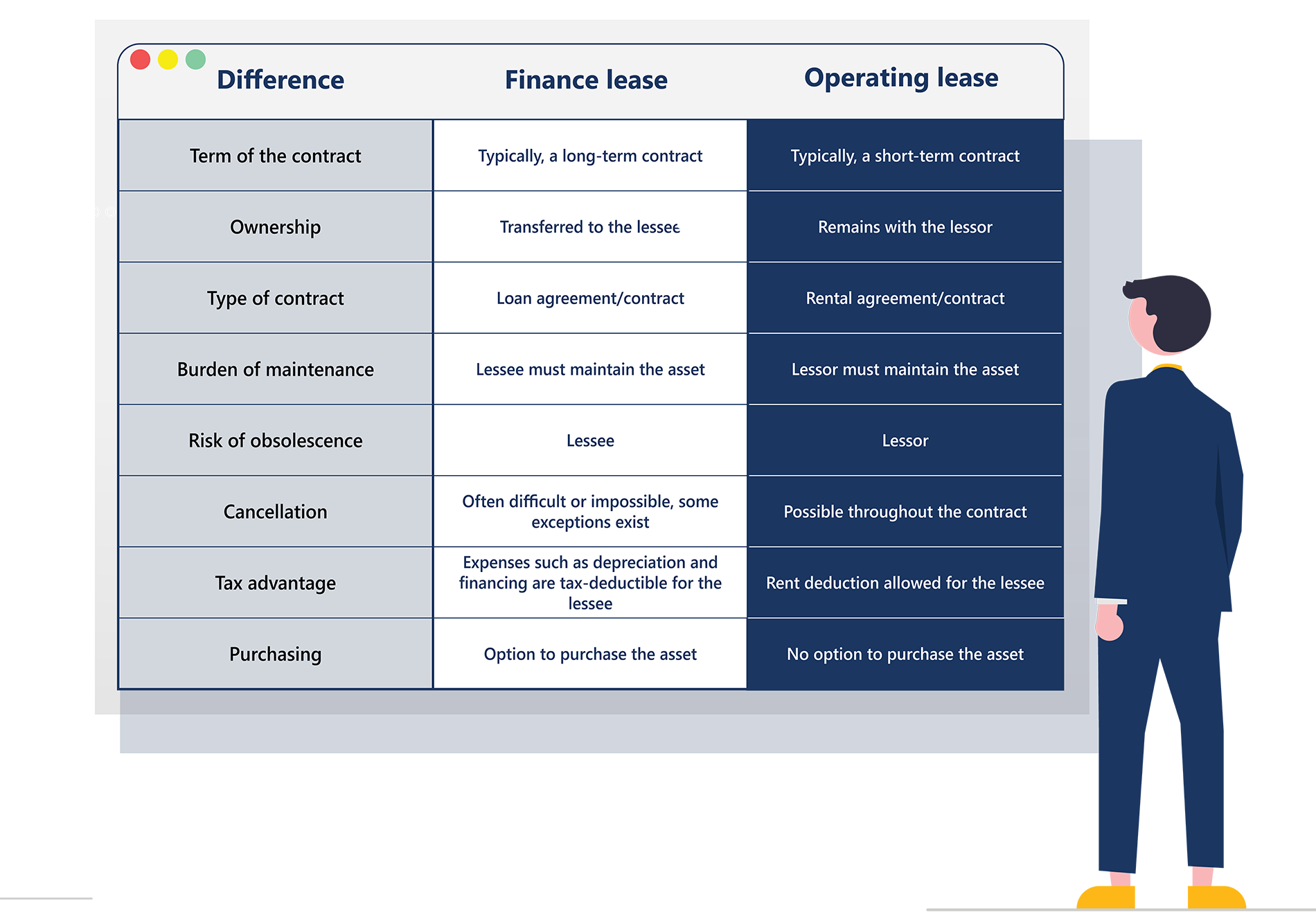

Operating leases and finance leases are two of the most common types of contracts that companies use today. Understanding the differences between them is critical to commercial success, and anyone running a company should carefully weigh their options when considering contract agreements.

There are several different ways to distinguish between operating leases and finance leases, and this blog will not only define each lease type but outline the key differentiators between the two.

A finance lease (a capital lease) is a commercial leasing arrangement where a finance company legally owns an asset, and the user rents it for an agreed-upon period. In this contract, the leasing company, typically the finance company, is referred to as the lessor, while the asset user is called the lessee.

Upon entering this agreement, the lessee gains operational control over the asset and assumes all associated risks and benefits of ownership. From an accounting perspective, the lease grants the lessee the economic attributes of owning the asset. The lessee records the asset as a fixed asset in their financial records, while the interest portion of the lease payment will be logged as an expense.

To meet the criteria for classification as a finance lease under US GAAP, the lease contract must satisfy at least one of the following conditions:

With the IFRS, a lease is considered a finance lease if it meets all of the following criteria:

A finance lease essentially functions as a business rental agreement, involving the following steps:

Regarding accounting, a finance lease significantly impacts a company’s financial statements. These leases are treated as ownership rather than rentals, affecting interest and depreciation expenses, assets, and liabilities. Due to capitalization, a company’s balance sheet shows increased assets and liabilities, while working capital remains unchanged.

The debt-to-equity ratio, however, rises. Expenses related to a finance lease are divided into interest expenses and principal value, akin to a bond or loan. Some payments are reported under operating cash flow, while others fall under financing cash flow, leading to an increase in operating cash flow for companies involved in finance leases.

Finance leases are customized based on the specific needs of both lessor and lessee. Despite variations, most finance leases typically include:

• Names of both parties, designating as lessor and lessee

• The asset being leased

• Total asset price

• Economic life of the asset

• Interest rate

• Principal and interest payment schedule

• Associated penalties and fees

This lease document can be intricate, and it’s advisable to consult a business or financial services lawyer to ensure the agreement is accurately drafted with all essential information.

Finance leases are employed across various industries, particularly when a company requires expensive equipment but wants to preserve cash flow and avoid a large upfront payment. Some examples of assets leased through finance arrangements include: land, plant equipment, heavy machinery, ships, aircraft, buildings, and patents.

An operating lease is a leasing arrangement in which the lessor permits the lessee to utilize an asset for a brief period in exchange for periodic payments, without transferring ownership rights of the asset.

From an accounting standpoint, leases are categorized as operating under ASC 842 if none of the five criteria for finance leases are met. In business, operating leases enable lessees to treat the leased assets as regular fixed assets while conducting their operations. However, this is only for a limited period, as the assets are ultimately returned to the lessor with some remaining useful life. The lessee essentially rents the asset to facilitate the normal operations of their business.

Operating leases are lease agreements where the terms do not resemble a purchase of the underlying asset. For instance, there is no transfer of ownership at the end of the lease, and the leased asset may be used by someone else after the lease term concludes. If none of the five criteria used to classify a lease apply, it is considered an operating lease.

These leases are employed for the temporary rental of assets and encompass conventional rental relationships. Previously, before the implementation of the new lease accounting standards, these leases were expensed outright, and neither the leased asset nor the associated liabilities were reflected on the balance sheet. Now, irrespective of whether a lease is operating or finance, both an asset and a liability must be recorded on the financial statements.

An operating lease is recognized under ASC 842 if it does not meet any of the following five criteria for finance leases:

In an operating lease arrangement, the lessor allows the lessee to use an asset for a limited duration in exchange for periodic payments. However, ownership rights of the asset remain with the lessor, and there is no transfer of ownership at the end of the lease term. The lessee treats the leased asset as a regular fixed asset, incorporating it into their business operations. Ultimately, the asset is returned to the lessor, typically with some useful life remaining.

An operating lease typically includes the following key elements:

Operating leases are commonly used for assets that have a limited lifespan or that are specialized and not expected to have alternative uses. Examples of assets frequently leased through operating agreements include: office space, vehicles, equipment, technology, and retail space.

Under IFRS accounting standards, if the risks and rewards are fully transferred, it is a finance or capital lease. Sometimes this can be hard to determine, so the IASB outlines it as if one of the following criteria apply:

Before the introduction of IFRS 16, numerous operating leases were recorded off the balance sheet. However, this changed, and all leases must now be treated in the way that finance leases are treated under IAS 17 except for those that meet the practical expedient for low value/short-term leases. Lessors are required to show a lease receivable and a future flow in income for each lease. To get a more thorough understanding, read our blog on the changes to accounting for operating leases under IFRS 16.

Whether you’re working with operating or finance leases, the administrative burden can overwhelm companies that do not have the right software. Investing in purpose-built property management software will be essential to effectively managing operating and finance leases and enabling your company to remain compliant.

Understanding the differences between operating and finance leases is essential. Every company’s demands are different, and fully understanding the compliance demands and risks can help you decide which option works best for you, whether you’re the lessee or lessor.

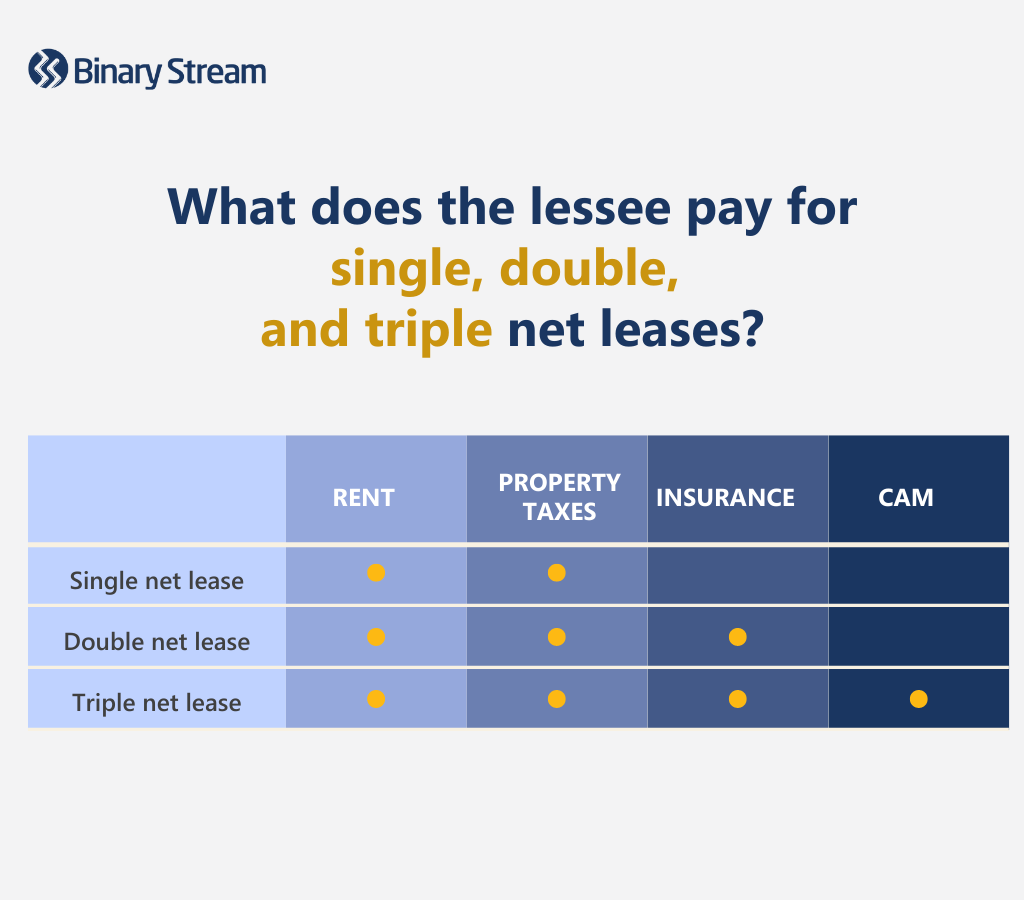

Net leases are quickly becoming the standard for rental agreements for commercial properties. Under a gross lease, lessees are only responsible for a flat-rate rental amount; however, under a net lease, lessees are also responsible for at least one additional operating expense. While it’s readily apparent how a net lease benefits a lessor, reducing responsibility and expenses for the upkeep of the property, they can also be advantageous for lessees.

Net leases provide lessees more control. Lessees may be more motivated to conserve their utility use since they’re responsible for a portion or all of the cost, which results in them paying less than they would in an all-encompassing gross lease. Read on to learn more about the differences between single, double, and triple net leases and how to account for them.

A net lease requires the lessee to pay base rent and assume responsibility for at least one additional operating expense associated with the property. The lessee can either pay the cost(s) directly or through remittance to the lessor. The following four lease subtypes determine the portion of additional expenses paid for by the lessee:

Net leases are one of the most common types of leases for commercial real estate. For multi-tenant properties, the net lease expenses are typically pro-rated and based on the rentable square feet occupied by each tenant.

For a single net lease, the lessee pays the monthly base rent and property taxes; meanwhile, the lessor takes care of all other operating expenses. Single net leases tend to be the least common type of commercial lease, but when they are implemented, it’s often for retail properties.

For a double net lease, the lessee pays the insurance in addition to the monthly base rent and property taxes. The lessor is responsible for all other operating expenses.

For a triple net lease, the lessee pays common area maintenance costs in addition to the monthly base rent, property taxes, and insurance. The lessor is responsible for any remaining incidental expenses, such as structural repairs to the property.

Absolute net leases, sometimes called bondable net leases, require the tenant to be responsible for rent and all other property-related expenses, including roof and structural repair costs. In these lease agreements, the lessor is relieved of all financial obligations. Absolute net leases are commonly used when the property investor borrows money to finance the commercial property and chooses to leave additional risks up to the lessee(s).

Although a less common lease subtype, confusion often arises because triple net and absolute net leases are both advertised as NNN leases. Structural repairs are generally costly, so it’s vital to complete ample research on different lease subtypes and clarify who will be responsible upfront.

Read more: Avoid these 7 common lease administration mistakes

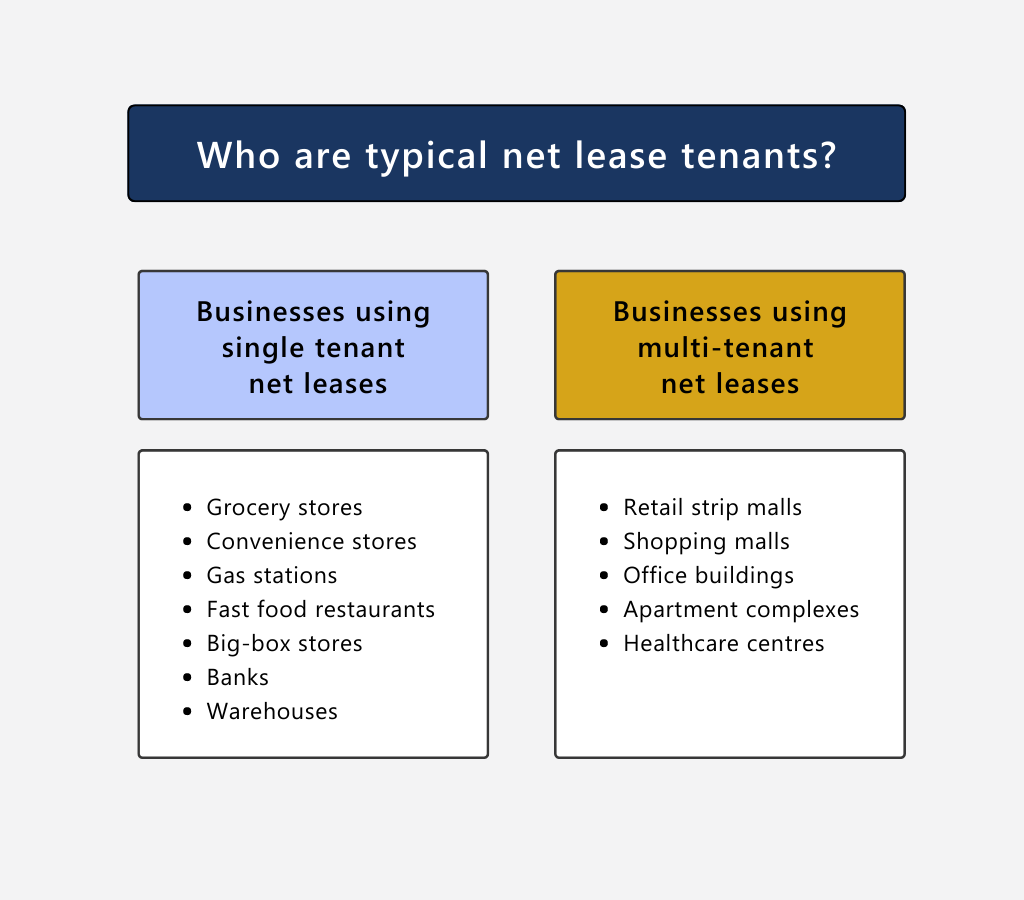

The most common net lease tenants are often businesses that offer fundamental goods and services, colloquially referred to as “recession-proof” tenants. These low-risk lessees are sought after for providing a steady flow of residual income. However, the unique benefits afforded to the lessor and lessee(s) are dependent on whether the lease is for a single tenant or multi-tenant property.

Commercial single tenant properties are often rented out via a triple net lease. These types of lease agreements often occur in real estate investments where the landlord does not actively manage the property. Typically, single tenant net leases have terms lasting ten or more years.

Common examples of businesses that utilize single tenant net leases include:

Commercial multi-tenant properties are more often rented out via a double net lease. Usually, each tenant possesses their own net lease agreement with the landlord, covering rent, property taxes, and insurance. Multi-tenant net leases tend to last for shorter durations—it’s rare for the terms to be longer than seven years.

Common examples of businesses that utilize multi-tenant net leases include:

While multi-tenant properties are higher risk investments that involve more maintenance work, lessors regularly receive higher yields and lessees pay lower monthly rent than for single tenant properties.

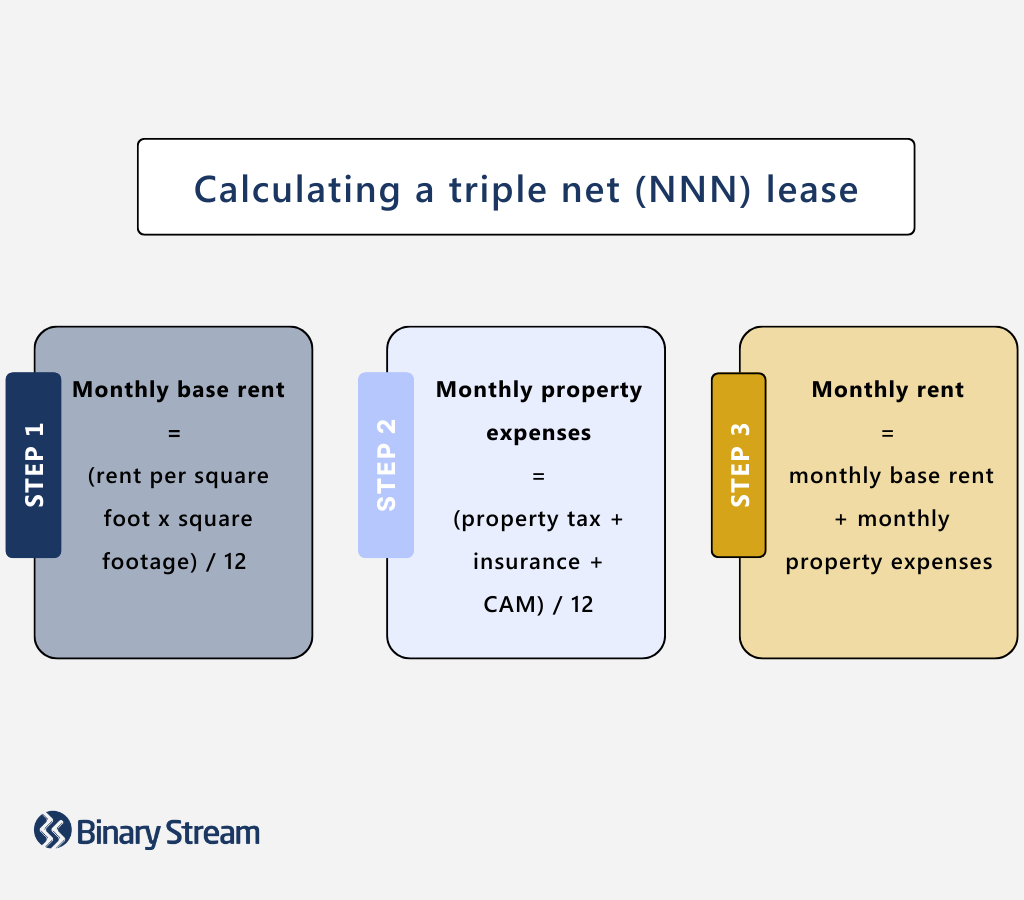

Understanding how to calculate a net lease is beneficial for both lessors and lessees. Lessees can make more informed decisions and compare lease advertisements while lessors can increase their odds of raising occupancy rates by better communicating the value of their offer.

For a triple net lease, the lessee must pay the base rent, property taxes, insurance, and common area maintenance (CAM) expenses. These charges are often lumped into one estimated annual rate that the lessee is required to pay. An example of an advertisement for a triple net lease would look something like this:

Lease rate: $20.00/ sq. Ft. NNN (Estimated NNN = $5 / sq. ft.)

In other words, the base annual rental rate is $20/ square foot, and the annual property expenses (NNN), which include property taxes, insurance, and CAM, are estimated at $5/square foot.

For single net (N) and double net (NN) leases, the estimated property expenses would not include CAM and would follow a similar format to triple net leases. For example, if the above advertisement was for a double net lease, it would be stated like this:

Lease rate: $20.00/ sq. Ft. NN (Estimated NN = $5 / sq. ft.)

Property expenses often change from year to year, so lessees must be prepared for costs to increase and decrease over a multiple year lease agreement.

Let’s assume that a lessor advertises the following for a 3,000 square foot, single tenant property:

Lease rate: $25.00/ sq. ft. NNN (Estimated NNN = $4 / sq. ft.)

The first calculation you’ll need to perform is finding the monthly base rent. This can be achieved using the following formula:

Monthly base rent = (rent per square foot x square footage) / 12

Monthly base rent = ($25 x 3,000 sq. ft.) / 12

Monthly base rent = $6,250

Then you must calculate the NNN or monthly property expenses:

Monthly NNN = ($4 x 3,000 sq. ft.) /12

Monthly NNN = $1,000

Finally, you must add together the values of the monthly base rent and the monthly NNN, which will return the monthly rent:

Monthly rent = $6,250 + $1,000 = $7,250

Therefore, the lessee must pay $7,250/month for the property. When the accounts are reconciled during period end, the lessee is billed or credited based on the actual expenses.

Net lease calculations can quickly become complicated, especially when managing multiple and multi-tenant properties. Errors from manual processes and delayed invoices can jeopardize your compliance requirements with accounting standards ASC 842, IFRS 16, and GASB 87, as well as negatively impact the relationship between the lessor and lessee. A robust solution, like Property Lease Management, automates your accounting processes and takes care of the nitty gritty, so you are free to focus on the tasks that matter.

Fractional ownership is having a moment, and it’s no wonder why. With inflation escalating the cost of many high-value assets globally, investors are looking for more cost-effective ways to gain ownership. With fractional ownership, investors pool resources and collectively own assets. It’s a strategic way for many to lower the barriers to entry and reduce the cost of investing in shares of a company or buying assets.

Fractional ownership is an investment where the cost of assets is split between shareholders. At its most straightforward, it is the percentage ownership of an asset. Owners or shareholders share the costs and benefits. Access may differ for various parties depending on the percentage ownership, but the benefits usually include usage rights, priority access, reduced rates, and income sharing. Suitable assets are generally capital-intensive, with the need for only occasional usage.

Fractional ownership in business is an investment where the asset/property is split between shareholders. It adheres to the same principles as regular fractional ownership. However, it’s often on a far grander scale. It allows companies and corporations to acquire assets that would be otherwise unaffordable.

The strategy is most effective where companies want to diversify their portfolio without taking on too much risk. It can also allow for the purchase of property or assets which are more stable than the stock market, giving companies access to stabilized income (e.g. fixed rents) while conservatively investing their funds.

If you don’t have fractional ownership experience, you might wonder about the benefits. Below are the five core benefits that make this investment type critical for companies as they expand.

Investments tend to involve a lot of time and paperwork, with teams struggling to complete these processes efficiently. Experts claim that the administrative burden is often lighter with fractional ownership as agreements and documentation tend to exist already, allowing companies to review the terms and make decisions quickly, benefitting companies who are in a hurry to invest.

One of the leading benefits of fractional ownership is the cost-effective nature of the investment. Companies gain access to all ownership advantages without paying or borrowing large sums of money at the outset. Where there is rental revenue or stock appreciation, investors reap the rewards without paying the total ownership costs.

Often the kinds of commercial real estate available for fractional ownership are called Grade A properties. Grade A properties tend to be home to multinational corporation tenants. Given the value of these properties and the coveted locations, the lessees are locked in with extensive terms defining future rent escalations. Those entering the fractional ownership agreement can easily see expected income streams and accurately predict the return on their investment.

Fractional ownership gives companies the flexibility to invest in several markets, properties, or assets. Rather than putting all their eggs in one basket, they can spread funds across several key growth areas and monitor returns. This allows companies to grow and diversify their portfolios simultaneously and gives them the flexibility to make responsive decisions in times of uncertainty.

Fractional ownership outperforms other investment types in three core areas: safety, stability and return on investment. The presence of an asset with consistent, predictable returns makes these types of investments particularly beneficial in times of economic uncertainty and fluctuating markets. Another reason they’re solid investments is the ability to quickly sell stocks or portions of the assets in times of flux.

There are two ways that companies tend to distribute rights for fractional ownership of assets. These are the pay-to-use, and the usage assignment approaches.

In this approach, co-owners pay a fee to use the property or asset. Generally, usage is calculated over a set period, i.e. per diem/week. Usage fees and rental income cover the costs of the asset. Any surplus is split between co-owners. When a deficiency arises, co-owners split the cost of satisfying the difference. Usually, the percentage of ownership does not impact usage rights, as all owners can pay to use the asset, and the amount paid in these instances is based on the usage amount.

All co-owners have a set number of days to use the property or asset in a year. Duration of usage can be either fixed or flexible or a mixture of both. Co-owners can use the property/asset during their assigned usage periods. In this type of agreement, co-owners’ usage rights and the amount paid for ownership should be proportional to each other, i.e. those who invest less have less access to usage or a lower number of assigned days.

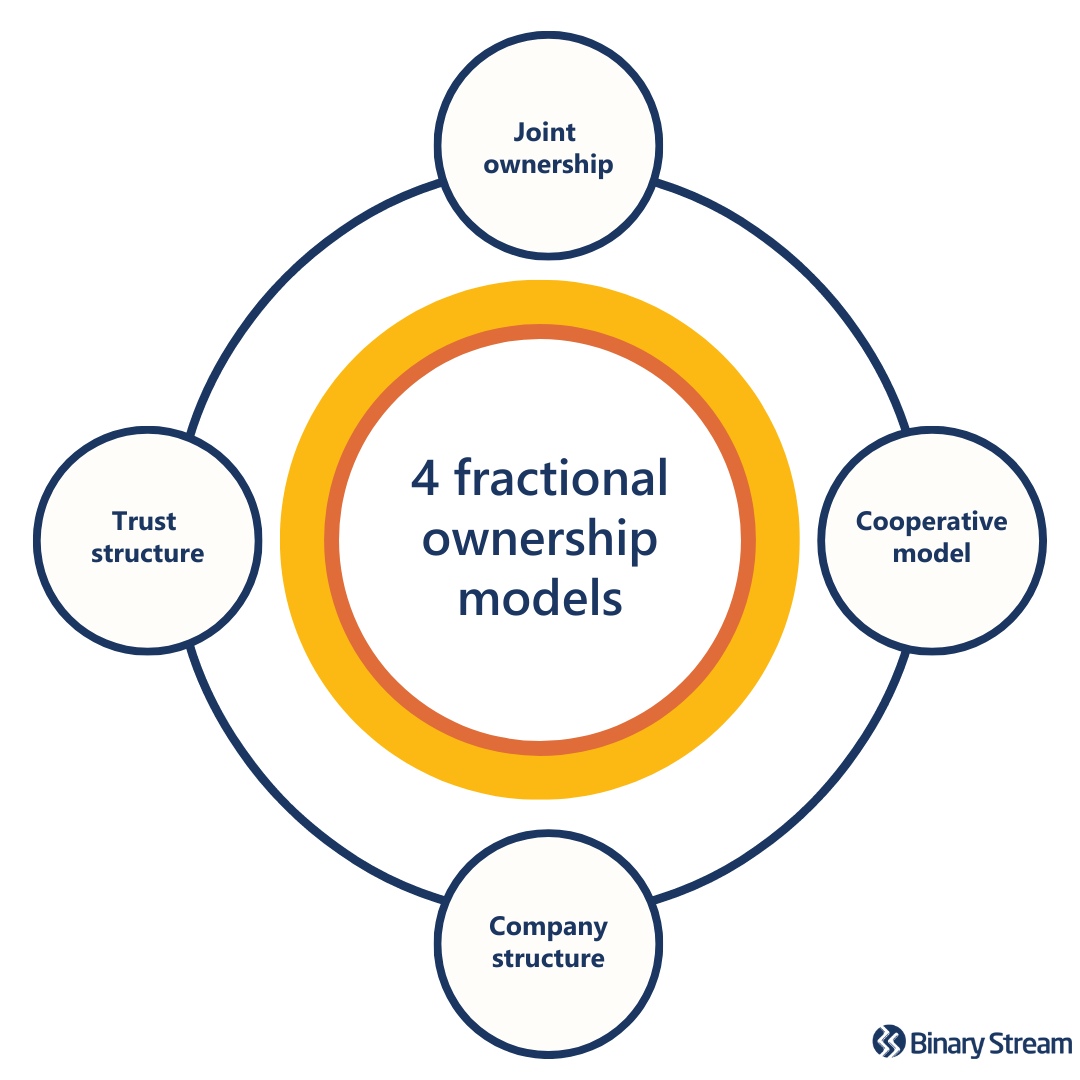

Fractional ownership varies from agreement to agreement, but there are a few core models that can easily be identified. Below we outline the most common models, however, please not that it’s essential to have these agreements reviewed by legal experts who can make sure everything is in order before you invest.

In a joint-ownership agreement, all the asset owners are co-owners. It includes a wide range of ownership types, including various types of tenancy. Where ownership is split into equal portions, it is referred to as joint tenancy. There are several different ways this model is applied. Those investing in joint ownership should pay particular attention to unity of title, unity of interest, unity of time, and unity of possession.

In a joint-ownership agreement, all the asset owners are co-owners. It includes a wide range of ownership types, including various types of tenancy. Where ownership is split into equal portions, it is referred to as joint tenancy. There are several different ways this model is applied. Those investing in joint ownership should pay particular attention to unity of title, unity of interest, unity of time, and unity of possession.

This model requires investors/key stakeholders to form a cooperative society which purchases an asset together, with each party owning a piece of the property/asset. They then share income, employment, and services, while investing time, labour, products, and other resources into building the value of the asset/property. This is less common among businesses but can be effective for community-based enterprises. Stakeholders in the cooperative are free to sell their shares and responsibilities to new owners.

The party responsible for selling the asset/property executes a trust deed which potential fractional owners create. This structure is subject to precise guidelines that must be adhered to, mainly where offshore trusts and tax treaties are involved. Companies that want to reap the tax benefits of this kind of model should speak to a team of trusted advisors before investing.

Investing in commercial properties can be a lucrative business endeavour, but only with proper planning. First, you must decide whether you will invest in single-tenant or multi-tenant commercial real estate.

While this might seem trivial, several distinctions beyond the number of tenants are vital to understanding which type of property aligns with your investment goals. By examining the differences between single-tenant and multi-tenant properties, you’ll be well positioned to develop suitable investment and leasing strategies to maximize profitability for your business.

Interested in a specific aspect of single and multi-tenant commercial real estate? Click on the topic below to skip ahead.

A single-tenant lease is a rental agreement between a lessor and the sole lessee of a property. Often, single-tenant properties are rented via absolute triple net (NNN) leases by investment-grade corporations, providing consumer staples in ideal locations and are insulated against economic disruptions. Common examples of single-tenant properties include:

A multi-tenant lease is a rental agreement between a lessor and several lessees in a larger, multi-unit property. However, it’s also common for lessors to rent out each unit in a multi-tenant property individually to a single tenant via a gross or net lease. The strongest multi-tenant investment properties consist of a diversified portfolio of reliable tenants offering consumer staples in a prime location. Common examples of multi-tenant properties include:

A co-tenancy clause in a commercial lease agreement permits lessees to reduce their rent if a core lessee or a certain number of lessees leave the multi-tenant property. A core lessee, sometimes referred to as an “anchor”, often generates a significant amount of traffic and provides incentive for other lessees to locate to that specific property. The reduced rent helps to compensate for a loss of traffic associated with the departure of the core lessee.

Co-tenancy clauses are fiercely negotiated items that can severely impact the profitability of commercial real estate. Often, lessors will insist on certain conditions to protect themselves from further legal action in the event of a co-tenancy violation. For example, lessees may not be able to invoke a co-tenancy clause if they are under default on the lease or they may have to provide evidence of a drop in sales during the co-tenancy violation period.

Further reading: 5 ways to optimize your property lease management strategy

Lease terms for single-tenant properties tend to be longer, fixed periods, ranging from 10–20 years. These long leases allow you to predictably accrue rental income and develop a transaction history with your tenant, generating enough data to be analyzed for insights to support long-term planning.

Single-tenant properties often operate with NNN leases, which means that, in addition to rent, the tenant pays for the taxes, insurance, common area maintenance (CAM), capital expenditures, and any other property maintenance costs. An absolute NNN lease enables a hands-off management style, allowing you to passively collect rent and focus your time on other endeavours.

One unit, one tenant, one lease—that’s what a lease consists of for single-tenant properties. While some complicated terms and negotiations can still exist, you won’t have to handle anything nearly as complex as managing the multitude of leases required to operate a multi-tenant property.

A gap in rental income while you search for a new lessee or complete property improvements can severely impact your bottom line. With only one lessee, you risk facing total vacancy if they leave at the end of the lease term. This is especially true if there is debt on the property, as you’ll still be expected to pay the mortgage, taxes, and other expenses.

You won’t be the only one aware of the risk of all-or-nothing occupancy. Lessees of single-tenant properties tend to have better leverage than lessees of multi-tenant properties because they can singlehandedly impact your cash flow. Whether they’re overly zealous negotiators or forgetful space cadets, improper tenant screening could lock you into a situation where you must either accept unreliable payments for upwards of ten years or pay hefty penalties to find a new tenant.

Multi-tenant properties often have reusable exterior and interior finishes, but single-tenant properties are usually heavily customized for the current tenant. When the time comes to sell, you’ll likely have to budget for a bloated tenant improvement allowance and preliminary maintenance charges to improve the property’s marketability. If prospective tenants cannot easily envision themselves in the space, it will be nearly impossible to convince them to sign the lease.

The value of a single-tenant property depends on the length of the lease term. While these properties may initially benefit from a lower capitalization rate than multi-tenant properties, the reverse will become true once the lease has less than seven years remaining. Additionally, longer lease terms prevent lessors from regularly adjusting rent, so while a single-tenant property may offer predictability, its value is not guaranteed.

Unlike single-tenant properties, there is a low risk that all the lessees of a multi-tenant property will leave at the same time. You can even take measures to help further prevent this, like staggering the length and end dates of the leases and leasing to tenants from various industries.

It is unlikely that every industry will experience disruption simultaneously or to the same degree. Therefore, multi-tenant properties with a diverse portfolio of lessees are often better equipped to survive recessions and continue to provide a steady income for lessors year-round.

Multi-tenant properties give lessors the unique opportunity to lease to tenants early in their growth journey. Rather than having to move, reliable tenants can lease out more units as they expand. Lessees can benefit by keeping costs low while scaling, and lessors can benefit from the value added to their property.

Multi-tenant properties offer shorter lease terms than single-tenant properties, often lasting between three to seven years. These lower commitment leases allow lessors to acquire higher value tenants, facilitate building upgrades, regularly adjust rent, and sell the property during a prime window of opportunity.

While the variety of tenants can help insulate you against market disruptions, it can also add to the managerial responsibilities. Accommodating different payment options, managing multiple leases, and responding to various emergencies are part of these properties’ more hands-on approach.

It’s common for tenants of multi-tenant commercial properties to pay a gross lease rather than a net lease. In these scenarios, lessees do not pay for secondary expenses like maintenance, insurance, or taxes. While you can still negotiate a net lease, you might lose prospective tenants who’ve only budgeted for a gross lease. Lessors frequently perform a balancing act to ensure that the rent covers costs without accidentally pricing out potential lessees.

Short-term leases are often a double-edged sword because, while they can provide flexibility, they commonly lead to more frequent tenant turnover. At times it may feel like there is a revolving door of lessees, and the uncertainty in vacancies can hinder your ability to project long-term income.

This is one of the biggest drawbacks to investing in multi-tenant properties. Unless you can negotiate a net lease, it’s far more likely that the lessor will be responsible for common area maintenance and building expenses. These responsibilities include numerous, time-consuming, and expensive tasks, such as repairing the plumbing or installing security systems.

Complicated lease terms and negotiations, proving regulatory compliance, allocating liability insurance, and paying taxes and management fees are some of the confusing minutiae that come with complex lease management. Without the proper tools, keeping track of the details of multiple leases can quickly spiral out of control.

Fortunately, solutions like Property Lease Management can help you accurately manage your leases without becoming overwhelmed. By automating processes like rent collection, compliance with accounting standards, and reporting, you’ll free up precious time to tend to the more challenging aspects of property management.

Binary Stream and Domain 6 combine 20 years of experience in complex lease management in a new partnership. Phase one of the collaboration will expand the reach of Property Lease Management for Microsoft Dynamics 365 Finance, with plans to extend momentum to Dynamics 365 BC in phase two.

Domain 6 specializes in helping organizations focused on managing and supporting assets find the right technology to empower growth. Salim Faroukh, CEO of Domain 6 Inc., expresses how the joint partnership will help leaders in the real estate market gain a competitive advantage with an end-to-end solution, built on a reliable, scalable and connected platform.

“This unique solution perfectly fills key white space in our customers’ ERPs. It’s a robust set of tools that streamlines lease management and will enable teams to optimize operations and focus on strategic decisions while saving time and money. We see this as an incredible opportunity to pool our knowledge and help accelerate the growth of D365 Finance and support our clients who are using Domain 6’s Asset Agreement Management Accelerator on the Power Platform.”

Lak Chahal, CEO at Binary Stream, agrees. He describes the partnership as an opportunity for both companies to build on their growing reputations in the Microsoft community.

“We’re so pleased to work closely with Domain 6. Property Lease Management is in the best possible hands as they always put the customer front and center, a fact reflected by Domain 6’s status as Gold-certified Microsoft Partners. We hope to combine our strengths to reach more leaders in the community.”

With the rise of non-compliance issues and a significant lift in the number of leases handled by the average company: complex lease management has never been more critical. For those using D365 Finance, it’s essential to have the right tools to fill the gaps in lease accounting functionality and empower your finance team.

For more information on Property Lease Management for D365 Finance, click here.

Navigating lease management is challenging enough without the added complication of understanding commercial lease terms. Whether you’re the lessee or lessor, it’s essential to understand common terminology to negotiate lease agreements effectively. This glossary will help you quickly scan and find simple definitions for the lease terms that might cause you confusion.

A lessor or landlord legally owns the asset or property. They may be a person, company, or legal entity. They lease the property or asset by giving the lessee the right to use or occupy it for a specified period.

A lessee or tenant pays rent for the right to occupy or use the property. They may be a person, company, or legal entity.

A term sheet or offer to lease outlines the terms and conditions of the lease agreement in bullet points. It’s used to guide the drafting of the formal lease agreement and is commonly used during negotiations to determine key terms such as base rent, lease period, and incidental expenses.

Base rent is the set amount the lessee pays to the lessor each month to occupy the premise or use the asset. It typically corresponds to square footage. There may be additional rent to pay each month, which is outlined in the other terms of the lease agreement.

Gross lease agreements may be referred to in a few ways: full-service gross lease, full-service lease, or even FSG. Any of these terms refers to a lease agreement where the lessee pays a flat monthly rate to the lessor. This payment covers both base rent and incidental expenses, meaning the lessor takes care of any additional costs. Usually, the base rent rate is higher to mitigate the risk of unexpected costs for the lessor. It’s a simple lease agreement that’s easy for all parties to understand.

A modified gross lease or MG lease refers to a lease agreement where the lessor shares the cost of defined incidental expenses. The lessee pays base rent monthly and agrees to some of the operating expenses for the property or asset. For instance, they might pay for utilities such as heat or electricity in addition to base rent.

A percentage lease is most typical in a commercial retail lease agreement. It requires a lessee to pay a monthly base rent and a percentage of gross sales over a defined minimum amount.

A net lease or N lease is where the lessee pays the monthly base rent and one incidental expense (e.g. insurance, property tax, utilities, etc.). The lessor is responsible for all other incidental expenses in this type of lease. Depending on the lease agreement, the lessee can pay the additional cost directly or remit payment through the lessor.

A double net lease or NN lease is where the lessee pays the monthly base rent and two incidental expenses (e.g. insurance, property tax, utilities, etc.). The lessor is responsible for all other incidental expenses. Depending on the lease agreement, the lessee can pay the additional costs directly or remit payment through the lessor.

A triple net or NNN lease is where the lessee pays the monthly base rent plus all incidental expenses (i.e. property taxes and insurance, utilities, and other operating and maintenance costs). The lessor is only responsible for structural repairs to the property.

Incidental expenses on a lease agreement refer to the costs of operating and maintaining the property. They are costs added to the base rent that either the lessee or lessor must pay. Examples include property taxes and insurance, utilities, common area maintenance, and repairs.

Common area maintenance or costs (CAM) refer to an incidental expense usually found on lease agreements. They refer to the cost of maintaining common areas shared between tenants of a building and include expenses such as property management, concierge or reception, snow removal, cleaning services, and landscaping.

Additional rent refers to incidental expenses that the lessee is responsible for paying in addition to base rent each month.

TMI is a commercial lease agreement term meaning “taxes, maintenance, and insurance”. It’s commonly found on agreements where the lessee is responsible for paying some or all of the incidental expenses (i.e. net, double net, and triple net lease agreements).

ILA is a commercial lease agreement term meaning “independent legal advice”. It refers to the recommendation that both parties receive legal advice before signing. If either the lessee or lessor forgoes the option to obtain legal counsel, this clause upholds the lease agreement terms against claims of misunderstanding.

Trade fixtures refer to any items the lessee chooses to install, which can be taken with them when they vacate the property. Typically trade fixtures refer to furniture, inventory, and hardware. Lease agreements should clearly define any assets lessees plan to take when they leave. Usually, the clause specifies the lessee’s responsibilities for any damage removal or installation might cause.

Tenant inducement payments (TIPs) are incentives added to a lease agreement to encourage lessees to rent the property or asset. Payments vary and can be rent-free months, cash payments, moving expenses, allowances for fixtures or leasehold improvements.

A tenant improvement allowance is an amount given by the lessor to help pay for leasehold improvements or renovations. It usually refers to permanent changes a lessee wants to make to prepare the space for commercial use or the specific demands of their operations. Examples include flooring, lighting, drywall, etc. These payments are often used as tenant inducements.

Turnkey improvements are renovations that the lessor carries out when you sign the lease. They may be included as a tenant inducement in a lease agreement.

Subleasing or sublet clauses are used in commercial lease agreements when the tenant leases unused space to another tenant. The subtenant lease agreement is independent of the original lease agreement. Tenants cannot sublease unused space unless this clause exists to give consent.

An exclusive right or exclusivity clause is particularly important for commercial lease agreements. This clause gives the lessee the right to be the only provider of a particular product or service. For instance, in a shopping mall, a hairdresser might want exclusive rights to haircutting services in the building.

A rent escalation clause limits and defines rent increases. This clause is essential for lessees as it impacts the cost of tenancy over time. Depending on the lease agreement, there may be a predefined rent increase every few years or an annual increase of 2%.

A vanilla shell lease or whitebox condition refers to a property that is almost move-in ready. Usually, buildout costs have been taken care of by the landlord, and amenities exist. For example, you can expect to get the property with finished ceilings and restrooms, HVAC, and ductwork complete, lighting, and elevators. Base rent is higher when the property is in this condition.

A cold dark shell lease refers to a commercial space without amenities. It means that the area is down to the studs, and you will still need to complete HVAC, plumbing, elevators, etc. The advantage of a lease like this is that the base rent tends to be lower, and lessees can negotiate a generous tenant improvement allowance to assist in building out amenities.

Second-generation leases are commercial leases where a similar tenant previously used the space. They dramatically reduce buildout costs. For example, if the new tenant is opening a restaurant and the property was formerly a restaurant, the lease might include many amenities standard in a commercial kitchen. Similarly, medical facilities may seek out second-generation lease agreements where units were previously used for medical purposes as spaces will likely include appropriate ventilation, waste removal amenities, etc.

Many companies perform a range of monthly lease-related transactions; rent, property insurance fees, tenant improvement allowances, common area maintenance (CAM) charges, and sublease payments are just a few examples that require accurate accounting. The ideal lease management process involves a consistently up-to-date lease portfolio with custom real-time reports and scalable accounting practices to maintain compliance.

So, what happens if you mismanage your leases? The short answer is wasted time and lost revenue. If you want to reposition your company to better align with the ideal management process, you’ll need to dig to discover why your team is struggling. This blog walks you through seven common lease administration mistakes that hold companies back and teaches you how to diagnose and fix poor property lease management.

Interested in a one of the lease administration mistakes? Click on the topic below to skip ahead.

As your lease portfolio expands, manually keeping track of critical dates to prevent payment penalties can become an impossible task. The average lease length varies internationally; therefore, failure to terminate a lease within the timeframe established in the agreement could result in an unintentional renewal and a hefty fee for breaking the renewed lease.

And while tasks like building maintenance and property inspections don’t have hard deadlines, if you are not performing routine maintenance duties, you could end up with a fine for outdated building codes or safety violations. Many counties are starting to enforce accessibility laws, so it’s best to ensure that your building has features like wheelchair ramps and braille signs.

Managing lease payments may seem simple but can become increasingly complex as your portfolio expands. Adhering to strict payment due dates for real estate taxes, CAM charges, and property insurance fees is non-negotiable. Delayed and inaccurate payments are unprofessional, costly, and erode tenant-landlord relationships.

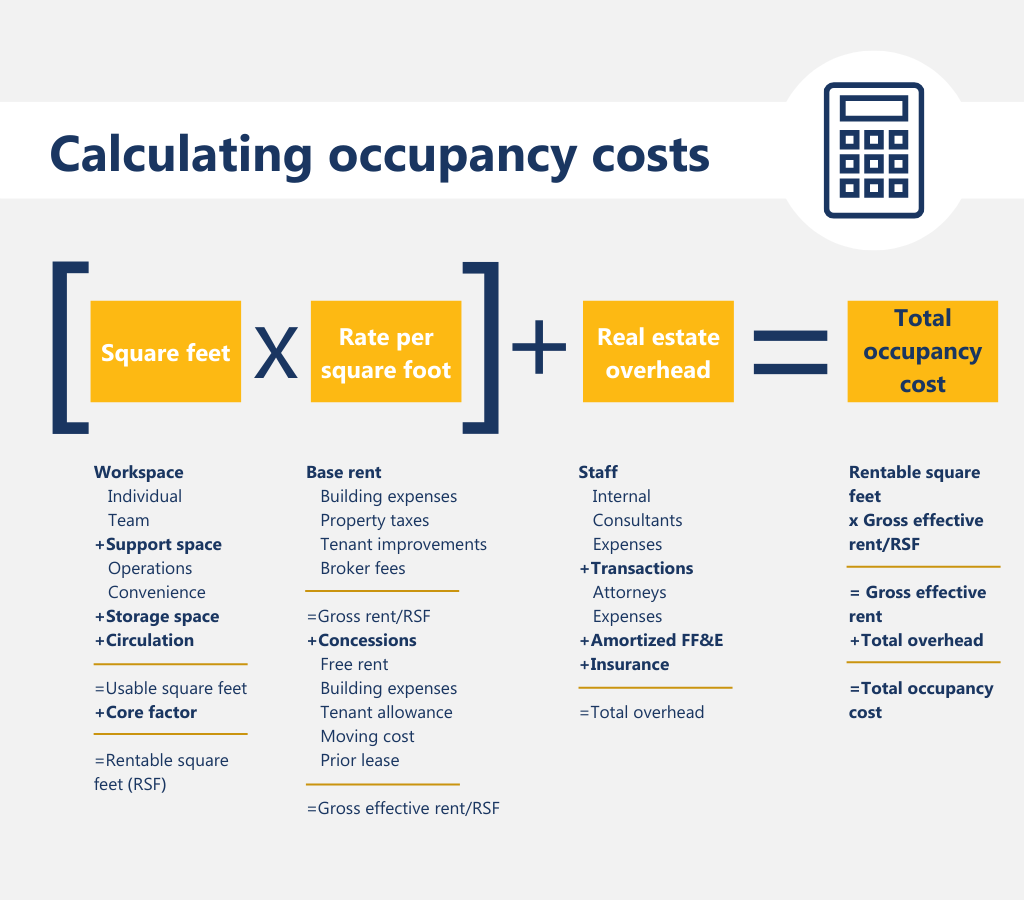

The right software will allow your company to reduce risk by automating labour-intensive manual processes and delivering a higher degree of accuracy. Equipped with a set of highly flexible tools, companies can properly calculate occupancy costs and allocate complex lease payments based on percentages, metering, square footage, or indices to streamline the lease process from start to finish.

Losing documents or partially filling out paperwork is one of the more easily preventable, yet still serious record-keeping mistakes commonly made by lease administrators. You must keep lease agreements, eviction notices, and move-in or move-out forms on file. It’s also advisable to separate lease-to-purchase and lease agreements, as the combination can result in confusion over who owns the property and who leases it. These documents will be indispensable if you ever need to go to court.

Watch out for two particular clauses in lease agreements: term dates and rentable square feet. This information is often incomplete or outdated, and clerical errors that provide conflicting evidence might confuse all parties down the line, resulting in undesirable consequences.

For example, if a lease states that the term is five years but includes dates that are for four years, the tenant may vacate the property before the lessor is prepared to refill it, leading to months or years of lost potential revenue.

Additionally, the exact rentable square feet for new builds are often unknown until the project is complete. However, the lease agreement must be updated before reconciliation when that information becomes available, as operating expenses are calculated using the rentable square feet.

Read more: 5 ways to maximize your property lease management strategy

Reviewing your building operating expenses is critical to understanding the cash flow associated with each property. Still, this process quickly goes out the window when companies relax their lease management practices. Overbilling by landlords, missed reimbursements, erroneous CAM charges, over or under-spending on building repairs, and tax errors are more common financial blunders that quickly stack up, impacting the bottom line.

Reviewing building operating expenses provides an opportunity to catch these errors, allowing you to recoup some of your revenue. Many companies that disregard the review process do so because they lack control over their lease management and view it as a time-consuming exercise. Fortunately, this is one of those mundane tasks that lease management software automates.

Whether it’s merely an oversight or desperation, filling properties by rushing the tenant screening process could cost you more than a vacant property. Missing or poorly handled conduct-related terms and restrictions combined with lax qualifications is a recipe for delinquency and high tenant turnover.

Tenants need clarity when it comes to the guidelines and your relationship. It’s often not enough to make a phone call or drop by when something goes wrong. The lease agreement must include how the tenant uses the space, their responsibilities, and whether they are allowed to assign their lease or sublet their space to a third party. Signage, verbal communication, and occasional reprimands hold little weight compared to written and signed acknowledgements from each tenant.

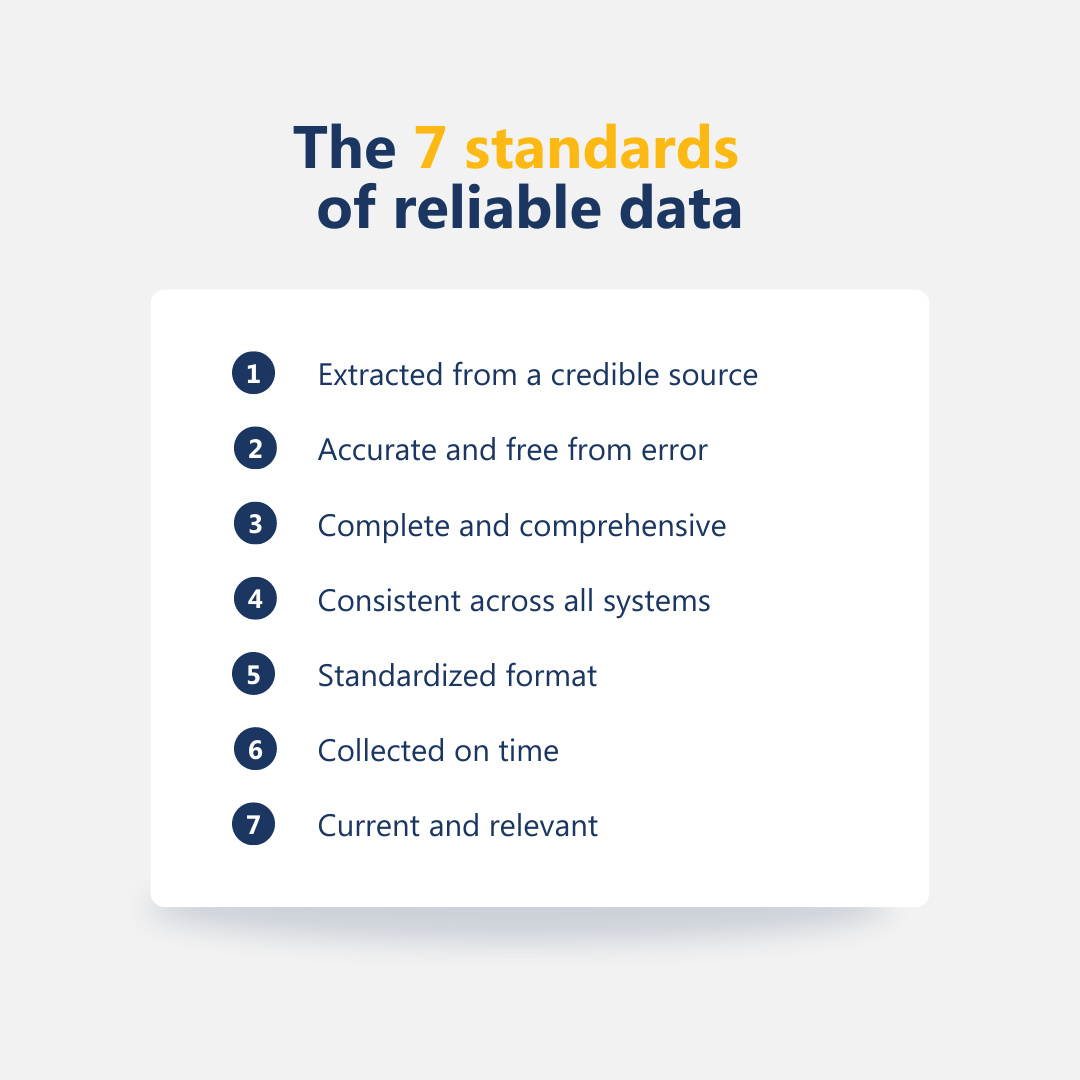

Organizations need a well-rounded view of all lease-related data, which can become challenging to maintain as your company grows. Not properly integrated data, updates that aren’t uniform across teams, and discrepancies between documents are common mishaps plaguing companies that rely on paper filing systems or a mishmash of spreadsheets and documents to store their information.

Poor data management can also result in too many vacancy days and unnecessary leasing delays, which increases the necessity of costly tenant inducements or generous tenant improvement allowances to attract new tenants.

Implementing a centralized data management system is integral to forecasting your cash flow, managing your lease portfolio, and preparing for compliance. You need to be able to create custom reports based on the data in your system and facilitate the ability to pull key real-time reports on property analysis, vacancy, delinquency, rent roll, and lease details.

Accounting standards are constantly evolving to keep pace with global innovation, so you must remain up to date with standards like GASB 87, ASC 842, and IFRS 16. Misinterpreting compliance regulations or, worse, ignoring new standards could result in hefty penalties.

As private companies start to embrace the new lease accounting rules, they can learn from what went wrong with public companies’ implementations—the process will take more time and resources than expected. The number of leases you may need to record on company balance sheets could dramatically increase, and from the outset, other departments need to be involved as they may be affected by the changes.

Maintaining compliance is easier when you compile your lease information into one easy-to-access database rather than scattered across various documents and spreadsheets. Modern companies optimize this process by integrating their accounting software with their lease information.

Implementing a robust solution enables your company to get ahead of these common lease administration mistakes. With software that fits your business requirements, you can access better data management for granular visibility and enable smoother compliance with accounting standards.

Property Lease Management digitalizes your lease portfolio, allowing you to manage complex charges and reconciliation at multiple levels of property with easy-to-use wizards. You can also automate manual processes to ensure that you never miss a critical deadline or lose important documentation. Your finance department will be freed up to focus on budgeting and data mining for strategic insights.

Lease management software varies in both the quality and the functionality of its features. If you’re investing in software to manage property, plant or equipment leases, you need to be aware of each feature’s benefits when managing the complexity of lease portfolios.

As your company grows, optimizing your lease administration strategy will be critical as property management grows in complexity. The right software will enable you to simultaneously scale, reduce risk, and streamline operations. Although there are some cheap solutions on the market, you tend to get what you pay for. Cheap lease management software rarely has the functionality you can rely on to get the job done efficiently. If you’re interested in finding a robust solution, this blog covers the essentials.

This feature comes first as it’s one that many companies forget. It’s easy to get distracted by new functionality, but there’s nothing more important than being able to seamlessly integrate your new solution with your current systems and databases. An inability to do this means you end up working between disparate systems—a process that results in bottlenecks and human error.

If you’re going to invest in an ERP system to manage your leases, the first item on your checklist should be integrating with your current systems. If you use Microsoft Dynamics, it will be essential to find property lease management software that extends its functionality, rather than increase complexity and errors with a system that doesn’t integrate fully.

Older systems often run from an on-premise database or server, with users having to be onsite to input data. This is a solution that is no longer suitable for busy property managers as technology has increased our business speed. Cloud-based systems allow teams to work in real-time with access to a centralized database from any location.

By allowing your lease management to exist in the cloud, you allow yourself more flexibility and give your team the ability to access the info they need when they need it. Resulting in fewer bottlenecks and allowing more efficient decision making. Also, you eliminate the need for large on-premise servers that are expensive to maintain and upgrade.

Lease management is heavy on administration, so it’s crucial to get a system capable of automating your most time-consuming processes. Bills, invoices, disbursements and reconciliations should all be possible to automate to cut down on manual labour and data entry errors. The same goes for handling complex charges based on sales, square footage, or economic indices, and automating time-sensitive tasks such as CAM reconciliations.

Using a system that cuts down on arduous processes will improve workflows. Automation also gives your team time to spend on more critical tasks, like analyzing the reports, looking for inconsistencies and resolving any discrepancies. It’s also wise to invest in solutions with front-end portals to make it easier to manage customer interactions and expectations.

Recommended reading: 10 steps to help you build an ERP requirements checklist

Failing to comply with legislation and regulations leads to penalties, and in some cases, the loss of your licence. As a property manager, you need to be sure you stay on top of the most recent leasing guidelines. Good commercial leasing software enable audit-friendly data and reporting, making it much easier to prove compliance.

No software guarantees compliance, but it should be built in line with regulations like IFRS 16 so that you your portfolio is adhering to the most recent accounting guidelines. Double-check that the software enables compliance before investing.

When it comes to communicating the data collected in your property lease management software, it’s essential that your system allows you to create custom reports and automate their delivery to the right people. One of the main advantages of having dedicated lease software is getting updates on lease performance and tackling red flags as they arise.

Looking for a system that allows you to create the reports your stakeholders want to see will be critical to fast growth. Not only will you not have to waste time looking for the information they require to make decisions, but they will automatically receive it on a predictable basis, allowing them to better plan significant decisions.

Recommended reading: 7 questions you should ask before choosing lease accounting software

Although this may not sound like a feature of new software, it is essential. Many of us have been burned by poor customer care in our lifetime, and the implementation of new leasing software is a time when you’re going to need a team on hand to help.

Make sure the software provider is available to offer support and training. Good customer care will be invaluable to ensure the correct adoption of new software. It also means your team will have someone to call if they get confused or overwhelmed by the new system

Commercial lease management involves the use of a lot of sensitive data. Therefore, your new system needs to make data security a priority. Look for software that emphasizes the importance of data protection and security so there’s no risk of a breach of your database. Look for SSL encryption and two-factor authentication, as well as advanced firewalls and automated notifications for new logins.

When it comes to renewals and terminations, it’s vital that your system keeps track and notifies you in advance. Timely notifications help ensure that your team is on top of all deadlines and informs all relevant parties of critical dates in advance. Missed critical dates is costly for property managers as it often results in holdover penalties and unexpected evergreen fees.

When landlords are securing lease contracts for properties, they often include an allowance for the tenant to improve the property. Generous allowances often help landlords secure longer-term leases that benefit both parties throughout the rental period.

However, as with all aspects of property lease management, if not handled appropriately, these allowances can cause difficulties when it comes to accounting and proving compliance with accounting standards. This blog will cover all the most asked questions about tenant improvement allowances and how to account for them.

If you’re looking for the answer to a specific question, select one of the topics below and jump ahead:

Leasehold improvements or tenant improvements refer to the renovations or customizations made to a property to benefit the tenant. To be considered a tenant improvement, the modification must have the following characteristics:

A tenant improvement allowance is a fund the landlord provides to pay for improvements to the leased space. These allowances often pay for costs incurred when a tenant moves to the new property, such as updating floors or windows.

Landlords allow tenant improvement allowance to cover both hard and soft costs of any renovation to the rented space. Hard costs are improvements to the property that the tenant will leave behind that benefit the landlord. Examples of hard costs include new flooring, electrics, HVAC, windows, framing, and doors. Soft costs include things like management fees.

The tenant improvement allowance doesn’t cover projects or expenses incurred due to the following reasons:

The amount available through a tenant improvement allowance varies and depends on the amount of work required and the specific renovation plans. Some properties may need very little work, and others will require a complete transformation. Without a detailed outline of the renovation, the allowance can be as low as $10–20 per square foot, which is unlikely to be adequate funding for new offices or commercial units.

Landlords decide on the exact allowance with the tenant funding any desired improvements that fall outside this budget. Usually, they will decide on an amount by assessing the real estate market, the client value, and the added value of the proposed renovations. For example, landlords may be willing to give a larger allowance to companies converting a warehouse into a modern workspace.

Additional reading: Top 8 essential commercial lease management software features

A turn-key agreement or a turn-key build-out occurs when the landlord solely oversees the construction process of tenant improvements and delivers the completed space to the tenant. Turn-key agreements protect the landlord from budget overruns via contingency costs.

However, tenants may be wary of this arrangement because it removes their ability to maximize the benefit of the tenant improvement, especially if the landlord is under budget. For example, if a landlord estimates $40 per square foot during the lease-signing process, but completes the project for $35 per square foot, the tenant has lost $5 per square foot in potential improvements.

No. Tenant improvement allowance are not considered loans and do not need to be repaid by the tenant—unless it’s an amortized tenant improvement allowance.

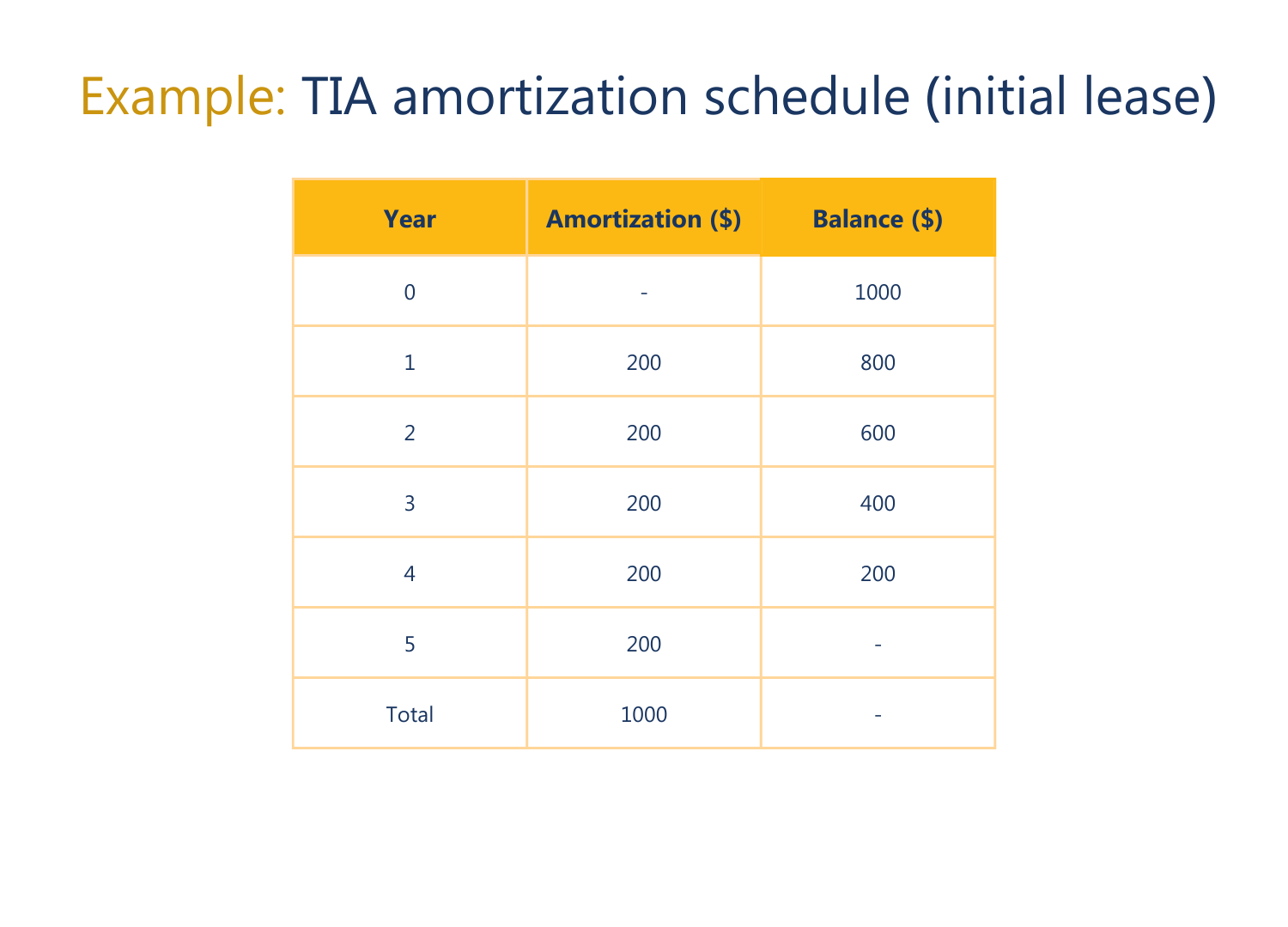

The tenant improvement allowance can be combined with a loan from the landlord to create an “amortized tenant improvement allowance”. Amortization is an accounting technique that reduces the book value of a loan or intangible asset over a set period. Typically, the amortization is repaid in instalments over the term of the lease, usually with interest.

Accounting experts suggest that if the total expenses incurred for tenant improvements exceeds the tenant’s capitalization limit during the same period, the total should be capitalized and amortized over the term of the lease or the life of the improvements. Nevertheless, this is something that’s negotiated on a case-by-case basis and agreed upon by both parties.

No. However, landlords can account for depreciation of tenant improvements because they are considered part of the building. Whoever oversees the improvements, tenant or landlord, can claim the depreciation deduction.

More often than not, the landlord will own the tenant improvements. Even if the tenant funds and oversees the renovations, that does not guarantee that they will own the improvements.

While payment of tenant improvements is a negotiated deal, ownership is usually determined by the terms of the lease agreement. Nearly all commercial net leases state that the tenant improvements become the landlord’s assets upon completion.

Additional reading: 7 questions you should ask before choosing lease accounting software

Accounting for tenant improvement allowances depends on whether the landlord or the tenant funds, oversees, and owns the improvements. Below, offers a quick overview of accounting for these allowances based on whether the landlord or the tenant owns the improvements.

When the landlord owns the renovations, they must record tenant improvements as fixed assets and account for the depreciating value of these assets over a specified period. The depreciation period for tenant improvements is either the useful life of the renovation or the term of the lease, whichever is shorter.

For example, if carpeting is installed that’s expected to be replaced in five years, and the remaining lease term is for seven years, the depreciation period should only be for five years. However, if the lease term is two years instead of seven, then the depreciation period should be for two years because it is shorter than the useful life of the new carpeting.

In some cases, the tenant may have a high expectation of renewing a lease and will consent to extending the depreciation period to cover the additional term of the lease, capped at the useful life of the asset.

When a new tenant moves in during the period in which the asset’s depreciation is being accounted for, as long as they do not require any additional improvements, the landlord can continue to account for the previous depreciation schedule. If there’s destruction or damage to the property, the remaining balance is recorded as a loss on the income statement.

When the tenant owns the improvements, they should record the TIA as an incentive or tenant inducement, treat it as a capital expenditure, and amortize the amount spent over the rental term. Salvage value is not included in the depreciation calculation, since the landlord will take over any remaining assets. In cases where the rental period is too short, the tenant must write off the outstanding balance.

Tenant lease improvements are considered assets, and accounting for them is crucial to remaining compliant with accounting standards like GASB 87, IFRS 16, and ASC 842. If you’ve multiple properties, keeping track of TIAs and making sure they’re appropriately accounted for can become complicated fast. Visibility and tracking of improvements are essential for commercial properties where renovations are expensive. Failure to adequately record and depreciate these values can be detrimental to your company’s health.

Rather than worry about keeping track of all these figures manually, it’s advisable to invest in property lease management software. Purpose-built software will enable your team to make sure you’ve full visibility of all funds and have the tools to track and depreciate the value of assets over time without having to worry about data-entry mistakes and administrative bottlenecks.

Additional reading: Using lease management software vs outsourcing your lease administration processes

The process of retail lease administration has evolved from a support function to a strategic role. Retailers face an array of demanding challenges brought on by a volatile and uncertain market, while striving to optimize profitability and add value through lease restructuring and management. When equipped with effective tools and processes, companies can facilitate better data management to support profitable decisions for both lessors and lessees. Unfortunately, many lack the technological infrastructure to achieve these goals.

Most commercial businesses depend on legacy technology systems, which can hamper their ability to innovate and progress. In fact, 80% of retailers lack a fully modernized core system that could incorporate emerging technologies, handle complex lease restructuring, and maintain compliance with global leasing standards ASC 842, GASB 87, or IFRS 16, as well as advanced cybersecurity protocols. After a careful audit of their systems and processes, many brands determine that they require financial transformation.

This blog explores seven of the most pressing challenges facing commercial lessors and lessees, and how to address these issues with a robust lease administration solution.

Lease renewals create an opportunity for lessees and lessors to negotiate for a more suitable lease agreement. Proactively engaging the other party and researching up to date comparables from the commercial real estate market can help prepare your company for a successful dialogue. Unfortunately, the process is not always so straight forward, especially if you need to negotiate multiple lease renewals. There are a host of details and deadlines to keep track of and any missteps can jeopardize your chance to improve your lease agreement.

Lease management software streamlines complex lease administration, so you can handle operating and finance leases with confidence. A centralized system stores all information in one place to allow you to stay on top of deadlines and negotiate from a proactive position. You can even automate notifications or routine time-sensitive tasks to ensure nothing slips through the cracks.

A tenant improvement allowance is a fund to pay for improvements to a leased space. These allowances often cover expenses that would provide additional value to the lessor. For example, a new lessee moves into a new property; renovations and updates like new flooring, HVAC, windows, framing, and doors would be covered. However, alterations that cater to the lessee’s specific needs or are removable are not covered by a tenant improvement allowance, such as electronic equipment, fixtures, furniture, or cabling for the Internet.

Tenant lease improvements are considered assets, and accounting for them is crucial to remaining compliant with accounting standards, especially if you’ve multiple properties. For commercial properties where renovations are typically more expensive, visibility and completion tracking are essential. Failure to adequately record and depreciate these values can be detrimental to your company’s financial health. That’s why it’s advisable to invest in property lease management software. Purpose-built software can help to eliminate data-entry mistakes and administrative bottlenecks while empowering your team with full visibility of all funds.

Lease administrators are often stuck navigating decentralized systems; locating spreadsheets riddled with errors due to manual data entry or wasting hours waiting for data to be emailed insecurely between teams. A problem that is only compounded when a retailer has thousands, or even millions, of data points about their stores, store locations, and leases from all over the world. Without the capability to adequately house that information, extracting relevant and accurate data is made nearly impossible.

With lease, deal, and comparables available in a centralized system, you can better evaluate available opportunities and make data-driven decisions. Comprehensive lease management enables both lessees and lessors to improve risk management, optimize profitability, and effectively evaluate liabilities. The high level of visibility afforded by modern technology could mean the difference between setting up in a prime business district and attracting the talent you want or being eclipsed by your competitors.

As a company scales its properties, it can become daunting to keep track of all vendors, brokers, and contracts. Not to mention coordinate multiple departments and teams within your organization. Relying on an ad-hoc system of emails, spreadsheets, and physical documents can lead to miscommunications and missed deadlines due to bottlenecks.

When everyone can access and collaborate on contracts within the same platform, the extended real estate team can establish clear lines of communication and work on projects in real time. Lease management software reduces the amount of time spent administrating, so your team is freed up to focus on building relationships with vendors and brokers while maintaining enough visibility to leverage opportunities as they arise.

A co-tenancy clause provides lessees with some measure of protection by allowing lessees to reduce their rent if key lessees or a certain number of lessees leave the retail space. Malls, shopping centres, and strip mall owners frequently encounter co-tenancy clauses; however, these are trickier to manage these days with unprecedented impacts on the brick-and-mortar retail experience.

To avoid breaching co-tenancy clauses and accommodating concessions, lessors must be able to coherently restructure existing leases and utilize force majeure clauses. In other words, all parties need access to accurate and up-to-date granular data. Robust lease administration smooths the path for lessors and lessees to find a creative and viable solution to disruptions and unforeseen circumstances. Complete visibility into existing portfolios enhanced with real-time analytics is an essential component of this process.

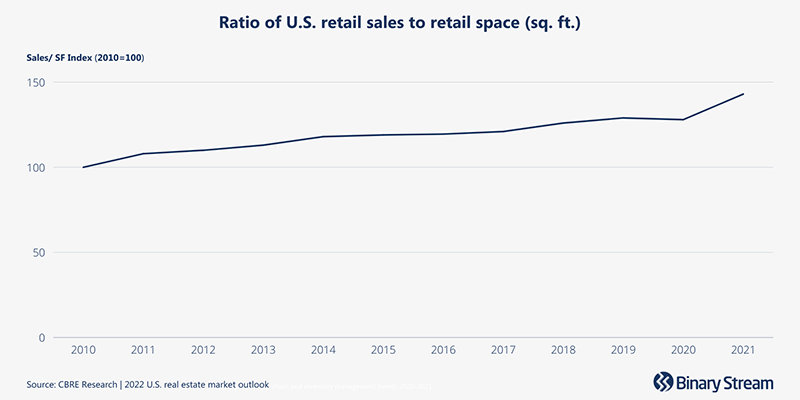

By 2023, it’s estimated that over 300 million US shoppers will be doing their purchasing online. However, 55% of shoppers visit a retail store before purchasing online, and only 10% of US consumer spending is done online. The trajectory of online shopping and its relationship to brick-and-mortar stores is introducing a host of new store concepts.

Some retailers are expanding their online presence and right sizing their locations, while some online-only retailers are seeking in-person store placement to better compete with existing products and create a space for face-to-face interaction with their customers. Some retailers are even experimenting with miniature, in-store concepts by leasing small areas of large footprint stores or trying out pop-up shops.

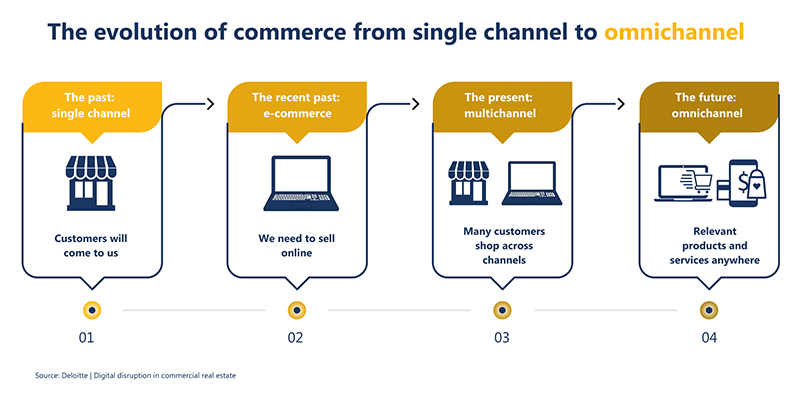

Adapting to consumer trends necessitates you provide subleasing and dynamic leasing options. As retailers embrace online shopping and omnichannel commerce, lessors must seek out unique ways to lease out their spaces. Unconventional lessees, mixed-use spaces, and subleases for online retailers are just a few emerging practices lessors need to understand to stay competitive in the market.

It can be difficult to maintain compliance under new lease structures and ever-changing accounting standards. Regardless of which standards your company needs to comply with (ASC 842, GASB 87, or IFRS 16), lease management software reduces risks your company faces and streamlines the process of proving compliance. Your team can save weeks (and sometimes even months) that would otherwise be spent double-checking entries and accounting for errors.

A robust lease management solution is an essential tool for modern retailers. Property Lease Management is a complete solution for property, plant, and equipment lease management with all the flexibility needed to suit your unique business model. It enables you to digitalize your lease portfolio, manage lease revenue and expenses, as well as handle complex charges and reconciliation. It’s available as an extension directly embedded into Microsoft Dynamics 365 Finance and Operations, Business Central, and GP.