As SaaS continues to rise in popularity and recurring billing models move from niche to normal, many businesses are migrating to modern pricing models and finding ways to expand their billing options. This transition often involves implementing new subscription billing processes and may even require the adoption of new solutions to help manage more demanding workflows.

Automated recurring billing software is a fantastic tool that will help position your finance team to handle the back end of rigorous expansion while keeping overhead to a minimum. Let’s explore seven ways recurring billing automation saves your company time and money.

1. Streamlines billing processes for large volumes of invoices

Subscription pricing models and recurring billing options are incredibly agile, variable, and customizable. These advantages allow businesses to thrive in a fast-paced market but can increase the workload for your finance team. Accounting needs to be primed for the intense workload with an investment in automation. Invoicing is no longer straightforward—variable amounts, tiered pricing, and multiple billing frequencies are common factors that can quickly complicate your billing system.

Recurring billing automation is vital to achieving rigorous expansion and optimizing your recurring payment management. Spreadsheets won’t cut it when your finance department needs to process thousands of invoices each month. Augmenting human productivity with software automation to handle routine accounting processes allows your team to comfortably manage an expanding customer base without missing critical deadlines or making costly mistakes.

2. Harvests financial insights faster with real-time reporting

Leadership requires access to timely reports to act on financial insights and sustain a high degree of business agility. Therefore, accounting teams must achieve faster closes during period-ends. Automated recurring billing software accelerates these processes, and some solutions are built with real-time reporting, empowering team members to access performance insights from a single source of truth.

Real-time reporting was a critical value-add for OTC Markets Group. The business relied on a complex jigsaw of three decentralized systems that confused external auditors and potential shareholders. After implementing an automated recurring billing solution, they’ve reduced the time spent compiling month-end financial statements by 50%, saving over 120 hours of work per month. To read more about how OTC Markets Group minimized time spent on month ends, download the case study here.

3. Maintains data integrity by eliminating manual data entry

Businesses dependent on manual data entry tend to suffer from unclear, messy, and error-riddled data, resulting in poor financial visibility. Gartner found that poor data quality costs companies $12.9 million annually on average. Yet, while teams sacrifice many hours entering information into systems, they often spend even longer fixing mistakes. Research has shown that 40% of workers spend up to a quarter of their week on manual data entry and related repetitive tasks.

QTS Data Centers (QTS) struggled to scale their operations appropriately due to a significant number of core processes being redundant and time-consuming. Prior to implementing automated recurring billing, they operated 33 separate databases across multiple entities and manually processed 38,000 unrecognized deferral entries. The new software automated recurring billing activities across all entities, accounting for a 30% reduction in redundant processes and saving 11 days on end-of-month close cycles. To read more about how QTS regained control over their data management systems, download the case study here.

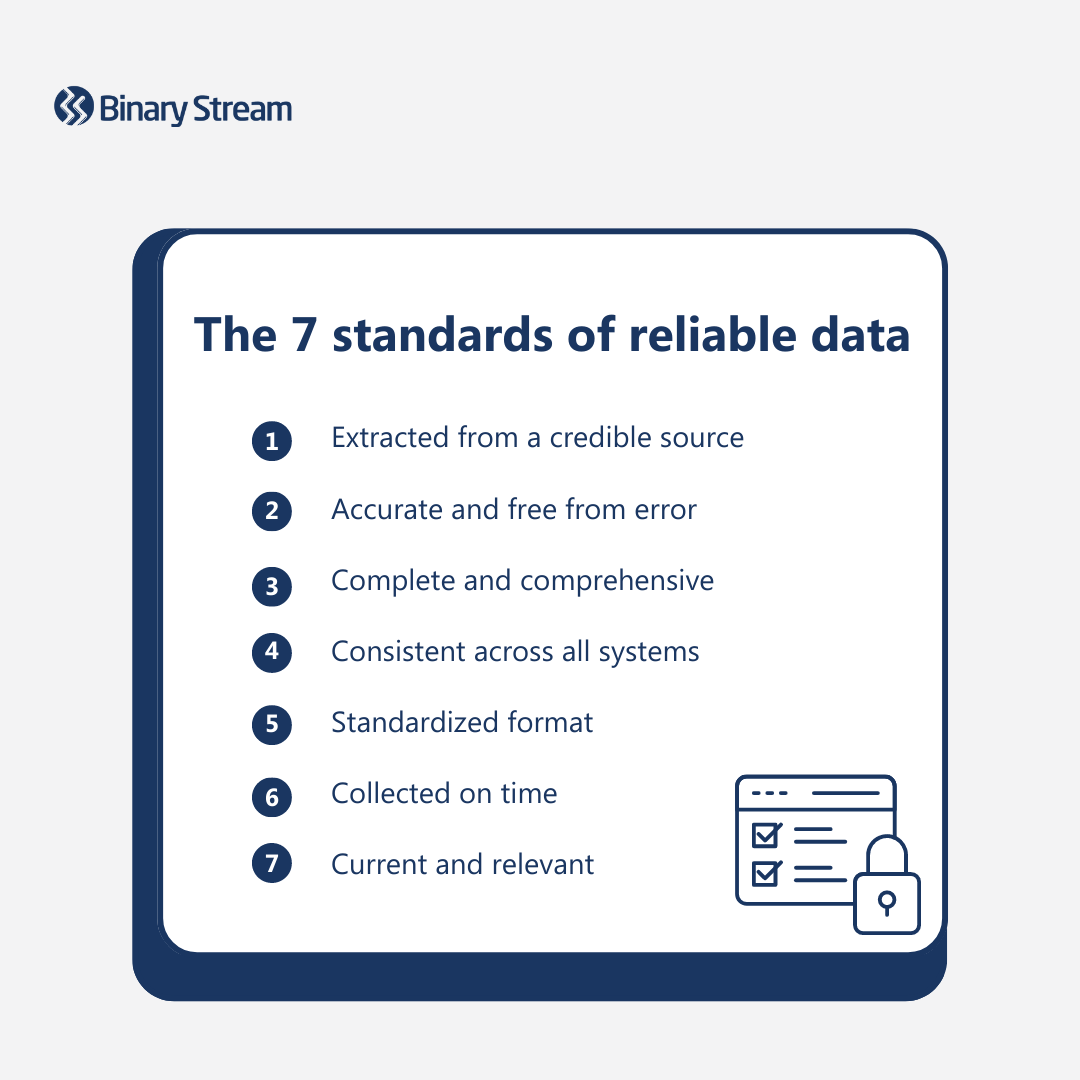

Automated recurring billing software streamlines workflows, liberating teams from obsolete, repetitive tasks and minimizing clerical errors. Real-time reporting and historical invoicing empower leadership with contextualized insights based on the most up-to-date information at any given time. The software also makes it simpler for finance teams to maintain best practices in data management and uphold the seven standards of reliable data.

4. Ensures invoicing is accurate and on time

Mistakes can cost your team hours, if not days, of extra work. These losses quickly add up, resulting in entire weeks lost to checking and correcting errors in the system. Missing a critical deadline, billing the wrong amount, invoicing the wrong customer—these are all examples of errors that contribute to customer churn. According to a recent study by PWC, 32% of all customers surveyed reported they would stop doing business with a brand they loved after one bad experience.

Automated recurring billing saves your business from these unnecessary blunders, helping maintain a loyal base of happy recurring customers and improving cash flow. For example, Sunshine 811 lacked complete visibility of their billing processes and, due to an immense amount of labour-intensive administrative work, frequently sent out invoices that were inaccurate and/or late.

By adopting automated recurring billing software, they recouped $15,000 annually and now accurately bill over a thousand members each month. For the complete story of how Sunshine 811 took back control over their billing system, download the case study here.

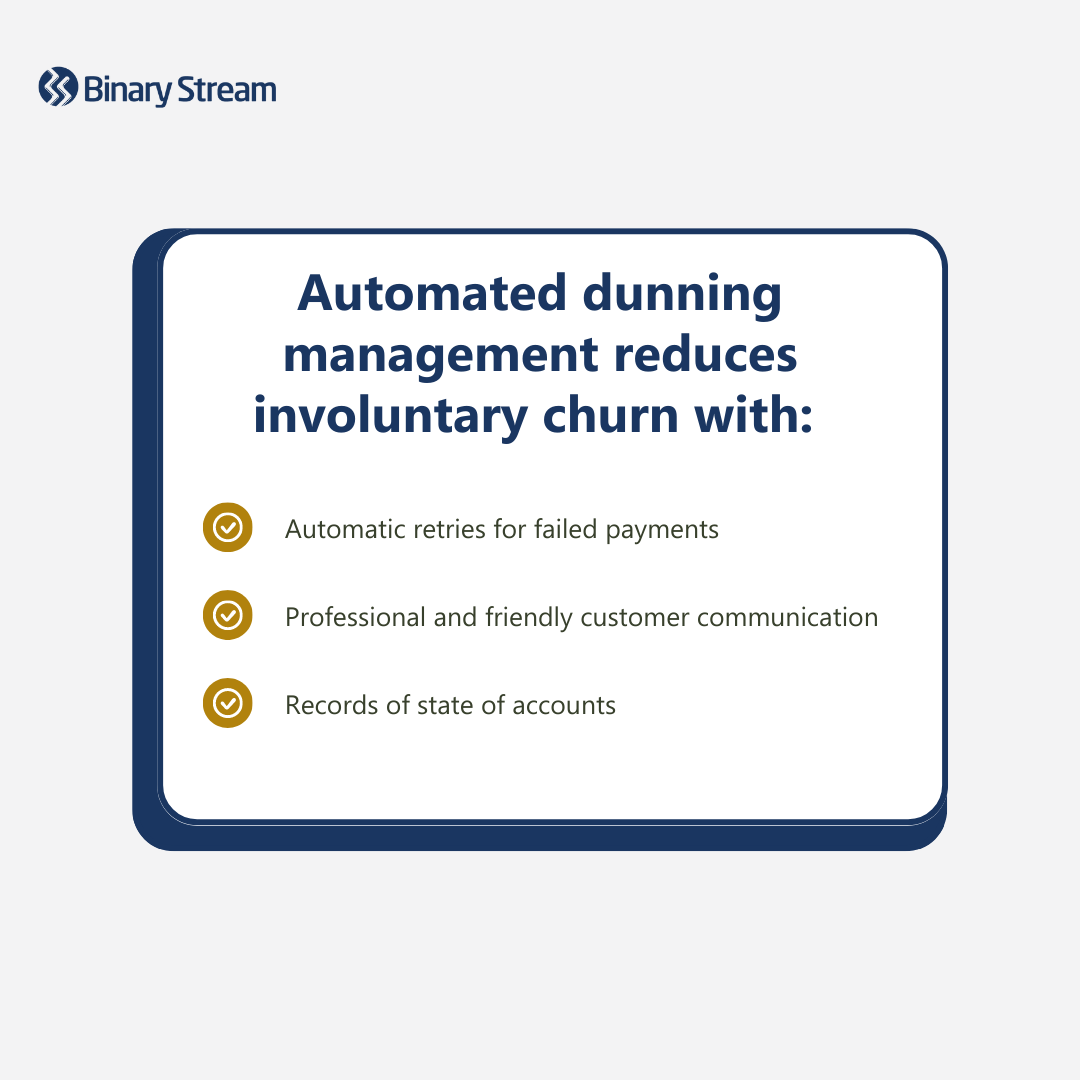

5. Optimizes dunning and collections processes to prevent revenue leakage

Subscriber churn is one of the costliest challenges that subscription businesses face. Subscription services lose approximately 2% of customers monthly due to expired credit cards, and failed payments account for $278 million in lost revenue for the subscription industry over the past twelve months.

Companies stand to regain a huge chunk of their monthly recurring revenue (MRR) by communicating with their customers and implementing modern dunning processes. An automated recurring billing solution will enable you to master dunning and collections management to prevent subscription revenue leakage by automating credit card updates, dunning emails, and collection re-attempts. Your accounts receivable (AR) team will also recoup time to follow up with high-priority customers who need a more human touch.

6. Simplifies complex tax calculations

Calculating taxes can quickly become overwhelming, particularly when companies expand operations into various regions. Managing multiple currencies and languages while complying with local tax requirements can take up a lot of resources, ultimately getting in the way of company growth targets.

Recurring billing automation saves time for your finance team when overseeing complex taxation requirements—instantly applying changes based on taxability rates and rules and accounting for exceptions. Depending on the software, your team can even automate other redundant or repetitive tax-related tasks, accelerating reporting for month-ends.

MoxiWorks was able to save 80 days annually by automating their recurring billing processes. The real estate software provider employed a team of 150 employees to manage over 340,000 active users, totalling $150 million annual recurring revenue (ARR). After implementing an automated recurring billing solution, they now save 15 days preparing taxes per year. To read more about how MoxiWorks cut down time spent on month ends, download the case study here.

7. Facilitates revenue recognition, enabling compliance with accounting standards

ASC 606 and IFRS 15 protocols require companies to recognize revenue as they fulfil performance obligations, like delivering goods or services, rather than at the initial time of sale. However, it’s nearly impossible to manually track deferred revenue, especially when deferrals span many months and are distributed unevenly.

An automated recurring billing solution helps to organize your ledgers, maintaining tidy and accurate records that are audit-ready year-round. This saves your company from fines and penalties for non-compliance, as well as frees up your finance team to focus on more strategic tasks.

BT Conferencing greatly benefitted from adopting automated recurring billing software and now effortlessly manages 10,000 deferral accounts. The business struggled to keep up with rigorous requirements imposed by their parent company’s overall financial compliance team. However, the new solution reduced the labour required to complete month-ends to just 10% of one full-time employee’s workload. To read more about how BT Conferencing converted days’ worth of effort into the click of a button, download the case study here.

Find a solution that does it all

Advanced Subscription Management is a recurring billing solution that leverages automation to streamline workflows, support complex pricing models, and maintain compliance with international accounting standards. Fully embedded within Dynamics 365 Business Central, Finance, and Dynamics GP, you can accelerate your business’ agility and start saving. If you have any further questions or would like to book a demo with our experts, feel free to contact us anytime.