage is crucial.

In our previous blog on revenue leakage, we delved into the fundamentals—defining revenue leakage, exploring its root causes, and providing a straightforward tool for calculating your profit drain. Building on that foundation, this installment focuses on actionable steps. We’ll guide you through the process of conducting a targeted audit to identify specific types of revenue leakage affecting your bottom line. Moreover, we’ll present practical solutions to plug those leaks and initiate measures to prevent any further profit drain. Let’s embark on a journey to safeguard your revenue and fortify your financial well-being.

When searching for revenue leaks in your company, it’s like solving a puzzle – there are leaks in various departments, and it can be overwhelming. To simplify the process, start by estimating areas where the leaks might be originating. While it’s common to focus on the top accounts, it’s crucial to involve those closest to the revenue generation process for a comprehensive understanding.

Once you consolidate your ideas about where the leakage occurs, rank the leaks by economic value (including time and other resources spent). Prioritize those causing the most significant financial impact, directing your attention to the major contributors before tackling smaller issues. For instance, if a substantial leak costs $4,500 per month while seven minor leaks add up to $1,030, address the big hitting one first.

Finally, test your theories through a thorough audit, involving the finance team and those responsible for revenue generation. This audit should scrutinize data, processes, and retrace steps related to key revenue moments to ensure accuracy in identifying and addressing the leaks. Here’s a short questionnaire to help you give your finance function a health check.

Simply put, the first step in preventing revenue leakage is carefully checking all your agreements with your suppliers. In the business world, everything runs on contracts – from buying goods to getting services like coffee or office cleaning. Sometimes, these contracts can be a headache. They might be missing, expired, or nobody really knows what’s in them. There could be changes discussed in emails that aren’t reflected in the official contracts.

To sort this out, we recommend looking at all your contracts with vendors and customers. It’s like a checkup for your agreements. Start by focusing on the big suppliers—those who are crucial to your business. Ask your purchasing team to evaluate them based on factors like complexity and past experiences. This helps identify any potential issues and ensures that your contracts are in good shape.

Understanding and identifying churn metrics is crucial for any company looking to grow, as these metrics provide valuable insights into areas that need improvement. In the past, calculating churn rates was challenging, but with today’s abundance of data, tracking and using churn metrics for adjustments has become much easier. Knowing your churn rate acts as a litmus test for your business health – satisfied customers will stay, while a high churn rate indicates potential issues with your service that need attention.

It’s common for companies to overlook churn metrics until it’s too late, leading to a sudden increase in churn rates that causes concern. However, proactively reducing churn rates, even when they are low, is a smart approach. By understanding why customers leave, you can make necessary adjustments to retain them and refine your services before more subscribers decide to leave. Learn more about how to calculate and reduce subscriber churn in this blog.

Making sure our billing and invoicing processes run smoothly is super important for preventing revenue leakage. It’s like giving our business a health check. By carefully auditing these processes, we can spot areas where things might be slowing down or where mistakes could be happening. The goal is to make everything work better and be more accurate. Our blog on the savings you can make by automating recurring billing is a useful resource when making a case for automation.

One way to achieve this is by using automation tools, such as special software designed for recurring invoices. These tools easily fit into our current ways of doing things and help prevent errors in our billing process. For instance, automation can handle tasks like setting billing periods and creating invoices with all the correct details. Simple changes like incorporating automation can have a big impact on ensuring we receive all the money we’re supposed to. So, looking at how we handle billing and invoices and finding ways to make it smoother can truly pay off in the long run.

Dealing with project visibility and cross-functional communication is crucial in preventing revenue leakage, often arising from seemingly simple issues. A major culprit is insufficient internal communication. For example, if the sales team lacks information on pricing or key policies, they might unintentionally sell services at lower rates or miss opportunities for upselling. Such misalignment can lead to significant revenue leakage over time. Effective communication between teams can prevent these costly mistakes, ensuring everyone is on the same page.

Additionally, inadequate project visibility, especially in invoicing and revenue-generating processes, makes it difficult to proactively manage services and accurately assess performance. This lack of transparency can result in lost or delayed revenue. In project management, issues like scope creep, delayed deadlines, and inaccurate budget estimates can contribute to revenue leakage. Another concern is inaccurate billing due to poor tracking of billable hours, potentially resulting in services provided beyond what’s billed. Addressing these communication and visibility challenges is vital for preventing revenue leakage and maintaining financial health.

Possible outcomes of this step:

Welcome to the first installment of our two-part series on revenue leakage – a pervasive challenge faced by businesses across industries. In this blog, we’ll address a series of commonly asked questions that form the foundation for understanding and tackling it effectively. We’ll start by unravelling the concept, exploring its synonyms, and delving into the typical culprits behind this profit-sapping phenomenon. Through illustrative examples, we’ll shed light on the tangible impacts it can have on your business.

The second blog in this series will serve as a practical guide for those who want to conduct an internal audit and want to take actionable steps to fortify their business against further leakage. But, before we jump to solutions, it’s essential to understand where these leaks might arise and prioritize the areas so that you can identify possible problem areas. Below, you’ll find a list of questions that will be addressed. You can skip ahead by clicking the topic that interests you most. Let’s dive in and start reclaiming those lost profits.

Revenue leakage is a term that refers to the gradual dissipation of potential earnings arising from a medley of factors such as oversights, discrepancies, and inefficiencies within the billing and revenue management workflows. It’s akin to money earned by a business yet left uncollected—a disparity between what’s rightfully due and what actually finds its way into the coffers. Put simply, revenue leakage represents the funds owed to a company that slip through the cracks due to a myriad of reasons.

Research shows that revenue leakage is common, with 42% of companies experiencing the issue. One of the prime channels through which leakage transpires is a lack of internal awareness. This can manifest in scenarios where sales teams might inadvertently misinterpret or overlook changes in pricing structures, leading to inadvertent undercharges for services rendered. Moreover, inefficiencies within financial processes, instances of human error, pricing or billing discrepancies, and incongruities in billing systems can all contribute to profit drain, culminating in a notable impact on a company’s financial health. Recognizing and addressing these leaks is paramount to safeguarding a business’s bottom line.

The effects or impacts can have wide-ranging consequences on a business, affecting its financial health, growth potential, and overall competitiveness. Here is a comprehensive list of the potential effects:

Addressing profit drain is critical for businesses seeking to maintain their financial stability and competitiveness in a dynamic market environment. Implementing robust internal controls, conducting regular audits, and leveraging technology solutions are essential steps in mitigating the impacts of revenue leakage.

In businesses of all sizes and industries, revenue leakage can manifest in various forms, ultimately impacting the company’s financial health and overall profitability. These leaks can occur both externally, stemming from customer interactions and market dynamics, as well as internally, often related to operational inefficiencies and employee conduct. The image below gives a brief summary of common areas, and below it you will find further information about what each categorization means.

Recognizing these common examples and types of revenue leakage is essential for businesses seeking to maintain a healthy financial position. By implementing robust internal controls, conducting regular audits, and leveraging advanced technologies, companies can effectively identify and address these leaks, safeguarding their profitability and ensuring long-term success.

Every business is distinct, meaning there could be specific reasons for revenue loss that apply uniquely to your enterprise. However, in broad terms, there are common inefficiencies and shortcomings that lead to revenue leakage in businesses, particularly when it comes to subscription or modern billing models.

In the realm of revenue management, one of the primary culprits for revenue leakage is the presence of inefficiencies and errors within billing operations, especially in recurring billing processes. These errors can arise from both manual oversight and automated mishaps. Manual errors, such as sending out invoices with incorrect total amounts, can have a cumulative impact on a company’s earnings. Similarly, automated errors, like inaccuracies in data extraction for automated invoice generation, can lead to periodic overcharges or undercharges, further contributing to revenue loss over time.

Furthermore, the complexity of billing cycles can exacerbate the issue. When existing systems lack the capacity to effectively handle intricate billing cycles, companies may find themselves grappling with errors when attempting to downgrade or upgrade billing plans. For SaaS companies, this can translate into a significant loss of rightfully earned income. These challenges underscore the critical need for a robust billing solution to mitigate the risk of revenue leakage.

In addition to these broader inefficiencies, there are specific areas within recurring billing that demand attention. Pricing discrepancies across products, tiers, or customer segments can lead to either undercharging or overcharging, directly impacting revenue streams. Similarly, even slight inaccuracies in tracking customer consumption for subscription models based on usage can accumulate over time, resulting in substantial revenue losses. Unresolved disputes in billing and invoicing can lead to delayed payments or even complete revenue loss, while failing to bill for all services or products provided can leave potential revenue uncollected, ultimately affecting the overall financial health of the business.

Excessive reliance on special offers and discounts can be a double-edged sword. While discount codes can effectively drive transactions and attract new customers, it’s crucial to strike a balance. If your sales team doles out too many discounts, it can erode your profits over time. Similarly, if there’s an abundance of easily accessible coupon codes circulating online, it may lead to the same issue.

It’s worth noting that the proliferation of discount code websites poses a potential challenge. Without a system in place to monitor and manage these platforms, outdated or untracked discount codes may inadvertently cost your business. This situation can arise even if you don’t recall issuing those codes.

Furthermore, it’s essential to be mindful of how discounts and promotions are implemented. Over-discounting or applying promotions incorrectly can devalue your products or services, ultimately impacting your revenue potential. Striking the right balance in incentivizing transactions while safeguarding your bottom line is key to sustainable business growth.

One significant factor contributing to revenue leakage in SaaS companies is the inefficiency of their Accounts Receivable (AR) processes. Allocating valuable workforce resources to manually chase unpaid invoices not only consumes time but also detracts from the core focus of delivering value to customers. In contrast, opting for an automated solution streamlines and organizes the AR procedures, offering a more efficient approach.

For instance, manual follow-ups and reminders necessitate a coordinated effort across marketing, finance, and operations teams, making them labor-intensive and time-consuming. Implementing automated intelligent payment recovery protocols not only mitigates the risk of human error but also trims down collection expenses, thereby reducing dependency on resources.

Moreover, overlooking renewals, especially in subscription-based models, can lead to revenue leakage. Failing to capture opportunities for sustained customer engagement through missed renewals can result in a notable loss of revenue. It underscores the importance of implementing robust renewal strategies to ensure continued value delivery and revenue retention in subscription-based businesses.

In the realm of SaaS and recurring billing, involuntary churn refers to the loss of a subscriber due to mechanical issues like payment failures or card declines, rather than a lack of appreciation for the service. This can occur when payment gateways are unreliable or when a customer’s credit card expires. To prevent automatic cancellations, it’s crucial to have a backup payment method or an additional card on file, regardless of the customer’s intention to continue the subscription.

Complications arise when customer data for processing payments is fragmented across different systems, potentially resulting in outdated information. In such cases, businesses may struggle to collect payments from customers, even if services continue to be provided. This leads to a revenue loss, which can be further compounded if services are extended to these customers without receiving proper compensation.

Another challenge tied to involuntary churn is chargebacks, which occur when a customer disputes a transaction with their card provider. This category also encompasses product returns. The card issuer then demands the specified amount to be returned by the business. Interestingly, despite its seeming inevitability, involuntary churn can be managed. Implementing a dunning management system offers an effective solution, allowing businesses to recover potentially lost revenue through customized and streamlined automated processes tailored to their specific software operations.

Neglecting to implement effective measures to reduce voluntary churn can also lead to revenue loss. This type of churn occurs when a customer chooses to cancel their subscription or downgrade to a lower-tiered plan. To mitigate voluntary churn, it’s crucial for businesses to proactively identify and address issues in their customers’ experiences, ensuring that they remain satisfied and have no reason to leave or downgrade their subscriptions.

Additionally, emphasizing the significance of revenue operations is essential for aligning various functions within organizations, fostering a cohesive approach to maximizing revenue and ensuring sustainable growth. This entails integrating sales, marketing, finance, and customer service efforts to optimize revenue-generating strategies.

A significant concern in revenue management is the lack of internal communication, which may appear deceptively simple but can lead to substantial revenue leakage. If your customer sales team is not well-versed in critical business policies or pricing structures, they may inadvertently undercharge or remain unaware of additional costs for certain services. Establishing a consistent flow of communication across all teams in your organization can prevent these potentially costly errors.

Moreover, misalignment between the sales team and Customer Success Manager (CSM) can also result in revenue loss. For instance, a customer seeking an extra feature presents an upsell opportunity, but without accurate tagging between these teams the opportunity may be missed. This not only leads to lost revenue but can also result in voluntary churn if the customer seeks a different provider offering the desired functions.

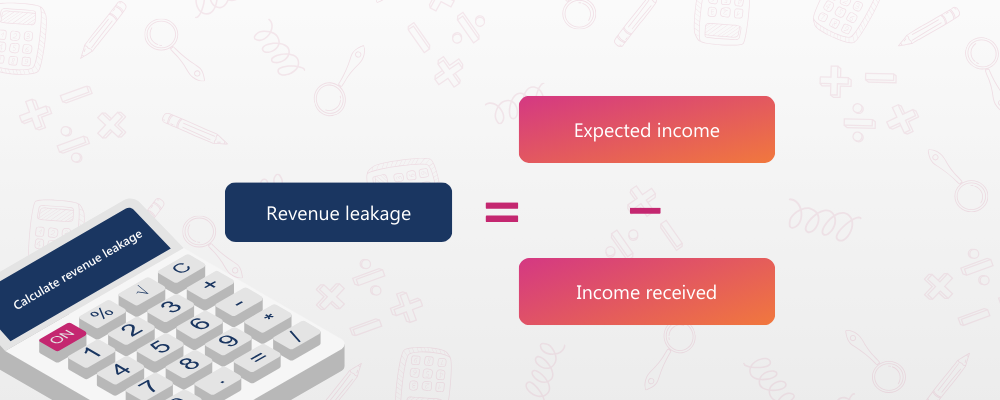

Mitigating revenue leakage can prove to be quite challenging without the appropriate strategies in play. However, assessing the extent of revenue leakage is a relatively straightforward process. By employing a basic formula, you can determine the extent of leakage within your business operations. Initially, aggregate the projected revenue from your projects or product lines. Subsequently, calculate the actual cash received. The variance between these figures provides an estimate of your revenue leakage.

The healthcare industry is undergoing a rapid and substantial expansion, with projections indicating that the global healthcare budget will surge to an astounding $15 trillion USD by the year 2030. This surge signifies an escalating demand for adept healthcare administrators and managers possessing a visionary approach to address challenges, thereby propelling operations to new heights.

Remarkably, administrative costs constitute a significant portion, accounting for 34% of the total healthcare expenses in the United States. Within this dynamic landscape, healthcare administrators contend with a myriad of pressing issues daily, ranging from surging costs and regulatory shifts to operational bottlenecks, security imperatives, and the transformative impact of cutting-edge technologies.

For healthcare providers, the prospect of overlooking this rapid growth is not an option. To flourish in today’s swiftly evolving environment, they must embrace adaptability as a cornerstone. This blog is dedicated to illuminating healthcare’s prevalent administrative hurdles and providing insights and optimal strategies to confront some of the industry’s most paramount concerns.

Each team will face different concerns. Skip ahead by clicking a challenge below:

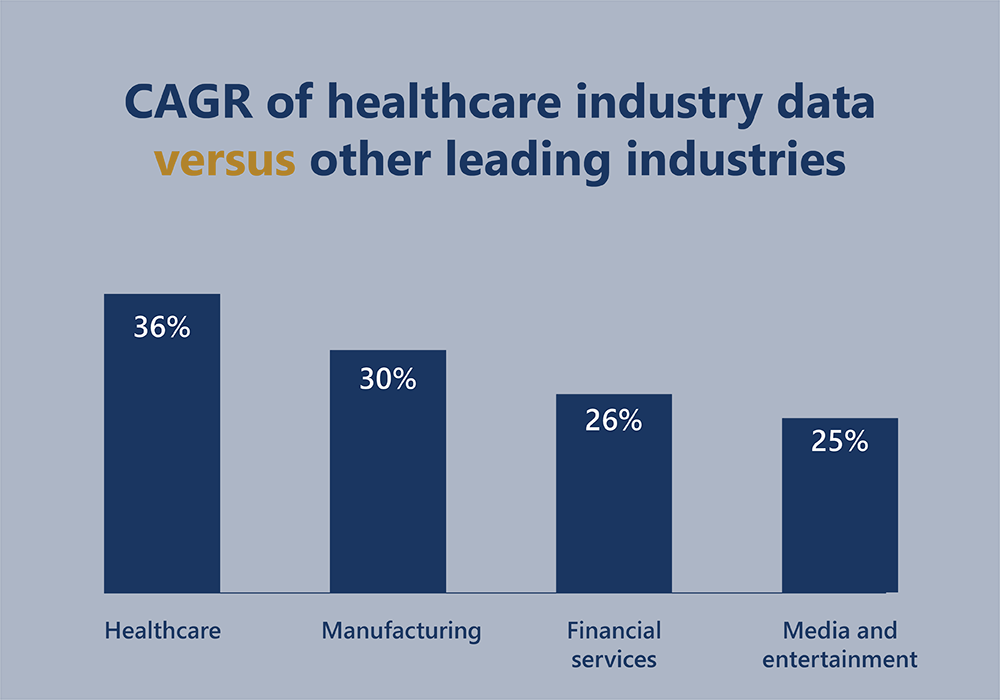

Effectively managing data is crucial in securing the future of healthcare. By 2025, it’s anticipated that a staggering 36% of the world’s data volume will stem from the healthcare sector, positioning it ahead of manufacturing, financial services, and media and entertainment. Refer to the accompanying image for a visual representation of this substantial growth in healthcare data compared to other industries.

Building a strategy to move forward

This surge in data necessitates a strategic approach from healthcare administrators. They must not only gather and interpret this data but also utilize it in meaningful ways to ensure the industry’s resilience. Given the diverse sources of data, administrators must prioritize best practices in data management, especially in financial contexts.

To navigate this data landscape effectively, investment in cloud-based solutions is imperative. These solutions offer comprehensive data visibility and advanced real-time reporting capabilities, enabling administrators to capitalize on this invaluable information. Too often, critical insights are lost in convoluted spreadsheets or outdated systems, which lack the agility required in an industry experiencing rapid expansion.

According to the American College of Healthcare Executives’ annual survey of issues confronting hospitals, financial challenges were the leading concern of hospital CEOs. Many point to the rising cost of healthcare due to the increase in insurance premiums and pharmaceuticals. However, financial concerns for the average clinic or hospital run much deeper than that.

The scope of concerns covers everything from consolidating financials across multiple health care units to managing medical billing, and denial and negotiating reimbursements. Robust financial management is vital. Most healthcare providers will require a digital transformation as the sheer scale of complexity would be impossible to handle manually. Our complete guide to financial management in healthcare is an online hub where we cover much of this information with videos, booklets and other resources.

Many are under pressure to expand and scale operations to serve the growing demand for services, which only adds to the complexity of their financial management. For instance, consolidating financial statements across multiple healthcare facilities is more involved than completing the period end report for one hospital.

For those with multiple healthcare units, check out our guides to financial consolidation:

As the demand for healthcare facilities surges, it’s no surprise that many healthcare providers will find themselves moving to new premises. Given the specialized nature of clinics and hospitals, finding a suitable space can be a costly venture. When your focus is on healthcare, the administration involved in managing and negotiating leases may come as an unwelcome complication.

Our blog on how to successfully negotiate medical facility leases sets out the best practices for healthcare providers looking to scale. It should give your administration team an idea of some of the challenges involved, such as tenant improvement allowances and exclusivity clauses.

Security is a growing concern of many healthcare providers. According to research, healthcare is particularly vulnerable to data breaches. Between February and May 2020, 132 breaches were reported in the US in large part due to the chaos introduced by COVID-19 that enabled scammers to take advantage while the industry struggled with a global crisis. It’s worth taking this risk and what it means for the future seriously, particularly given the amount of sensitive data stored by healthcare providers.

When it comes to protecting the financial health of your organization as you scale and grow, it’s worth investing in systems and solutions that boast advanced security options that protect you and your patient’s information. All accounting should take place in a highly secure environment that can store data and protect against threats.

Furthermore, it’s crucial to implement continuous monitoring and stay updated on the latest security protocols. As cyber threats evolve, so should our defences. Employing robust encryption technologies and implementing multi-factor authentication can provide additional layers of security for safeguarding sensitive information. By maintaining a proactive stance towards security, healthcare providers can fortify their defences against potential breaches and ensure the integrity of their data.

If you manage multiple healthcare units or are expanding, here are five steps to help you reduce and assess security risks.

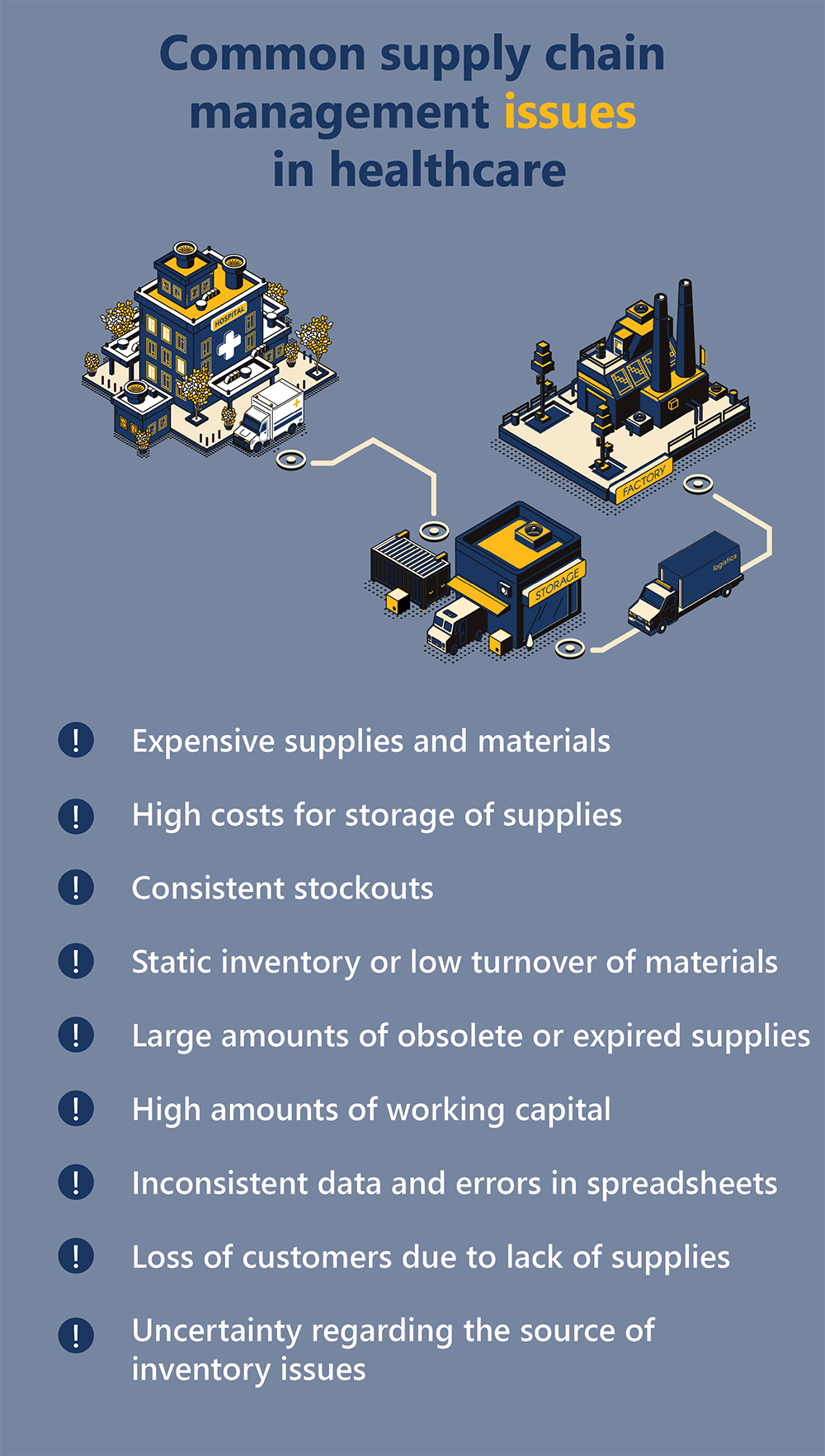

The supply chain is at the core of the healthcare industry, playing a pivotal role in its seamless operation. One of the most pressing challenges that administrators grapple with today revolves around the effective management of inventory.

This challenge is underscored by a range of common issues that frequently arise in healthcare supply chain management including expensive supplies and materials, high costs for storage of supplies, consistent stockouts, static inventory or low turnover of materials, large amounts of obsolete or expired supplies, high amounts of working capital, inconsistent data and errors in spreadsheets, loss of customers due to lack of supplies, and uncertainty regarding the source of inventory issues.

These challenges, while significant, are not insurmountable in today’s technologically advanced landscape. With the right software solutions in place, healthcare providers can address each of these issues effectively. Whether it’s optimizing inventory turnover or mitigating the costs associated with storage, modern technology offers practical solutions.

For those unsure about the urgency of supply chain management concerns in their facility, our guide to diagnosing and rectifying inventory issues provides a comprehensive resource. It aids in taking a step back, assessing any burgeoning inventory concerns, and addressing potential bottlenecks in the system. This proactive approach ensures that supply chain management remains robust and reliable, ultimately contributing to the seamless operation of healthcare facilities.

Remaining on top of changing healthcare regulations and policies is a critical facet of effective healthcare administration. The landscape of healthcare is continuously evolving, with new regulations and policies emerging to address the dynamic needs of the industry. Staying abreast of these changes is paramount for healthcare administrators to ensure that their organizations remain in compliance, provide quality care, and mitigate potential risks associated with non-compliance.

Adhering to global data management standards and regulations is another crucial aspect of maintaining a robust healthcare system. In addition to industry-specific standards like HIPAA in the United States, there are broader global data protection regulations that demand a high level of accountability in managing personal information. For instance, the General Data Protection Regulation (GDPR) in the European Union sets forth stringent requirements for the handling and protection of personal data. Healthcare providers operating on an international scale must navigate these complex regulatory frameworks to uphold patient privacy and data security.

By steadfastly abiding by these industry-specific and global standards, healthcare administrators not only ensure legal compliance but also instill trust in patients. This trust is a cornerstone of the patient-provider relationship, reinforcing the integrity of the healthcare system as a whole. It signifies a commitment to safeguarding patient information and prioritizing their well-being, which in turn, contributes to a culture of excellence and accountability within the healthcare organization.

Telemedicine and virtual healthcare have revolutionized the way healthcare is delivered, providing patients with the convenience of accessing medical services remotely. However, this shift has brought about a critical need for streamlined and automated complex billing solutions within the healthcare industry.

With the rise of telemedicine, healthcare providers are now catering to a larger patient base, many of whom prefer digital and automated methods for handling their bills. Patients expect fast, efficient, and hassle-free ways to make payments and receive invoices. Automating billing processes not only enhances the patient experience but also relieves the administrative team of the burden associated with manual billing tasks.

By implementing automated billing solutions, healthcare providers can significantly reduce the manual workload on their administrative teams. These solutions can handle tasks such as generating invoices, sending payment reminders, and processing payments. This allows the administrative team to focus on more critical tasks, such as consolidating financials and conducting thorough checks for errors or discrepancies.

One of the most significant advantages of automated billing in the context of telemedicine is its ability to provide immediate and accurate billing information to patients. This is particularly crucial for patients who need to make claims with their insurance providers promptly. With automated systems in place, patients can access their billing information in real-time, leading to faster and more efficient reimbursement processes.

For more information on modern billing, check out some of our key guides:

Revenue operations (RevOps) serves as a powerful framework and set of tools that can significantly enhance the management of every step along the patient journey in healthcare. This approach is particularly valuable for identifying friction points and aiding administrators in comprehending where bottlenecks and pain points may arise. Some of the areas RevOps can address include: resource allocation, workflow optimization, complex billing, patient pain points, end-to-end visibility, and friction resolution.

This is a relatively new concept for healthcare, and so we recommend checking out our guides to get a firm understanding of the power of this framework:

RevOps offers a tailored approach to healthcare, acknowledging its unique challenges and demands. By aligning sales, marketing, and customer success functions with revenue goals, healthcare providers can enhance patient satisfaction, operational efficiency, and financial viability. It is a fitting framework for healthcare and an essential one. It empowers healthcare providers to navigate the complexities of the patient journey, optimize workflows, and ultimately deliver higher-quality care. When implemented effectively, the approach can lead to a more patient-centric, efficient, and profitable healthcare operation.

In the realm of healthcare administration, recognizing the need for tailored, centralized solutions is paramount. Each healthcare facility operates with its own unique set of administrative challenges, from managing patient data to overseeing financial processes. A custom Enterprise Resource Planning (ERP) system designed specifically for healthcare can revolutionize operations by streamlining workflows, ensuring compliance, and enhancing overall efficiency.

To embark on this transformative journey, we encourage you to download our comprehensive custom ERP requirements checklist. This invaluable resource will serve as your blueprint, enabling you to meticulously outline the specific features and functionalities crucial to your healthcare facility.

By taking this proactive step, you’re poised to build a customized solution that perfectly aligns with your administrative needs, ultimately propelling your healthcare institution toward unprecedented levels of effectiveness and success. Don’t miss out on this opportunity to revolutionize your healthcare administration—download our checklist today and embark on the path to seamless, tailored operations.

Subscription revenue recognition has evolved in line with the advent of modern billing models introduced by the growth of subscription services. The ubiquity of subscription billing has led to many SaaS companies scrambling to understand best practices when it comes to revenue recognition.

While complicated to manage, these less traditional billing models can be very beneficial for companies looking to maximize their revenue and capture new markets with competitive subscription strategies. Understanding how to recognize revenue from these models is critical to their success and it can feed into every aspect of the company’s financial health. It’s a mistake to assume that only the finance teams need to understand how it works. Most companies will need to get numerous departments involved so they can evaluate their contracts, strategies, key performance metrics, planning, budgeting, pricing strategies, and even IT requirements.

In this blog, you’ll learn all about revenue recognition and get access to useful resources to help you better understand the complexities of “rev rec” for recurring billing and the accounting standards that you will need to meet (i.e., ASC 606 and IFRS 15). Below is a list of the topics covered. You can click each one to jump ahead to that section:

Subscription revenue refers to the income generated from ongoing subscriptions to a product, service, or platform. It represents the revenue stream that a business receives on a regular basis from customers who have subscribed to their offering for a specific period. This revenue is typically recurring, predictable, and often collected at regular intervals, such as monthly or annually. Subscription revenue is a key metric for subscription-based businesses and is influenced by factors such as the number of subscribers, subscription fees, and the retention rate of customers.

This type of revenue is frequently accompanied by enhanced customer retention, particularly when subscribers are required to actively cancel their subscriptions to discontinue the service. By subscribing, clients can anticipate their expenses over the subscription term and allocate funds accordingly. The revenue acknowledged by the company should align with the performance obligations, which are the services agreed upon with the client in exchange for the subscription fee.

It is a generally accepted accounting principle (GAAP) referring to how you recognize revenue. Regardless of when money lands in an account, the revenue only counts when the product or service is delivered and accepted. It helps companies identify what is actual revenue and what is a liability and should be deferred revenue.

In more traditional business models, the difference between cash collection and revenue recognition is often subtle, delivery of the product happens at the time of the transaction. For SaaS companies, it’s not so simple. Revenue should be recorded depending on how it accrues over time. You should only ever recognize revenue when the entire revenue-generating process is complete i.e., you must not recognize revenue until the contract’s performance obligation has been met and accepted.

Subscription revenue recognition is a subset of overall revenue recognition. It involves recording income once the entire revenue-generating process is complete and the performance obligation outlined in the subscription contract has been fulfilled and accepted by the customer. This shift in recording revenue impacts how subscription-based companies account for their financials, moving away from capturing a one-time lump sum payment and considering the subscription term as an essential component of their accounting practices.

Accrued revenue and deferred revenue are two distinct concepts within subscription revenue recognition. Accrued revenue refers to recognizing revenue for performance obligations that have been fulfilled but not yet billed, while deferred revenue involves deferring subscription revenue for cash received but not yet fulfilling all performance obligations.

Revenue recognition is of utmost importance for subscription billing due to several key reasons. Firstly, it ensures that accounting records are accurate and up to date in real-time. By properly recognizing and accruing revenue as performance obligations are fulfilled, companies can maintain accurate profit and loss margins that reflect their actual revenue.

Moreover, revenue recognition plays a vital role in connecting actual revenue and expenses concurrently, providing companies with a clear understanding of their financial health and identifying which subscriptions or activities are truly profitable. This visibility into subscription revenue recognition impacts every aspect of the business, allowing for informed decision-making and resource allocation.

Accurate revenue recognition is particularly crucial when it comes to external factors such as seeking investments, going public, or securing business loans. To attract investors and maintain transparency, companies must accurately recognize and defer revenue on their financial statements. Failing to grasp the intricacies of revenue recognition can have detrimental effects on the company’s reputation and its ability to make sound financial decisions.

Additionally, revenue recognition is essential for corporate tax calculations and compliance. The introduction of accounting standards such as ASC 606 and IFRS 15 has helped SaaS companies gain a better understanding of revenue recognition practices and the necessary steps to ensure compliance.

In order to gain a comprehensive understanding of how revenue recognition works for subscription-based businesses, let’s explore four different examples of subscription strategies and how revenue would be recognized in each situation.

These examples provide a simplified depiction of revenue recognition principles for subscriptions. However, it is important to note that implementing revenue recognition can become complex, especially when managing multiple revenue models.

The specific method of revenue recognition will depend on various factors, including the terms outlined in your contracts, the performance obligations involved, and the accounting standards that your company is required to adhere to.

Consider a content streaming platform as an example. Typically, these companies recognize revenue on a monthly basis. If a subscriber pays $15 per month for their subscription, you would record $15 in revenue each month on your financial statements for the duration of the customer’s subscription.

There are companies that offer annual subscriptions (often at a reduced rate for the commitment). A good example might be a software license. Revenue is recognized over the entire subscription period. If a customer pays $240 for an annual plan, you would divide the full amount by twelve months and, recognize $20 in revenue each month.

Similar to annual subscriptions, businesses may choose to provide longer-term contracts that recognize revenue throughout the contract duration. Suppose a customer signs a three-year deal for $576. In this case, you would recognize $16 in revenue each month over the course of three years, you arrive at this number by dividing the total revenue by the number of months over which the revenue will be recognized.

With usage-based subscriptions, such as cloud computing or pay-as-you-go services, revenue recognition may be based on the customer’s usage or activity. Let’s say a customer utilizes cloud storage at a rate of $1 per GB. If they were to use 500 GB in one month, the company would recognize $500 in revenue.

Determining the appropriate timing for recognizing subscription revenue is a crucial consideration for subscription-based businesses. Revenue should be recorded on an accrual basis, meaning it is recognized when the value is earned, rather than when payment is received. However, the complex nature of subscription models, where products and services are provided over different time periods, can complicate the recognition process.

At the time of payment

Before payment is received

After payment is received

Prepaid subscriptions

You earn revenue for a service each day that you deliver that service. If you claim the unearned income, it can lead to tricky situations if customers decide to complain, cancel, or ask for refunds. Deferring revenue appropriately makes it a liability and will protect your cash flow, preventing you from investing more than you earn.

Traditionally speaking, companies didn’t need to defer much of their revenue. Goods were usually paid for and received over the counter. Buying software was as simple as purchasing a disk and then downloading the content onto your hard drive. The customer had ownership of the product and might wait for years to update the technology.

In our current world, technology is advancing at an accelerated rate. Software no longer takes years to update, and by hosting services online and selling subscriptions. SaaS companies allow customers immediate access to the latest updates and configurations.

Companies are establishing recurring billing relationships that are mutually beneficial. However, this does complicate revenue recognition for the software or subscription provider. Customers may pay for services or software in advance, but you can only recognize revenue as services are delivered. For instance, if a customer buys a yearlong subscription and pays upfront. You are obliged to defer most of that revenue (as it is a liability rather than an asset) and recognize the revenue throughout the year.

SaaS companies often struggle to understand revenue recognition for services sold in bundles. Sometimes, a new customer will pay for several features at once. It’s common to have consulting services, set-up fees, customization, and support services included with the initial purchase of software.

Some of these services may be optional (e.g., consultancy services). Others might be obligatory (e.g., set-up fees). Revenue recognition is determined by whether or not these services are separate units of accounting.

In this instance, you should recognize the revenue of the set-up fee and annual fee over the first year of the service. Though the set-up fee is delivered early in the contract, it’s obligatory. Therefore it is part of the same unit of accounting as the subscription fee.

In contrast, the consulting service can be bought separately. It is a separate unit of accounting. Recognize the revenue over the first three months as the delivery of the consultancy services occur.

The growth of subscription services led to the introduction of ASC 606 and IFRS 15 by the Financial Accounting Standards Board (FASB) and International Accounting Standards Board (IASB). These standards help SaaS companies better manage their revenue recognition. As a result, enabling them to stay consistently compliant. They created a five-step approach that can be applied to any subscription billing structure. It outlines how to correctly recognize revenue with any contract.

There’s a lot to learn in each of these steps, which is why we created a booklet to help you better understand each stage and how they apply to your company. You can download it for free below. Start to recognize revenue correctly and enable your company to reach its full potential.

In today’s rapidly evolving business landscape, companies are increasingly relying on recurring revenue models to drive sustainable growth. Among the key metrics used to measure success in the subscription economy, Annual Recurring Revenue (ARR) stands out as a powerful indicator of a company’s financial health and future prospects. ARR serves as a litmus test for businesses, offering valuable insights into revenue stability, customer retention, and growth potential. By providing a comprehensive understanding of a company’s expected revenue streams, ARR enables more accurate forecasting, strategic decision-making, and long-term planning.

In this blog, we will delve into the frequently asked questions surrounding ARR, specifically in the XaaS and subscription economies, shedding light on its significance and best practices for tracking and reporting this critical metric.

As companies continue to expand their recurring revenue streams, it becomes imperative to establish effective reporting systems and keep a close eye on crucial metrics like ARR. To help you navigate the complexities of this vital metric, we will address some frequently asked questions in the context of the SaaS and subscription economies. If you have a specific question and would like to jump to that answer, simply click the question that interest you below.

Annual Recurring Revenue (ARR) is a key financial metric used in the subscription economy to measure the predictable and recurring revenue that a company expects to receive from its subscriptions or contracts over a period of one year. ARR specifically focuses on the value of term subscriptions normalized for a single calendar year.

What sets ARR apart from other revenue metrics is its emphasis on recurring revenue. Unlike one-time or sporadic sales, ARR accounts for the ongoing revenue generated from subscriptions that renew or continue on an annual basis. It provides a clearer and more reliable picture of a company’s revenue stability and growth potential by excluding one-time or non-recurring revenue sources.

Traditional revenue metrics, such as total revenue or monthly revenue, may not accurately reflect the long-term revenue outlook for subscription-based businesses. These metrics can be influenced by sporadic or seasonal sales, making it challenging to assess the sustainability and predictability of a company’s revenue stream.

In contrast, ARR focuses on the annualized value of recurring revenue, providing a more consistent and predictable measure of a company’s revenue performance. It enables businesses to evaluate their growth trajectory, assess customer retention rates, and forecast future revenue with greater accuracy. By concentrating on recurring revenue, ARR aligns closely with the core revenue model of subscription-based businesses, making it a valuable metric for understanding and analyzing their financial health.

ARR is regarded as a reliable indicator of a company’s health and growth potential for several reasons:

ARR plays a critical role in enhancing forecasting accuracy and facilitating strategic decision-making for businesses. Here’s how ARR impacts these aspects:

When calculating Annual Recurring Revenue (ARR), companies should consider the following factors to ensure accuracy and completeness:

![]()

Tracking and reporting ARR effectively involves implementing best practices to ensure accuracy, consistency, and transparency. Here are some key practices to consider:

Subscription Billing Suite (SBS) is a comprehensive software solution designed to automate the tracking and calculation of Annual Recurring Revenue (ARR) for companies operating in the subscription economy. By leveraging SBS, businesses can streamline their revenue management processes, reduce manual errors, and maximize their revenue streams. The suite offers robust features for managing subscription lifecycles, including automated billing, invoicing, and revenue recognition.

It seamlessly integrates with Microsoft Dynamics 365 solutions, ensuring accurate and up-to-date data synchronization. With Subscription Billing Suite, companies can gain real-time insights into their ARR, monitor subscription performance, and identify opportunities for upselling, cross-selling, and retention. By automating ARR calculations and revenue management, companies can focus on strategic initiatives, optimize their revenue potential, and drive sustainable growth in the subscription economy.

Northern Business Intelligence (Northern BI), a Canadian-based telematics provider, recently faced challenges in managing their monthly subscription billing accounting effectively. However, with the adoption of a new solution, Subscription Billing Suite (SBS), Northern BI was able to streamline their billing processes and manage their subscriptions more efficiently.

SBS allowed Northern BI to effectively manage recurring billing monthly schedules and reduce the growing number of invoice errors, ensuring greater accuracy in billing and helping keep customers satisfied. The cloud-based solution also accommodated growth year-on-year, enabling accounting to keep pace and scale operations with the company’s rapid expansion.

With SBS, Northern BI was able to automate reconciliations, eliminating manual processes and creating efficiency in the team’s operations. The solution was also built to integrate with both Dynamics GP and Dynamics 365 BC, making the transition between the old and new systems smoother and requiring a shorter training period.

The adoption of SBS allowed Northern BI to reduce the time spent on recurring billing cycles by 50%, and achieve a 98% customer retention rate. Furthermore, the migration from on-premise to cloud-based was a smooth and effective process, with the team fully supported by the SBS team throughout the transition.

Northern BI’s success story with SBS highlights the importance of adopting the right solution for managing recurring billing and subscriptions, and the positive impact it can have on a company’s operations and customer satisfaction. Download the full story with our case study.