In today’s rapidly evolving business landscape, automating accounts payable processes using software has become a game-changer for organizations seeking to enhance efficiency and reduce manual errors. Whether undergoing a financial transformation or revamping accounts payable processes for the first time, choosing the right software solution is crucial. Companies need to have a firm understanding of the top accounts payable software features that ERPs require to maximize productivity. For instance, one fundamental decision to make is whether to adopt a centralized or decentralized accounting approach.

This blog delves into the key features companies should consider when selecting an enterprise resource planning (ERP) system to streamline and automate these critical financial operations. By harnessing accounts payable automation, companies unlock significant time and cost savings, improve accuracy, and gain valuable insights for strategic decision-making.

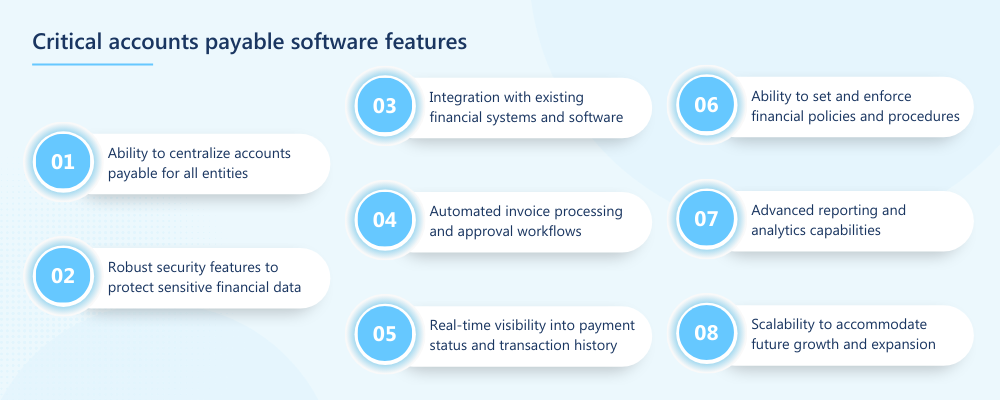

1. Ability to centralize accounts payable for all entities

One of the critical aspects of automating accounts payable processes is ensuring that month-end are centralized across all entities, eliminating the need for manual consolidation and the time-consuming task of chasing paper from various subsidiaries or other branches. Centralized payment processing software provides a significant advantage by allowing companies to streamline intercompany accounting and automate the transfer of critical information such as invoicing records in a timely manner. Centralization reduces the time and effort spent processing month-ends for multiple entities within an organization.

To illustrate the tangible benefits of such a system, let’s consider the example of American Software, a company that successfully centralized accounting processes. In their first year, they managed to save a remarkable $50,000 in operational costs. By eliminating the need for separate checks for each entity and streamlining intercompany transactions, American Software significantly reduced the time spent on manual processes, enhanced efficiency, and achieved substantial cost savings. This example highlights the potential savings and efficiency gains that can be achieved by implementing a centralized system. By reducing manual efforts, organizations can allocate their resources effectively, focus on strategic initiatives, and drive business growth.

2. Robust security features to protect sensitive financial data

Security features can seem like a vague concept if you’re not sure what to ask about. To ensure that the necessary safety measures are being taken to protect customers and financial data, companies can consult with software providers before investing to see what sorts of protocol are in place. Companies should gain a clear understanding of the security features and protocols in place before investing in any software.

It’s wise to inquire about the specific encryption methods used, the presence of firewalls and intrusion detection systems, and seek information about multi-factor authentication options. Software providers can also provide insights into the regularity and comprehensiveness of security audits, vulnerability assessments, and employee training programs. Through this collaboration, companies can verify that the robust safety features they require are indeed implemented and aligned with their security needs, ensuring enhanced protection for sensitive financial data and customer information.

Recommended reading: 5 steps to reduce and assess security risk in mergers and acquisitions

3. Integration with existing financial systems and software

Full integration of accounts payable software with your other financial systems and existing software is crucial for several reasons. Firstly, when all systems seamlessly integrate, there is no need for complex data transfers or extensive configuration processes, leading to a smoother and more efficient implementation. This saves valuable time and resources for the company, allowing them to focus on their core operations.

Integrated accounts payable software also cuts down on training requirements. When the software integrates seamlessly with existing financial systems, employees can leverage their existing knowledge and skills. They do not have to undergo extensive training on a completely new system, reducing the learning curve and accelerating the adoption process. This ensures a more seamless transition and minimizes disruptions to daily operations.

Moreover, the integration of accounts payable software enables a seamless flow of information across different financial systems. Data can be automatically synced and shared between systems, eliminating the need for manual data entry or transfers. This not only saves time but also reduces the risk of introducing errors that can occur when manually transferring data.

An example of the benefits of full integration can be seen in the case of Northern BI. By investing in a system that allowed them to migrate from on-premise accounting with Dynamics GP to Dynamics 365 BC. They were able to reduce their billing workload by 50%. This highlights how seamless integration eliminates the need to learn an entirely new system from scratch, enabling businesses to quickly leverage the benefits of the new software and realize significant efficiency gains.

4. Automated invoice processing and approval workflows

Automated invoice processing and approval workflows are critical features that enhance the efficiency and accuracy of accounts payable software. Manual invoice processing is often plagued with challenges such as time-consuming data entry, manual routing for approvals, and the potential for errors. By automating these processes, companies can streamline their accounts payable operations and mitigate the risks associated with manual handling.

With automated invoice processing, invoices can be electronically captured and entered into the system, eliminating the need for manual data entry. This reduces the likelihood of errors and speeds up the invoice processing timeline. Additionally, automated approval workflows ensure that invoices move seamlessly through the necessary channels for review and approval. Instead of relying on manual routing and physical paperwork, the software can automatically route invoices to the appropriate individuals based on predefined rules and hierarchies. This not only accelerates the approval process but also provides visibility into the status of invoices at any given time.

5. Real-time visibility into payment status and transaction history

Real-time visibility into payment status and transaction history is a valuable feature that empowers businesses to make informed financial decisions and proactively address any payment-related issues. With this feature, companies can access up-to-date information on the status of their payments, including whether invoices have been received, processed, approved, and paid. This real-time insight allows businesses to have a clear understanding of their cash flow and financial obligations, enabling them to plan and allocate resources effectively.

Furthermore, having access to real-time transaction history provides a comprehensive view of past payment activities. Companies can easily track and monitor their payment records, including details such as payment dates, amounts, and recipient information. This historical data can be vital for financial analysis, audits, and reconciliations, as well as for building strong relationships with suppliers or vendors.

The ability to view payment status and transaction history in real-time brings several benefits. It allows businesses to identify any potential payment delays or discrepancies promptly, enabling them to take immediate action to resolve issues. This feature also fosters transparency and accountability, as all stakeholders involved in the payment process can easily track and verify transaction details. Check out the core benefits of financial transformation for more information on the strategic advantage these insights give companies.

6. Ability to set and enforce financial policies and procedures

The ability to set and enforce financial policies and procedures is a critical feature of accounts payable solutions. It enables businesses to establish and maintain standardized practices that align with their financial governance requirements. By leveraging this feature, companies can define and enforce specific policies and procedures across all entities, ensuring consistent adherence to regulatory guidelines and internal controls.

Setting financial policies and procedures provides clarity and guidance to employees involved in the accounts payable process. It establishes a framework for handling financial transactions, expense reporting, vendor management, and other relevant activities. With well-defined policies in place, employees are equipped with clear instructions on how to process invoices, authorize payments, and handle exceptions, reducing the risk of errors and ensuring compliance with established protocols.

7. Advanced reporting and analytics capabilities

Advanced reporting and analytics empower businesses to gain deep insights into their financial operations and make data-driven decisions. With customizable dashboards and real-time data analysis, companies can access comprehensive and up-to-date information about their accounts payable processes. The ability to customize dashboards allows users to configure visual representations of key performance indicators (KPIs) and metrics that are most relevant to their business. This provides a holistic view of accounts payable activities, including invoice processing time, payment cycle, vendor performance, and cash flow analysis. By having these visual representations at their fingertips, businesses can quickly identify trends, spot bottlenecks, and identify areas for improvement.

Real-time data analysis takes reporting a step further by providing instant access to live data. This enables businesses to monitor accounts payable performance in real-time and promptly address any issues that may arise. It also facilitates timely decision-making, as companies can proactively respond to changing financial circumstances or market dynamics. Companies can generate detailed reports and extract valuable insights from their accounts payable data. These insights can help identify cost-saving opportunities, optimize payment processes, negotiate better terms with suppliers, and enhance overall financial performance.

8. Scalability to accommodate future growth and expansion

Scalability is a crucial feature that organizations should seek in an accounts payable solution. As businesses grow and expand, the volume of transactions and entities involved in the accounts payable process increases significantly. It is essential that the chosen solution can scale seamlessly to handle this growth without any compromise on performance or security.

A scalable accounts payable solution can efficiently manage the increased workload, ensuring that transaction processing remains swift and responsive. It should be capable of handling a higher number of invoices, payments, and vendors without experiencing performance bottlenecks. This scalability is essential to maintain operational efficiency and prevent any disruptions or delays in the accounts payable process.