Welcome to the first installment of our two-part series on revenue leakage – a pervasive challenge faced by businesses across industries. In this blog, we’ll address a series of commonly asked questions that form the foundation for understanding and tackling it effectively. We’ll start by unravelling the concept, exploring its synonyms, and delving into the typical culprits behind this profit-sapping phenomenon. Through illustrative examples, we’ll shed light on the tangible impacts it can have on your business.

The second blog in this series will serve as a practical guide for those who want to conduct an internal audit and want to take actionable steps to fortify their business against further leakage. But, before we jump to solutions, it’s essential to understand where these leaks might arise and prioritize the areas so that you can identify possible problem areas. Below, you’ll find a list of questions that will be addressed. You can skip ahead by clicking the topic that interests you most. Let’s dive in and start reclaiming those lost profits.

- What is revenue leakage? (Definition and synonyms)

- What are the effects of revenue leakage?

- What are examples of types of revenue leakage?

- What are the core causes of revenue leakage?

- How to calculate revenue leakage?

What is revenue leakage? (Definition and synonyms)

Revenue leakage is a term that refers to the gradual dissipation of potential earnings arising from a medley of factors such as oversights, discrepancies, and inefficiencies within the billing and revenue management workflows. It’s akin to money earned by a business yet left uncollected—a disparity between what’s rightfully due and what actually finds its way into the coffers. Put simply, revenue leakage represents the funds owed to a company that slip through the cracks due to a myriad of reasons.

Research shows that revenue leakage is common, with 42% of companies experiencing the issue. One of the prime channels through which leakage transpires is a lack of internal awareness. This can manifest in scenarios where sales teams might inadvertently misinterpret or overlook changes in pricing structures, leading to inadvertent undercharges for services rendered. Moreover, inefficiencies within financial processes, instances of human error, pricing or billing discrepancies, and incongruities in billing systems can all contribute to profit drain, culminating in a notable impact on a company’s financial health. Recognizing and addressing these leaks is paramount to safeguarding a business’s bottom line.

Synonyms for revenue leakage

- Profit drain | This term encapsulates the financial seepage that occurs when a business’s potential earnings slip away, mirroring the concept of revenue leakage.

- Income erosion | Much like erosion gradually erodes the landscape, income erosion signifies the slow but steady attrition of potential revenue within a business.

- Revenue seepage |Just as water can seep through tiny openings, revenue seepage portrays the subtle but significant loss of earnings due to various operational inefficiencies.

What are the impacts or effects of revenue leakage?

The effects or impacts can have wide-ranging consequences on a business, affecting its financial health, growth potential, and overall competitiveness. Here is a comprehensive list of the potential effects:

- Reduced profit margin: leakage directly translates to decreased overall profits, as the business fails to capture all the revenue it has rightfully earned.

- Cash flow constraints: Unaccounted revenue can lead to cash flow issues, potentially affecting a company’s ability to meet its financial obligations in a timely manner.

- Impaired growth opportunities: Insufficient revenue can hinder a business’s capacity to invest in growth initiatives, such as expanding operations, entering new markets, or launching new products or services.

- Reducing company’s perceived value and investor confidence: Consistent revenue leakage can lower the perceived value of a company, potentially deterring potential investors and adversely impacting its market capitalization.

- Inhibited innovation and R&D: Insufficient funds may restrict a business’s ability to invest in research and development, limiting its capacity for innovation and competitiveness in the market.

- Underinvestment in resources: Inadequate revenue can lead to a lack of resources for essential functions such as employee training, technology upgrades, and infrastructure improvements.

- Reduced marketing and advertising budgets: A shortfall in revenue may necessitate cuts to marketing and advertising budgets, limiting a company’s ability to reach and acquire new customers.

- Customer dissatisfaction and churn: Inaccurate billing or pricing discrepancies can lead to customer dissatisfaction, potentially resulting in customer churn and a decline in customer lifetime value.

- Damaged reputation: When leakage is due to billing errors or discrepancies can harm a company’s reputation and erode customer trust, potentially leading to a loss of market share.

- Legal and regulatory consequences: In some cases, leakage stemming from non-compliance with contractual agreements or industry regulations may lead to legal disputes or regulatory fines.

- Strained supplier relationships: In instances where leakage affects payments to suppliers, it can strain relationships with key partners and potentially disrupt the supply chain.

- Limited investment in employee development: Insufficient revenue can hinder a company’s ability to invest in employee training and development programs, potentially impacting workforce productivity and morale.

- Inhibited M&A opportunities: Consistent revenue leakage may deter potential acquirers and limit a company’s ability to engage in mergers and acquisitions.

- Weakened financial resilience: A continuous loss of revenue can reduce a company’s financial cushion, making it more vulnerable to economic downturns or unexpected crises.

- Lack of funds for contingencies: Inadequate revenue may leave a business ill-prepared to handle unforeseen expenses or emergencies.

- Inaccurate financial reporting: Revenue leakage can distort financial statements and reports, making it more challenging for stakeholders to assess the company’s financial health accurately.

- Increased cost of capital: A track record of revenue leakage may lead to higher borrowing costs or reduced access to capital, particularly for companies seeking financing from lenders or investors.

Addressing profit drain is critical for businesses seeking to maintain their financial stability and competitiveness in a dynamic market environment. Implementing robust internal controls, conducting regular audits, and leveraging technology solutions are essential steps in mitigating the impacts of revenue leakage.

What are examples or types of revenue leakage?

In businesses of all sizes and industries, revenue leakage can manifest in various forms, ultimately impacting the company’s financial health and overall profitability. These leaks can occur both externally, stemming from customer interactions and market dynamics, as well as internally, often related to operational inefficiencies and employee conduct. The image below gives a brief summary of common areas, and below it you will find further information about what each categorization means.

Customer-related

- Underbilling customers: This occurs when customers are charged less than the actual price for products or services, potentially due to invoicing errors or miscommunications.

- Misapplied discounts: Instances where discounts are incorrectly applied or not properly tracked, leading to a loss of revenue that could have been rightfully earned.

- Subscription overlaps: When customers have multiple overlapping subscriptions, it can result in overuse or underbilling, ultimately affecting revenue streams.

- Failure to apply late fees or penalties: Neglecting to charge customers the appropriate fees for late payments or violations of terms can result in forgone revenue.

Market-related

- Price erosion pressure: Competitive forces may necessitate lowering prices, which, although a strategic move, can lead to reduced overall revenue.

- Industry-wide stockouts: Insufficient inventory levels due to industry-wide demand can result in missed sales opportunities and potential revenue loss.

- Product cannibalization: The introduction of new products or services may inadvertently reduce demand for existing offerings, leading to lost revenue for the company.

- Loss of sales to competitors: Fierce competition may lead to potential customers choosing rival companies, resulting in revenue leakage.

Operational

- Inaccurate inventory management: Poor tracking and management of inventory can lead to losses from theft, spoilage, or obsolescence, directly affecting the company’s bottom line.

- Inefficient fulfillment processes: Delays or errors in order processing and fulfillment can lead to customer dissatisfaction and lost sales opportunities, impacting revenue streams.

- Ineffective pricing strategies: Failing to adjust prices in response to market changes or customer behaviour can result in missed revenue opportunities and potential profit drains.

Employee fraud or misconduct

- Misappropriation of funds: Employees divert funds intended for the company’s use for personal gain, diverting revenue away from the business.

- Embezzlement: This involves the theft or misappropriation of company funds by an employee entrusted with financial responsibilities, leading to significant revenue loss.

- Falsifying records: Employees altering financial records or transactions to conceal discrepancies can lead to leakage and potential financial instability.

Recognizing these common examples and types of revenue leakage is essential for businesses seeking to maintain a healthy financial position. By implementing robust internal controls, conducting regular audits, and leveraging advanced technologies, companies can effectively identify and address these leaks, safeguarding their profitability and ensuring long-term success.

What are the core causes of revenue leakage?

Every business is distinct, meaning there could be specific reasons for revenue loss that apply uniquely to your enterprise. However, in broad terms, there are common inefficiencies and shortcomings that lead to revenue leakage in businesses, particularly when it comes to subscription or modern billing models.

1. Shortcomings and mistakes in billing processes

In the realm of revenue management, one of the primary culprits for revenue leakage is the presence of inefficiencies and errors within billing operations, especially in recurring billing processes. These errors can arise from both manual oversight and automated mishaps. Manual errors, such as sending out invoices with incorrect total amounts, can have a cumulative impact on a company’s earnings. Similarly, automated errors, like inaccuracies in data extraction for automated invoice generation, can lead to periodic overcharges or undercharges, further contributing to revenue loss over time.

Furthermore, the complexity of billing cycles can exacerbate the issue. When existing systems lack the capacity to effectively handle intricate billing cycles, companies may find themselves grappling with errors when attempting to downgrade or upgrade billing plans. For SaaS companies, this can translate into a significant loss of rightfully earned income. These challenges underscore the critical need for a robust billing solution to mitigate the risk of revenue leakage.

In addition to these broader inefficiencies, there are specific areas within recurring billing that demand attention. Pricing discrepancies across products, tiers, or customer segments can lead to either undercharging or overcharging, directly impacting revenue streams. Similarly, even slight inaccuracies in tracking customer consumption for subscription models based on usage can accumulate over time, resulting in substantial revenue losses. Unresolved disputes in billing and invoicing can lead to delayed payments or even complete revenue loss, while failing to bill for all services or products provided can leave potential revenue uncollected, ultimately affecting the overall financial health of the business.

2. Over incentivization with special offers and discounts

Excessive reliance on special offers and discounts can be a double-edged sword. While discount codes can effectively drive transactions and attract new customers, it’s crucial to strike a balance. If your sales team doles out too many discounts, it can erode your profits over time. Similarly, if there’s an abundance of easily accessible coupon codes circulating online, it may lead to the same issue.

It’s worth noting that the proliferation of discount code websites poses a potential challenge. Without a system in place to monitor and manage these platforms, outdated or untracked discount codes may inadvertently cost your business. This situation can arise even if you don’t recall issuing those codes.

Furthermore, it’s essential to be mindful of how discounts and promotions are implemented. Over-discounting or applying promotions incorrectly can devalue your products or services, ultimately impacting your revenue potential. Striking the right balance in incentivizing transactions while safeguarding your bottom line is key to sustainable business growth.

3. Manual and inefficient accounts receivable process

One significant factor contributing to revenue leakage in SaaS companies is the inefficiency of their Accounts Receivable (AR) processes. Allocating valuable workforce resources to manually chase unpaid invoices not only consumes time but also detracts from the core focus of delivering value to customers. In contrast, opting for an automated solution streamlines and organizes the AR procedures, offering a more efficient approach.

For instance, manual follow-ups and reminders necessitate a coordinated effort across marketing, finance, and operations teams, making them labor-intensive and time-consuming. Implementing automated intelligent payment recovery protocols not only mitigates the risk of human error but also trims down collection expenses, thereby reducing dependency on resources.

Moreover, overlooking renewals, especially in subscription-based models, can lead to revenue leakage. Failing to capture opportunities for sustained customer engagement through missed renewals can result in a notable loss of revenue. It underscores the importance of implementing robust renewal strategies to ensure continued value delivery and revenue retention in subscription-based businesses.

4. Frequent payment failures and involuntary churn

In the realm of SaaS and recurring billing, involuntary churn refers to the loss of a subscriber due to mechanical issues like payment failures or card declines, rather than a lack of appreciation for the service. This can occur when payment gateways are unreliable or when a customer’s credit card expires. To prevent automatic cancellations, it’s crucial to have a backup payment method or an additional card on file, regardless of the customer’s intention to continue the subscription.

Complications arise when customer data for processing payments is fragmented across different systems, potentially resulting in outdated information. In such cases, businesses may struggle to collect payments from customers, even if services continue to be provided. This leads to a revenue loss, which can be further compounded if services are extended to these customers without receiving proper compensation.

Another challenge tied to involuntary churn is chargebacks, which occur when a customer disputes a transaction with their card provider. This category also encompasses product returns. The card issuer then demands the specified amount to be returned by the business. Interestingly, despite its seeming inevitability, involuntary churn can be managed. Implementing a dunning management system offers an effective solution, allowing businesses to recover potentially lost revenue through customized and streamlined automated processes tailored to their specific software operations.

5. Failing to take adequate steps to improve voluntary churn

Neglecting to implement effective measures to reduce voluntary churn can also lead to revenue loss. This type of churn occurs when a customer chooses to cancel their subscription or downgrade to a lower-tiered plan. To mitigate voluntary churn, it’s crucial for businesses to proactively identify and address issues in their customers’ experiences, ensuring that they remain satisfied and have no reason to leave or downgrade their subscriptions.

Additionally, emphasizing the significance of revenue operations is essential for aligning various functions within organizations, fostering a cohesive approach to maximizing revenue and ensuring sustainable growth. This entails integrating sales, marketing, finance, and customer service efforts to optimize revenue-generating strategies.

6. Lack of internal communication

A significant concern in revenue management is the lack of internal communication, which may appear deceptively simple but can lead to substantial revenue leakage. If your customer sales team is not well-versed in critical business policies or pricing structures, they may inadvertently undercharge or remain unaware of additional costs for certain services. Establishing a consistent flow of communication across all teams in your organization can prevent these potentially costly errors.

Moreover, misalignment between the sales team and Customer Success Manager (CSM) can also result in revenue loss. For instance, a customer seeking an extra feature presents an upsell opportunity, but without accurate tagging between these teams the opportunity may be missed. This not only leads to lost revenue but can also result in voluntary churn if the customer seeks a different provider offering the desired functions.

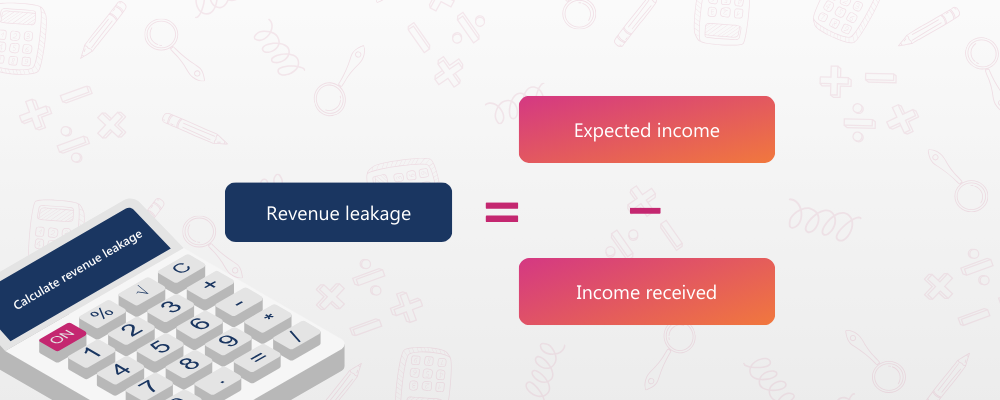

How to calculate revenue leakage?

Mitigating revenue leakage can prove to be quite challenging without the appropriate strategies in play. However, assessing the extent of revenue leakage is a relatively straightforward process. By employing a basic formula, you can determine the extent of leakage within your business operations. Initially, aggregate the projected revenue from your projects or product lines. Subsequently, calculate the actual cash received. The variance between these figures provides an estimate of your revenue leakage.