Welcome to the first installment of our two-part series on revenue leakage – a pervasive challenge faced by businesses across industries. In this blog, we’ll address a series of commonly asked questions that form the foundation for understanding and tackling it effectively. We’ll start by unravelling the concept, exploring its synonyms, and delving into the typical culprits behind this profit-sapping phenomenon. Through illustrative examples, we’ll shed light on the tangible impacts it can have on your business.

The second blog in this series will serve as a practical guide for those who want to conduct an internal audit and want to take actionable steps to fortify their business against further leakage. But, before we jump to solutions, it’s essential to understand where these leaks might arise and prioritize the areas so that you can identify possible problem areas. Below, you’ll find a list of questions that will be addressed. You can skip ahead by clicking the topic that interests you most. Let’s dive in and start reclaiming those lost profits.

Revenue leakage is a term that refers to the gradual dissipation of potential earnings arising from a medley of factors such as oversights, discrepancies, and inefficiencies within the billing and revenue management workflows. It’s akin to money earned by a business yet left uncollected—a disparity between what’s rightfully due and what actually finds its way into the coffers. Put simply, revenue leakage represents the funds owed to a company that slip through the cracks due to a myriad of reasons.

Research shows that revenue leakage is common, with 42% of companies experiencing the issue. One of the prime channels through which leakage transpires is a lack of internal awareness. This can manifest in scenarios where sales teams might inadvertently misinterpret or overlook changes in pricing structures, leading to inadvertent undercharges for services rendered. Moreover, inefficiencies within financial processes, instances of human error, pricing or billing discrepancies, and incongruities in billing systems can all contribute to profit drain, culminating in a notable impact on a company’s financial health. Recognizing and addressing these leaks is paramount to safeguarding a business’s bottom line.

The effects or impacts can have wide-ranging consequences on a business, affecting its financial health, growth potential, and overall competitiveness. Here is a comprehensive list of the potential effects:

Addressing profit drain is critical for businesses seeking to maintain their financial stability and competitiveness in a dynamic market environment. Implementing robust internal controls, conducting regular audits, and leveraging technology solutions are essential steps in mitigating the impacts of revenue leakage.

In businesses of all sizes and industries, revenue leakage can manifest in various forms, ultimately impacting the company’s financial health and overall profitability. These leaks can occur both externally, stemming from customer interactions and market dynamics, as well as internally, often related to operational inefficiencies and employee conduct. The image below gives a brief summary of common areas, and below it you will find further information about what each categorization means.

Recognizing these common examples and types of revenue leakage is essential for businesses seeking to maintain a healthy financial position. By implementing robust internal controls, conducting regular audits, and leveraging advanced technologies, companies can effectively identify and address these leaks, safeguarding their profitability and ensuring long-term success.

Every business is distinct, meaning there could be specific reasons for revenue loss that apply uniquely to your enterprise. However, in broad terms, there are common inefficiencies and shortcomings that lead to revenue leakage in businesses, particularly when it comes to subscription or modern billing models.

In the realm of revenue management, one of the primary culprits for revenue leakage is the presence of inefficiencies and errors within billing operations, especially in recurring billing processes. These errors can arise from both manual oversight and automated mishaps. Manual errors, such as sending out invoices with incorrect total amounts, can have a cumulative impact on a company’s earnings. Similarly, automated errors, like inaccuracies in data extraction for automated invoice generation, can lead to periodic overcharges or undercharges, further contributing to revenue loss over time.

Furthermore, the complexity of billing cycles can exacerbate the issue. When existing systems lack the capacity to effectively handle intricate billing cycles, companies may find themselves grappling with errors when attempting to downgrade or upgrade billing plans. For SaaS companies, this can translate into a significant loss of rightfully earned income. These challenges underscore the critical need for a robust billing solution to mitigate the risk of revenue leakage.

In addition to these broader inefficiencies, there are specific areas within recurring billing that demand attention. Pricing discrepancies across products, tiers, or customer segments can lead to either undercharging or overcharging, directly impacting revenue streams. Similarly, even slight inaccuracies in tracking customer consumption for subscription models based on usage can accumulate over time, resulting in substantial revenue losses. Unresolved disputes in billing and invoicing can lead to delayed payments or even complete revenue loss, while failing to bill for all services or products provided can leave potential revenue uncollected, ultimately affecting the overall financial health of the business.

Excessive reliance on special offers and discounts can be a double-edged sword. While discount codes can effectively drive transactions and attract new customers, it’s crucial to strike a balance. If your sales team doles out too many discounts, it can erode your profits over time. Similarly, if there’s an abundance of easily accessible coupon codes circulating online, it may lead to the same issue.

It’s worth noting that the proliferation of discount code websites poses a potential challenge. Without a system in place to monitor and manage these platforms, outdated or untracked discount codes may inadvertently cost your business. This situation can arise even if you don’t recall issuing those codes.

Furthermore, it’s essential to be mindful of how discounts and promotions are implemented. Over-discounting or applying promotions incorrectly can devalue your products or services, ultimately impacting your revenue potential. Striking the right balance in incentivizing transactions while safeguarding your bottom line is key to sustainable business growth.

One significant factor contributing to revenue leakage in SaaS companies is the inefficiency of their Accounts Receivable (AR) processes. Allocating valuable workforce resources to manually chase unpaid invoices not only consumes time but also detracts from the core focus of delivering value to customers. In contrast, opting for an automated solution streamlines and organizes the AR procedures, offering a more efficient approach.

For instance, manual follow-ups and reminders necessitate a coordinated effort across marketing, finance, and operations teams, making them labor-intensive and time-consuming. Implementing automated intelligent payment recovery protocols not only mitigates the risk of human error but also trims down collection expenses, thereby reducing dependency on resources.

Moreover, overlooking renewals, especially in subscription-based models, can lead to revenue leakage. Failing to capture opportunities for sustained customer engagement through missed renewals can result in a notable loss of revenue. It underscores the importance of implementing robust renewal strategies to ensure continued value delivery and revenue retention in subscription-based businesses.

In the realm of SaaS and recurring billing, involuntary churn refers to the loss of a subscriber due to mechanical issues like payment failures or card declines, rather than a lack of appreciation for the service. This can occur when payment gateways are unreliable or when a customer’s credit card expires. To prevent automatic cancellations, it’s crucial to have a backup payment method or an additional card on file, regardless of the customer’s intention to continue the subscription.

Complications arise when customer data for processing payments is fragmented across different systems, potentially resulting in outdated information. In such cases, businesses may struggle to collect payments from customers, even if services continue to be provided. This leads to a revenue loss, which can be further compounded if services are extended to these customers without receiving proper compensation.

Another challenge tied to involuntary churn is chargebacks, which occur when a customer disputes a transaction with their card provider. This category also encompasses product returns. The card issuer then demands the specified amount to be returned by the business. Interestingly, despite its seeming inevitability, involuntary churn can be managed. Implementing a dunning management system offers an effective solution, allowing businesses to recover potentially lost revenue through customized and streamlined automated processes tailored to their specific software operations.

Neglecting to implement effective measures to reduce voluntary churn can also lead to revenue loss. This type of churn occurs when a customer chooses to cancel their subscription or downgrade to a lower-tiered plan. To mitigate voluntary churn, it’s crucial for businesses to proactively identify and address issues in their customers’ experiences, ensuring that they remain satisfied and have no reason to leave or downgrade their subscriptions.

Additionally, emphasizing the significance of revenue operations is essential for aligning various functions within organizations, fostering a cohesive approach to maximizing revenue and ensuring sustainable growth. This entails integrating sales, marketing, finance, and customer service efforts to optimize revenue-generating strategies.

A significant concern in revenue management is the lack of internal communication, which may appear deceptively simple but can lead to substantial revenue leakage. If your customer sales team is not well-versed in critical business policies or pricing structures, they may inadvertently undercharge or remain unaware of additional costs for certain services. Establishing a consistent flow of communication across all teams in your organization can prevent these potentially costly errors.

Moreover, misalignment between the sales team and Customer Success Manager (CSM) can also result in revenue loss. For instance, a customer seeking an extra feature presents an upsell opportunity, but without accurate tagging between these teams the opportunity may be missed. This not only leads to lost revenue but can also result in voluntary churn if the customer seeks a different provider offering the desired functions.

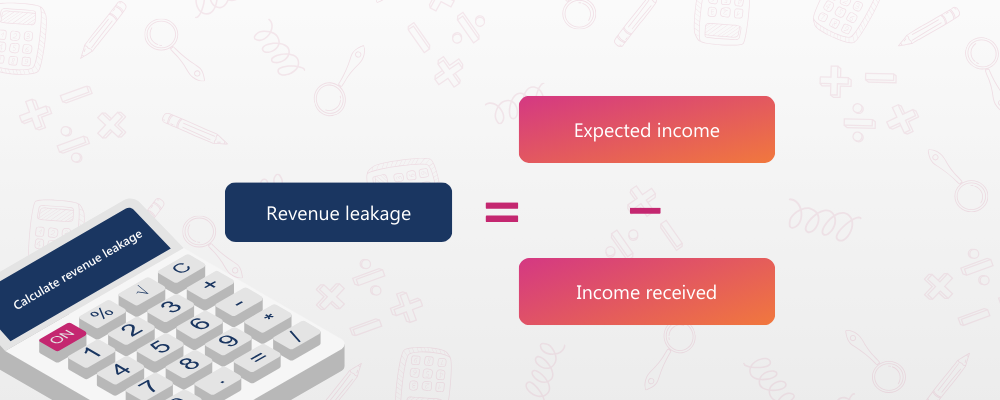

Mitigating revenue leakage can prove to be quite challenging without the appropriate strategies in play. However, assessing the extent of revenue leakage is a relatively straightforward process. By employing a basic formula, you can determine the extent of leakage within your business operations. Initially, aggregate the projected revenue from your projects or product lines. Subsequently, calculate the actual cash received. The variance between these figures provides an estimate of your revenue leakage.

Subscription revenue recognition has evolved in line with the advent of modern billing models introduced by the growth of subscription services. The ubiquity of subscription billing has led to many SaaS companies scrambling to understand best practices when it comes to revenue recognition.

While complicated to manage, these less traditional billing models can be very beneficial for companies looking to maximize their revenue and capture new markets with competitive subscription strategies. Understanding how to recognize revenue from these models is critical to their success and it can feed into every aspect of the company’s financial health. It’s a mistake to assume that only the finance teams need to understand how it works. Most companies will need to get numerous departments involved so they can evaluate their contracts, strategies, key performance metrics, planning, budgeting, pricing strategies, and even IT requirements.

In this blog, you’ll learn all about revenue recognition and get access to useful resources to help you better understand the complexities of “rev rec” for recurring billing and the accounting standards that you will need to meet (i.e., ASC 606 and IFRS 15). Below is a list of the topics covered. You can click each one to jump ahead to that section:

Subscription revenue refers to the income generated from ongoing subscriptions to a product, service, or platform. It represents the revenue stream that a business receives on a regular basis from customers who have subscribed to their offering for a specific period. This revenue is typically recurring, predictable, and often collected at regular intervals, such as monthly or annually. Subscription revenue is a key metric for subscription-based businesses and is influenced by factors such as the number of subscribers, subscription fees, and the retention rate of customers.

This type of revenue is frequently accompanied by enhanced customer retention, particularly when subscribers are required to actively cancel their subscriptions to discontinue the service. By subscribing, clients can anticipate their expenses over the subscription term and allocate funds accordingly. The revenue acknowledged by the company should align with the performance obligations, which are the services agreed upon with the client in exchange for the subscription fee.

It is a generally accepted accounting principle (GAAP) referring to how you recognize revenue. Regardless of when money lands in an account, the revenue only counts when the product or service is delivered and accepted. It helps companies identify what is actual revenue and what is a liability and should be deferred revenue.

In more traditional business models, the difference between cash collection and revenue recognition is often subtle, delivery of the product happens at the time of the transaction. For SaaS companies, it’s not so simple. Revenue should be recorded depending on how it accrues over time. You should only ever recognize revenue when the entire revenue-generating process is complete i.e., you must not recognize revenue until the contract’s performance obligation has been met and accepted.

Subscription revenue recognition is a subset of overall revenue recognition. It involves recording income once the entire revenue-generating process is complete and the performance obligation outlined in the subscription contract has been fulfilled and accepted by the customer. This shift in recording revenue impacts how subscription-based companies account for their financials, moving away from capturing a one-time lump sum payment and considering the subscription term as an essential component of their accounting practices.

Accrued revenue and deferred revenue are two distinct concepts within subscription revenue recognition. Accrued revenue refers to recognizing revenue for performance obligations that have been fulfilled but not yet billed, while deferred revenue involves deferring subscription revenue for cash received but not yet fulfilling all performance obligations.

Revenue recognition is of utmost importance for subscription billing due to several key reasons. Firstly, it ensures that accounting records are accurate and up to date in real-time. By properly recognizing and accruing revenue as performance obligations are fulfilled, companies can maintain accurate profit and loss margins that reflect their actual revenue.

Moreover, revenue recognition plays a vital role in connecting actual revenue and expenses concurrently, providing companies with a clear understanding of their financial health and identifying which subscriptions or activities are truly profitable. This visibility into subscription revenue recognition impacts every aspect of the business, allowing for informed decision-making and resource allocation.

Accurate revenue recognition is particularly crucial when it comes to external factors such as seeking investments, going public, or securing business loans. To attract investors and maintain transparency, companies must accurately recognize and defer revenue on their financial statements. Failing to grasp the intricacies of revenue recognition can have detrimental effects on the company’s reputation and its ability to make sound financial decisions.

Additionally, revenue recognition is essential for corporate tax calculations and compliance. The introduction of accounting standards such as ASC 606 and IFRS 15 has helped SaaS companies gain a better understanding of revenue recognition practices and the necessary steps to ensure compliance.

In order to gain a comprehensive understanding of how revenue recognition works for subscription-based businesses, let’s explore four different examples of subscription strategies and how revenue would be recognized in each situation.

These examples provide a simplified depiction of revenue recognition principles for subscriptions. However, it is important to note that implementing revenue recognition can become complex, especially when managing multiple revenue models.

The specific method of revenue recognition will depend on various factors, including the terms outlined in your contracts, the performance obligations involved, and the accounting standards that your company is required to adhere to.

Consider a content streaming platform as an example. Typically, these companies recognize revenue on a monthly basis. If a subscriber pays $15 per month for their subscription, you would record $15 in revenue each month on your financial statements for the duration of the customer’s subscription.

There are companies that offer annual subscriptions (often at a reduced rate for the commitment). A good example might be a software license. Revenue is recognized over the entire subscription period. If a customer pays $240 for an annual plan, you would divide the full amount by twelve months and, recognize $20 in revenue each month.

Similar to annual subscriptions, businesses may choose to provide longer-term contracts that recognize revenue throughout the contract duration. Suppose a customer signs a three-year deal for $576. In this case, you would recognize $16 in revenue each month over the course of three years, you arrive at this number by dividing the total revenue by the number of months over which the revenue will be recognized.

With usage-based subscriptions, such as cloud computing or pay-as-you-go services, revenue recognition may be based on the customer’s usage or activity. Let’s say a customer utilizes cloud storage at a rate of $1 per GB. If they were to use 500 GB in one month, the company would recognize $500 in revenue.

Determining the appropriate timing for recognizing subscription revenue is a crucial consideration for subscription-based businesses. Revenue should be recorded on an accrual basis, meaning it is recognized when the value is earned, rather than when payment is received. However, the complex nature of subscription models, where products and services are provided over different time periods, can complicate the recognition process.

At the time of payment

Before payment is received

After payment is received

Prepaid subscriptions

You earn revenue for a service each day that you deliver that service. If you claim the unearned income, it can lead to tricky situations if customers decide to complain, cancel, or ask for refunds. Deferring revenue appropriately makes it a liability and will protect your cash flow, preventing you from investing more than you earn.

Traditionally speaking, companies didn’t need to defer much of their revenue. Goods were usually paid for and received over the counter. Buying software was as simple as purchasing a disk and then downloading the content onto your hard drive. The customer had ownership of the product and might wait for years to update the technology.

In our current world, technology is advancing at an accelerated rate. Software no longer takes years to update, and by hosting services online and selling subscriptions. SaaS companies allow customers immediate access to the latest updates and configurations.

Companies are establishing recurring billing relationships that are mutually beneficial. However, this does complicate revenue recognition for the software or subscription provider. Customers may pay for services or software in advance, but you can only recognize revenue as services are delivered. For instance, if a customer buys a yearlong subscription and pays upfront. You are obliged to defer most of that revenue (as it is a liability rather than an asset) and recognize the revenue throughout the year.

SaaS companies often struggle to understand revenue recognition for services sold in bundles. Sometimes, a new customer will pay for several features at once. It’s common to have consulting services, set-up fees, customization, and support services included with the initial purchase of software.

Some of these services may be optional (e.g., consultancy services). Others might be obligatory (e.g., set-up fees). Revenue recognition is determined by whether or not these services are separate units of accounting.

In this instance, you should recognize the revenue of the set-up fee and annual fee over the first year of the service. Though the set-up fee is delivered early in the contract, it’s obligatory. Therefore it is part of the same unit of accounting as the subscription fee.

In contrast, the consulting service can be bought separately. It is a separate unit of accounting. Recognize the revenue over the first three months as the delivery of the consultancy services occur.

The growth of subscription services led to the introduction of ASC 606 and IFRS 15 by the Financial Accounting Standards Board (FASB) and International Accounting Standards Board (IASB). These standards help SaaS companies better manage their revenue recognition. As a result, enabling them to stay consistently compliant. They created a five-step approach that can be applied to any subscription billing structure. It outlines how to correctly recognize revenue with any contract.

There’s a lot to learn in each of these steps, which is why we created a booklet to help you better understand each stage and how they apply to your company. You can download it for free below. Start to recognize revenue correctly and enable your company to reach its full potential.

Northern Business Intelligence (Northern BI), a Canadian-based telematics provider, recently faced challenges in managing their monthly subscription billing accounting effectively. However, with the adoption of a new solution, Subscription Billing Suite (SBS), Northern BI was able to streamline their billing processes and manage their subscriptions more efficiently.

SBS allowed Northern BI to effectively manage recurring billing monthly schedules and reduce the growing number of invoice errors, ensuring greater accuracy in billing and helping keep customers satisfied. The cloud-based solution also accommodated growth year-on-year, enabling accounting to keep pace and scale operations with the company’s rapid expansion.

With SBS, Northern BI was able to automate reconciliations, eliminating manual processes and creating efficiency in the team’s operations. The solution was also built to integrate with both Dynamics GP and Dynamics 365 BC, making the transition between the old and new systems smoother and requiring a shorter training period.

The adoption of SBS allowed Northern BI to reduce the time spent on recurring billing cycles by 50%, and achieve a 98% customer retention rate. Furthermore, the migration from on-premise to cloud-based was a smooth and effective process, with the team fully supported by the SBS team throughout the transition.

Northern BI’s success story with SBS highlights the importance of adopting the right solution for managing recurring billing and subscriptions, and the positive impact it can have on a company’s operations and customer satisfaction. Download the full story with our case study.

Finding innovative ways to improve the recurring billing and payments process should be at the core of any subscription billing strategy. Although what that means can be different depending on the industry or offering, there’s a need for most teams to streamline and automate critical components of revenue recognition and deferral workflows so that they can do more with less.

Modern billing doesn’t have to be complicated, yet many make it so. Rather than invest in the automation needed to bolster billing operations for strategic pricing strategies, they scramble to make month-ends, often resulting in high subscriber churn.

When you struggle to bill effectively, it impacts every level of your organization. With the rise of subscription options across industries, many need help to keep up with the flood of administrative work in finance departments.

If you want to meet customer demand and relieve your finance team of unnecessary work, you’ve come to the right place. This guide is your guide to improving your billing one step at a time.

Here’s what you’ll find inside your copy of the guide