ASC 810 is a US GAAP accounting standard set by the Financial Accounting Standards Board (FASB), providing guidance for companies with multiple entities to remain compliant when consolidating their financials. It’s similar to IFRS 10, the standard implemented by the International Accounting Standards Board (IASB), but differs in some key areas. Whether your company is merging with another, acquiring a smaller company or expanding into new territories, it’s critical that your team is fully aware of the guidelines set out under this standard.

This blog offers an introduction to ASC 810 to help your team better understand the complexities introduced by the accounting standard and gain insight into how to maintain compliance when preparing consolidated financial statements. If you have more general questions or need a refresher on the topic, check out our complete guide to financial consolidation before you continue reading this blog.

The purpose of consolidated financial statements is to present, primarily for the benefit of the owners and creditors or the parent, the results of operations and the financial position of a parent and all its subsidiaries as if the consolidated group were a single economic entity. There is a presumption that consolidated financial statements are more meaningful than separate financial statements and that they are usually necessary for a fair presentation when one of the entities in the consolidated group directly or indirectly has a controlling financial interest in the other entities. (810-10-10-1).

In the past, determining the parent entity after a merger or acquisition often came down to percentage ownership. In an effort to address the growing number of variations in multi-entity business structures, FASB issued FIN 46R, which introduced the concept of “control exercised through economic power”. This concept means that ownership percentage is secondary to an entity’s ability to influence decision-making and financial results through contractual rights and obligations and risk exposure.

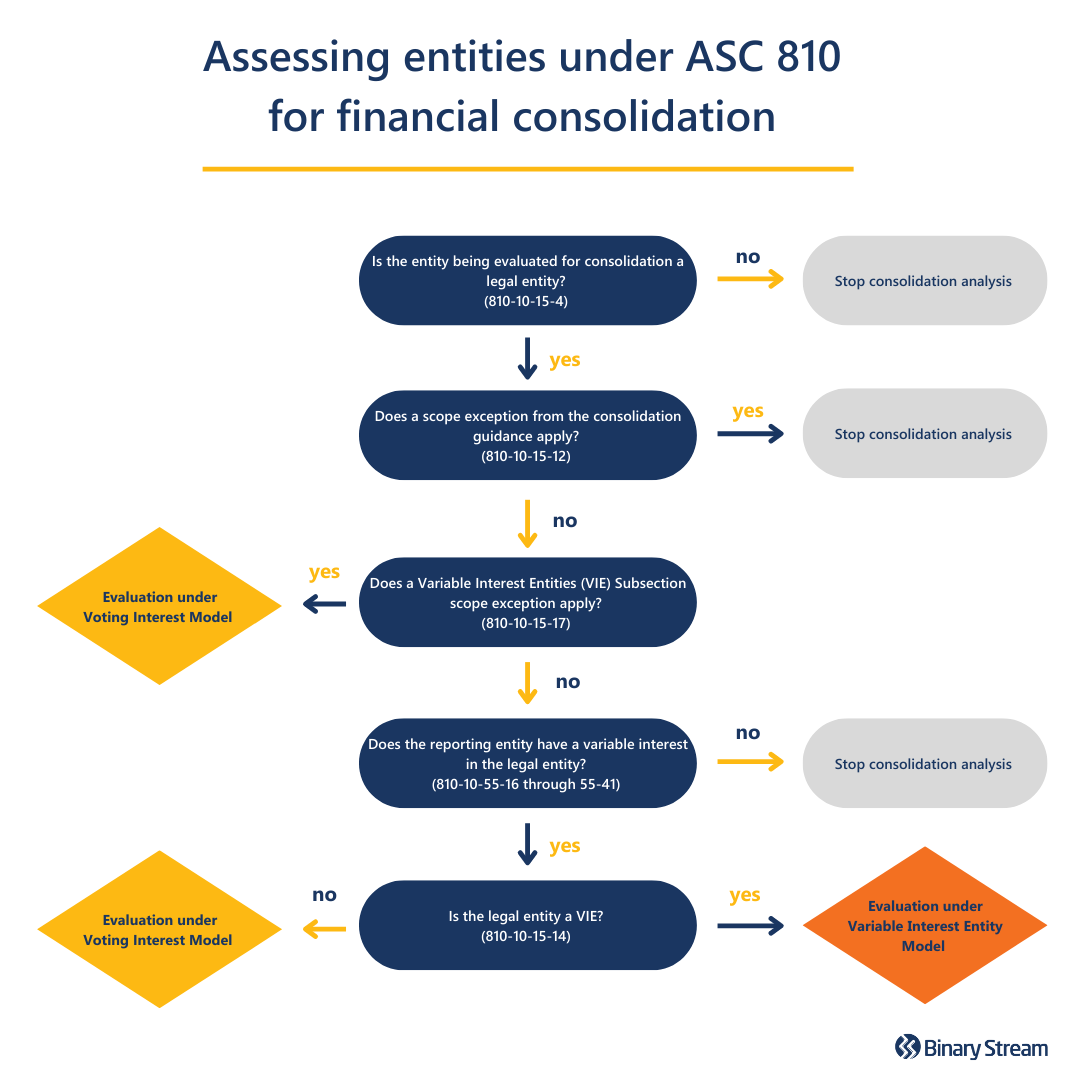

The consolidation evaluation process under ASC 810 incorporates this principle from FIN 46R. Today, companies can determine the parent entity by evaluating ownership percentage as long as the entity in question does not meet the criteria to be considered a “variable interest entity” or VIE.

When evaluating each subsidiary or entity for consolidation, you must familiarize yourself with two key models introduced by ASC 810: the Variable Interest Entity (VIE) Model and the Voting Interest Model (VIM). Under the VIE model, a controlling financial interest in a VIE exists if the reporting entity has both:

Under the VIM, the reporting entity displays a controlling financial interest if it possesses a majority voting interest in another entity. Depending on certain circumstances, like contractual provisions or agreements between shareholders, the power to control may exist even when one entity holds less than 50% voting interest.

To properly determine whether an entity meets the requirements for consolidation under the VIE model or VIM, the following are some of the questions that should be asked about each entity:

Some of the criteria that can help you determine if an entity is a legal entity are as follows:

ASC 805 defines a business as: “An integrated set of activities and assets that is capable of being conducted and managed for the purpose of providing a return in the form of dividends, lower costs, or other economic benefits directly to investors or other owners, members or participants.” (805-10-55-3A).

A variable interest is defined as any interest or combination of interests that absorbs an entity’s variability. Although there is no specific list that outlines all variable interests, they are often assets such as receivables, leases, economic benefits, performance obligations, loans, or even an exercisable right to purchase an asset at a fixed rate.

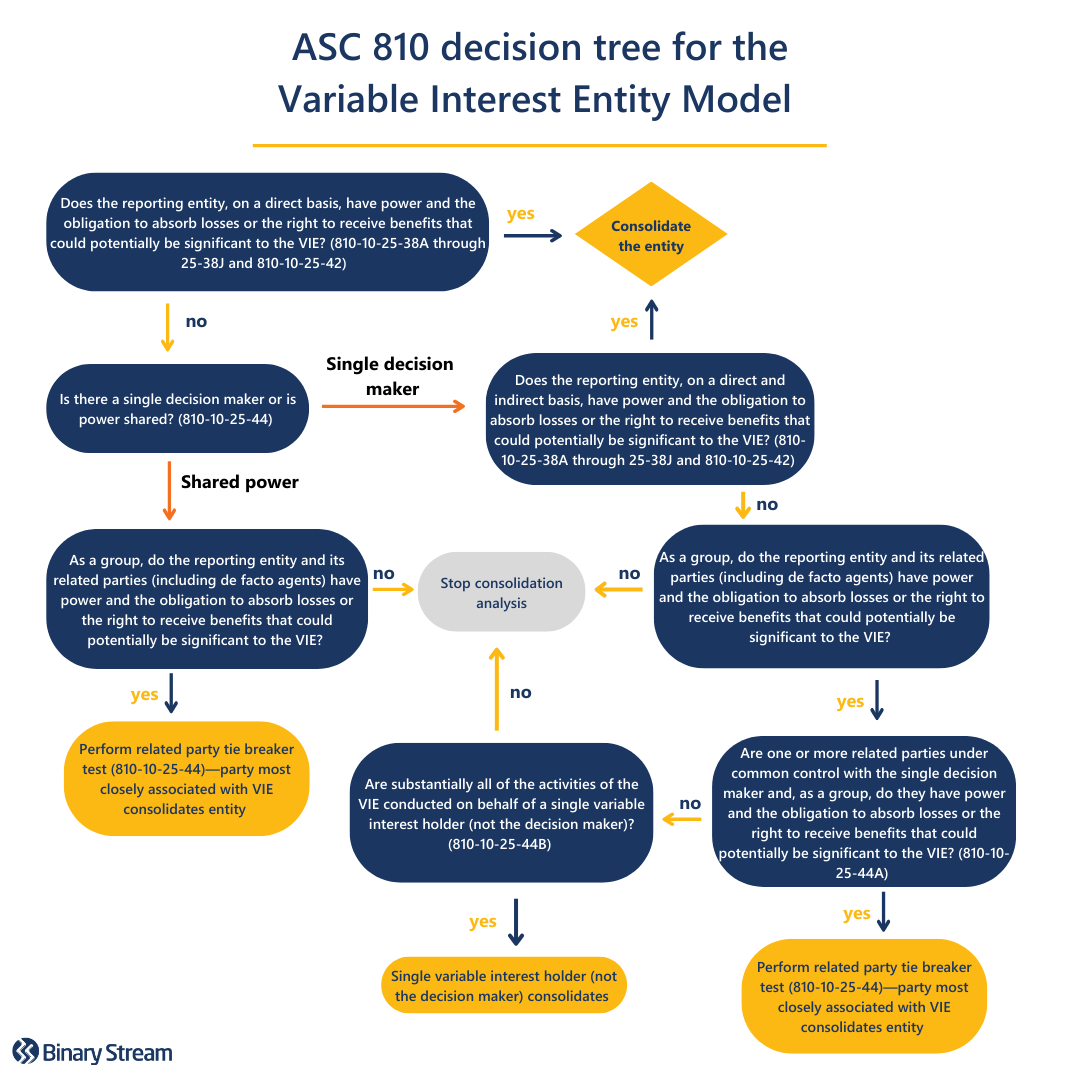

When applying the Variable Interest Entity Model, an entity is likely a VIE if it satisfies the following conditions:

However, the most helpful resource for companies trying to decide whether they should consolidate under ASC 810 is the VIE model decision tree pictured in the image below.

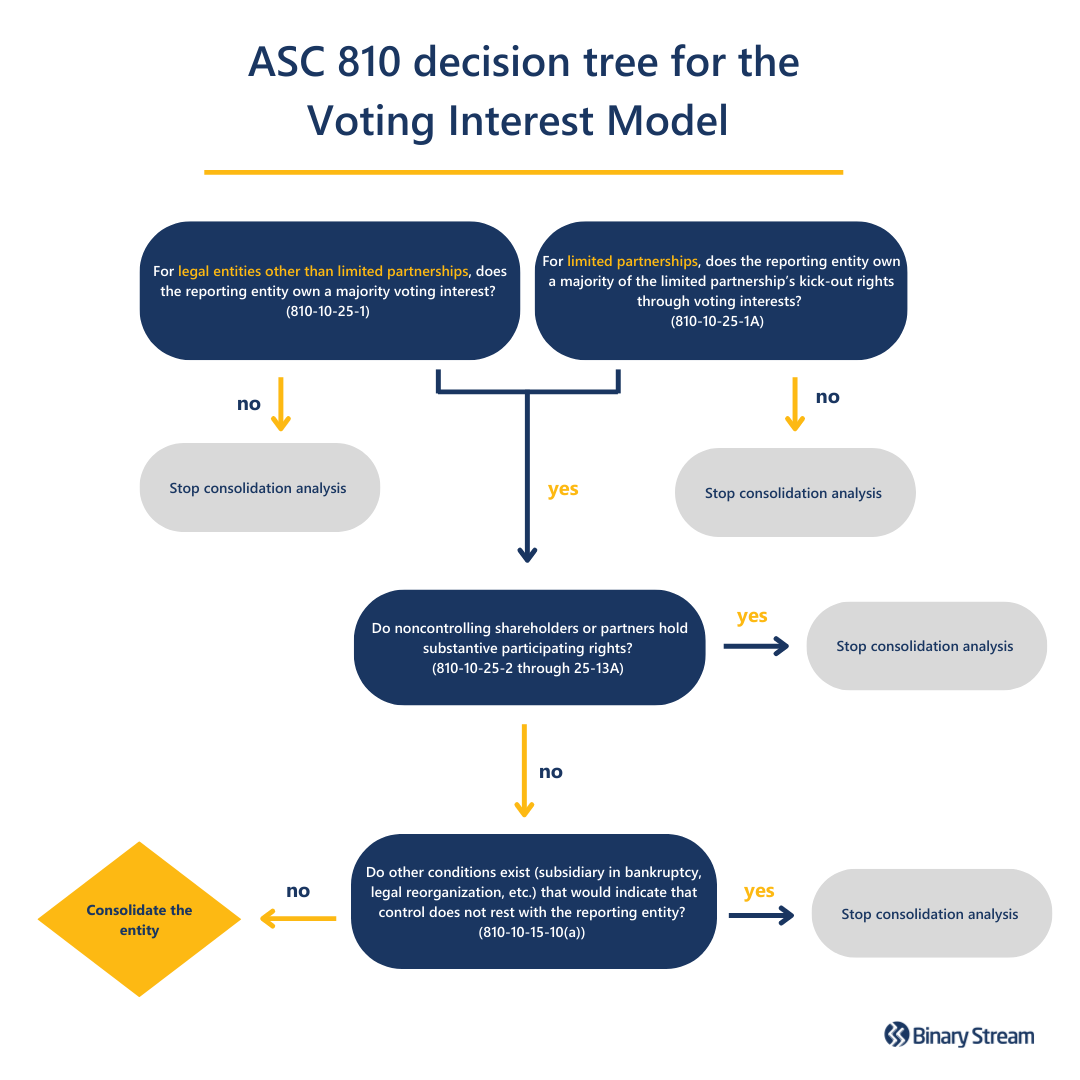

The Voting Interest Model (VIM) is a much simpler model that is familiar to most accounting teams. If a company does not meet the requirements to consolidate under the VIE model, it must look at the VIM. Put simply, this model requires that a company consolidates an entity if it owns the majority of that entity, i.e., over 50%.

Under previous guidance, the general partner would consolidate most limited partnerships. While most limited partnerships were not considered VIEs, in cases where they did qualify, the general partner would often be regarded as the primary beneficiary and be required to consolidate the limited partnership anyways.

With the most recent amendments to ASC 810, general partners must follow the new guidance and likely will no longer need to consolidate limited partnerships. This makes sense as the general partner typically does not truly have control and often acts as a service provider for the other partners. Nevertheless, general partners must provide more extensive disclosures in their financial statements, as most limited partnerships are now considered VIEs under the new guidance (810-10-15-14).

When it comes to compliance for financial consolidation, most companies will face a few challenges. You must invest in software that can appropriately meet the demands of accounting for multiple entities under GAAP regulations. Why not check out Multi-Entity Management, a solution built to help your company simplify processes and streamline financial consolidations.

IFRS 10 is an accounting standard set by the International Accounting Standards Board (IASB), providing guidance for companies with multiple entities to remain compliant when consolidating their financials. It’s similar to ASC 810 (the US GAAP accounting standard for financial consolidation) but differs in some key areas. Although, it’s important to note that both will usually result in the same conclusions.

Companies that need to prepare financial statements under IFRS rules must pay close attention to the guidelines set out under IFRS 10. This blog serves as an aid for your team to understand the complexities introduced by the accounting standard.

If you have more general questions or need a refresher on the topic, check out our complete guide to financial consolidation before you continue reading this blog.

When it comes to IFRS 10, it’s best first to understand the objectives set out under the accounting standard. Put simply, IFRS 10 establishes principles for presenting and preparing consolidated financial statements when an entity controls one or more other entities.

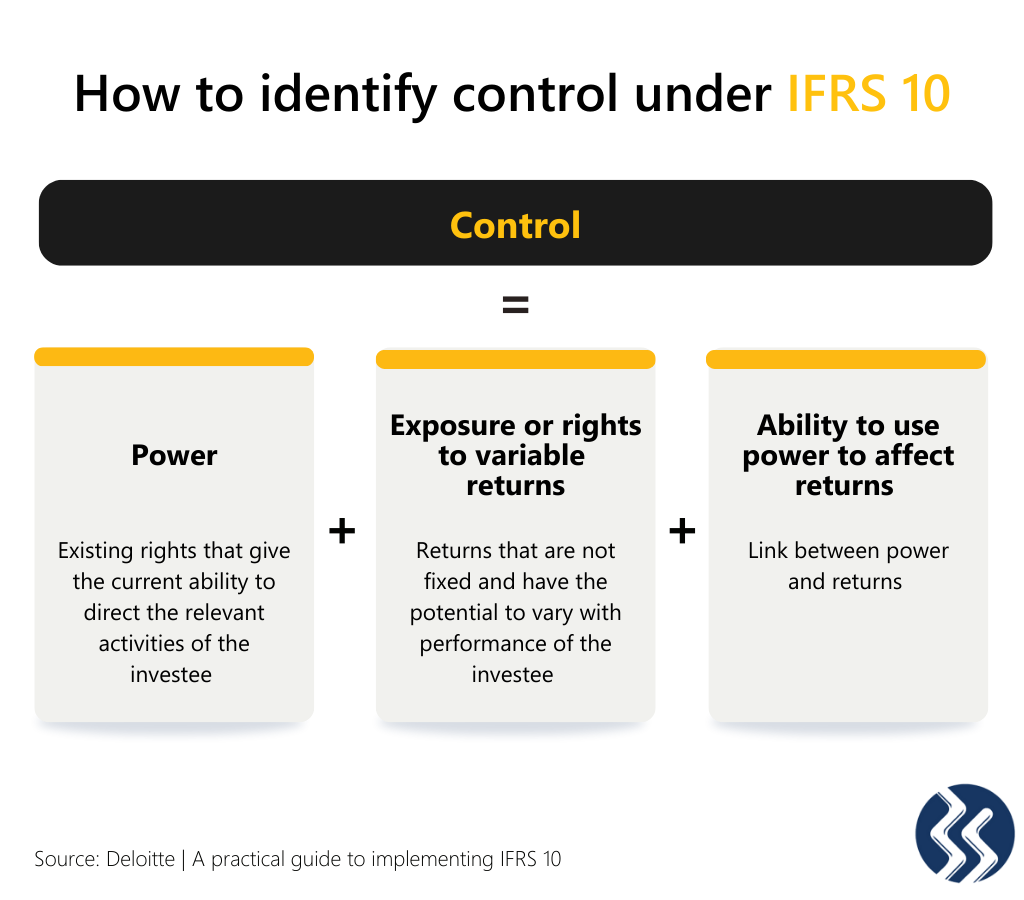

If you’re consolidating financial statements under IFRS 10, then the model is based on an investor’s control of an investee. Control is defined in the IFRS guidelines as follows, “An investor controls an entity when it is exposed, or has rights to variable returns with its involvement with the investee and has the ability to affect those returns through its power over the investee.”

Therefore, to control an entity, the investor must possess all three of the following elements:

When a company is trying to identify which entities have control, they should consider each entity’s rights. Power usually arises from an entity’s rights, such as voting rights, the right to appoint key personnel, the right to decisions within a management contract, and removal rights.

An investor without a majority of voting rights may still possess sufficient substantive rights that grant it power (i.e. de facto power). While substantive rights relate to the practical ability to direct relevant activities, protective rights relate to fundamental changes to the activities of the entity or apply in exceptional circumstances. It’s important to note that protective rights do not result in power or control.

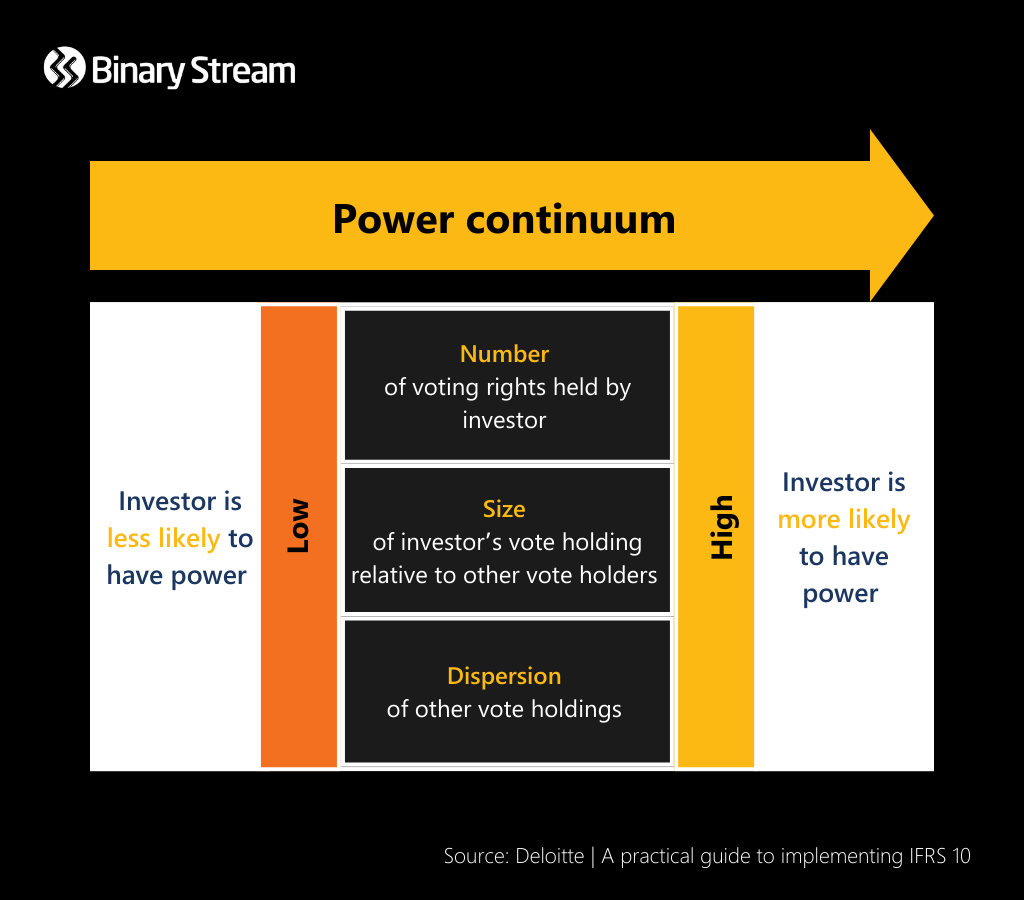

When determining if an investor’s voting rights are adequate to grant it power over an entity, leadership must consider the effect of the voting rights on the power continuum. If the decision is not clear, they must also take into account the following facts and circumstances outlined in IFRS 10:

Often an investor has greater incentive to obtain rights that reward power over an entity as it handles increased exposure to variable returns resulting from its involvement with that entity. Returns are not necessarily positive and can be negative, or a mix of both positive and negative. Some examples of returns include remuneration, cost savings, scarce products, proprietary knowledge, dividends, etc. Crucially, the magnitude of the returns does not factor into whether the investor holds power.

Key to determining if an investor has control is whether there is a link between power over an investee and returns. An investor that cannot benefit from its power over an entity does not have control. Likewise, an investor does not have control if it cannot use its power to direct activities that significantly impact the entity’s returns.

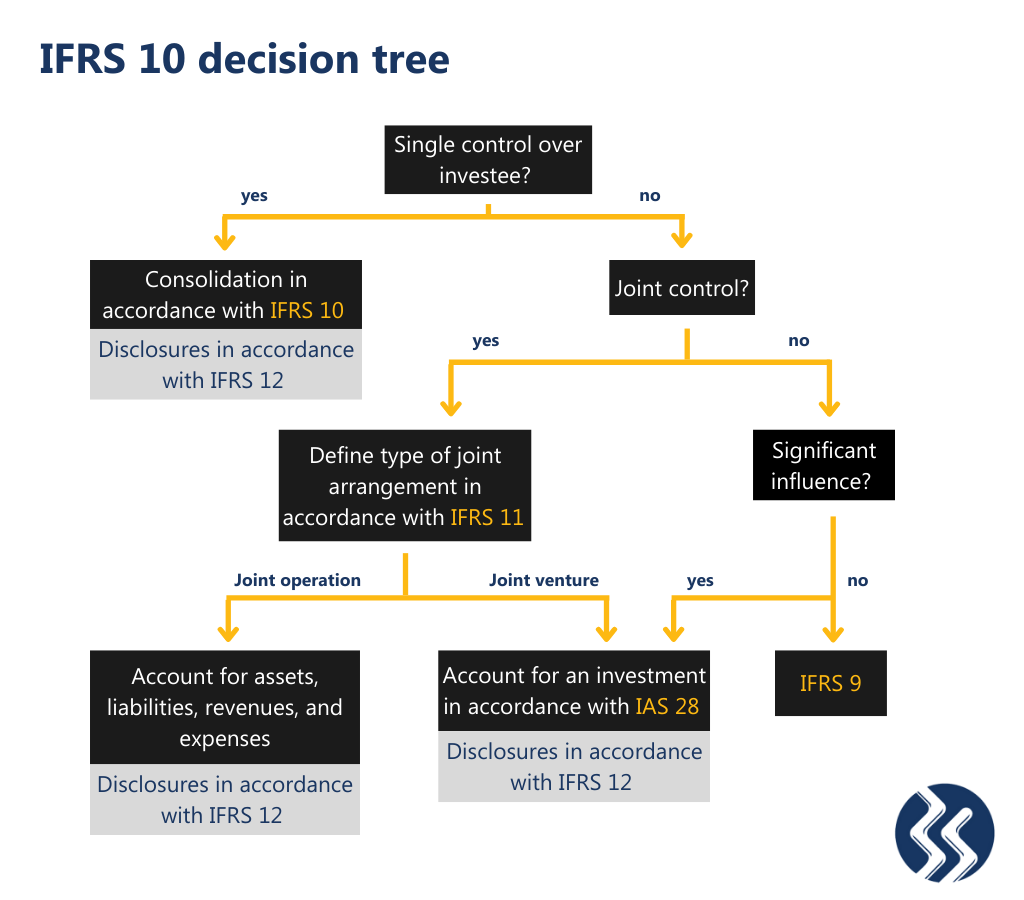

When leadership determines that an entity does not have control, the requirements of IFRS 11 and IAS 28 must then be considered to examine whether an investor has joint control, significant influence, or no governance over an entity.

The following decision tree allows you to assess if IFRS 10 is the accounting standard that best suits your needs.

According to IFRS 10, a parent company is exempt from presenting consolidated financial statements if it meets all the following conditions:

Disclosures are not specified in IFRS 10; however, the required disclosures can be found in IFRS 12 ‘Disclosure of Interests in Other Entities’. The accounting standard states that “a reporting entity should disclose significant judgements and assumptions made in determining whether it controls, jointly controls, significantly influences or has interests in other entities.”

We recommend reading the IFRS 10 guidelines in full. Here is a summary of just some of the critical areas the guidelines cover:

When it comes to compliance for financial consolidation, most companies will face a few challenges. You must invest in software that can appropriately meet the demands of accounting for multiple entities under IFRS regulations. Why not check out Multi-Entity Management, a solution built to help your company simplify processes and streamline financial consolidations.

An intercompany transaction is when a sale occurs between two divisions, units, or entities within the same organization. There are many instances where modern companies must make these types of transactions. For example, a parent company might loan money to one of its subsidiaries or a department might transfer inventory to another unit.

At this point you may be wondering, how do you account for these types of transactions? This blog will answer some of the most commonly asked questions about intercompany accounting.

Interested in a specific aspect of intercompany accounting? Click on the question below to skip ahead.

Intercompany accounting comprises all financial and commercial transactions documented between separate legal entities belonging to the same parent company. These types of transactions may occur between:

An intercompany journal entry is a financial record in the accounting ledger that specifically relates to intercompany transactions. Anytime a transaction occurs between two related entities, the exchange must be recorded and reconciled. A few examples of intercompany journal entries include:

Intercompany journal entries enable companies to meet the same standards of detailed accounting that are expected of all other financial activities. A transaction may only impact a business’ profit and loss statement when it involves an independent, external entity.

Since the entities involved in an intercompany transaction are related, they are not independent, and therefore it would be wrong for the parent company to record a profit or loss. However, by reviewing intercompany journal entries, companies can evaluate the full monetary value of their collective transactions and cultivate a nuanced understanding of their overall financial health.

Accurate financial records of intercompany transactions are vital to strict adherence to regulatory compliance. Accounting principles like ASC 810 and IFRS 10 provide the requirements for preparation and presentation of consolidated financial statements.

Intercompany accounting has become a staple of everyday business, increasingly companies must develop protocols to mitigate the risk posed by handling high volumes of transactions between related entities. The five core intercompany accounting challenges multi-entities face include:

To reduce the complications introduced by intercompany accounting, companies of all sizes must adopt rigorous policies and implement robust processes. Without a proper financial backbone, companies risk non-compliance and hours of lost time as their systems buckle from expansion. Below lists five intercompany accounting best practices all multi-companies can take advantage of:

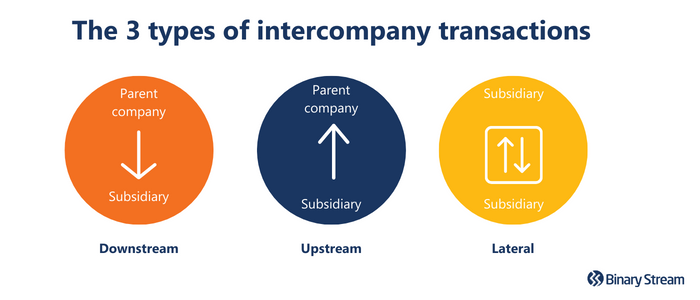

A downstream transaction occurs when the parent company sells to its subsidiary. In this case, the parent company is responsible for recording the transaction and any profit or loss. The transaction is not transparent to the subsidiaries, only the parent company and its stakeholders.

An upstream transaction occurs when a subsidiary sells to its parent company. In this type of transaction, the subsidiary is responsible for record-keeping and documenting any profit or loss. Not only is the transaction visible to minority and majority interest stakeholders, but they can also share the profit or loss because they share ownership of the subsidiary.

A lateral transaction occurs when two subsidiaries belonging to the same parent company sell to each other. Similar to an upstream transaction, either or both subsidiaries may record the transaction and applicable profit or loss.

The intercompany eliminations process involves deleting transactions made between related entities from the financial statements. This process is essential to mitigate the effects of intercompany transactions on the bottom line and present clear, consolidated financial statements that explicitly show third party transactions.

Further reading: The complete guide to financial consolidation

Transactions involving sales or interest payments between affiliated companies are referred to as intercompany revenues and expenses. These transactions are disregarded by the accounting team because a business cannot record sales of goods to itself as revenue, and the company’s consolidated net assets are unaffected by the removal of linked revenue, cost of goods sold, and profits.

When intercompany stock ownership is eliminated, the assets and stakeholders’ equity accounts for the parent company’s ownership of the subsidiaries are eliminated. The accounting team must create an intercompany elimination to take the profit out of retained earnings.

Intercompany debt is eliminated when a parent firm lends money to a subsidiary, and each party has a note payable and a note receivable. The loan is reduced to a simple cash exchange when the two companies are consolidated; therefore, the accounting team must cancel both the payment and the receivable.

Determining how to manage your intercompany transactions and maintain accurate multi-entity financial records can be a daunting task, but it’s well worth it to develop efficient and effective reporting protocols so that leadership can make data-driven decisions that maximize your company’s resources.

Implement the following eight best practices to streamline financial consolidation and master intercompany accounting:

A robust financial management solution, like Multi-Entity Management (MEM), provides a secure, centralized environment for intercompany accounting and empowers your company to gain better insights with real-time consolidated reporting. Directly embedded in Dynamics GP and Dynamics 365 Business Central, complete your intercompany transactions from end to end within a single database or instance while protecting your data with a scalable security setup customized to your organizational structure.

Recent years have seen a rise in the number of transactions taking place between related companies. Intercompany accounting has become a fact of everyday business, yet, despite this, many remain unaware of the best practices for managing intercompany transaction challenges or have a plan in place to mitigate the risks that can arise when handling high volumes of transactions between related organizations.

If you’re new to intercompany accounting, then take a moment before we jump into the challenges of handling intercompany transactions and check out this short primer on the FAQs. If you’re already up to speed, then let’s jump straight into the core issues multi-companies are trying to overcome through automation.

Handling intercompany accounting involves tracking, settling, eliminating, and reconciling all intercompany transactions between entities. It involves numerous steps, transaction types, and scenarios that need to be worked through for parent companies to produce an accurate consolidated financial statement.

As companies grow and these transactions increase, finance faces an immense backlog of unprocessed data, improvising manual processes to try and meet deadlines, and error-riddled reports that are effectively useless. All these issues can exist as well as the problem of having the entire team tackling the task of trying to fix them, leaving little time for the many other duties on the average finance department’s plate.

If everyone is busy inputting data manually, rectifying errors and scrambling to get month-ends complete, what happens to the strategic elements of finance? How can your team grow operations if you are already struggling to keep up with the pace of intercompany transactions?

A lack of documentation may not seem like the most pressing concern if you currently face a bottleneck of intercompany transactions. However, every minute spent defining processes and standardizing the approach to intercompany accounting will save you hours in the long run.

Often, parent companies adjust for all subsidiaries to produce a consolidated financial statement. Yet, there’s no reason individual subsidiaries can’t complete the bulk of this work with the proper guidance. One problem that regularly occurs is different approaches from different teams and little communication from the parent company regarding accounting expectations.

When acquiring new branches or expanding, companies need to sit down and consider every stage of the intercompany process. Building out policies for handling every transaction type, ensuring teams have adequate tools, establishing a global chart of accounts, and communicating changes to existing policies through continuous training and documentation.

Accurate reporting already costs intercompany accounting teams a lot of time and energy without the additional stress of dealing with errors. Most companies will likely spend most of their time researching discrepancies between reports and rectifying errors on month-ends. Often transactions queried at the end of a month will be weeks old, and parent companies may have to go through multiple departments in a subsidiary to get answers as to what went wrong.

Rectifying errors can cost teams more time than it should take to process an intercompany transaction end-to-end. Wasting time in this manner can impact team productivity and morale, as strategy takes a backseat, and accountants figure out inconsistencies across multiple reports and teams.

The biggest roadblock for accounting professionals is the lack of good tools to handle intercompany transactions challenges. Deloitte polled 4,217 accountants facing intercompany hurdles and found that the most common challenge was decentralized accounting systems.

Far too many multi-entity companies operate from disparate accounting systems, with teams handling finance in silos, importing, and exporting reports, and updating records manually. This scenario is an administrative nightmare and a recipe for financial disaster. It

is worth noting that transferring sensitive financial information in this way is a process vulnerable to security breaches and data manipulation. In the worst cases, it can lead to issues with filing taxes, the loss of essential documents, and reporting that fails to meet compliance requirements.

Finance needs to convince leadership teams of the cost of non-compliance and alert them to the amount of time and money commonly saved by investing in the right tools. Financial transformation often doesn’t begin until it’s long overdue, and when it comes to multi-companies, it should be a top priority before problems start to arise.

Non-compliance is a risk most multi-companies should not be willing to take, yet it’s a risk that many take every day when they postpone financial transformation. Global accounting standards like IFRS 10 and ASC 810 are non-negotiable, and teams must work to keep intercompany transactions in line with the expectations in these guidelines.

Often companies have developed high-level strategies to tackle compliance issues, but the real work happens at the line-item level. Creating smooth workflows involves implementing global policies and frameworks that meet the growing demands of governing bodies.

Although several solutions exist for each issue, automation is at the heart of each. Postponing the inevitable and trying to manually address the rising tide of intercompany transactions in your company will only lead to stressed teams without the tools to properly manage the issues.

Suitable ERPs will allow your team to manage end-to-end intercompany processes without headaches so that you can focus on growing operations through strategic initiatives. If you’re in the market for multi-entity management software, check out this blog on the features to look for in financial consolidation ERPs.

Intercompany transactions often result in cumbersome workloads for accounting teams. This statement is as true for smaller organizations as for global corporations. The best practices presented below are essential for companies of all sizes and help teams reduce the complications of intercompany transactions across any number of entities.

Finance teams must be mindful of intercompany accounting policies and implement the robust processes needed to manage these transactions as complexity increases and organizations grow. Those that fail to prioritize intercompany accounting run the risk of non-compliance and hours of time lost to time-consuming manual processes. Companies can utilize the practices below to solve the everyday challenges of intercompany accounting for financial consolidation.

Not sure if this article is for you. Here’s what you’ll learn to do:

Further reading: Your FAQs about intercompany accounting for multi-entities answered

Getting multiple companies to coordinate their reporting and intercompany transactions can be quite the headache. One of the best ways to get all entities on the same page is to choose an established framework. Frameworks should allow you to break down the end-to-end process while providing a vision for teams to understand new policies and where their efforts fit into the bigger picture. It also assists teams in drafting global accounting

This framework is an excellent place to start your intercompany accounting journey as it breaks down the approach into seven critical components. Below the image, we’ve quickly defined each area for consideration.

Intercompany accounting practices start with effective global policies governing data management, accounts charts, transfer pricing, and revenue allocation.

Finance works to develop appropriate arm’s length pricing and introduce global pricing policies across all subsidiaries that provide transaction-level pricing and reporting guidance.

Categorize intercompany transactions by type. Then develop specific workflows and procedures to streamline and simplify processing for each category and normalize reporting. These steps enable consistency, as well as effective dispute resolution between entities.

Developing a centre of excellence for data management and governance requirements is a critical component of intercompany accounting. Common charts of accounts and clearly defined reporting requirements are crucial to meeting global data management accounting regulations.

Companies who want to streamline this time-consuming element of intercompany accounting must consider the introduction of automated workflows and a centralized accounting environment that can handle multiple entities. Without this step, companies will find managing this will burn through resources, squandering valuable talent as teams struggle to balance statements and produce accurate financial information.

Companies need a defined cash management strategy and a multilateral settlement. It’s wise to determine policies for settlements requiring a cash transaction rather than an account entry. It’s also important to outline when to clear originating transactions son local ledgers.

The consolidated financial statement presents the biggest challenge of intercompany accounting for parent companies and even for child companies trying to satisfy the requirements of their parent organization. Collecting consistent records across all entities can be daunting, and those that excel in this area generally have all the other components in place. Leaders tend to have a centralized intercompany accounting environment with minimal manual input from various entities.

Deloitte refers to intercompany accounting as “the mess under the bed, ” a mess which involves serious risk for those who fail to clean up their processes. Regardless of the size of your enterprise, intercompany transactions increase with complexity as you grow. Whether dealing with two entities in the same city or twenty spread worldwide, you must be mindful of the guidelines governing your transactions between entities.

The challenges of intercompany transactions include everything from managing different currencies and exchange rates to varying compliance standards. To meet the financial requirements of global governing bodies, your organization needs to establish policies that account for these variations across all entities.

The problem is that most companies believe they’ve already taken this step. Most can present several pages of high-level policies that cover intercompany accounting. However, these policies often fail to provide the level of detail needed to ensure smooth intercompany transactions. This level of detail is essential for proving compliance with global accounting standards like IFRS 10 and ASC 810.

Having standardized global policies that include intercompany transactions in their scope is only the first step. As anyone can tell you, the best-laid plans are rarely enough to achieve the desired results. Implement policies in a controlled, centralized environment that reduces the likelihood of human error.

These policies are often rigorous and challenging to implement across various entities. It’s best to consider the value added by a centralized ERP system, allowing you to create standardized charts of accounts that ensure consistency across all transactions and accounting.

Invariably, using appropriate software saves teams from spending many hours figuring out intercompany transactions and making adjustments in consolidated reports. It also helps with creating standard processes and calculations, which makes accounting for month-ends more efficient.

For more on the features to look for in financial consolidation software, check out this blog.

Ask any team that deals with multiple entities where they sink the most time, and you’ll find that eliminations and reconciliations for intercompany transactions will be pretty high on the list. Reconciling transactions across various systems can be an administrative nightmare that can take days (if not weeks) to solve each month.

Plenty of software solutions automate this process by matching transactions between entities. These systems should be capable of identifying different types, automatically identifying and accounting for each in month-end reporting. This frees up time to deal with issues as they arise, allowing your team to allocate resources to only investigate the most complicated intercompany transactions rather than every single one.

Accounting for intercompany transactions is one of the most time-consuming and cumbersome tasks that accounting teams face at the end of a period. Most companies require this task either monthly or quarterly, leading to hectic period ends, with all-hands-on-deck scrambling to consolidate financials from each entity into one comprehensive financial statement.

The problem is that teams are querying intercompany transactions that may have occurred four weeks ago. In most companies, a lot happens in a month, and the older a transaction is, the more time-consuming it can be to query.

The best practice is to introduce continuous close accounting practices that turn your usual period-end closing tasks into daily activities throughout the month or quarter. This allows your team to match, reconcile, and eliminate transactions on an ongoing basis, spreading the workload across the period and removing the need to scramble to account for all intercompany transactions at month-end.

Understanding the most common financial consolidation challenges will give you the power to avoid them. Start by asking yourself these questions:

As these questions make evident, financial consolidation feeds into many aspects of your company’s growth. It allows investors to assess the opportunities and gives stakeholders, regulators and auditors a clear understanding of your company’s finances.

Effective financial consolidation is a rigorous process requiring accurate data, expert project management across all entities, and compliance with accounting regulations.

As you scale, consolidation increases in complexity. Despite this, many growing companies still rely on outdated tools and processes. This blog outlines the most common financial consolidation challenges companies face and best practices to avoid them.

Unreliable data is one of the most common hurdles companies face. Inaccuracies can be due to the use of multiple disparate sources. Often information is manually inputted into these sources, which is a cumbersome task that results in human-error.

Consolidating multiple sources and judging the accuracy of the data can become an almost impossible task, sinking resources into a process that may take months to resolve. It can be hard to know how inaccurate data arises and where to correct it. A failure to address this issue will result in companies facing issues across the board, including data entry errors and bottlenecks caused by cross-checking transactions.

One of the most common financial consolidation challenges is failing to automate time-consuming processes. As you’ve seen above, manual data entry eats up time and resources. It can create more problems than it solves. It’s possible to implement an effective consolidation process by investing in automation to reduce errors and free up time and resources.

Many companies make the mistake of using multiple systems without checking if they integrate fully. As you can imagine, this results in a headache for those responsible for consolidating all this information into one system. It’s not uncommon for each branch of a company to use a different reporting tool, which is problematic.

You need to invest in a single ERP system that creates a chart of accounts adhered to by all entities. For best results, look for one that integrates with your current tools and processes. It’s also wise to consider those specifically built for your industry. For example, hospitals should look for solutions that focus on healthcare materials management. Similarly, SaaS companies may want solutions designed to handle the complexities of subscription billing models.

Another of the most common financial consolidation challenges arises when companies try to record and make adjustments for intercompany transactions. These transactions happen between entities of the same company and include three categories.

You need to adjust for these transactions to give a fair view of the group’s financial health. Making these adjustments can be a time-consuming process that leads to significant delays in the close cycle.

Reporting guidelines, statutory requirements and compliance regulations are continually evolving. As a company scales, it can be challenging to keep on top of all the changes to best practices. Compliance is an ongoing hurdle for most companies, one that is integral to financial reporting and consolidation. Look for an ERP system built to handle compliance as you scale.

One of the most significant issues with using spreadsheets for financial consolidation is security. It’s much easier to manipulate and change data. If it does occur, it is hard to track the source of fraud or data manipulation. One of the easiest ways to circumnavigate this challenge is to invest in software that makes security a priority, allowing you to control access and automate data input—making financial statements much harder to manipulate.

Accounting standards vary from country to country, as do currencies. Each entity must compile a financial statement that meets the reporting standards of its country. These different reporting standards can make consolidation difficult, as you will need to remediate this information in the parent company’s consolidated financial statement.

Currencies and exchange rates are sometimes converted manually and imported to systems, but this is an error-prone process. The only way to accurately handle financial consolidation across multiple countries is to invest in a system built to handle the complexities of different accounting standards and currencies.

Selecting the right Enterprise Resource Planning (ERP) software is rarely an easy decision, and the biggest mistake most companies will make is rushing into it without first establishing their functional requirements. A slap-dash approach will only end up costing you time, money, and resources. There are a number of downloadable ERP requirements checklists and templates online, but very few of them are useful as they tend to focus on generic features rather than the specific needs of the team that will be using the ERP for years to come.

Best practice is to establish a custom checklist based on your specific needs, that way you won’t end up wasting more money on flashy features that have very little to do with your company’s goals.

This blog will help you build a custom ERP requirements checklist that is right for your company and equip your team with the criteria and questions needed to assess each system and find one that will work best. You can also download this free ERP functional requirements checklist template, to explore the top features and get started.

Core topics covered in this blog (skip ahead by clicking on a topic)

ERP is an acronym that stands for enterprise resource planning. It’s software that centralizes work across multiple departments, so that you can streamline processes and ensure the secure management of your resources (financial and otherwise). ERPs cover functions such as marketing automation, financial management, customer relationships management, supply chain management, etc. They can be industry-specific and save teams considerable time and money by modernizing workflows and consolidating crucial company information.

ERPs serve a wide range of functions depending on industry requirements. Many of the solutions on the market can be modified or customized to meet the demands of a company. However, there are some core benefits regardless of the exact functionality an ERP is purchased for, and these benefits tend to impact all departments. So, whether you’re looking for an ERP to handle financial, human, or marketing resources, it’s likely that you will experience the following benefits:

(click one to jump ahead)

Make a comprehensive list of all your business requirements for the ERP. You will need to survey the people it will impact most i.e. the users and those directly impacted by its functionality. There is no one-size-fits-all checklist, and you will need to speak to employees at all levels of your company to get a feel for the right criteria. It might be useful to make a list of those who will use the system, and then start by asking them what they need it to be able to do with it. Then, you may want to ask upper management what sorts of reports they need to see to make financial decisions. You also want to ask trusted customers and suppliers what would help them.

If you do this well, you will end up with a large list of ideas. Take this list and use it to form a tiered list of requirements. Working with your team, establish what are the “must-haves”, “good to haves” and “nice to haves”. Your list may have more tiers than this. The overall aim is to get a clear picture of the essential features for your ideal ERP system and which features you can maybe live without.

Once the list is tiered, get the entire team to evaluate it. Can someone fight for a feature that got pushed to the bottom of the list? Be flexible and try to listen to everyone’s input. Weigh the costs and benefits of what they advocate for before you finalize the list.

At the end of this process, you will be able to start looking at some of the other technical requirements of a good ERP. Looking at solutions before you know exactly what you need can have dizzying results. It may even prevent you from making a decision grounded in your business requirements.

It’s up to you to convince upper management of the importance of the project and get them to have total buy-in and give full support. Your list of business requirements should be one tool that will make it easy to show them the potential of the right ERP system, but really, you need more from them than just budget approval. Without their buy-in, you may end up getting a cheaper solution with less functionality than you require and find that it costs you in the long run.

Before you approach upper management, be sure to have read through this list comprehensively, as it details many things that you may want to be aware of (and have answers for!) before you book a meeting.

It’s also wise to consider the adoption of a new ERP as a financial transformation that is a major decision which impacts every aspect of your company. Framing it this way can help leadership understand the importance of the change and get the support you need to drive what will be a transformative process for the entire organization.

Chances are that there are members of your team who have a wealth of experience using different ERPs at previous jobs. Many of these ERPs will be specific to your industry’s needs. As part of your checklist, get their suggestions on the systems they’ve loved throughout their careers. This is important information and can cut down on training costs later. If you end up choosing a solution that some of the team is already familiar with, they can help with training the wider team. It’s also important to understand what they loved about those systems so that you can be sure any new ERP will get their full support.

You need your team’s full support to make the system work. After all, they will be using the system, and the learning curve can be steep. Sometimes, companies make the mistake of landing their teams with a new system, without first supporting them in the transition. Think about how to manage the change to a new ERP from a human perspective. Your team needs to know that documentation and training will both be readily available.

Once you’ve got a clear understanding of your team’s abilities and requirements, it’s time to get technical. Consider what functional requirements your ERP needs to make your company run smoothly. For instance, should it be hosted on-premise or in the cloud? Will you be using this in addition to a CRM system or run your sales processes out of your ERP? Other functionalities might be the ability to manage multiple currencies and companies.

It’s as important to establish the functional requirements you don’t need. For instance, if you don’t manage inventory, then the system you choose won’t need to have that functionality. Many ERPs are built specifically for certain industries. It’s worth considering which functionalities are crucial to your business.

Your company already has processes and systems in place. Your new ERP solution should not interfere with these workflows and technologies, unless necessary. The ERP must be easy to integrate. Otherwise, you will end up creating an administrative nightmare that will make it impossible to fully optimize your systems.

For example, if you’re already using Microsoft 365 it makes sense to opt for ERP systems that will integrate with that system. Basically, you need to actively look for companies that have built solutions for your industry. These companies will likely have processes in place to integrate your systems with the ERP.

In some cases, you may find your current systems are all out-dated. It will end up making the most sense not only to invest in an ERP but also the other tools and systems that integrate with that system. Although this may feel daunting, it will save time and money in the long run.

Whatever you decide, make sure your ERP requirements checklist has a section outlining the systems it will need to integrate with. There’s no point wasting time researching ERPs that won’t function in your workplace.

It’s also important to think about the future when deciding on your ERP requirements checklist. Most likely, your company plans to scale, and as it grows your systems need to be able to seamlessly manage that growth. That means choosing a solution that will be as good for your company tomorrow as it will be today.

If you do plan to scale and won’t need all functionality immediately, it’s important that you think about scalability and updates to the system as time passes.

Deciding how much money is realistically available for an ERP system is crucial. This is an investment in a system that will operate at the very heart of your business for at least a decade. It’s important to weigh up how much you’re going to spend. Be sure that management understands the benefits before you start whipping numbers out of the air.

In 2019, a report that analyzed data from over 2,000 projects. They found that the average budget per user for an ERP project was USD 7,200. Training costs, integration costs and the system cost are all part of the expenditure you can expect in getting your ERP up and running. Make sure your requirements checklist understands the true budget required to get the job done.

Once you establish a budget, it’s time to calculate your return on investment. Make sure these costs and benefits are spread over time so that you get a clearer picture of the ROI over time. Once you know how much it will cost, you can start to think about the improvements and benefits of the system and calculate the money that can be saved. E.g. processes that once took hours, may now only take minutes.

Now that you will have a system taking care of labour-intensive work, you may be able to free up staff to provide valuable services that were impossible in conjunction with arduous reporting and invoicing processes. This will be very different for each company and comes back to the business requirements. Your team must understand the time and money that will be saved and that this is an investment that will have a measurable ROI.

One of the biggest costs in implementing any ERP system is requiring a lot of customizations, this is often because the solution is too general and not fit for purpose. Ask yourself is your company so unique that no other company has ever needed the same tools? Although this is possible, it’s not likely. You should be able to find an ERP that has been tried and tested and that has functionality specific to your industry. Whenever you find an ERP system pushing customizations, ask yourself if those features might be standard in a system built with your industry in mind.

For instance, a healthcare provider looking to manage materials is going to have completely different requirements from a SaaS company that wants to streamline its subscription billing. Both companies will need a system that can support industry-specific extensions that supplement the core ERP rather than relying on overpriced customizations built by ERP providers who don’t usually operate in their industry.

One way of establishing whether or not a software provider has the tools you need is to look for case studies or examples that exist where similar business models to you have successfully implemented and used that ERP. If you are going to need customizations, be sure you focus on providers who have a team of skilled developers who will be able to quickly and efficiently tweak your system.

One component that often gets left off ERP checklists is deciding what sort of team you intend to work with. It’s a piece of software! Why does it matter as long as it has the right functionality? The people behind the product matter when a system is integral to the day-to-day running of your company.

Make sure you know how helpful they’re willing to be? If they will be hands-on with training? If an implementation framework exists? How have other companies found working with them? The right global ERP system will also have demonstrated success in the countries where you operate, so make some of your selection criteria the availability of useful resources, case studies and references that are relevant and industry-specific. Compare and contrast how well different ERP systems work within your space.

By establishing what it is you’re looking for as part of your ERP checklist, it will then be easy to research different solutions and make sure that the team behind the system will be as responsive and helpful as you need.

For those who don’t want to build a custom ERP checklist, it’s possible to use this requirements template which outlines the top functionality you should consider when prioritizing features. Even if you are building a custom checklist, defining some of the most common functionalities can be helpful before you get started. Below is a list, segmented by department, to help you choose an ERP or facilitate the discussion about company requirements. Alternatively, download the free ERP requirements checklist here.

Given the demands of modern finance, it’s no surprise that one of the core functions of an ERP is to streamline and automate processes so that the finance team can focus on more strategic initiatives. Here’s a list of the requirements accounts teams usually request:

Most industries have seen the adoption of complex pricing models, and SaaS migration has become a necessity for many forward-thinking companies. You could easily consider subscription management tools under the finance section. Still, it’s valuable to give this functionality a separate heading given how central these tools are to the future of organizations. Below is a list of requirements your ERP needs if you plan to incorporate recurring revenue strategies in your future plans.

Integration is one of the most critical core requirements, yet it’s also easy to ignore. Double-check all solutions and explore options built to integrate with your current processes and workflows.

One of the central conversations in choosing an ERP is effectively managing sensitive data. It is essential across all industries, even more so for those navigating stringent regulatory guidelines such as healthcare and finance. It is imperative that your ERP can handle the complexity of modern data management and protects sensitive information against security breaches and attacks.

One of the most compelling reasons for any leadership team to invest in an ERP is the ability to attain business intelligence that will help set your company apart from the competition. Reporting and analytics empower teams to make strategic decisions based on accurate and timely information. Here are some of the requirements leaders look for:

Whatever your industry, it is likely that commercial leases are part of how you do business. Health care companies find themselves converting retail spaces or leasing out equipment, retailers lease multiple locations, and manufacturers and SaaS companies spend a considerable amount of their budget on leasing storage facilities. Whether you are the lessee or the lessor, it’s likely that as operations grow, lease management requirements will increase. Below are some of the features you should consider.

The list above is by no means comprehensive and merely acts as a launch point for companies trying to set expectations and define requirements. It’s also essential to consider the demands of your operations, the struggles with your processes, and any custom requirements you might encounter. It’s worth creating a list of what this looks like department by department, getting marketing, HR, product, and customer service all to weigh in. Here are some industry-specific requirements you might need to consider, depending on your goals for the ERP.

Recent years have seen the trend of healthcare mergers and acquisitions continue to grow. In 2020 at least ten “mega mergers” (i.e. mergers with at least $1 billion in annual revenue) were announced in the U.S. alone. Evidence of smaller hospitals joining hospital systems continues to escalate, with a report by Deloitte indicating that nearly 60% of hospitals in the U.S. are part of a health system.

The prevalence of such deals continues to present challenges and opportunities for organizations, both big and small. Handled well, they can lead to unprecedented opportunity and growth. Handled poorly, they can lead to administrative chaos. In any deal, there are steps both parties take that ensure success in these transactions.

The first step is to stop referring to mergers as a “transaction”, a word that paints the merger as a singular event to be stamped and dated. Changing mindsets begins with the terms used by our organizations, and it’s essential to treat deals of this magnitude as an ongoing process that requires buy-in at every level of organizations to be successful.

Healthcare mergers and acquisitions impact all aspects of standard operations, and it’s important to recognize this to avoid an onslaught of administrative issues, which will ultimately impact patient care. There are many benefits to mergers and acquisitions for both parties, but only if an appropriate strategy or checklist is in place to manage the aftermath.

Leadership teams need to prepare a plan which allows for a smooth transition and adequate change management. An appropriate program allows your team to make sure patients continue to receive the care and services they need. Without this in place, the organization can falter, and patients may get caught up in the mix.

In 2017, Deloitte analyzed the impact of mergers and acquisitions on a hospital’s performance and reported commonalities between leadership teams that succeeded and those that struggled. Below is a list of traits that successful leadership teams exhibited.

Healthcare is one of the most regulated industries globally, and creating a culture of compliance is one of the keys to successfully merging two organizations. It’s wise to designate roles for governance and establish compliance standards early in the process.

Establish a committee accountable for complying with all rules and regulations as your teams work together to consolidate operations and finances. Some healthcare organizations can be tempted only to include c-suite employees, but it’s best practice to include effective project managers in the mix. It will be essential to have critical voices from across both organizations to get a clear picture of challenges and roadblocks as they arise.

This committee will be instrumental in addressing barriers to success and will require the support of executives from all levels of both organizations. Because of the many moving parts involved, project managers are often uniquely positioned to give realistic projections and timelines based on current workloads and capabilities. They’re also aware of challenges and struggles on the ground floor that might not always make it to the c-suite level.

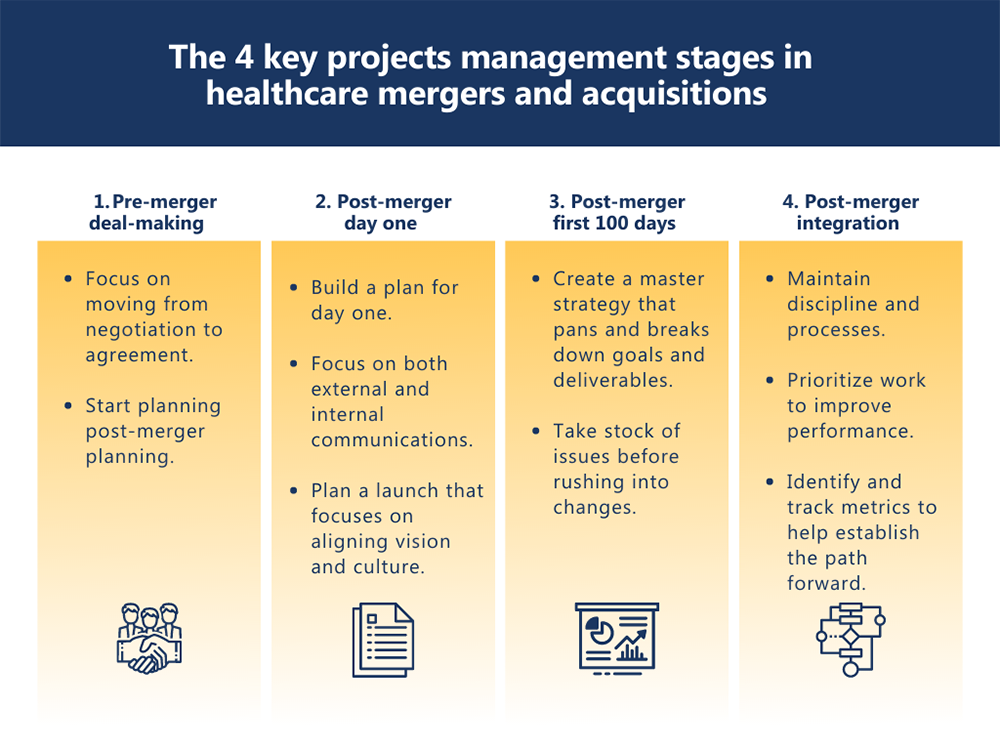

You may want to hire additional project managers to help. It’s also possible that the talent you need exists within the merging organizations. Task these individuals with setting up processes that will enable stability for years to come. The governance committee should ultimately be held accountable for the merger’s success. They can break this down into four key stages: pre-merger deal-making, post-merger day one, post-merger first 100 days, and post-merger integration.

After any healthcare merger, ERPs often become one of the central topics of conversation, but this is often too little, too late. If you’re only starting to talk about this on day one, your team will likely face administrative challenges. Not least, that first month’s close where they will need to consolidate financial statements for the first time. Without adequate technology in place, this will be time-consuming and riddled with errors from manually transferring data between systems.

It’s usually better to start planning for the effective integration of software long before kick-off. The ERP is central to how any healthcare organization operates, and it’s almost impossible to succeed if you postpone finding the right solution and aligning all parties on how to use and manage processes within it.

Best practice would dictate that a centralized ERP solution with advanced security options is the best fit for securing data from multiple entities post-merger. It allows you to consolidate financials easily and manage the supply chain across the entire organization, giving you actionable insights into performance.

Prioritizing ERP integration is not a step unique to healthcare organizations. This blog on why you need to worry about post-merger ERP integration now offers further insights into the impact this crucial step can make.

Often it is assumed that change and project management are somehow the same. However, change management concerns itself more with the cultural aspects of the merger and acquisition process. An effective change management strategy helps deliver insights on how people in both organizations feel about the merger and then use these insights to build a culture that unites the organizations.

It’s rarely a good idea to imprint the parent organization’s culture on the smaller organization, so this is a role that requires a tremendous amount of tact and empathy. Ideally, change management should help identify and diagnose gaps between the two organizations and resolve these differences through measurable initiatives, creating a culture that serves the future of the merger. There are several ways to invest in change management. Within the Microsoft community, both ProSci and the ADKAR model come highly recommended.

Although it is possible to manage the complexity of healthcare mergers and acquisitions, some organizations still struggle to meet the administrative demands of the process. This blog hopefully serves as a jumping-off point to help your team navigate the transition and enable you to advocate for the resources you will need.

For the 11th year in a row, the healthcare industry had the highest average data breach cost. Healthcare data breach costs increased from an average of $7.13 million in 2020 to $9.23 million in 2021. For reference, the average cost of a data breach across all industries in 2021 was $4.24 million. Now more than ever, it’s crucial that your healthcare organization prioritizes data protection.

Although some healthcare providers worry that an enterprise resource planning (ERP) system will be a prime target, it’s much easier to use adequate resources and technology to protect information stored in one place. That being said, not all ERPs offer the same calibre of data protection. This blog delves into the challenges facing healthcare ERP security, so you can adopt the best practices for protecting your data.

Click on the healthcare security topic you’re most interested in to skip ahead:

Before getting to the nitty-gritty of cybersecurity, it is essential to distinguish between cyber-attacks and security breaches (as many get the two confused). A cybersecurity attack is a severe offence whereby data or confidential information is stolen by electronic means, including ransomware and hacking. A security breach, also known as a data breach, is any unauthorized or unintentional disclosure of confidential information.

Therefore, all cyber-attacks are security breaches, but not all security breaches are cyber-attacks. This blog focuses on security breaches of all kinds, as they cause concern and complications for security experts and impact patients, stakeholders, employees, organizations and businesses. To best defend the data in your healthcare ERP, it’s essential to understand the common causes and symptoms of a security breach.

If security is a vital concern for your organization, you must research the pros and cons of centralized and decentralized ERP systems before you invest. Centralized systems consolidate information across various entities and departments, such as accounting, warehouse, inventory, HR, etc. Unifying data across different business units allows them to function efficiently and generates a seamless data flow stored within a centralized database.

Decentralized systems silo data by entity offering management maximum flexibility; however, their defence protocols are usually stretched too thin, creating a spider web of cracks in your security. Every time your data moves between different systems, there’s a risk of a security breach. Each data transfer needs its own form of high-level security, and each of these processes needs to be monitored and routinely updated to ensure that nothing slips through the cracks.

The protocols needed to achieve the same level of security in a centralized system are easier to keep track of than in a decentralized system. You can also usually afford better protection when using a centralized system because your budget isn’t split across multiple business units and processes.

A successful cyber-attack can be very lucrative for hackers but incredibly detrimental to your organization. In the eyes of cyber-criminals, critical data like patient and employee personal identifiable information (PII), patient personal health information (PHI), financial information, and proprietary formulas are the crown jewels of your organization. Therefore, protecting your data with every available precaution is necessary.

Read more: How healthcare providers benefit from implementing an ERP

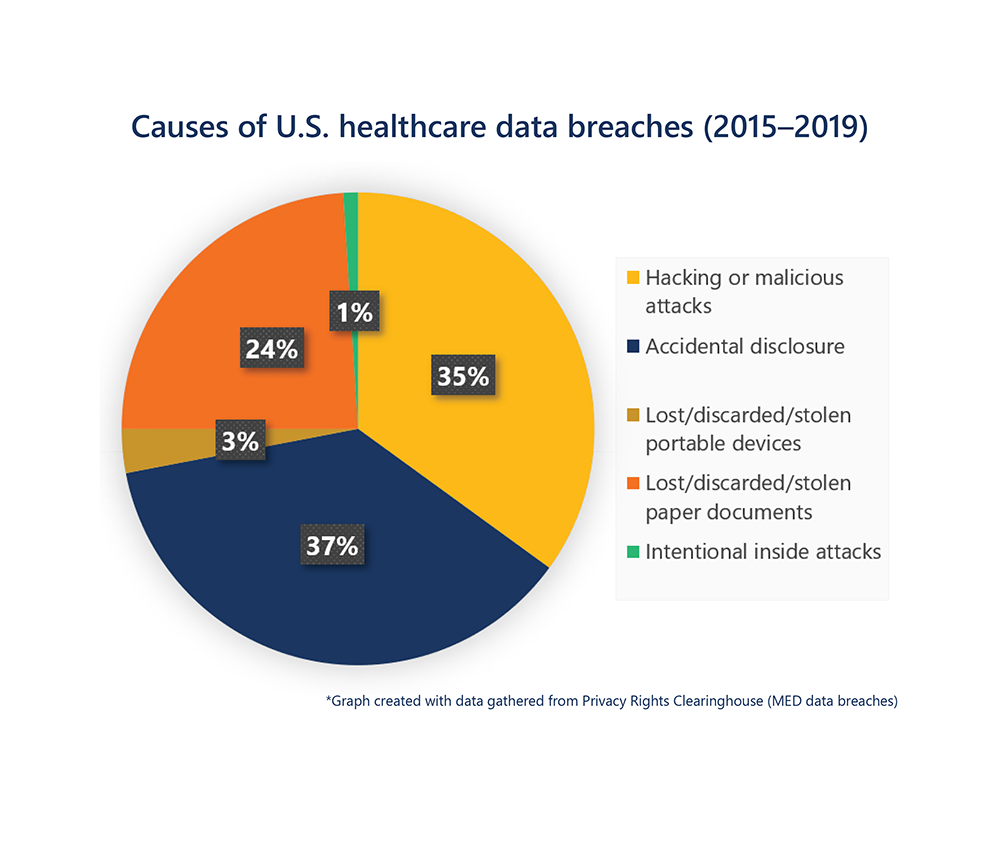

The three prominent causes of security breaches in healthcare arise from accidental disclosures, lost/stolen/discarded physical records or devices, and hacking or malicious attacks. It would be best if you had security measures to prevent all three types of breaches from occurring.

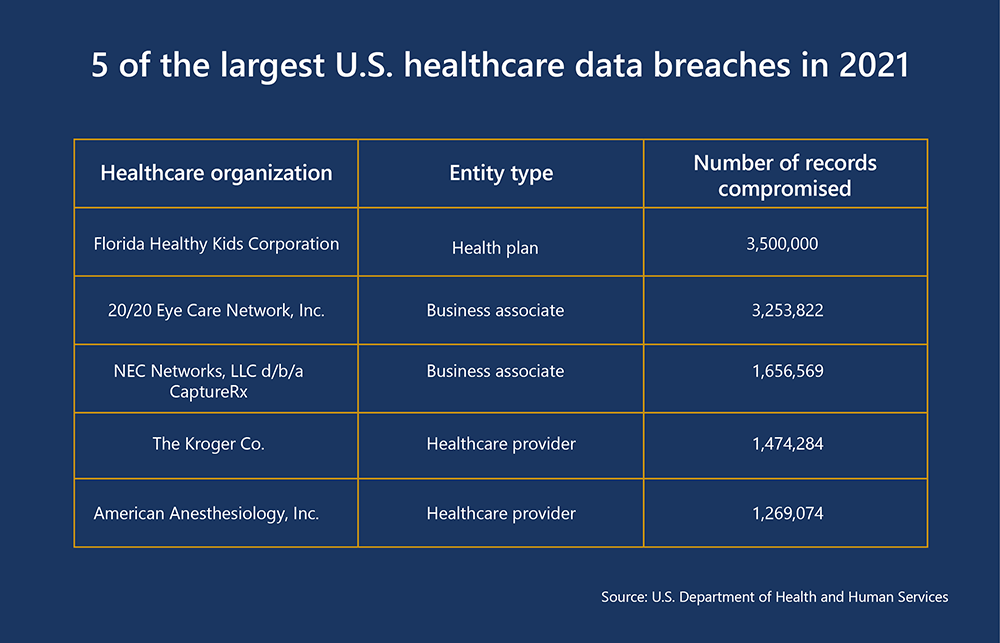

In the first half of 2021, the U.S. Department of Health and Human Services reported that 72% of healthcare security breaches were due to hacking incidents. One of the biggest data breaches of 2021 uncovered a seven-year security breach targeting the Florida Healthy Kids Corporation compromised upwards of 3.5 million records. However, the 2015 Anthem security breach remains the worst case for the industry, with over 80 million documents leaked from a cyber-attack. Anthem settled multiple class-action lawsuits for $115 million and paid the fine of $16 million to resolve HIPAA violations uncovered during its breach investigation.

Despite the recent increase in hacking and malicious attacks, it’s not the only way to compromise healthcare ERP data. The other two leading causes are serious threats. Health Share of Oregon compromised 654,362 records due to a laptop stolen from their patient transportation vendor in November 2019. Elkhart Emergency Physicians leaked 550,000 records from 2002–2010 because a third-party vendor didn’t shred patient files before disposing them.

Accidental disclosures commonly occur from sending emails containing PHI to the wrong recipient or leaving servers publicly accessible. In 2018, an employee at Independence Blue Cross accidentally uploaded the names, birthdays, diagnosis codes and provider information of 17,000 members to the company website.

In 2021, the average cost per record lost in a security breach was $161, and if PII was compromised, that price increased to $180. However, the cost of a cyber-attack is often more than just the money spent to restore and re-secure your healthcare ERP systems—recovering from a security breach impacts the day-to-day functionality of your business. The downtime while the systems are out of operation will result in a loss of revenue and productivity. Anyone’s job could be at risk, and if production drops to a low enough point, you may be facing the possibility of letting people go and paying them damages.

Most importantly, your patients care about the safety of their PII, so a breach could cause them to lose confidence in your organization—jeopardizing your brand value and compromising your company’s reputation. These risks and improper handling of a cyber-attack could have a negative influence on future sales. In some ways, the loss of trust imposed by a security breach is a more significant threat to your revenue than the costs of recovering the data. Without essential safeguards in place, ERP systems are vulnerable to attacks, which is why it’s so important to invest in solutions with robust cybersecurity measures to protect your organization.

Advancements in hacking and cyber-crime require a shift in mindset. It is no longer enough to focus on keeping the bad guys out; the bad guys are in your network. Now, it’s essential to consider how to protect your data from getting stolen. In 2021, it took companies an average of over 200 days to identify and 75 days to contain a data breach; however, if they kept the lifecycle of a data breach below 200 days, they reduced the average cost by $1.26 million. If there’s a security breach, can you spot it, contain it, and deal with it as soon as possible? To answer this question, let’s go through some of the best cybersecurity practices.

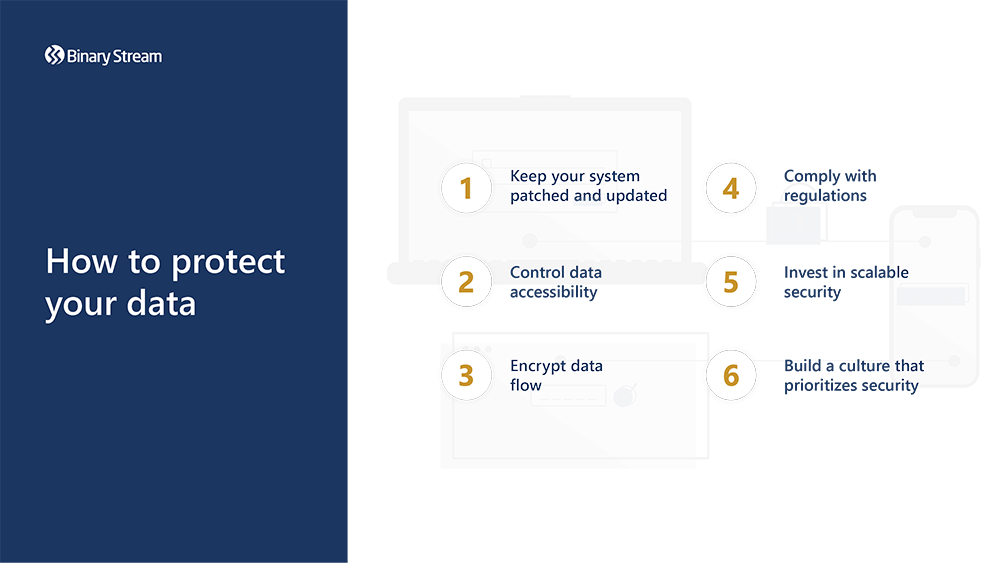

The very first thing you should do is update your system and, going forward, ensure to keep it updated. Cyber-criminals actively look to exploit outdated healthcare ERP software because it’s more vulnerable without the latest security patches, and it’s harder to rectify technical issues, like crashes, when you’re running an unsupported version of the software. To ensure that you’re always running a fully up-to-date system, it can be a good idea to approve automatic updates or set up a schedule that will install available updates during non-operating hours. Even better, invest in software with a reputation for consistent updates and robust security features. For example, Microsoft has a very secure ecosystem and invests $1 billion in cloud security each year.

It’s not just the ERP system that needs to be routinely updated. Users are accessing the system in multiple ways. Any device that accesses the system must be secured and updated. If any of the methods are compromised, it poses a risk to the entire ERP application.

Successfully managing staff across different departments and locations can be a challenge, so you must consider what access rights each individual needs to do their job effectively. For example, the CFO needs access to performance reports across all entities to understand the big picture for the organization. Still, employees from one entity don’t necessarily need access to reports from the other entities. Similarly, you may want junior accountants to enter data but not edit existing data without requesting additional permissions. Full access rights and permissions should not be the default, and each user should have strictly controlled data accessibility.

The IT department should also monitor and assess the risk of every device that connects to the network, creating an inventory of approved devices. It is crucial to reassess the level of access rights awarded to an individual as changes occur within the organizational structure of your employees. Opportunities for re-evaluation include hiring new employees, changing job roles, after promotions, or after mergers and acquisitions (M&A).

The nature of ERP systems means a constant stream of data between different departments and across a multitude of devices. In addition to protecting your network through security tactics like a virtual private network (VPN) or a firewall for local connections, your organization must invest in solutions with advanced encryption. Using these methods in tandem will offer you the absolute best defence for your data flow, even across wireless networks and messaging systems. Data encryption has the added benefit that it will help keep your organization HIPAA compliant by protecting personal information from a security breach.

Ensure that your security is up to the standards of the rules and regulations governing your geographic region. The healthcare industry is highly regulated, and compliance is non-negotiable, especially regarding data security. For example, the minimum fine for willful violations of HIPAA Rules is $50,000. The maximum criminal penalty for a HIPAA violation by an individual is $250,000, with the likely addition of restitution paid to the victims and jail time.

Examples of national security compliance standards that apply to healthcare:

Read more: A guide to creating a culture of healthcare compliance in your organization

Whether your organization has a handful of clinics or a network of hospitals, your security software must maintain a high level of data protection throughout your growth journey. Relying on older technology coupled with constantly adding new devices will put a strain on your security measures. When choosing an ERP system, it is best to look for ones that offer scalable security options, ensuring that your data remains safe through growth. Some even come with industry-specific features or add-ons that can help you to stay compliant.

As much as upgrading your systems to newer technology can be time-consuming and costly, sometimes it is the best decision to make. Systems that are out of date not only slow down the efficiency and productivity of your organization but can also pose a severe security risk to your data. Knowing when it is appropriate to upgrade your technology is vital. If you notice that future ERP software updates would be unsupported by your current system, that’s a good indication that it’s time to think about upgrading. Keeping up with advancements will help you determine whether there is value in updating your technology.

Social engineering is one of the most frequently used methods by cyber-criminals to manipulate humans. Spear phishing emails prey on your employees’ emotions and can look legitimate enough to dupe them into leaking vital healthcare ERP data. Undertrained staff who regularly handle sensitive data may be a greater risk to your business than external cyber-attacks.

Developing a security training program that features regular and easily understood sessions will enable your employees to maintain healthy security habits. Implementing two-factor authentication, routinely changing passwords, and not exporting data across multiple systems (like storing ERP data in spreadsheets and sharing it via email) are just a few protocols that can greatly increase your security if practiced consistently.

In addition to frequent security training, an incident response (IR) team and IR plan testing are invaluable tools in the event of a security breach. In 2021, companies with an IR team and IR plan testing saved on average $2.46 million off the total cost of a data breach. The IR plan contains some variation of six steps; preparation, identification, containment, eradication, recovery, and lessons learned. By creating a procedure for handling security threats, you can minimize the damage while maintaining a record of the incidents to prevent follow on attacks or similar events in the future.

The healthcare industry is undergoing enormous changes with unprecedented levels of international healthcare mergers and acquisitions (M&A), which presents unique challenges for medical financial management. One of the tasks that’s impacted by the evolving nature of the healthcare industry is financial consolidation. Despite hesitancy to adopt new technologies, modern accounting software can simplify the process of consolidating your financial statements and empower your healthcare organization to overcome common limitations and barriers.

There is an explosive trend internationally towards consolidated and integrated healthcare organizations. As with any other industry, all multi-companies are required to consolidate their finances. Whether it’s a multi-practice clinic or a chain of hospitals, consolidated financials are essential for a period end to close your accounting records and for stakeholders to understand service lines, allocate capital, and fund the organization.

In a 2019 annual report by the Financial Executives Research Foundation and Robert Half, 48% of all U.S. companies and 40% of all Canadian companies still use manual accounting practices. While these percentages are significant, in 2018, the numbers were even more astounding at well over half for all Canadian and U.S. companies.

The trend towards implementing digital transformation is not random—it gets results. The average time it takes annually to complete financial reports went down between 2018 to 2019, from 31 to 24 working days in the U.S. and 42 to 20 working days in Canada. Automation reduces the potential for human errors and frees up staff to focus on value creation initiatives.

Unfortunately, healthcare tends to lag other industries when it comes to adopting technological solutions. Most healthcare organizations are not positioned to reap the benefits of accounting software, like enterprise resource planning (ERP) systems, and continue to deal with inefficiencies due to not adjusting their processes along with their systems. These inefficiencies stack up and contribute to health spending consuming large shares of public expenditure.

The international push for provider consolidations and integrations means that healthcare financial management increasingly requires financial consolidation. The evolving landscape of the healthcare industry coupled with the sheer scale and complexity of handling a healthcare organization’s financial accounts presents unique limitations and barriers that manual accounting practices can’t overcome.

Below are 4 common conditions that cause financial consolidation to be a challenge for multi-entity healthcare providers:

1.) Emphasis on business growth demands agility

2.) Rapid geographic expansion strains infrastructure

3.) Intercompany activity complicates financial statements

4.) Financial reporting timelines are compressed

Read more: 6 essential financial consolidation software features for your company

Healthcare organizations are focusing on growth to keep up with the explosive number of M&A opportunities in the industry. To accommodate these integrations, your finance department must have the capacity to rapidly establish records that align with the rest of the company. Low quality or inaccurate data caused by manual entry errors or bottlenecks caused by using multiple systems that do not fully integrate are unfortunate problems that can be solved with the implementation of a system that automates the grunt work for you. However, to truly optimize your operations for agility, investing in software that offers real time consolidated reporting will revolutionize finance’s role from a mere preparer to the analyzer and reviewer—freeing up leaders to decisively carry out quick pivots based on better business intelligence.

The prevalence of integrations and consolidations means that your organization needs to be able to seamlessly add virtual and physical entities, like new services or multiple care facilities. These additional entities often exist in a different region, enabling your company to expand into new territories; although, traditional accounting and finance systems struggle to adapt to these changes. Modern accounting software leverages a centralized database, which enables you to seamlessly add new business entities and access financial information across geographic jurisdictions. You will be able to see patients and vendors across all entities housed within your organization. They can also be programmed to handle multiple currencies and remain compliant as you scale.

Increasing the number of facilities or entities also increases intercompany activity, which can complicate financial statements. Consolidating your finances eliminates all intercompany activities and balances to report transactions with external third parties as if the entire group of companies was operating as a single entity. The centralized database offered by accounting software does away with siloed data so that corporate accounting staff have all the data from every geography, business line, or specialty at their fingertips. Some software solutions also offer a centralized environment for transaction processing allowing you to complete intercompany transactions in an instant rather than over the course of a few weeks. This can be a huge time saver that also saves a complete record of historical transactions.

All healthcare organizations are under pressure to tighten their reporting deadlines with improved transparency for stakeholders, as well as industry and government regulators. There is a need to adhere to a well-documented and strictly controlled consolidation process that enhances financial reporting integrity. Accounting software allows you to meet your reporting goals by automating time-consuming tasks and centralizing your data for better decision-making. You can also meet your deadlines with the confidence that your data remains secure if you opt into scalable security features that include SSL encryption, two-factor authentication, advanced firewalls and automated notifications for new sign-ins.