Binary Stream announced it has partnered with Avalara, a leading provider of tax compliance automation software for businesses of all sizes.

Binary Stream announced it has partnered with Avalara, a leading provider of tax compliance automation software for businesses of all sizes.

Binary Stream is now part of Avalara’s “Certified for AvaTax” program, which features integrations that perform at the highest level, providing the best possible customer experience. As a result of this partnership, Binary Stream’s customers can now choose Avalara’s AvaTax to deliver sales and use tax calculations within Multi-Entity Management — in real time.

Khaled Nassra, Head of Marketing at Binary Stream, explained the importance of using this partnership to empower more multi-entities to streamline their finances through effective intercompany automation.

“Streamlining intercompany accounting processes has always been at the core of what we do here at Binary Stream, so we’re partnering with Avalara to combine our collective experience and enable multi-entities to automate taxes and intercompany transactions from within Dynamics 365 Business Central.”

Marshal Kushniruk, Executive Vice President of Global Partners at Avalara said, “Binary Stream understands the needs of its customers, and Multi-Entity Management reduces complexity for their customers in many ways. We understand that digitization of business processes is not an option, it is essential; we are proud to offer fast, accurate, and easy tax compliance solutions to our shared customers.”

Binary Stream is now an Avalara Certified partner. Certified partners pass a series of criteria developed by Avalara to help ensure the connector’s performance and reliability, thereby helping mutual customers benefit from a seamless experience with Avalara’s tax compliance solutions.

About Avalara, Inc.

Avalara helps businesses of all sizes get tax compliance right. In partnership with leading ERP, accounting, ecommerce, and other financial management system providers, Avalara delivers cloud-based compliance solutions for various transaction taxes, including sales and use, VAT, GST, excise, communications, lodging, and other indirect tax types. Headquartered in Seattle, Avalara has offices across the U.S. and around the world in Brazil, Europe, and India. More information at avalara.com

Intercompany financial management (IFM) refers to the practice of organizing, authorizing, and handling financial processes that occur between a corporation’s legal entities. These activities include intercompany transactions, accounting, tax, policies, etc. The main goal of IFM is to support the achievement of business objectives by improving productivity and accuracy, ensuring compliance with tax and regulatory standards.

As companies grow, smooth and efficient intercompany processes are essential. Unfortunately, a recent survey conducted by Dimensional Research found that 96% of respondents encountered challenges with intercompany activities and 99% agree that intercompany processes are becoming increasingly complex and challenging. Without a solution in place, poor IFM can negatively impact business outcomes, resulting in huge time-wastes manually correcting errors and costly penalties from non-compliance. Continue reading for five tips to streamline your intercompany financial management.

Lack of ownership combined with a perceived lack of importance is one of the key barriers to efficient intercompany financial management. According to Deloitte’s Intercompany Accounting and Process Management Survey, 50% of respondents identified a lack of defined ownership of intercompany processes, resulting in poor financial visibility. Often companies assume that the finance department will handle it; however, intercompany processes are a shared responsibility that require a holistic approach.

Clear communication that establishes roles and manages expectations is vital to overcoming this barrier. Enacting global accounting policies and implementing an intercompany accounting framework are two best practices for intercompany transactions that can provide a consistent structure for your team to follow.

Cash liquidity is a vital component of a business’ survivability and profitability. Maintaining an appropriate balance empowers leadership to acquire necessities, secure new financing, and deploy funding—bolstering expansion initiatives.

The previously mentioned survey by Deloitte also found that 54% of respondents rely on manual intercompany processing and struggle with limited counterparty visibility to support reconciliation and elimination. Without at least partial automation to augment human productivity, companies often suffer from bottlenecks and poor cash flow. That’s why many companies are investing in automation to solve intercompany challenges.

Many businesses choose to pay intercompany charges in lump sum amounts due to difficulties in manually applying the correct classification and breakdown of expenses, but this is a bad habit that must be addressed. Over-simplification can skew your financial data, weakening the credibility of your analyses and making it difficult to defend your intercompany prices to authorities. You also lose clarity when forecasting or determining whether the company met performance targets.

Suitable ERP software with multiple element revenue allocation functionality will help you maintain a well-defined database that enables your finance team to dig into the nitty-gritty. Proper allocations and reporting provide leadership with valuable information and enable complete insight into historical transactions.

Further reading: Financial consolidations for multi-companies (FAQs answered)

Tax risks and considerations have a huge impact on financial performance and strategy. An issue that is only compounded if your company operates in multiple regions or participates in a supply chain that collects sales tax, use tax, and exemption certificates. It’s vital that your company adheres to each jurisdiction’s tax requirements and applies the correct treatments.

In recent years, tax authorities have implemented stricter auditing protocols, demanding more granular and up-to-date intercompany transactions. However, these changes have highlighted a deficit in many businesses with poor IFM. Companies reliant on manual tax processes open themselves to noncompliance and increased financial risk. Automated tax management can help finance teams take back control over their intercompany accounting processes.

IFM entails handling an overwhelming number of intercompany transactions as efficiently as possible. If a business relies on decentralized systems or unintegrated ERPs, inefficiencies arise and trigger reporting setbacks. When finance is bogged down with reconciliations and eliminations, a butterfly effect can be felt across the entire company, ultimately slowing down high-level business decisions.

Investing in integrated and aligned solutions frees up your accounting department to focus on more strategic tasks. Multi-Entity Management embeds directly in Microsoft Dynamics 365 Business Central and Dynamics GP to streamline intercompany transactions, completing the entire process within a single instance.

Intercompany reconciliations can be a major source of stress for accounting teams working with numerous entities. It doesn’t matter if you’re the parent company or the subsidiary. Reconciling a high volume of transactions every month can lead to administrative headaches and bottlenecks that leave your accounting team frustrated and struggling to update systems so that records are accurate across all entities.

Explore everything you need to know about intercompany reconciliations, from defining what they are to walking you through the benefits and challenges; there are helpful tips here for any company struggling to streamline this process.

If you have a specific area of interest, click the relevant question below.

Intercompany reconciliation is the process of verifying transactions between separate entities of the same parent company. These transactions are referred to as intercompany transactions. Reconciliation is a process relevant to many companies. An entity refers to any divisions, subsidiaries, units, or franchises that come under the ownership of a parent company.

Intercompany reconciliation must take place to ensure that consolidated financial statements and data are accurate. It involves confirming that the transaction amount is recorded correctly by both the parent company and the entity and then eliminating it from closing statements.

The three different types of intercompany reconciliation are directly aligned with the three types of intercompany transactions. Below is an example of each one.

Reconciliations do not just apply to the straightforward exchange of products, and it’s essential to understand that they must be performed on all intercompany payables and receivables. These can include the exchange of labour, products, or raw materials.

There are numerous examples of intercompany reconciliations, and depending on the type of transaction, the action required will vary. Let’s look at one of the most common types:

If both the parent company and the subsidiary record these steps appropriately, the transactions will cancel each other out, and they will successfully complete the reconciliation.

Intercompany reconciliations work when there are clear processes around managing transactions and companies have the necessary access to timely and accurate data from other entities.

One of the challenges when handling intercompany transactions is when teams assume they can manage the workload in spreadsheets or separate accounting solutions by manually inputting data. This can lead to cumbersome manual work (e.g., downloading and uploading different files and reports, trying to move information from one accounting system into another, cross-referencing and double-checking for the most recent version of files, struggling to keep up with emails from various entities) and can put both teams under administrative strain.

Reconciliations are best performed in an accounting solution where all entities have access to the data they need in a streamlined, centralized environment. It’s possible to invest in solutions that have advanced security, allowing subsidiaries access to only the information they need while granting parent companies enough access to complete reconciliations and eliminations accurately.

It’s best to perform reconciliations on an ongoing basis, as it can be hard to keep track when teams only check intercompany transactions every month or so. It’s easy for people to forget the details of particular transactions, and it can become increasingly more difficult o resolve errors. If teams have the capacity, this task should be performed on a weekly, if not daily, basis. Many companies invest in an automated solution as the volume of these transactions grows as it can become impossible to keep up.

Even when companies don’t have the means to invest in a centralized solution, they should take the time to roll out global accounting policies to help all entities report in a way that will enable compliance with accounting standards. These policies should include everything from naming conventions to workflow standardization. Setting expectations makes it easier to align data and reconcile transactions between entities.

Without automation, reconciliations can be time-consuming, with few benefits outside of remaining compliant with global accounting practices. However, when reconciliations are automated effectively, the process has many benefits. Here’s a handful:

When intercompany reconciliations are not streamlined or automated, they can present a number of challenges. Here are a few:

There are a number of steps you can take to streamline and automate intercompany reconciliations and ensure your finance team doesn’t struggle to keep up.

Automate, automate, automate | Wherever possible, teams need to eliminate bottlenecks by identifying time-consuming processes and looking to automate and streamline these areas. Investing in a solution built to handle the complexity of intercompany reconciliations will be key to boosting efficiency and improving intercompany reconciliations.

Centralize financial data across entities | A centralized solution can collectively save your entities months of work per year. By giving entities easy access to the information they need, you eliminate the back-and-forth of countless emails. Don’t let reports or records end up stranded on one person’s computer, ensure there’s an environment where anyone can gain secure access to the critical information they need to do their job.

Embrace continuous close | Rather than postponing reconciliations to the end of the month (which can lead to overwhelm), teams should constantly track and reconcile intercompany transactions. Automating this process is possible, so your system continually flags errors, mistakes, or potential fraud.

Poor data management leads to messy, error-prone data and unreliable insights. Finance teams struggling with these issues wind up left in the dark, and businesses lose their advantage over competitors and are more likely to take actions that will hurt the bottom line.

Companies must maintain a high data management standard to ensure that leadership can adequately guide the company in making sound financial decisions and remain compliant with accounting and data protection regulations.

This blog will introduce you to ten best practices in data management for finance teams so that you can harness the power of data analytics.

Interested in a specific aspect of data management? Click on the best practice below to skip ahead.

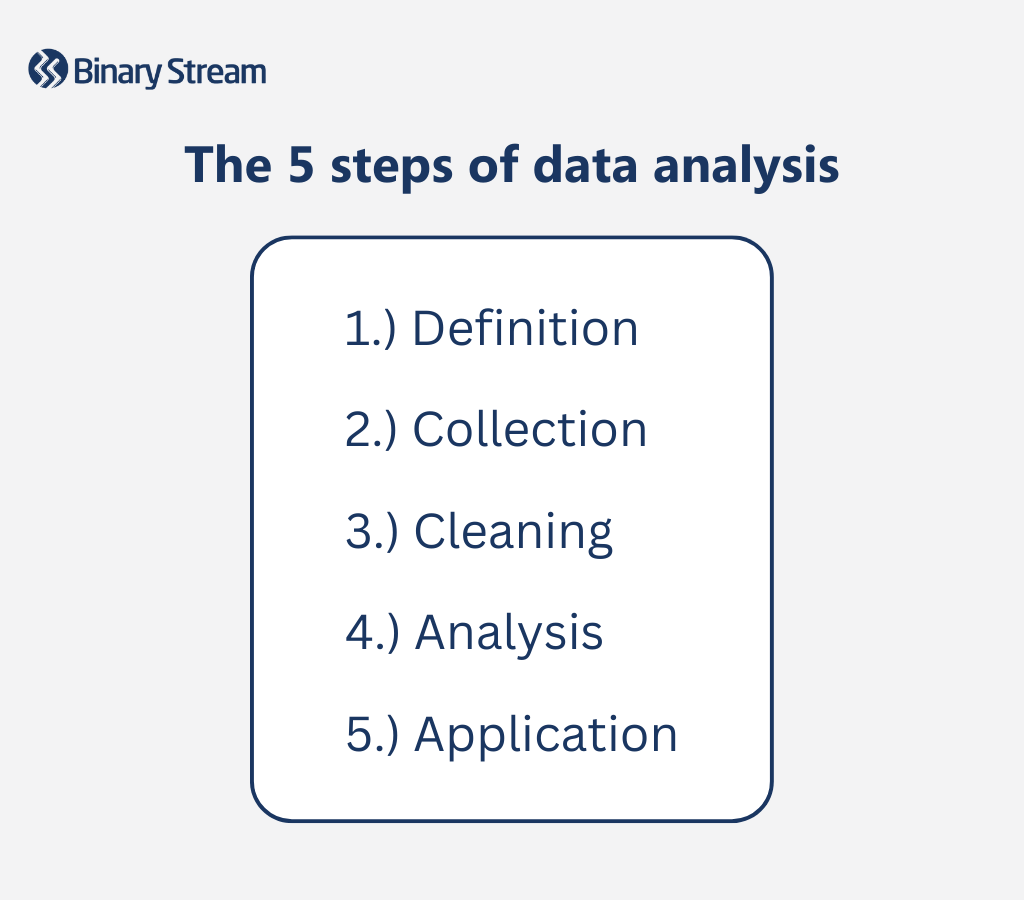

It’s much easier to spot and correct problems early on with a well-structured framework for data management and analysis. To garner better insights, your organization must have clear workflows detailing how to handle data for each of the five steps of data analysis; data definition, collection, cleaning, analysis, and application.

Below are some sample data management workflows covering the five steps of data analysis:

One of the most valuable applications of data is predictive analytics. This information is vital to creating an action plan for proactively responding to threats and opportunities. Companies can build customer behavioural models with today’s technologies and reliably predict future outcomes.

For example, say you want a good idea of when a customer will pay their due invoice. A robust data management system will enable your team to analyze past payment trends, compare them with other customers, and build a forecast model to determine when that customer will most likely pay their balance. By harnessing these insights, you can build reliable customer aging reports and inform dunning policies to maintain positive customer relationships and reduce involuntary churn.

You’ll gain reliable insights from nothing if you try to track everything. While it’s very tempting to maximize your usage of every available feature and collect every fragment of data, you’ll only burn through your resources and become too distracted to find information to answer your initial query.

After all, good data management is about enforcing the seven standards of reliable data:

This best practice is similar to the first step of data analysis, but you apply it to your entire data storage system. First, understand which metrics you want to track. Then, identify your search parameters and the variables that impact those metrics. After completing these steps, you can collect the necessary data to build your model.

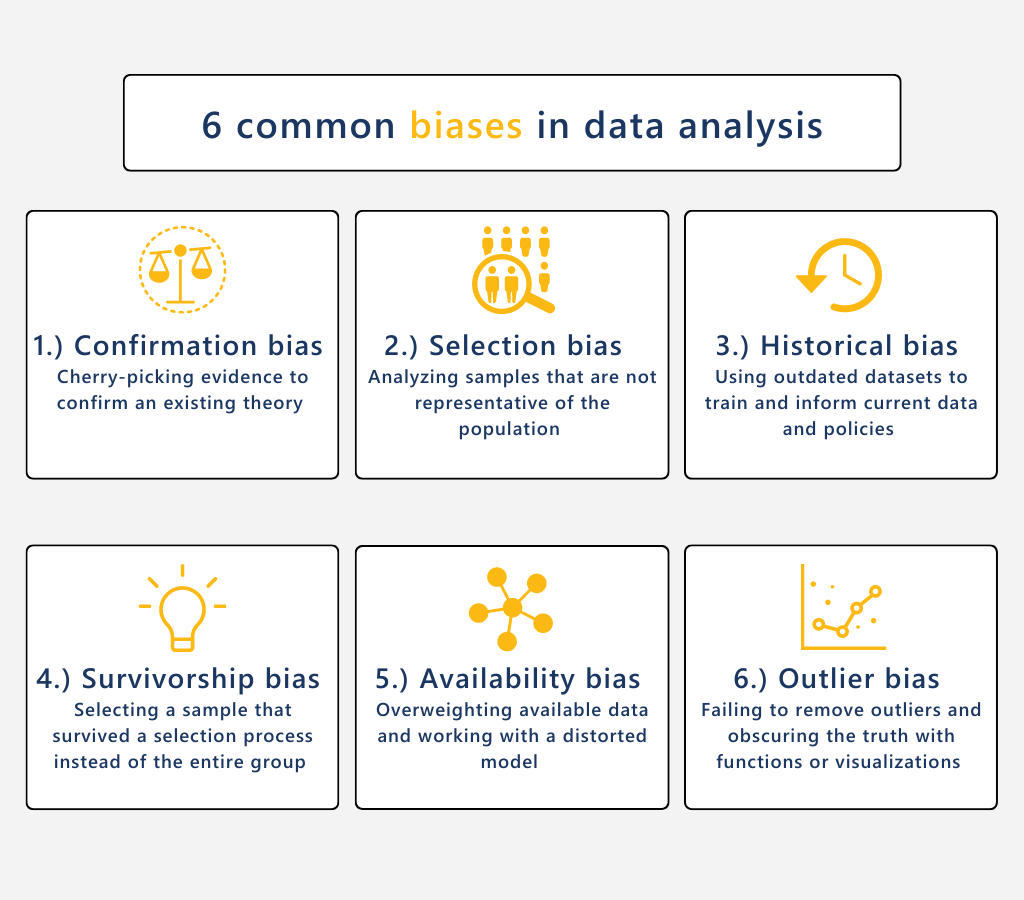

Beware of data biases! Bias is introduced to data when an error causes certain dataset elements to be over-weighted or overrepresented. Common examples of data biases include:

If leadership transitions from intuition-based to data-driven decision-making, they need clean data, or they could make a bad decision that harms the bottom line. Data analysts must note the different biases at each data management and analysis stage. Finance teams can even use AI and machine learning to help check data sets and flag potentially biased data to help raise awareness to leadership.

A common problem with poor data management is that team members lack access to necessary data. Leadership may be unaware that certain information already exists because the data is hiding on their servers and make unwise decisions that could have easily been aided by data analytics.

Of course, that doesn’t mean that everyone at the company should always have access to your company’s financial information. The best course of action is to set up data classification protocols that restrict and grant data access based on projects, job roles, and functions. Another strategy is to implement dashboards that track custom company performance metrics and share them at company-wide meetings.

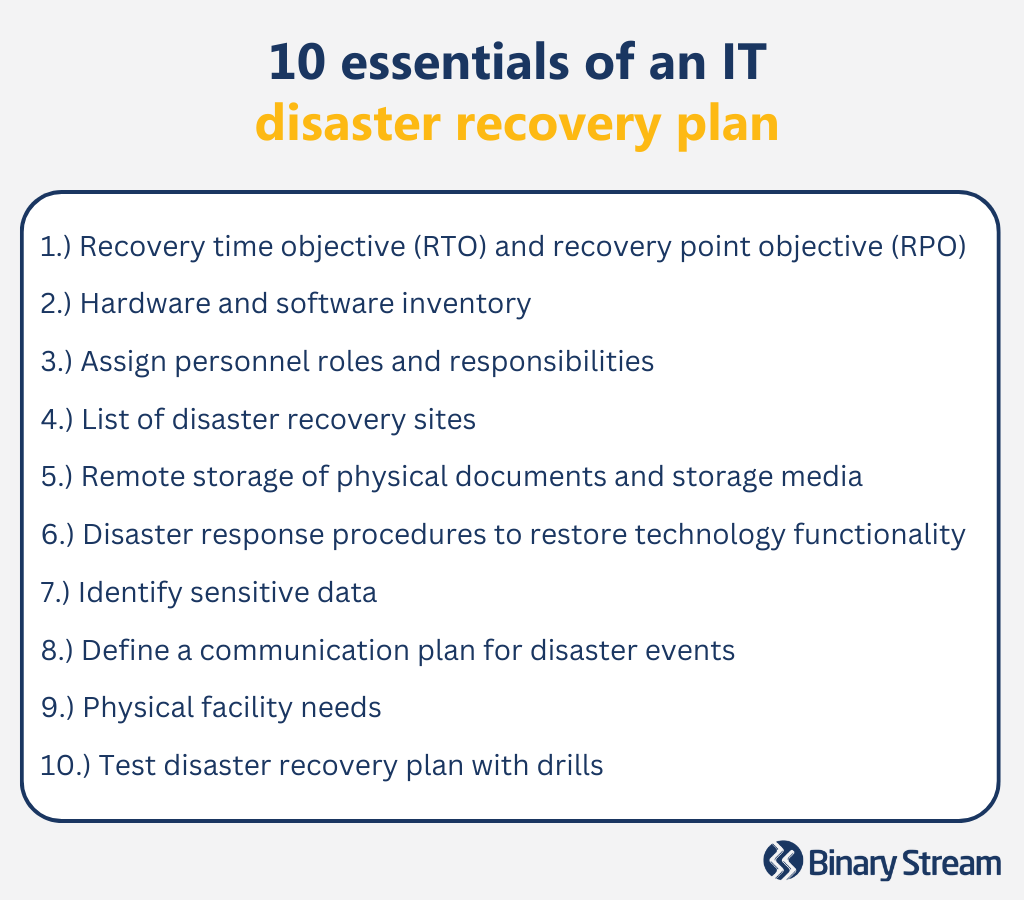

According to Veeam’s 2022 Data Protection Report, the average cost of downtime is $88,000 per hour. While it’s true that number is skewed by larger organizations, that doesn’t mean that it’s cheap inconvenience for small and medium businesses.

Data loss is a distressing, costly event with a plethora of ramifications. Human error, unexpected updates, damage to physical devices like servers, and cybersecurity attacks are all common causes of data breaches and data loss.

The best ways to prevent the more serious impacts of these events are frequently backing up data and having a disaster recovery plan (DRP). A DRP will help to keep business continuity while IT quickly recovers operations, mitigating disruption of product and service delivery.

Protecting your company’s data must be a top priority for all teams. Financial information is confidential, and a breach could result in reputational damage, lost opportunities, and regulatory fines. Strict security protocols are not optional, and any vendors or partners must adhere to the highest data protection standards.

Investing in scalable security tools that support secure sharing and encrypting data flow is essential. Look for SSL encryption, two-factor authentication, advanced firewalls, and automated notifications for new logins. Hosting security awareness training sessions at least once every six months will help your team stay vigilant.

Another great way to protect your data is to build a culture of compliance within your company so finance is always audit-ready. Depending on your industry, you’ll also have to adhere to specific data protection regulations. For example, healthcare organizations must have strong security measures to protect personal information and remain HIPAA compliant.

Check in with your risk and security officers about new technology with autonomous data capabilities that can support compliance. An invaluable data management tool is data discovery, a feature that reviews, identifies, and tracks data chains necessary for multijurisdictional compliance.

However you decide to tackle this issue, no software alone can completely guarantee compliance. Your policies must supplement your technologies to ensure that your team and tools are sustainable and keep pace with rapidly evolving accounting standards.

Spreadsheets quickly lose their appropriateness as the volume and variability of data increase. Real-time reporting and data mining can only truly be achieved with sophisticated business analytics tools and features with AI capabilities.

More importantly, you’ll need a dedicated team of data analysts trained on these latest technologies to enable prompt and accurate insights. Upskilling your existing talent on the finance team will help them become better data managers and result in better forecasting for cash flows, tax liabilities, and revenue growth.

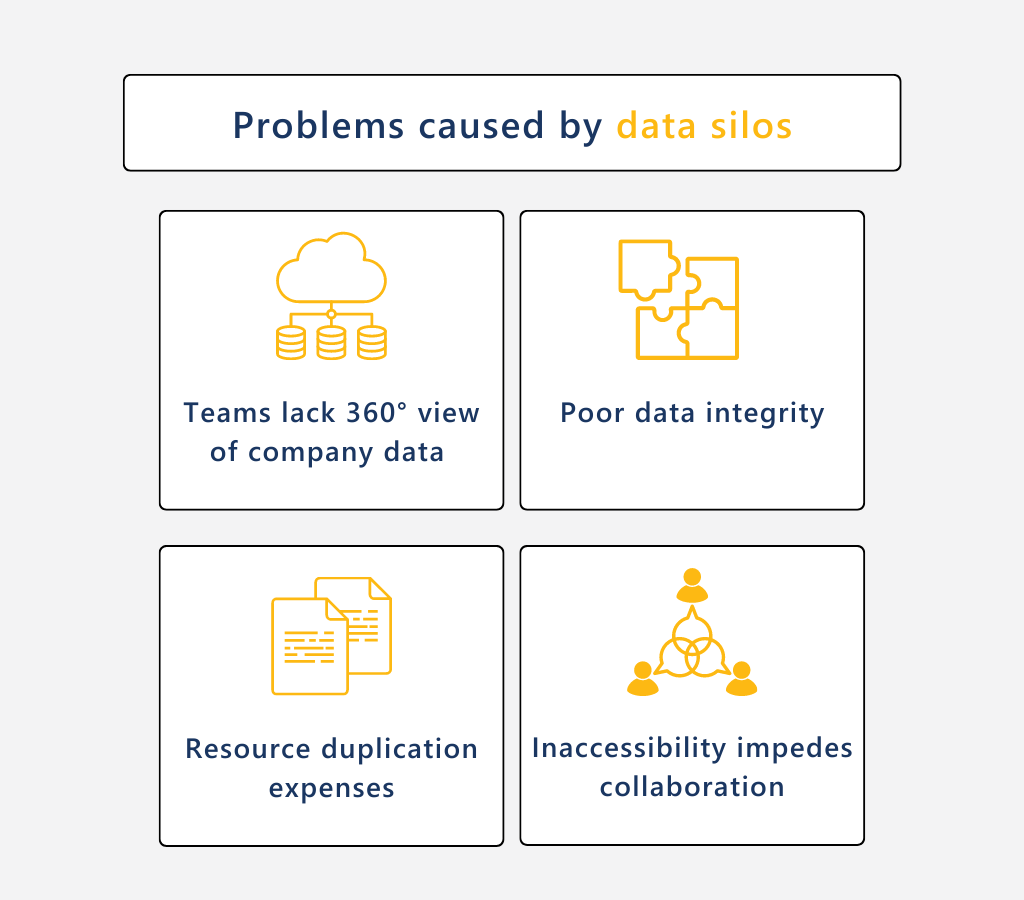

A data silo is an archive controlled by a single entity or is otherwise isolated from the rest of the organization. These repositories crop up in many ways, from files to emails to entire servers, but all share the same trait of hiding potentially vital information.

To gain a full view of your business metrics and understand your financial health at a deep level, your data must be accessible, and your models must include data from different sources. Unstructured, decentralized, and unshared data often cause problems and undermine the rest of the best practices written about in this blog.

If you can only implement one change to your existing data management—abolish the data silos. Whether you need to integrate a legacy system or clean excess raw data, obtaining an accessible and unified data set is worth it.

If you’re looking for more information about data management or have a specific question in mind, feel free to browse the resources listed below or contact our team. We’d love to hear from you.

ASC 810 is a US GAAP accounting standard set by the Financial Accounting Standards Board (FASB), providing guidance for companies with multiple entities to remain compliant when consolidating their financials. It’s similar to IFRS 10, the standard implemented by the International Accounting Standards Board (IASB), but differs in some key areas. Whether your company is merging with another, acquiring a smaller company or expanding into new territories, it’s critical that your team is fully aware of the guidelines set out under this standard.

This blog offers an introduction to ASC 810 to help your team better understand the complexities introduced by the accounting standard and gain insight into how to maintain compliance when preparing consolidated financial statements. If you have more general questions or need a refresher on the topic, check out our complete guide to financial consolidation before you continue reading this blog.

The purpose of consolidated financial statements is to present, primarily for the benefit of the owners and creditors or the parent, the results of operations and the financial position of a parent and all its subsidiaries as if the consolidated group were a single economic entity. There is a presumption that consolidated financial statements are more meaningful than separate financial statements and that they are usually necessary for a fair presentation when one of the entities in the consolidated group directly or indirectly has a controlling financial interest in the other entities. (810-10-10-1).

In the past, determining the parent entity after a merger or acquisition often came down to percentage ownership. In an effort to address the growing number of variations in multi-entity business structures, FASB issued FIN 46R, which introduced the concept of “control exercised through economic power”. This concept means that ownership percentage is secondary to an entity’s ability to influence decision-making and financial results through contractual rights and obligations and risk exposure.

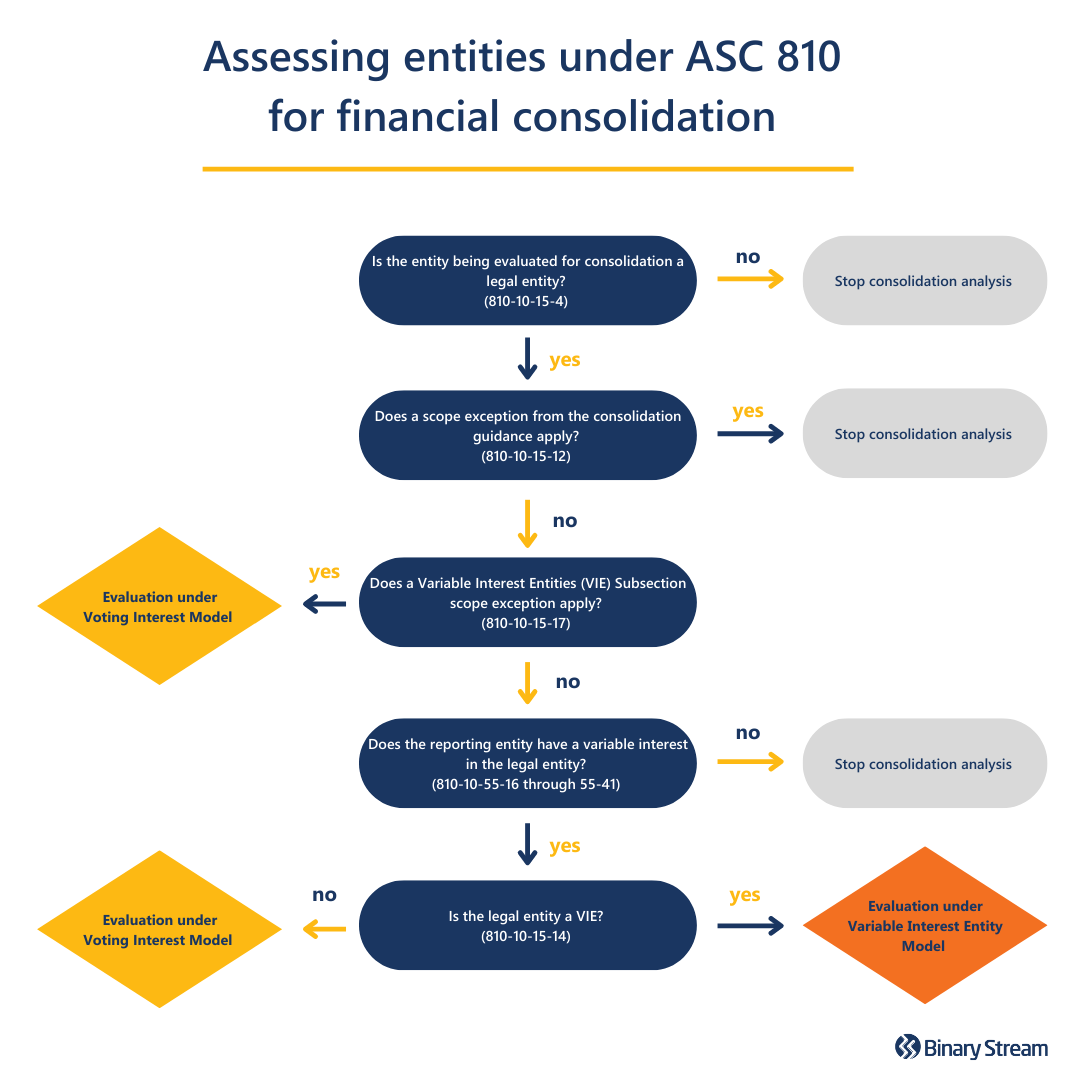

The consolidation evaluation process under ASC 810 incorporates this principle from FIN 46R. Today, companies can determine the parent entity by evaluating ownership percentage as long as the entity in question does not meet the criteria to be considered a “variable interest entity” or VIE.

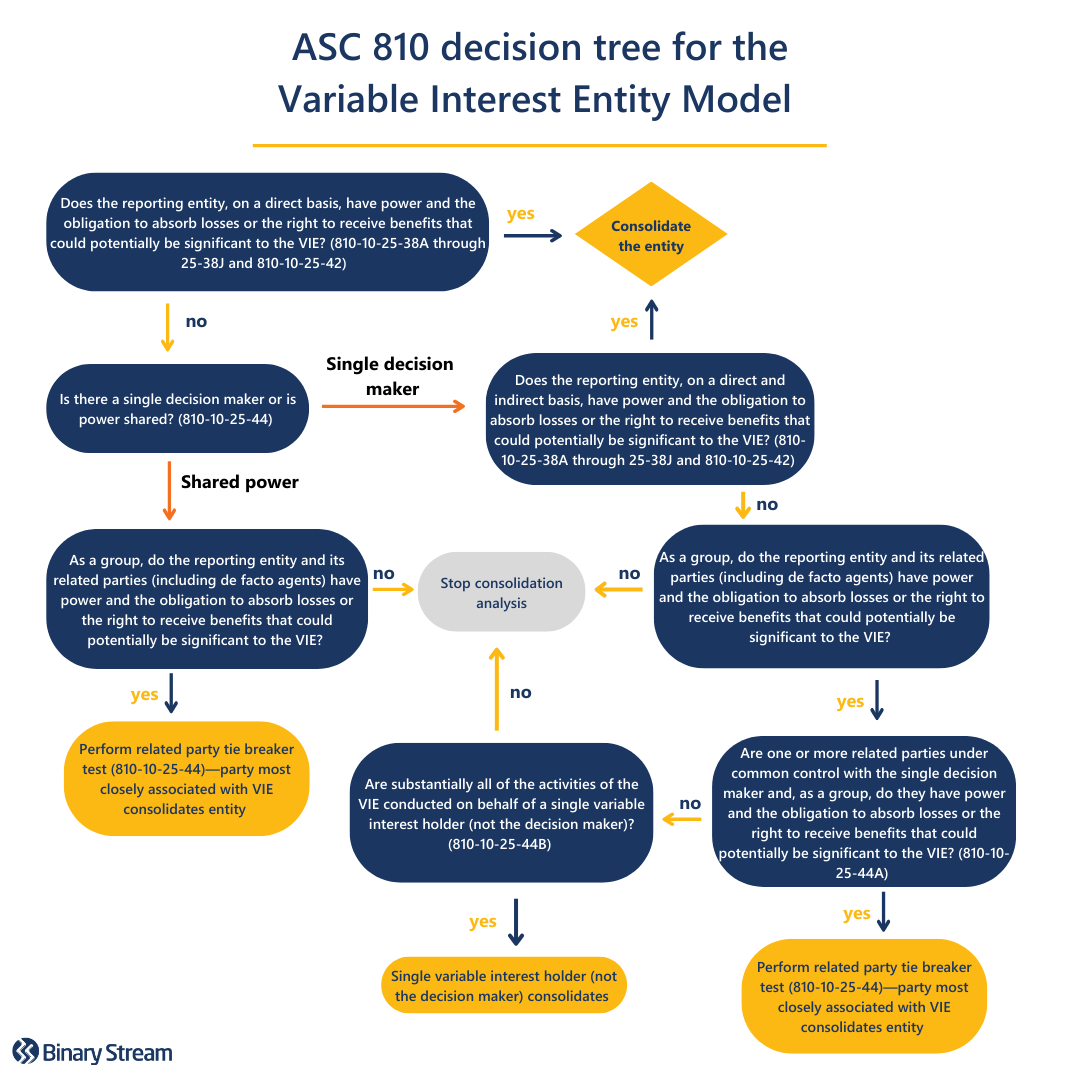

When evaluating each subsidiary or entity for consolidation, you must familiarize yourself with two key models introduced by ASC 810: the Variable Interest Entity (VIE) Model and the Voting Interest Model (VIM). Under the VIE model, a controlling financial interest in a VIE exists if the reporting entity has both:

Under the VIM, the reporting entity displays a controlling financial interest if it possesses a majority voting interest in another entity. Depending on certain circumstances, like contractual provisions or agreements between shareholders, the power to control may exist even when one entity holds less than 50% voting interest.

To properly determine whether an entity meets the requirements for consolidation under the VIE model or VIM, the following are some of the questions that should be asked about each entity:

Some of the criteria that can help you determine if an entity is a legal entity are as follows:

ASC 805 defines a business as: “An integrated set of activities and assets that is capable of being conducted and managed for the purpose of providing a return in the form of dividends, lower costs, or other economic benefits directly to investors or other owners, members or participants.” (805-10-55-3A).

A variable interest is defined as any interest or combination of interests that absorbs an entity’s variability. Although there is no specific list that outlines all variable interests, they are often assets such as receivables, leases, economic benefits, performance obligations, loans, or even an exercisable right to purchase an asset at a fixed rate.

When applying the Variable Interest Entity Model, an entity is likely a VIE if it satisfies the following conditions:

However, the most helpful resource for companies trying to decide whether they should consolidate under ASC 810 is the VIE model decision tree pictured in the image below.

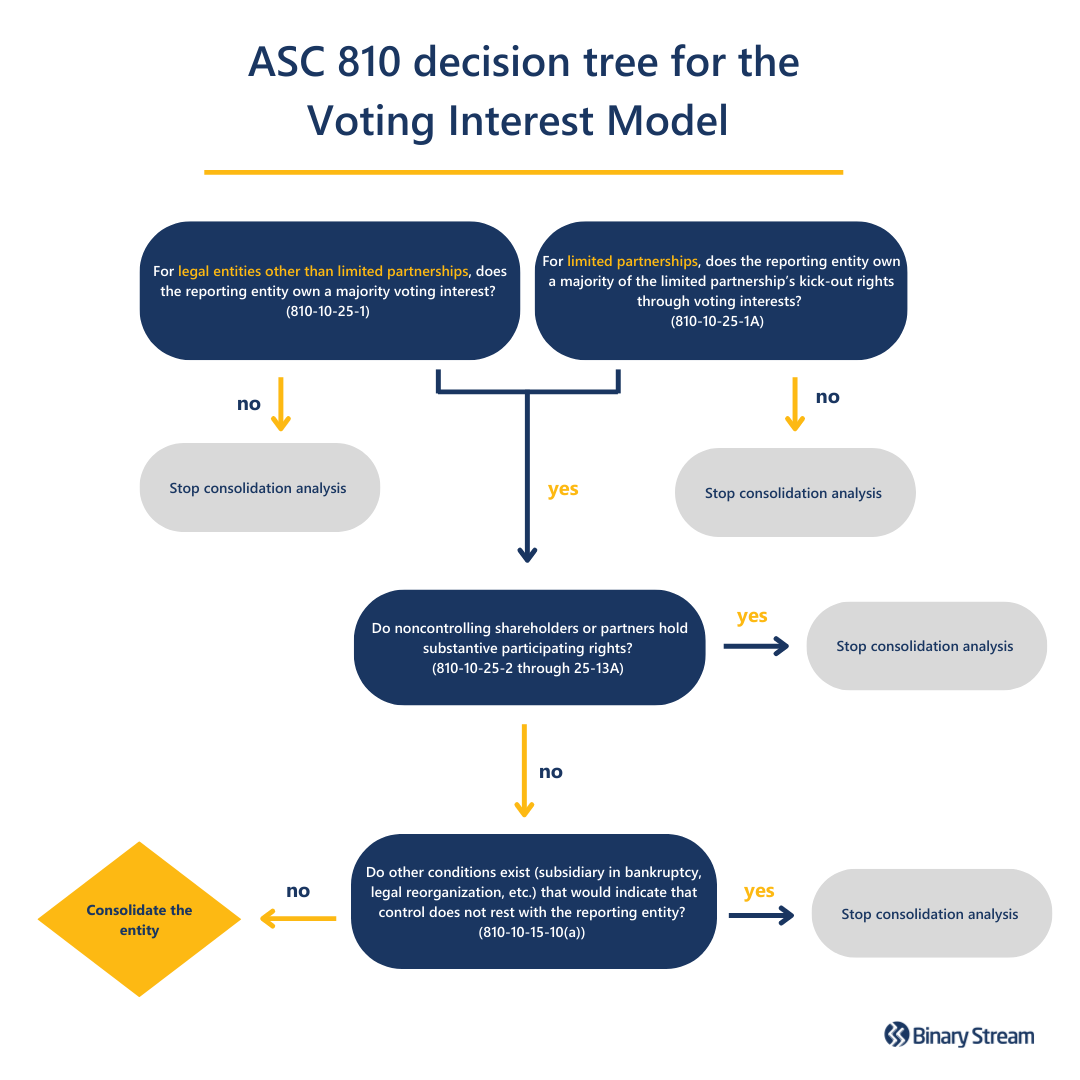

The Voting Interest Model (VIM) is a much simpler model that is familiar to most accounting teams. If a company does not meet the requirements to consolidate under the VIE model, it must look at the VIM. Put simply, this model requires that a company consolidates an entity if it owns the majority of that entity, i.e., over 50%.

Under previous guidance, the general partner would consolidate most limited partnerships. While most limited partnerships were not considered VIEs, in cases where they did qualify, the general partner would often be regarded as the primary beneficiary and be required to consolidate the limited partnership anyways.

With the most recent amendments to ASC 810, general partners must follow the new guidance and likely will no longer need to consolidate limited partnerships. This makes sense as the general partner typically does not truly have control and often acts as a service provider for the other partners. Nevertheless, general partners must provide more extensive disclosures in their financial statements, as most limited partnerships are now considered VIEs under the new guidance (810-10-15-14).

When it comes to compliance for financial consolidation, most companies will face a few challenges. You must invest in software that can appropriately meet the demands of accounting for multiple entities under GAAP regulations. Why not check out Multi-Entity Management, a solution built to help your company simplify processes and streamline financial consolidations.

To succeed in the hospitality industry, companies must continue to exceed customer expectations while simultaneously executing plans for rigorous expansion. However, this is only made more difficult by the host of modern challenges businesses must face. From stressed-out and understaffed teams to budget constraints and poor data management, finance departments are being pushed to the limit where even high performers are struggling to keep up.

That is why many companies are in the process of undergoing a financial transformation. Implementing technology to automate and streamline operations is vital to supporting staff members in delivering quality customer service.

Within the hospitality industry, financial transformation consists of adopting an agile mindset and upgrading to a cloud-based financial management system to streamline workflows, enhance productivity, and impact the bottom line. Often companies will implement a comprehensive enterprise resource planning system (ERP) to optimize operations and centralize crucial information.

By transforming financial management processes companywide, leadership can access strategic forecasting and achieve even the most ambitious expansion plans. Download our whitepaper for an in-depth exploration into how financial transformation can enable long-term, sustainable growth within the hospitality industry, complete with a modern-day case study, checklists, and statistics.

IFRS 10 is an accounting standard set by the International Accounting Standards Board (IASB), providing guidance for companies with multiple entities to remain compliant when consolidating their financials. It’s similar to ASC 810 (the US GAAP accounting standard for financial consolidation) but differs in some key areas. Although, it’s important to note that both will usually result in the same conclusions.

Companies that need to prepare financial statements under IFRS rules must pay close attention to the guidelines set out under IFRS 10. This blog serves as an aid for your team to understand the complexities introduced by the accounting standard.

If you have more general questions or need a refresher on the topic, check out our complete guide to financial consolidation before you continue reading this blog.

When it comes to IFRS 10, it’s best first to understand the objectives set out under the accounting standard. Put simply, IFRS 10 establishes principles for presenting and preparing consolidated financial statements when an entity controls one or more other entities.

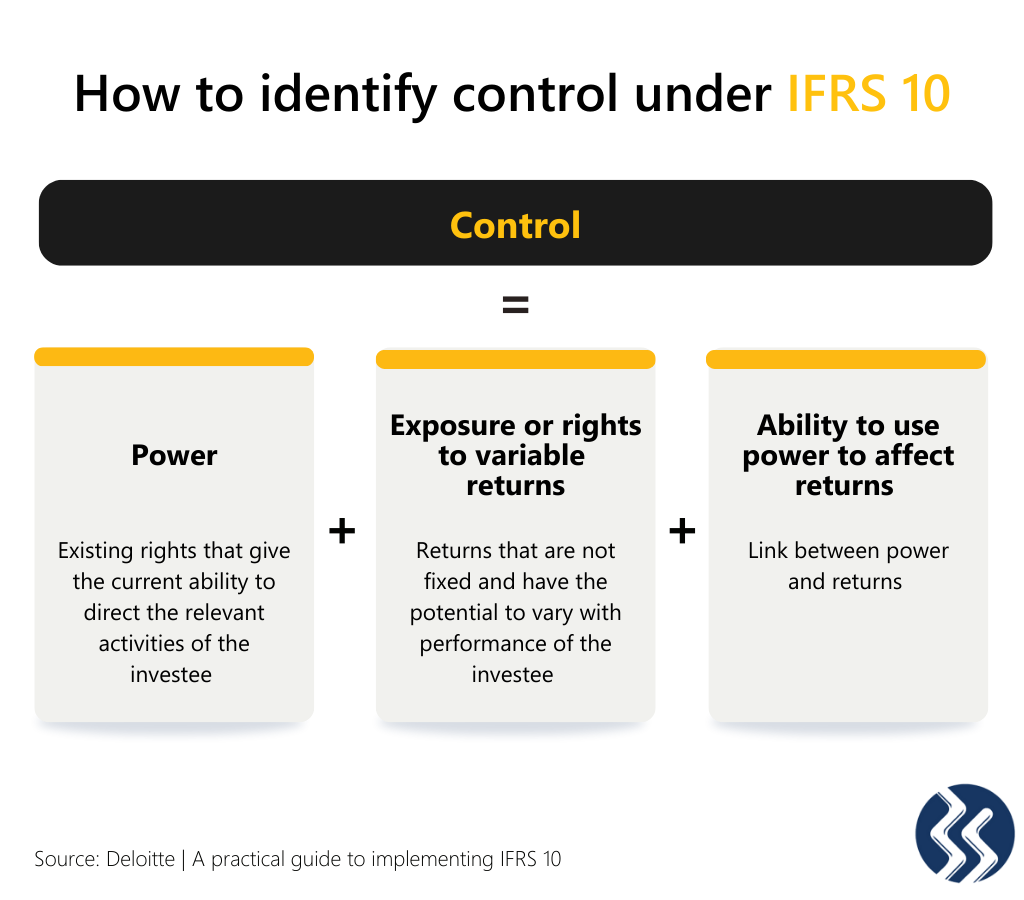

If you’re consolidating financial statements under IFRS 10, then the model is based on an investor’s control of an investee. Control is defined in the IFRS guidelines as follows, “An investor controls an entity when it is exposed, or has rights to variable returns with its involvement with the investee and has the ability to affect those returns through its power over the investee.”

Therefore, to control an entity, the investor must possess all three of the following elements:

When a company is trying to identify which entities have control, they should consider each entity’s rights. Power usually arises from an entity’s rights, such as voting rights, the right to appoint key personnel, the right to decisions within a management contract, and removal rights.

An investor without a majority of voting rights may still possess sufficient substantive rights that grant it power (i.e. de facto power). While substantive rights relate to the practical ability to direct relevant activities, protective rights relate to fundamental changes to the activities of the entity or apply in exceptional circumstances. It’s important to note that protective rights do not result in power or control.

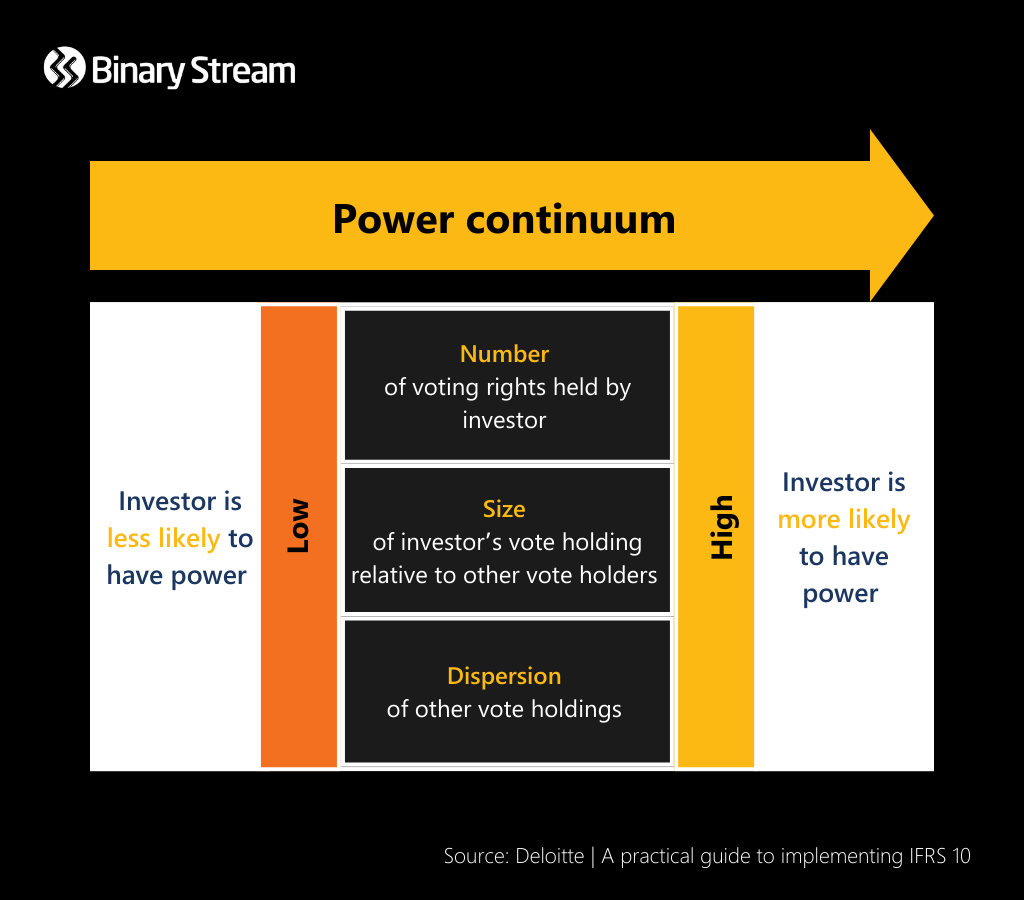

When determining if an investor’s voting rights are adequate to grant it power over an entity, leadership must consider the effect of the voting rights on the power continuum. If the decision is not clear, they must also take into account the following facts and circumstances outlined in IFRS 10:

Often an investor has greater incentive to obtain rights that reward power over an entity as it handles increased exposure to variable returns resulting from its involvement with that entity. Returns are not necessarily positive and can be negative, or a mix of both positive and negative. Some examples of returns include remuneration, cost savings, scarce products, proprietary knowledge, dividends, etc. Crucially, the magnitude of the returns does not factor into whether the investor holds power.

Key to determining if an investor has control is whether there is a link between power over an investee and returns. An investor that cannot benefit from its power over an entity does not have control. Likewise, an investor does not have control if it cannot use its power to direct activities that significantly impact the entity’s returns.

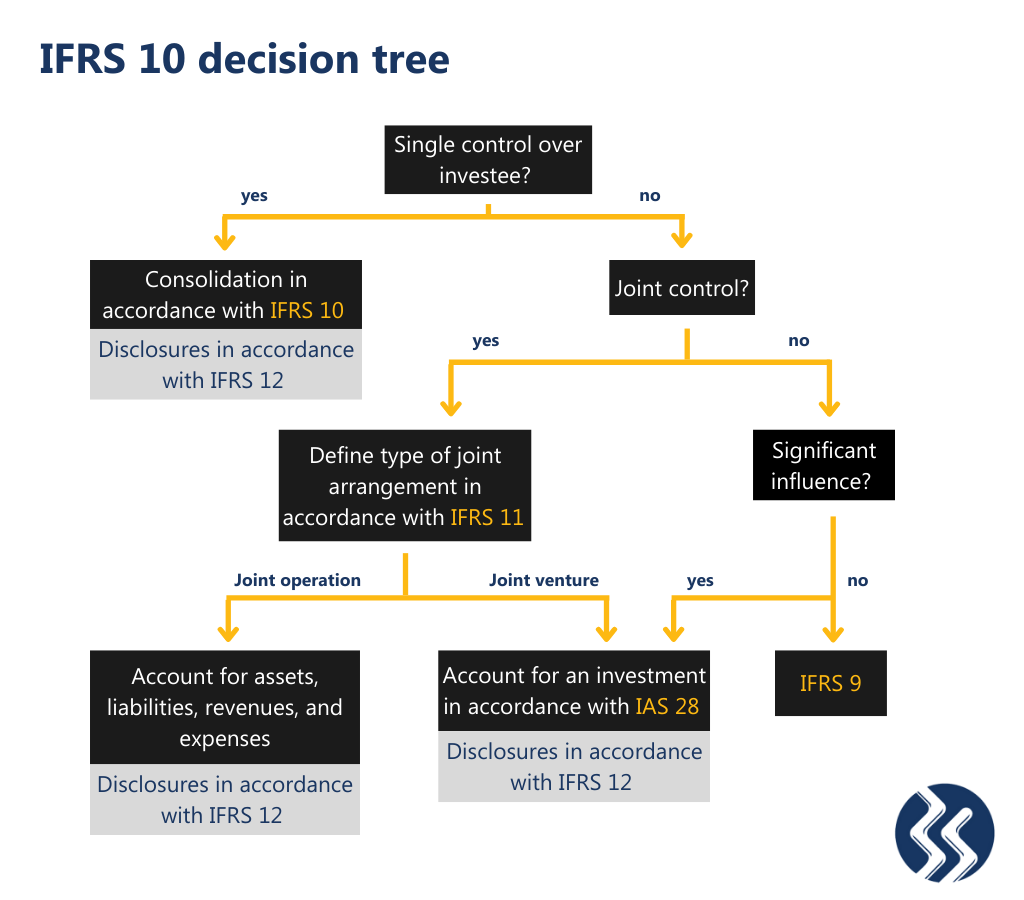

When leadership determines that an entity does not have control, the requirements of IFRS 11 and IAS 28 must then be considered to examine whether an investor has joint control, significant influence, or no governance over an entity.

The following decision tree allows you to assess if IFRS 10 is the accounting standard that best suits your needs.

According to IFRS 10, a parent company is exempt from presenting consolidated financial statements if it meets all the following conditions:

Disclosures are not specified in IFRS 10; however, the required disclosures can be found in IFRS 12 ‘Disclosure of Interests in Other Entities’. The accounting standard states that “a reporting entity should disclose significant judgements and assumptions made in determining whether it controls, jointly controls, significantly influences or has interests in other entities.”

We recommend reading the IFRS 10 guidelines in full. Here is a summary of just some of the critical areas the guidelines cover:

When it comes to compliance for financial consolidation, most companies will face a few challenges. You must invest in software that can appropriately meet the demands of accounting for multiple entities under IFRS regulations. Why not check out Multi-Entity Management, a solution built to help your company simplify processes and streamline financial consolidations.