Expansion is the new normal in the hospitality industry. With constant disruption, it’s not enough to stay afloat. Yet, hotels and restaurants face a demanding and often fickle customer base and challenges such as escalating operations costs, seasonal demand, and high staff turnovers. So how can anyone expect to expand in such an environment? The answer is simple. They can’t unless they build a sustainable financial framework for growth. Start with accounting processes, streamlining operations, and cutting costs so that expansion plans won’t collapse the administrative side.

With the escalation of customer expectations, few industries face more disruption in the coming years. Pandemics, fluctuating economies, and the advent of new technologies contribute to mass shifts in what customers require. There’s now a sizable difference between the average customer’s expectations and what’s on offer from the average hotel, restaurant, or resort. Financial transformation is key to sustainable expansion, yet many in the industry are reluctant to invest.

Many are wary of financial transformation in hospitality. It can be an expensive and time-consuming process with a low success rate. Yet, wide-scale digital transformation begins with the finance department. Sage recently reported that 70% of CFOs are now responsible for technological change. It is no longer an issue confined to the IT department and needs to be discussed at the highest levels of your organization to ensure longevity.

This blog covers a series of best practices and resources that will help you build the financial backbone necessary for success in the shifting world of hospitality.

Below is a list of topics covered. Click your area of interest to skip ahead.

Hospitality faces a significant problem: expand or disappear. Typically, hotels and restaurants will grow in several ways: open new locations, expand to new territories, adopt new ways to deliver services, launch loyalty programs, and create new bespoke services.

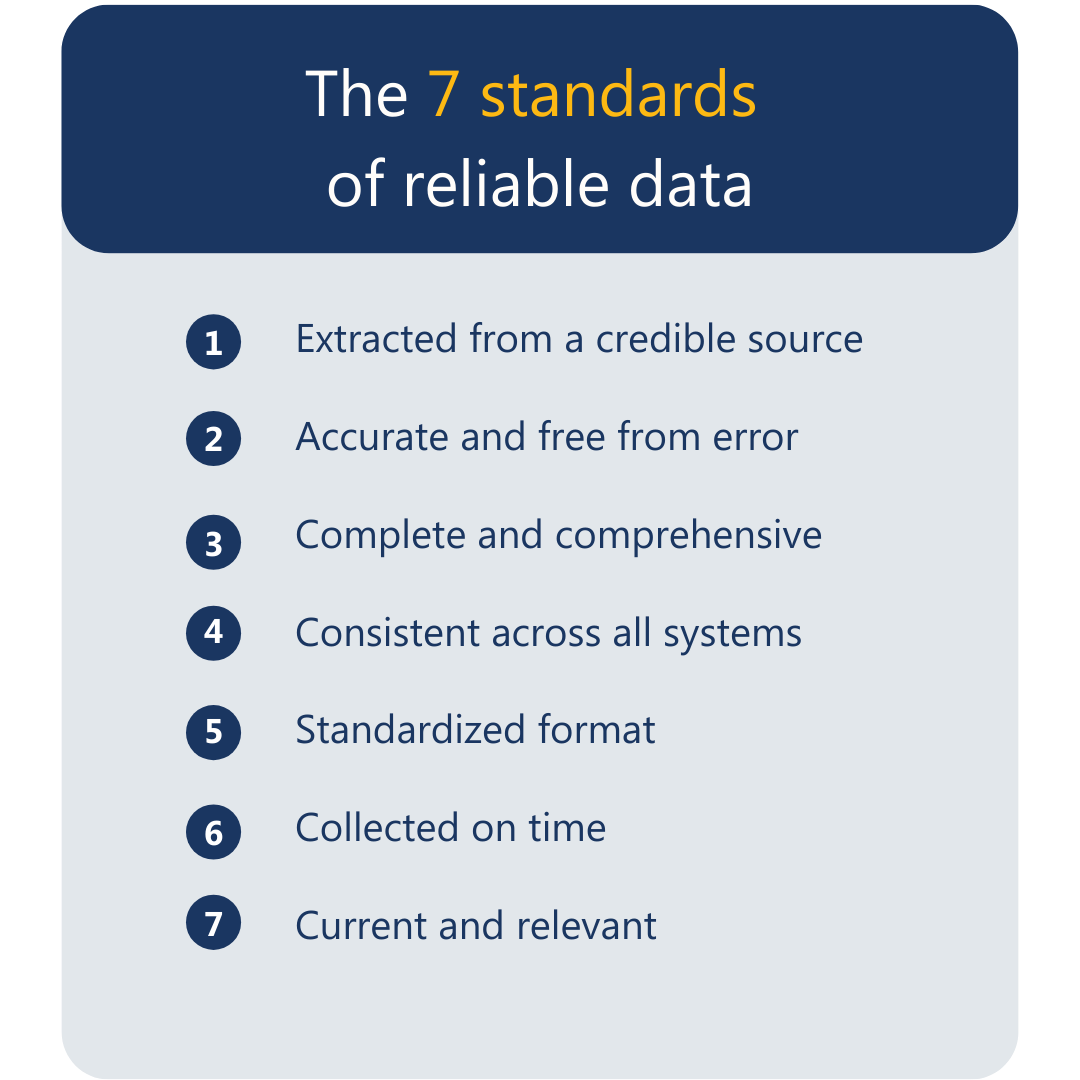

Companies need to implement robust accounting processes that can comfortably sustain future growth to expand sustainably. It’s impossible to accomplish any of your expansion goals without a financial backbone that allows for accurate analysis, reliable forecasting, and timely information. Teams need real-time reporting to support strategic decisions with insights, analytics, and reliable data.

Beyond this, billing is a core component of an industry that often relies on 24/7 booking capabilities. Customers expect billing to be accurate and immediate for hospitality services and anything less than that is not adequate. Expanding operations without the necessary financial tools can be challenging and result in issues with payments and billings.

Other examples of the problems that might surface include fines for non-compliance, bottlenecks, and inaccurate reports. Problems that end up impacting not only your team’s productivity but also the level of customer service you can provide. Hospitality is an industry defined by service, and stressed-out teams will not be able to meet customer expectations, let alone exceed them. After all, this is an industry where exceeding expectations is the hallmark of a good customer experience.

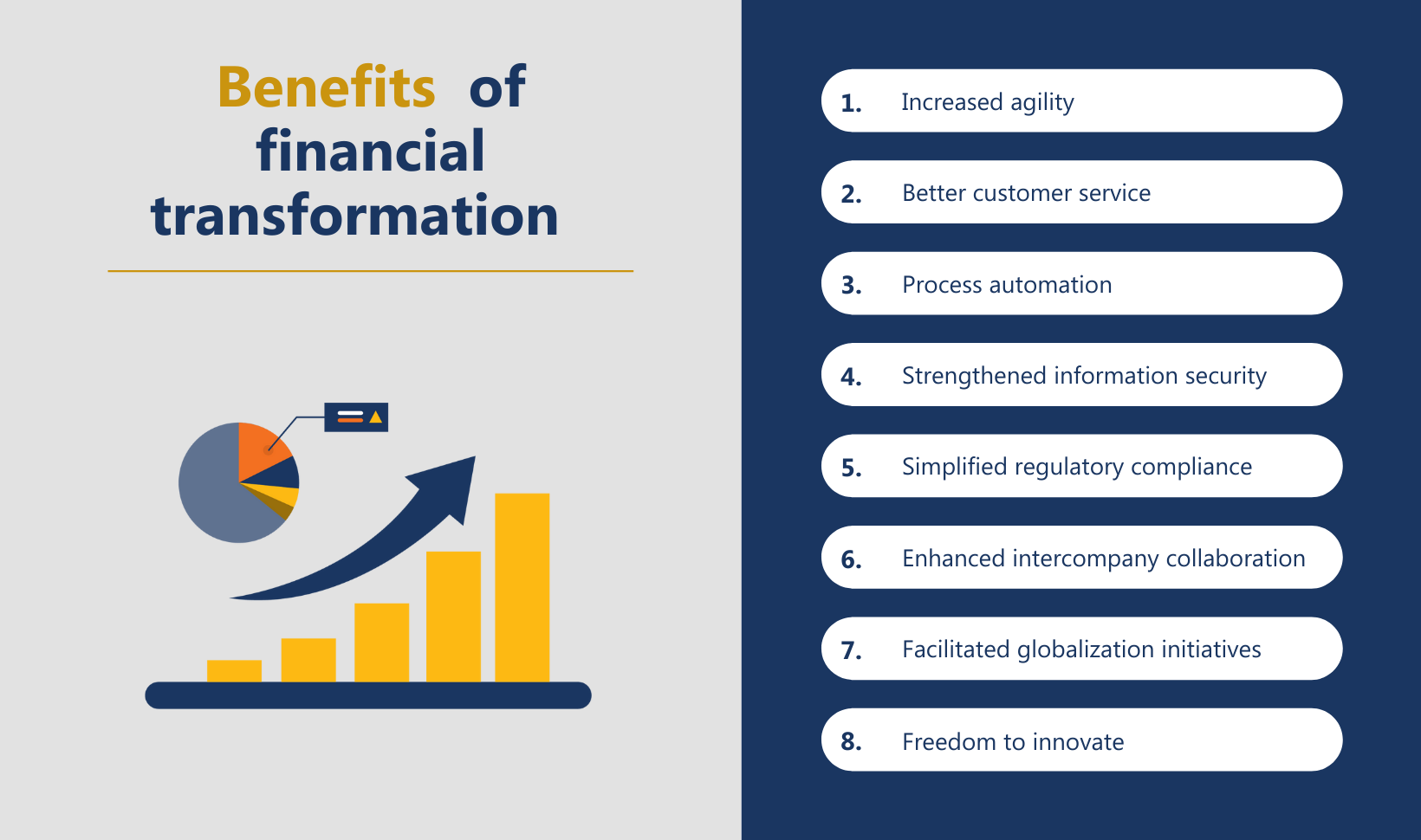

Financial transformation in hospitality relies on adopting cloud-based technology in tandem with an agile mindset and processes to optimize performance, impact the bottom line, and improve productivity across the organization. It often centers around implementing a comprehensive ERP to help streamline and centralize workflows and allow access to crucial information. Its core functionality should be transforming financial management processes companywide to enable strategic forecasting, and allow for sustainable hospitality expansion.

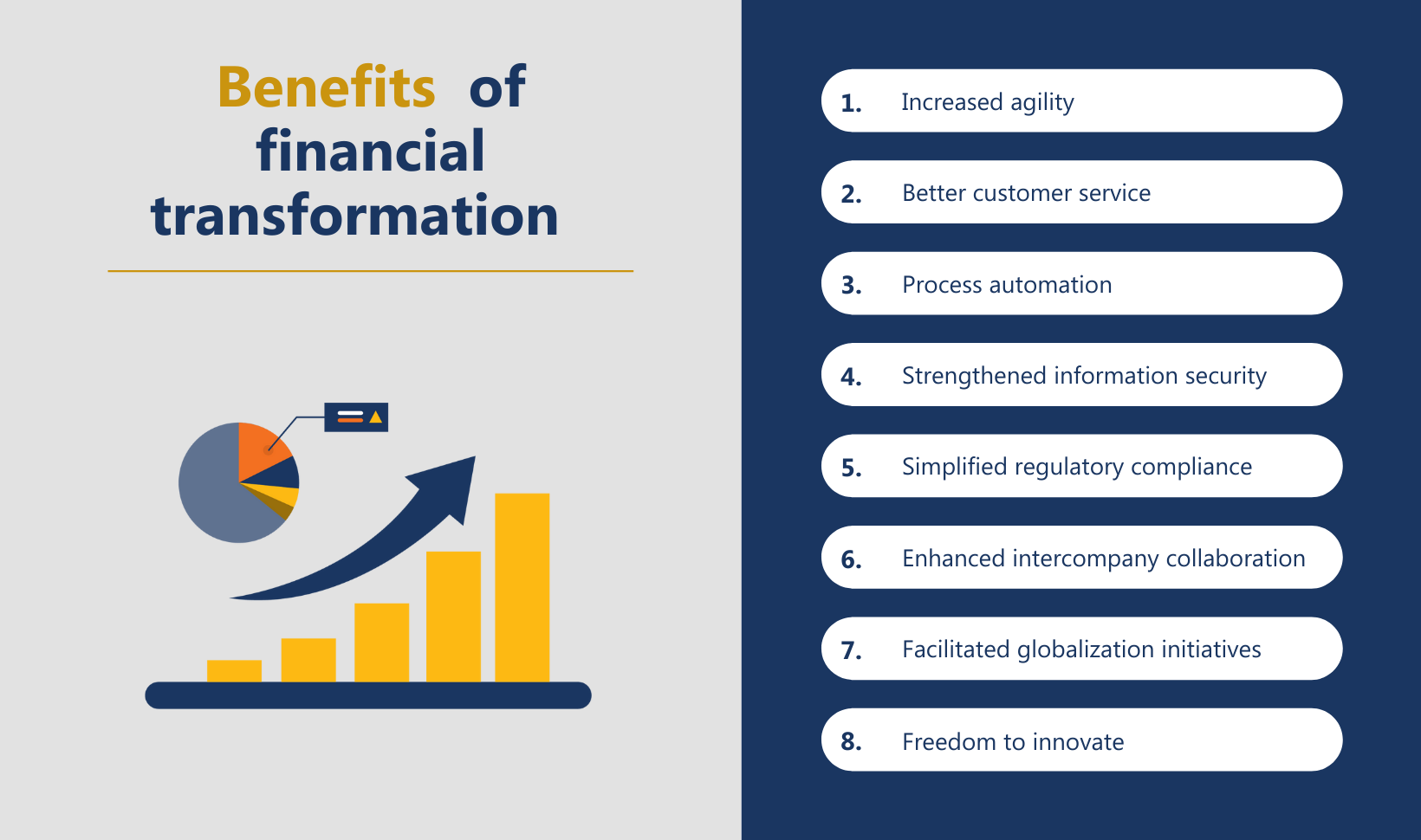

The benefits of financial transformation for hospitality expansion are extensive. Some of the core ones include increased agility, better customer service, automation of time-consuming processes, strengthened data security, simplified compliance, enhanced collaboration, and freedom to innovate and expand.

In a recent McKinsey Global survey, only 3% of the respondents who had begun a transformation in recent years managed to sustain change. That does not mean transformation is impossible; just that many fail to take the necessary steps to ensure success on a journey that will always start with leadership. Sticking to the following tips should help leadership navigate the challenges:

Many hospitality companies outsource their financial transformation, allowing consultants to manage the journey. Although these types of advisors are helpful for identifying solutions and helping identify templates for success, a truly successful transformation begins and ends internally. Not only do you need to engage your team at every level of the organization, but you will need to follow the best practices for financial transformation if you want to build a roadmap to successful hospitality expansion.

Many hospitality companies outsource their financial transformation, allowing consultants to manage the journey. Although these types of advisors are helpful for identifying solutions and helping identify templates for success, a truly successful transformation begins and ends internally. Not only do you need to engage your team at every level of the organization, but you will need to follow the best practices for financial transformation if you want to build a roadmap to success.

Finding the right solution can be tricky when many of the larger hospitality companies do not publicize the software and tools that help them succeed. Still, it’s wise to look for teams and consultants that understand the nuances and demands of the hospitality industry. Relevant recommendations should speak to many of the core challenges you’re facing. Even when non-disclosure agreements mean that a consultant can’t share the name of a company or brand, they will still be able to speak directly to how they can support your growth. It should also be possible for you to speak to those they’ve partnered with before and ask questions. Additionally, if you’re speaking with various consultants, it’s wise to have a list of questions on hand.

Selecting the right Enterprise Resource Planning (ERP) software is rarely an easy decision, and the biggest mistake most companies will make is rushing into it without first establishing their functional requirements. A slap-dash approach will only end up costing you time, money, and resources. There are a number of downloadable ERP requirements checklists and templates online, but very few of them are useful as they tend to focus on generic features rather than the specific needs of the team that will be using the ERP for years to come.

Best practice is to establish a custom checklist based on your specific needs, that way you won’t end up wasting more money on flashy features that have very little to do with your company’s goals.

This blog will help you build a custom ERP requirements checklist that is right for your company and equip your team with the criteria and questions needed to assess each system and find one that will work best. You can also download this free ERP functional requirements checklist template, to explore the top features and get started.

Core topics covered in this blog (skip ahead by clicking on a topic)

ERP is an acronym that stands for enterprise resource planning. It’s software that centralizes work across multiple departments, so that you can streamline processes and ensure the secure management of your resources (financial and otherwise). ERPs cover functions such as marketing automation, financial management, customer relationships management, supply chain management, etc. They can be industry-specific and save teams considerable time and money by modernizing workflows and consolidating crucial company information.

ERPs serve a wide range of functions depending on industry requirements. Many of the solutions on the market can be modified or customized to meet the demands of a company. However, there are some core benefits regardless of the exact functionality an ERP is purchased for, and these benefits tend to impact all departments. So, whether you’re looking for an ERP to handle financial, human, or marketing resources, it’s likely that you will experience the following benefits:

(click one to jump ahead)

Make a comprehensive list of all your business requirements for the ERP. You will need to survey the people it will impact most i.e. the users and those directly impacted by its functionality. There is no one-size-fits-all checklist, and you will need to speak to employees at all levels of your company to get a feel for the right criteria. It might be useful to make a list of those who will use the system, and then start by asking them what they need it to be able to do with it. Then, you may want to ask upper management what sorts of reports they need to see to make financial decisions. You also want to ask trusted customers and suppliers what would help them.

If you do this well, you will end up with a large list of ideas. Take this list and use it to form a tiered list of requirements. Working with your team, establish what are the “must-haves”, “good to haves” and “nice to haves”. Your list may have more tiers than this. The overall aim is to get a clear picture of the essential features for your ideal ERP system and which features you can maybe live without.

Once the list is tiered, get the entire team to evaluate it. Can someone fight for a feature that got pushed to the bottom of the list? Be flexible and try to listen to everyone’s input. Weigh the costs and benefits of what they advocate for before you finalize the list.

At the end of this process, you will be able to start looking at some of the other technical requirements of a good ERP. Looking at solutions before you know exactly what you need can have dizzying results. It may even prevent you from making a decision grounded in your business requirements.

It’s up to you to convince upper management of the importance of the project and get them to have total buy-in and give full support. Your list of business requirements should be one tool that will make it easy to show them the potential of the right ERP system, but really, you need more from them than just budget approval. Without their buy-in, you may end up getting a cheaper solution with less functionality than you require and find that it costs you in the long run.

Before you approach upper management, be sure to have read through this list comprehensively, as it details many things that you may want to be aware of (and have answers for!) before you book a meeting.

It’s also wise to consider the adoption of a new ERP as a financial transformation that is a major decision which impacts every aspect of your company. Framing it this way can help leadership understand the importance of the change and get the support you need to drive what will be a transformative process for the entire organization.

Chances are that there are members of your team who have a wealth of experience using different ERPs at previous jobs. Many of these ERPs will be specific to your industry’s needs. As part of your checklist, get their suggestions on the systems they’ve loved throughout their careers. This is important information and can cut down on training costs later. If you end up choosing a solution that some of the team is already familiar with, they can help with training the wider team. It’s also important to understand what they loved about those systems so that you can be sure any new ERP will get their full support.

You need your team’s full support to make the system work. After all, they will be using the system, and the learning curve can be steep. Sometimes, companies make the mistake of landing their teams with a new system, without first supporting them in the transition. Think about how to manage the change to a new ERP from a human perspective. Your team needs to know that documentation and training will both be readily available.

Once you’ve got a clear understanding of your team’s abilities and requirements, it’s time to get technical. Consider what functional requirements your ERP needs to make your company run smoothly. For instance, should it be hosted on-premise or in the cloud? Will you be using this in addition to a CRM system or run your sales processes out of your ERP? Other functionalities might be the ability to manage multiple currencies and companies.

It’s as important to establish the functional requirements you don’t need. For instance, if you don’t manage inventory, then the system you choose won’t need to have that functionality. Many ERPs are built specifically for certain industries. It’s worth considering which functionalities are crucial to your business.

Your company already has processes and systems in place. Your new ERP solution should not interfere with these workflows and technologies, unless necessary. The ERP must be easy to integrate. Otherwise, you will end up creating an administrative nightmare that will make it impossible to fully optimize your systems.

For example, if you’re already using Microsoft 365 it makes sense to opt for ERP systems that will integrate with that system. Basically, you need to actively look for companies that have built solutions for your industry. These companies will likely have processes in place to integrate your systems with the ERP.

In some cases, you may find your current systems are all out-dated. It will end up making the most sense not only to invest in an ERP but also the other tools and systems that integrate with that system. Although this may feel daunting, it will save time and money in the long run.

Whatever you decide, make sure your ERP requirements checklist has a section outlining the systems it will need to integrate with. There’s no point wasting time researching ERPs that won’t function in your workplace.

It’s also important to think about the future when deciding on your ERP requirements checklist. Most likely, your company plans to scale, and as it grows your systems need to be able to seamlessly manage that growth. That means choosing a solution that will be as good for your company tomorrow as it will be today.

If you do plan to scale and won’t need all functionality immediately, it’s important that you think about scalability and updates to the system as time passes.

Deciding how much money is realistically available for an ERP system is crucial. This is an investment in a system that will operate at the very heart of your business for at least a decade. It’s important to weigh up how much you’re going to spend. Be sure that management understands the benefits before you start whipping numbers out of the air.

In 2019, a report that analyzed data from over 2,000 projects. They found that the average budget per user for an ERP project was USD 7,200. Training costs, integration costs and the system cost are all part of the expenditure you can expect in getting your ERP up and running. Make sure your requirements checklist understands the true budget required to get the job done.

Once you establish a budget, it’s time to calculate your return on investment. Make sure these costs and benefits are spread over time so that you get a clearer picture of the ROI over time. Once you know how much it will cost, you can start to think about the improvements and benefits of the system and calculate the money that can be saved. E.g. processes that once took hours, may now only take minutes.

Now that you will have a system taking care of labour-intensive work, you may be able to free up staff to provide valuable services that were impossible in conjunction with arduous reporting and invoicing processes. This will be very different for each company and comes back to the business requirements. Your team must understand the time and money that will be saved and that this is an investment that will have a measurable ROI.

One of the biggest costs in implementing any ERP system is requiring a lot of customizations, this is often because the solution is too general and not fit for purpose. Ask yourself is your company so unique that no other company has ever needed the same tools? Although this is possible, it’s not likely. You should be able to find an ERP that has been tried and tested and that has functionality specific to your industry. Whenever you find an ERP system pushing customizations, ask yourself if those features might be standard in a system built with your industry in mind.

For instance, a healthcare provider looking to manage materials is going to have completely different requirements from a SaaS company that wants to streamline its subscription billing. Both companies will need a system that can support industry-specific extensions that supplement the core ERP rather than relying on overpriced customizations built by ERP providers who don’t usually operate in their industry.

One way of establishing whether or not a software provider has the tools you need is to look for case studies or examples that exist where similar business models to you have successfully implemented and used that ERP. If you are going to need customizations, be sure you focus on providers who have a team of skilled developers who will be able to quickly and efficiently tweak your system.

One component that often gets left off ERP checklists is deciding what sort of team you intend to work with. It’s a piece of software! Why does it matter as long as it has the right functionality? The people behind the product matter when a system is integral to the day-to-day running of your company.

Make sure you know how helpful they’re willing to be? If they will be hands-on with training? If an implementation framework exists? How have other companies found working with them? The right global ERP system will also have demonstrated success in the countries where you operate, so make some of your selection criteria the availability of useful resources, case studies and references that are relevant and industry-specific. Compare and contrast how well different ERP systems work within your space.

By establishing what it is you’re looking for as part of your ERP checklist, it will then be easy to research different solutions and make sure that the team behind the system will be as responsive and helpful as you need.

For those who don’t want to build a custom ERP checklist, it’s possible to use this requirements template which outlines the top functionality you should consider when prioritizing features. Even if you are building a custom checklist, defining some of the most common functionalities can be helpful before you get started. Below is a list, segmented by department, to help you choose an ERP or facilitate the discussion about company requirements. Alternatively, download the free ERP requirements checklist here.

Given the demands of modern finance, it’s no surprise that one of the core functions of an ERP is to streamline and automate processes so that the finance team can focus on more strategic initiatives. Here’s a list of the requirements accounts teams usually request:

Most industries have seen the adoption of complex pricing models, and SaaS migration has become a necessity for many forward-thinking companies. You could easily consider subscription management tools under the finance section. Still, it’s valuable to give this functionality a separate heading given how central these tools are to the future of organizations. Below is a list of requirements your ERP needs if you plan to incorporate recurring revenue strategies in your future plans.

Integration is one of the most critical core requirements, yet it’s also easy to ignore. Double-check all solutions and explore options built to integrate with your current processes and workflows.

One of the central conversations in choosing an ERP is effectively managing sensitive data. It is essential across all industries, even more so for those navigating stringent regulatory guidelines such as healthcare and finance. It is imperative that your ERP can handle the complexity of modern data management and protects sensitive information against security breaches and attacks.

One of the most compelling reasons for any leadership team to invest in an ERP is the ability to attain business intelligence that will help set your company apart from the competition. Reporting and analytics empower teams to make strategic decisions based on accurate and timely information. Here are some of the requirements leaders look for:

Whatever your industry, it is likely that commercial leases are part of how you do business. Health care companies find themselves converting retail spaces or leasing out equipment, retailers lease multiple locations, and manufacturers and SaaS companies spend a considerable amount of their budget on leasing storage facilities. Whether you are the lessee or the lessor, it’s likely that as operations grow, lease management requirements will increase. Below are some of the features you should consider.

The list above is by no means comprehensive and merely acts as a launch point for companies trying to set expectations and define requirements. It’s also essential to consider the demands of your operations, the struggles with your processes, and any custom requirements you might encounter. It’s worth creating a list of what this looks like department by department, getting marketing, HR, product, and customer service all to weigh in. Here are some industry-specific requirements you might need to consider, depending on your goals for the ERP.

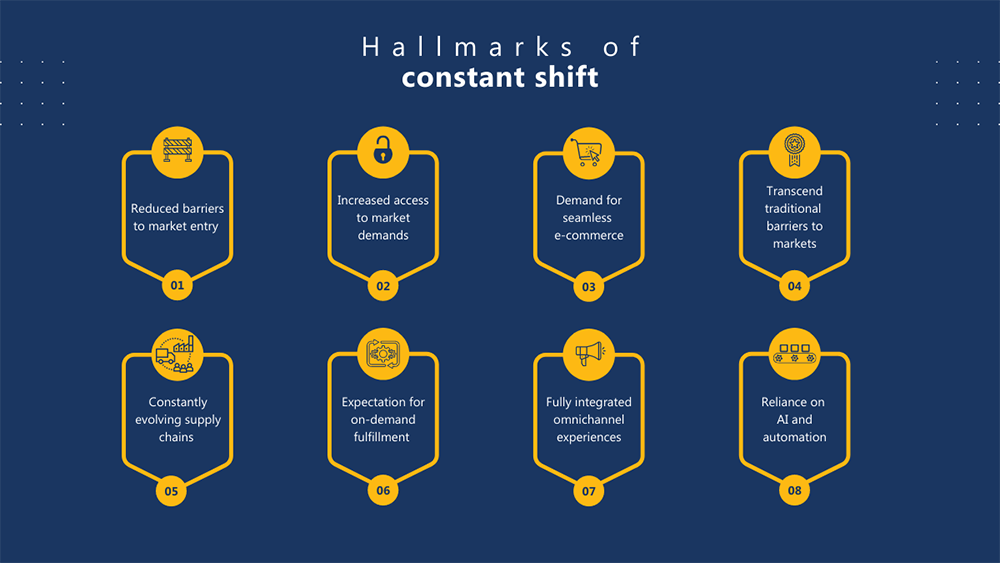

SaaS migration roadmaps vary dramatically between various industries and even companies. Often, these types of financial transformations involve the transition to a recurring revenue business model using SaaS pricing strategies. However, this is not necessarily always the case, and it’s essential to remain flexible when deciding what tactics best suit your organization. Many factors are driving what’s now become an almost universal shift, namely:

Reports state that 65% of companies transitioning to a recurring revenue model face operational challenges. A problem that should not discourage those contemplating the change but instead introduce a degree of caution and encourage an emphasis on strategic planning. The fact remains that those who cannot keep pace with the shift to a more agile mindset will inevitably become obsolete.

This blog steers clear of a one-size-fits-all template and sets out a list of best practices to help you build a custom roadmap that covers the nuances of your solutions and best fits your industry. Whether you’re a software company looking to break down legacy software into tiered microservices or a retailer experimenting with moving towards the subscription economy, these considerations will help you navigate the common challenges that impact the success of such transitions.

When it comes to any significant shift, you need to be fully aware of all the advantages and disadvantages. It’s easy to focus on the pros, but such two-dimensional thinking fails to prepare your team for the likely challenges ahead. In fully understanding what might occur, you can better align your teams to handle the transition without having them lose confidence at the first hurdle. Internal advocacy is a powerful component of successful SaaS migrations and can be hard to achieve if you do not take the time to prepare teams adequately. Get started with this blog on the pros and cons of SaaS migration.

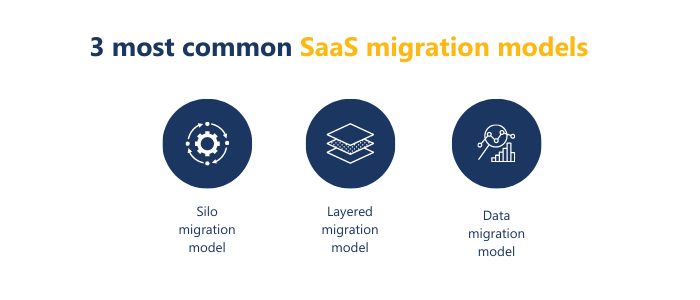

Not all migrations will be the same, so it’s no surprise that there are several different approaches to shifting your products and services over to SaaS. The model that fits best will depend on your solutions and your customers. One of the central challenges of any transition is retaining customers as you change, which means considering their experience at every stage of the journey. None of the following migration models are mutually exclusive, and companies often choose to adopt a hybrid version, particularly in the early stages of migration.

One of the most common SaaS migration models allows users (tenants) a dedicated server or infrastructure for your product or service. At its most fundamental level, this model means there’s no requirement for refactoring your product, and it essentially remains the same. From the end-user perspective, this may be the least disruptive, allowing the continuation of customized versions of your product. However, this may not be the best long-term solution when it comes to economies of scale.

A layered migration model involves moving your solution to the cloud in layers. With this approach, companies can start small and slowly move to a multi-tenant model, one service or component at a time. Similarly, they can remain in a single-tenant model, slowly moving customers to the cloud.

Often this is a hybrid model for SaaS migration that combines both single-tenant and multi-tenant migration strategies. For instance, data management might move to a multi-tenant cloud-based architecture for security reasons, but the rest of your solution might remain single-tenant.

One of the most significant shifts for any organization will be managing customer expectations and conducting thorough market research to back up any changes you feel you need to make to products or services. Without customer buy-in, it will be challenging to build on your current reputation, so it’s essential to keep existing users informed and make them part of the process. Some of the areas where customers can be most insightful are market-facing elements—for instance, worried about choosing the right subscription strategy? Not sure which pricing model best suits your market? Want to test run some pricing psychology tactics? Don’t just depend on competitor insights. Your customers will be able to offer just as much guidance in areas that impact them directly.

If you’re moving away from the traditional license and maintenance model, it stands that how you measure success will also have to shift. For one, most companies that undergo SaaS migration no longer receive upfront payments and rather receive and recognize revenue as it’s earned. This means that it will be harder to calculate profitability as initial sales will not earn as much as the Lifetime Value (LTV) of the customer.

Adjusting KPIs won’t just be restricted to sales and marketing, they will need to be changed to reflect the changes in every department. You will need to work with each department to figure out what success will look like based on new performance metrics. One place to start will be to closely monitor subscriber churn metrics and your customer acquisition and retention metrics.

Thinking of your SaaS migration as more than just a technological shift will be essential. This change impacts every aspect of your business and is much a cultural and financial transformation as anything else. Transitions like this start with leadership and require you to fully understand the digital maturity of your company before you can move forward.

Investing in communications at every level will make it possible to tackle challenges as they arise and ensure that the transition doesn’t adversely impact employee retention. You will need your best people on board to manage this change and sizable investments in your customer success support staff. Get started by reading this blog on the core challenges companies face during financial transformations.

When it comes to SaaSifying products and services, companies need to invest in tools that will help them automate manual processes at every level of the organization. Implementing a cloud-based CRM and subscription billing software will help you manage the complexity of high growth cycles.

Your team will be able to handle a more significant workload effortlessly. You will also understand some of the nuances your customers will face when migrating to your SaaS solution. For instance, what level of customer care seems appropriate? What parts of the process require the most communication? You can use your own experiences to help build these benchmarks.

Plan for automation wherever possible. Even if you need to wait to implement some of the tactics later in the process, that doesn’t mean you should sideline planning each strategic step. It’s possible to introduce phases that will help you systematically move to the cloud. It is wise to consult each department to find out where bottlenecks exist and alleviate the pressure in these areas. Get started with our guide to financial transformation resources for SaaS leaders.

Despite the recent growth of SaaS apps, not all of them integrate easily with other solutions. This lack of integrated options is an inconvenience and a deterrent as markets become more saturated. Suppose the difference between you and a competitor is that one of you integrates easily with current workflows and software. The solution that fails to integrate is likely to miss out on potential customers.

Being mindful of the demand for specialized apps that fully integrate with speed and ease will set you apart from many of your competitors. For instance, you may want to consider the compatibility of your tools with major CRMs or ERPs before you make the move. Even if you cannot promise integration right off the bat, it’s something to build towards for your development team.

Software as a service (SaaS) solutions are often the nucleus of a company’s modernization journey, but what about providers? How can they ensure that their own financial infrastructure is up to date and aligned with their company goals? The following resources have been hand-selected for leaders that are considering or currently managing a financial transformation. Below, you will find blogs, booklets, case studies, whitepapers, videos and more!

Skip to a specific aspect of thought leadership on financial transformation:

1. Keeping up with trends in financial transformation

2. Key metrics to analyze your finance function

3. Choosing which tools and technology to adopt

4. Staying on top of security and compliance

5. Best practices for implementing financial transformation

In today’s world, remaining relevant in the software industry is tantamount to ensuring your organization is digitally mature. With the constant influx of new players into an already saturated market, providers must exceed customer expectations and keep up with modern technologies. By following the trends in financial transformation, leaders can keep a finger on the pulse of the industry and better position their company for success.

Resources on trends in financial transformation:

How do you know when the time is right for financial transformation? While there isn’t a definitive answer to this question, there is an effective place to start. By routinely analyzing key metrics and your company’s performance, you can keep track of whether the finance function is in harmony with the overall business goals. If there is a misalignment, it would be a sound decision to investigate what a financial transformation could look like for your company. The following resources will help you develop a set of performance metrics and questions to ask, so you can monitor the health of your finance function.

Discover how to analyze your SaaS company’s performance:

Choosing the right tools and technology to fulfil your business requirements and provide your company with essential industry features is a huge undertaking. If you embrace a new system, it will transform the role of your finance department and likely sustain your organization for at least a decade. It’s not a decision that should be rushed. The following resources will kick-start your research and enable you to make a wise investment.

Learn how to pick software that will successfully modernize your business:

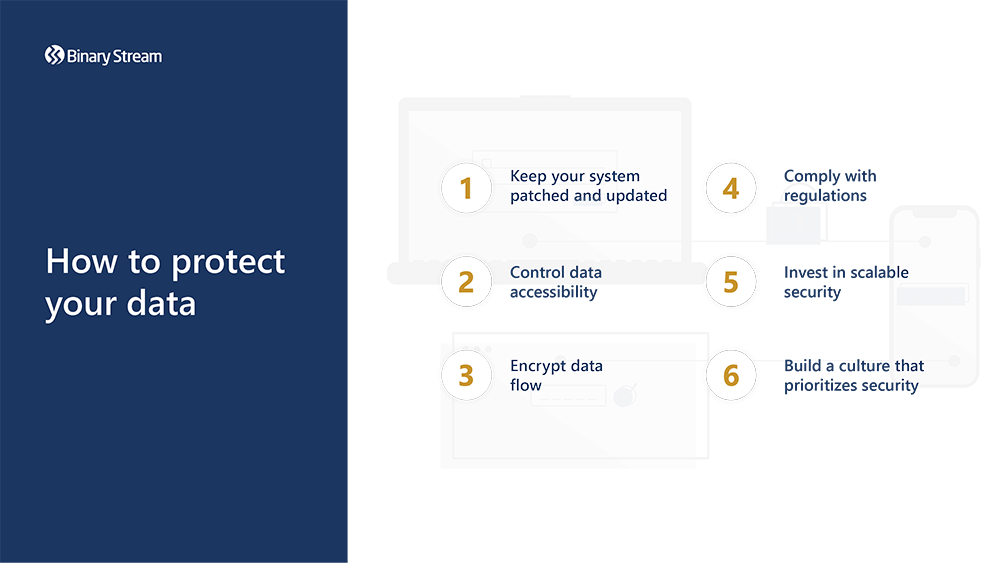

Accounting standards and regulations are constantly evolving to keep pace with the breakneck speed of innovation in the software industry. SaaS companies must adapt their processes to maintain compliance and enhance data security. This is especially true if your organization handles personally identifiable information (PII) or personal health information (PHI). The following resources will introduce you to methods for protecting your data and provide you with an overview of relevant accounting standards for SaaS companies.

Don’t be caught off guard. Find out how to bolster your security and maintain compliance:

More and more companies are undergoing financial transformation, but not all of them result in a successful modernization. Without a clear goal and action plan, teams may be distracted by irrelevant benchmarks or paralyzed by an ever-growing list of available add-ons. These resources will help SaaS leaders build a roadmap to circumvent common pitfalls and implement effective initiatives to achieve their targets.

Avoid silly mistakes with these best practices for implementing a financial transformation:

Like any other form of payment, recurring billing has its own unique challenges. Subscription services lose roughly 2% of customers each month due to expired credit cards that aren’t updated. When you start to factor in failed payments caused by spending limits, insufficient funds, payment gateway glitches, or cancelled credit cards the involuntary churn rate accounts for a sizable revenue leak.

Dunning is the process of communicating with customers to recoup such losses. Despite a negative public perception, modern dunning management can contribute to a positive customer experience and significantly increase your monthly recurring revenue (MRR).

Whether you’re implementing a SaaS billing model for the first time or simply trying to ramp up your monthly or annual recurring payments, effective dunning management will be central to your success. This blog answers some of the most frequently asked questions about dunning, so you can master the process to mitigate revenue leakage and involuntary churn.

Skip ahead to a specific section on dunning management by clicking on the topic below.

It’s normal for businesses to encounter a failed payment at some point. Whether it’s due to insufficient funds, a misconfigured payment gateway, or an expired credit card, you will need a way to recoup your monthly recurring revenue (MRR). Dunning is the practice of communicating with customers to recover lost revenue from failed payments and reduce involuntary subscriber churn.

Although the term “dunning” is still used in accounting, people who work in other departments might explain the same concept using terms like “accounts receivable” or “collections process” instead. For instance, dunning management can be found under the credit and collections feature and optimized with collections process automation for Microsoft Dynamics 365 solutions.

A dunning letter, or collection letter, is the collection notice sent to customers informing them that their last payment has not gone through. Modern subscription businesses rarely contact their subscribers via paper letters, opting instead for digital communication methods like email, SMS, or app notifications.

There are many templates and programs online that can help you generate a dunning letter. Here’s a helpful guide to walk you through creating a collection letter through the accounts receivable feature in Microsoft Dynamics 365.

Voluntary or active churn results from customers making the conscious decision to unsubscribe from your service. Typically, the subscription is cancelled because the service no longer fulfils the customer’s wants or needs.

Involuntary or passive churn occurs when a customer’s subscription is cancelled because something is stopping them from paying. This type of churn accounts for a sizable portion of preventable revenue leakage because the customers often don’t want to unsubscribe—they just aren’t presented with a clear option to fix their payment issue.

Subscriber churn is an unavoidable obstacle that every SaaS business must handle. Fortunately, effective dunning protocols can recover on average 9% of your MRR. Dunning management empowers you to proactively reach out to customers to update their payment method, prevent service disruptions, and facilitate an overall positive customer experience—reducing revenue lost through involuntary churn.

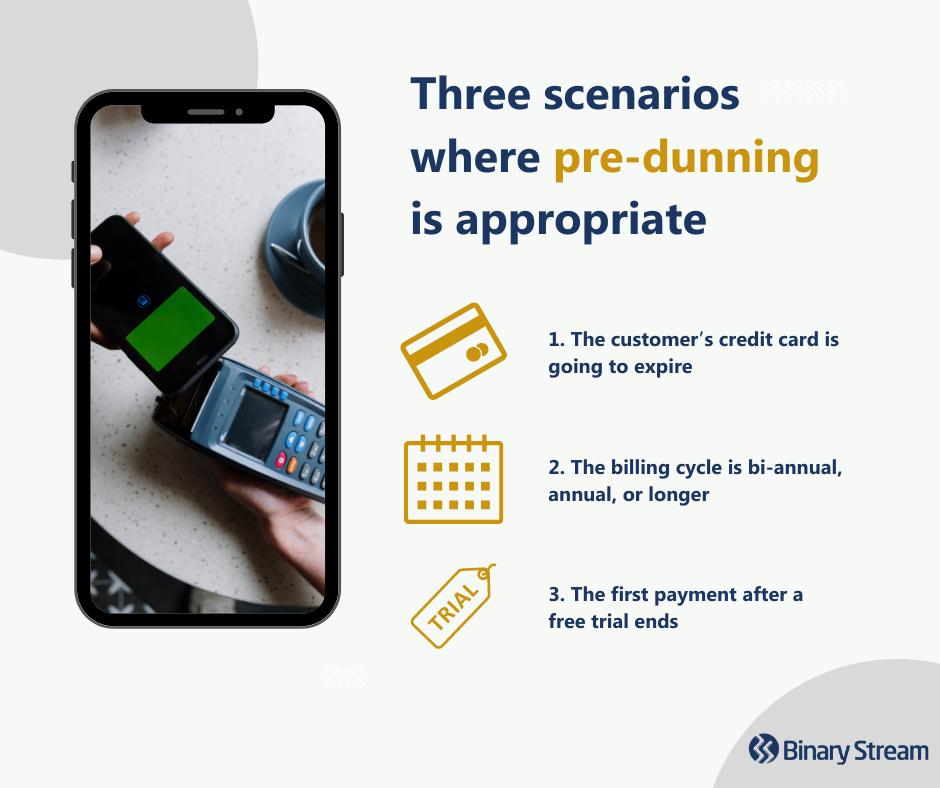

Pre-dunning is the practice of sending reminders to customers that an upcoming payment may fail unless they update their information. There has been an open debate about whether customers perceive this tactic as helpful or annoying.

Pre-dunning used to be a best practice, but in recent years it has started to fall by the wayside as subscription businesses have become more popular and there are more options for preventing failed payments behind the scenes. For example, some SaaS companies may communicate directly with issuing banks to automatically update customers’ credit card information.

Nevertheless, there are still a few scenarios where pre-dunning may be appropriate for your business. It has shown to be effective in the following three circumstances:

According to the Subscription Commerce Conversion Index, the average subscriber holds five different retail subscriptions. It’s safe to say that your customers may struggle to keep track of all their subscriptions and need a reminder to update their payment details. A best practice is to remind them 30 days before and, if they haven’t taken any subsequent action, 7 days before their card expires.

Oftentimes, the longer the duration between payments, the higher the risk of it failing. Businesses that offer billing cycles with bi-annual, annual, or longer options may benefit from pre-dunning to ensure that the customer’s payment method and details are still accurate.

Whether or not your business collects billing information during sign-up, it’s a good idea to establish transparency early in your relationship with the customer. A quick reminder that states when the free trial will end, the amount you will start charging, and the due date for the first payment will help avoid angry customers that simply forgot to cancel their subscription on time.

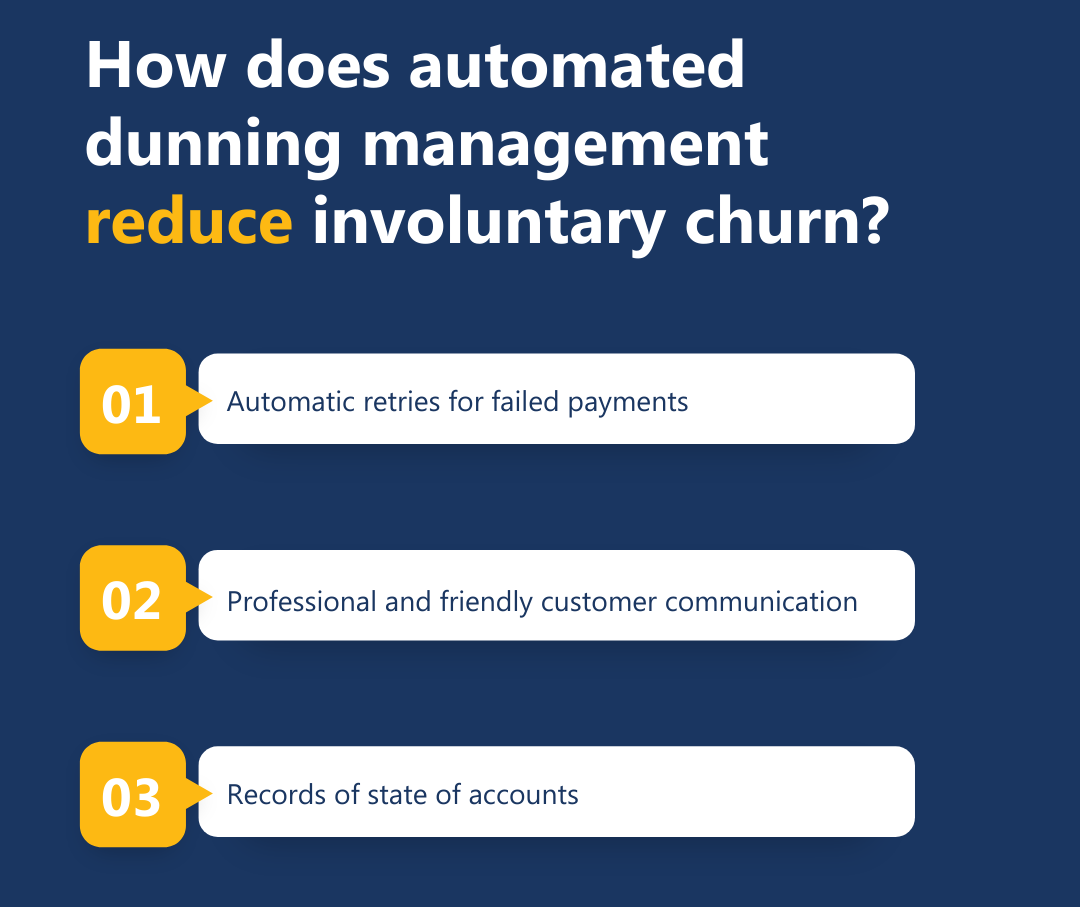

Manually addressing every customer’s declined or failed payments is an impossible task that would waste valuable time and resources. The only worse solution would be to not contact your customers at all. Automated dunning management (a.k.a. collections process automation) streamlines the process by performing actions like:

In addition to saving your accounting team hours combing through accounts and drafting dunning letters, automated dunning management counteracts involuntary churn by contributing to a positive customer experience. Below covers the top three features that benefit subscribers.

Subscription services have gained a reputation offering peak convenience, but when a payment fails, customers may become frustrated and churn for a few reasons:

Automatic retries with a customizable schedule can address all these concerns and minimize unpleasantness by reducing the frequency and degree to which the subscriber needs to get involved. Fewer barriers to paying for services means more happy customers.

Manually drafting dunning letters for every customer with a failed payment is not only a time-consuming process, but also is prone to error. Sending a collection notification riddled with typos or mixing up which past due invoice email to send to which subscriber can make your business look unprofessional. Automated dunning management organizes customer communications to facilitate enhance customer relations. Some solutions can even make the reminders more friendly by adding personalized touches like the customer’s or business’ name.

A statement of accounts and accounts receivable aging information is indispensable for assessing the financial health of your customers. Without good data management, it’s much harder to strategize feasible methods for decreasing outstanding payments and mitigating bad debt. Automated dunning management generates accurate customer aging reports that provide insights like the number of failed payments, renewed subscriptions, upgrades, and suspended accounts.

Binary Stream and SignUp Software join forces to bring innovative Microsoft Dynamics solutions to the global market. By integrating technologies and committing to joint research and development, they will continue to strategically enhance solutions across Dynamics 365 for both Business Central (D365 BC) and Finance and Operations (D365 F&O).

Olof Hedin, CEO of SignUp Software, sees the partnership as a step toward realizing value to existing customers and expanding reach across the Dynamics 365 community.

“We are excited for the opportunity to enrich our customers’ experience. But the most important part for us is that by working with Binary Stream, we know we can reach and help more customers across Microsoft’s flagship ERP lines.”

Binary Stream’s solutions Multi-Entity Management (MEM) for D365 BC and Subscription Billing Suite (SBS) for D365 BC and D365 F&O will be able to interface with SignUp Software’s solution ExFlow, an accounts payable (AP) automation solution featuring scanning and data capture, intelligent pre-coding, invoice matching, invoice approval workflow, and follow up analytics.

The companies will bridge their solutions by opening up their application programming interfaces (APIs) to each other. Other Dynamics 365 partners that choose to support these installations will benefit from reduced complexity and integration time for their customers.

“It’s a win-win for everyone involved. Customers will be able to use our solutions and streamline accounting processes faster than ever before. Our collective goal is to achieve seamless implementation, enable smooth application to application communication, and ultimately empower our users to optimize their AP process,” says Lak Chahal, CEO, Binary Stream.

This alliance brings two of Microsoft’s leading global ISVs together in a Partner-Partner (P-P) model that showcases the importance of connecting APIs so that our community can continue to thrive and grow its international footprint.

“We’re motivated to lead by example and demonstrate how strong partner alliances benefit Microsoft’s ecosystem,” says Michael Medipor, CEO and President, SignUp Software North America.

For more information on SignUp Software, contact:

Michael Medipor, SignUp CEO—North America | michael.medipor@signupsoftware.com and Olof Hedin, SignUp CEO—Global Group | olof.hedin@signupsoftware.com

SignUp Software (NASDAQ: SIGNUP) was founded in 1999 and launched ExFlow AP Automation in 2003. Fueled by an entrepreneurial mindset, SignUp Software is a global forerunner of financial and accounts payable process automation on Microsoft Dynamics 365 platforms. SignUp currently operates out of Stockholm, Sweden (HQ), North America, Denmark, the Netherlands, and Australia and has approximately 100+ employees across the globe.

Retailers face an exponential amount of change and will continue to do so for the foreseeable future. The Big Shift is a term often recycled and repurposed to fit any innovations or changes in the retail industry. Originally it was coined to refer to economic transformation caused by exponential improvements to the cost and performance of digital infrastructure, alongside the liberalization of public policy—leading to constant disruption and shifts in the balance of power between businesses and their customers.

The Big Shift effectively means that companies face the pressure of increased competition, and consumers gain the advantages of knowledge sharing and transparency. It points to a democratization of the retail landscape, robbing retail giants of market ubiquity and creating niches within markets.

Just as technological advancements have come under this label, so have responses to the climate crisis and customer care. Anything which disrupts business-as-usual is part of The Big Shift, and so in many ways, the term has lost all sense of real meaning.

One of the issues is that the phrase is singular, allowing brands to think of evolving circumstances as a fixed or distinct shift, i.e., a mindset that implies we’ve done The Big Shift once X is complete. Used accurately, it refers to the constant shifting which shapes the retail climate.

To prepare teams for the constant transformation needed to keep pace in a rapidly changing world, leaders need terminology to match the state of doing business. Brands must build robust processes and automation that will allow them to make the strategic pivots that expansion requires. Surviving, and thriving, falls to those brands that embrace the constant shift and engage in ongoing retail transformation.

Read our blog to learn more about how retail transformation can help you build a backbone for future expansions and download our whitepaper to learn more about how it connects to the constant shift.

With many retailers already saturating mature markets, it’s no surprise that so many are shifting their focus to expand operations and enter new markets. Barely a day goes by without another brand announcing retail expansion plans, whether that’s entering a new market, implementing an omnichannel approach, bolstering supply chains, opening stores in new cities, or doubling down on cross-border e-commerce. Here’s a quick rundown of the 8 most common ways retailers approach expansion:

Even the most robust expansion plans will fail if you don’t prime the finance team to handle the back-end accounting. Retailers struggle to achieve their goals when a financial backbone isn’t in place. Much of this is down to prioritizing the more exciting aspects of financial transformation, such as your omnichannel presence and failing to spend adequate time and money on the less glamorous parts of the expansion puzzle.

Constantly adding new things without building the required financial capabilities may leave your brand crippled by fines for various compliance standards, making significant decisions based on inaccurate reports, and struggling to get complete visibility of operations. All this leaks into the customer experience, with supply chains breaking down due to delayed payments, invoices arriving late, and stressed finance teams trying to find the capacity to deal with payment issues.

Retailers need to invest in financial transformation before hitting expansion mode. This blog approaches expansion with your finance team in mind. Let’s look at the tools and processes you need to have in place before you make your next big move.

Before you act, you must examine. Why not give your finance function a health check? You need to take a long hard look at your financial systems and processes. Adding a higher volume of work to under-pressure systems is rarely wise. So you will need to have full awareness of your current capacity.

Accurately determining where your finance team will face bottlenecks should be the first step in any retail transformation and must involve accounting team members. Leaders need to ask as many questions as possible during this phase.

At this point, most retailers will begin to identify the need for more robust systems to handle any future expansion. Check out our resource on building an ERP requirements checklist list to help you assess your specific needs.

Before you make any steps towards expansion, why not consolidate data and insights from across your organization so that you can make genuinely data-informed decisions about how best to grow operations.

Brands have more information at their fingertips than they realize, and it requires a truly agile approach to tap into that wealth of knowledge.

Speak to all departments, perhaps the marketing team is aware of demographics that aren’t on finance’s radar, or maybe the legal team knows about the difficulties of operating in a market that looks red-hot based on website hits. Understanding all the data you own will help you answer some of the many questions that expansion involves.

![]()

Retailers are usually brimming with knowledge about the ubiquity of WeChat in China or the popularity of mobile eCommerce in Brazil. Yet very few brands are aware of the nuances involved with accounting across borders. Before your team gets too excited about retail expansion in a new market, breaking down the financial reporting requirements in new jurisdictions is essential.

You’ll find that accounting regulations can shift in new markets and that remaining compliant with global accounting standards will save your brand from hefty fines and reputational damage. Even if you intend to stay in the same market, expansion may include adding subscription services, building a robust e-commerce channel, or opening a new store. It’s vital to understand all financial regulations governing these actions.

One of the biggest challenges retailers face when expanding is partnering with the right companies. Many large brands don’t allow their solutions partners to share their information, so you may need to speak directly with software consultants and their partners to determine their experience in your industry. Look for teams and consultants that understand the nuances of the retail landscape.

Once you get chatting, they’ll be able to make relevant recommendations. Once you speak to them, it will be evident if they’re aware of the challenges posed by retail expansion and whether their solutions can support your growth. Even if they can’t share the names of brands they work with, they will be able to provide relevant information based on their industry experience. Speaking with others about their experience partnering with the company should also be possible.

According to estimates, every 39 seconds, a data breach occurs in the United States. As a result, companies tend to put a lot of the focus on security on their customers’ data protection. However, they equally need to invest in appropriate back-end protection of all financial information.

The average cost of compliance has skyrocketed in recent years, with data breaches becoming part of the new normal. Not only do these breaches cost retailers hefty amounts through fines and legal fees, but they do considerable damage to reputations in new markets.

Often, retailers work between disparate systems, managing leases and recurring billing on separate databases. Not only does this make it hard to get visibility of your financial situation, but audits and proving compliance can be cumbersome. Not to mention the fact that this kind of set-up results in moving spreadsheets and critical financial information between systems to consolidate finances, leaving your brand vulnerable to attacks.

Critical to any successful retail expansion journey will be implementing centralized accounting systems and ERPs. These allow your finance team secure and controlled access to all your financial information. It’s just a matter of investing in robust, scalable solutions that can keep all your financial information safe as you grow.

Work with ERPs that allow for enhanced features. For instance, Microsoft Dynamics ERPs will enable you to add any functionality you need to handle leases through its network of partners. Out-of-the-box solutions such as Property Lease Management, Multi-Entity Management or Subscription Billing Suite give your team advanced accounting solutions within the secure interface of your ERP. To find out more about what to look for in an ERP, check out the ultimate guide to choosing an ERP for your transformation.

As companies evolve and innovate, they usually set incredible goals and targets. Teams then get to work, excited by the prospect of reaching new heights. However, it’s worth noting that these lofty goals are often set at precarious heights without a stable foundation and may leave the finance department struggling to keep up.

Substantial budgets are often poured into product, marketing, development, and sales, while finance teams struggle with stagnant budgets, legacy systems, and an understaffed finance team. Tasked with matching the pace of their innovative teammates, they may struggle to balance an ever-increasing workload without the proper infrastructure in place.

Although investing in finance might not sound as exciting as launching a brand new, innovative product or service, it’s worth every penny. Leaders must consider finance the foundation on which all other departments build. Without systems and people in place who can handle the growth, plans are likely to fail, causing a domino effect that will impact every corner of your company.

Below is a quick health check to help you determine the robustness of your current finance function. This questionnaire is taken from our whitepaper “The finance leader’s playbook for financial transformation”, where you can find best practices to help you build a stronger financial backbone for your organization.

For more on how to build a stronger financial backbone for your company, read our whitepaper “The finance leader’s playbook for financial transformation”.

Many companies outsource financial transformation to third-party consultants who take responsibility for creating a roadmap to success. However, relying on external sources to deliver internal change is not always the best framework for sustainable results. Though third-party organizations provide shortcuts to complying with accounting standards and setting budgets, they often fall short when it comes to implementing company-wide processes and transforming the way your teams work. One of the keys to lasting transformation is maintenance, which requires internal forces.

External advisors are helpful when setting templates and establishing what the best practices for your company will look like, but to get your company to engage wholeheartedly requires a different approach. This blog shows the best practices for any company trying to create a roadmap so that you can reap the benefits of financial transformation as you scale operations.

Below is a summary of what’s covered. To skip ahead, please click on the relevant link:

Although many like to think of their companies as innovative thought leaders, it’s wise to be objective when judging your position on the digital maturity scale. If your company is only dabbling in agile strategies, you may be a beginner. Deciding where you sit on the scale will set realistic expectations of what a financial transformation will entail.

Companies may even notice disparities between departments, with some teams exercising fully agile systems and reports and others lagging. For the transformation to be effective, you will need to plan to bring each department up to the same standard–making changes that everyone adopts rather than just a few digitally-enthusiastic finance team members.

Gartner estimates that close to 85% of finance departments are undergoing digital transformation, yet only some will succeed in hitting their projected benchmarks. McKinsey reports that even high-tech industries like media and telecom struggle, with transformation success rates below 26%. Traditional companies have even lower success rates, with sectors such as oil and gas or pharmaceuticals falling between 4 and 11 percent. These figures are hardly surprising, given that many companies approach financial transformation as if it can be solved by simply inserting technology where once there were spreadsheets.

However, the average financial transformation is a complex process that requires a nuanced understanding of company-wide processes and vigorous change management. Understanding how to tackle the core challenges is key to avoiding significant roadblocks that companies tend to hit. Companies should invest in thoroughly educating each team and building out a plan that embraces a transformation’s true complexity.

Teams can become frustrated if the goals and targets of a financial transformation remain unclear (and they often do, leaving individuals burdened with new technology and little guidance). It’s up to leadership to figure out what success looks like, how it will be defined and measured, and what teams should expect. Transformations require the widespread adoption of agile workflows, and this needs to be supported by leadership, training and straightforward, manageable expectations.

According to the Harvard Business Review, it’s often the case that teams use agile terminology but feel skeptical as they’ve not received adequate training or communications on what exactly those terms mean for them. People will feel more engaged if a roadmap outlines what success will look like and how your team will use agile processes to help achieve company goals.

It’s impossible to execute an effective financial transformation without assembling a team to manage it. All change starts with leadership and appointing the right leaders to head the charge. Not only do these people need to be convinced of the value of switching to a more agile mindset, but they should be prepared to embrace scalable solutions and understand how to make that happen cross-functionally.

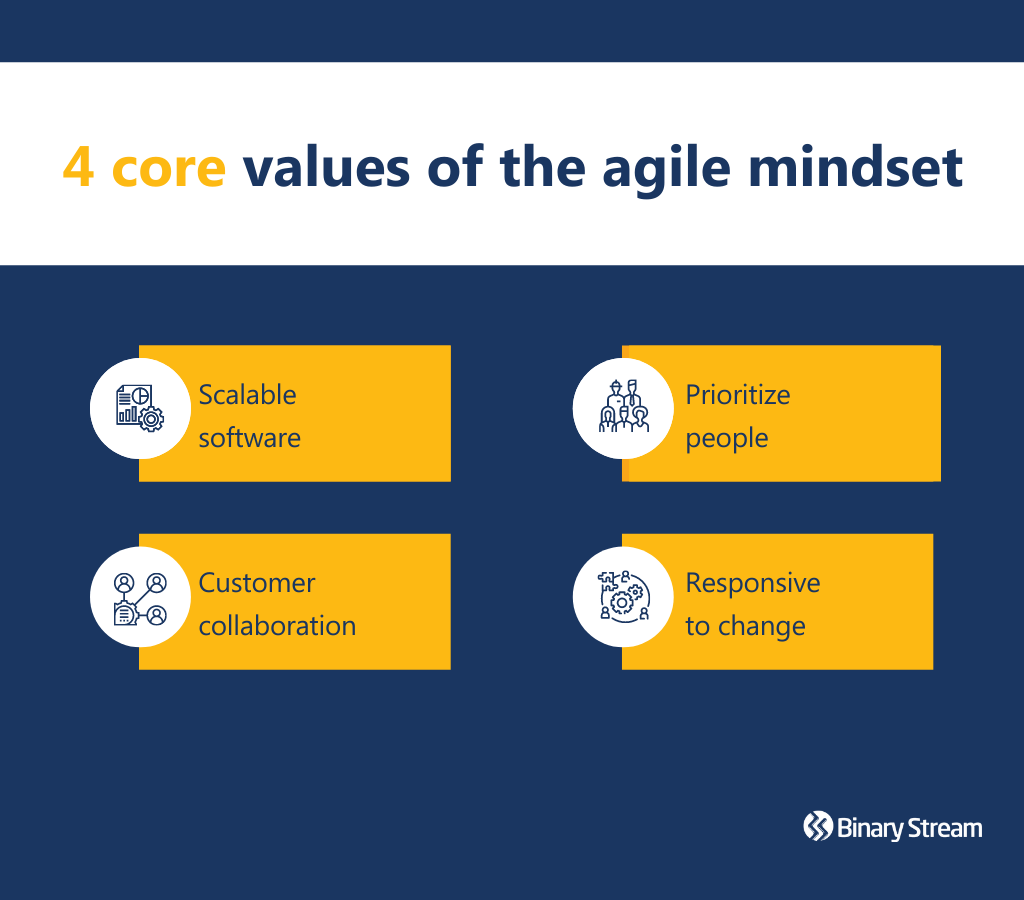

There’s no point in introducing agile processes on the finance team without ensuring that all the processes that feed into finance are updated. You cannot go “agile” without first defining what that means for your industry. The image below compares the five things successful leadership teams focus on when undergoing financial transformation and how they differ from those that fail to implement widespread change.

Building a comprehensive roadmap to success can be made easier by tweaking an existing framework to meet the demands of your company. There are many financial transformation frameworks to choose from, and each company will need to treat these as guidelines rather than something set in stone. Every single transformation will encounter unique challenges, and success will look slightly different for everyone.

The elephant that is always in the room when it comes to technology is the fear teams have of being replaced. Talk of cutting costs and streamlining processes can sound like alarm bells to many. One of the biggest challenges will be managing a cultural, and perhaps, for some, emotional change to their working life.

It’s not enough to insist on agile workflows from the top down. It’s more effective to engage change management experts to help your team effectively communicate and provide a space for people to voice concerns and receive ongoing education and training.

According to a paper by MIT, “culture can advance or inhibit digital transformation. If companies can lay the groundwork by building a culture that is more adaptable to change, then implementing new technology and business processes can proceed more smoothly.” Presenting the changes as an opportunity for all and emphasizing what new roles and duties will look like will be essential to your success.

Even for roles that technology will replace, this is an occasion to build on their capabilities. Perhaps those that mine spreadsheets to fix data errors can use that energy and attention to detail to conduct competitive analysis. Allowing your team time to embrace the changes and consider new ways to use their skill set or develop new skills will improve the adoption of your transformation efforts.

Companies shouldn’t rush into selecting the right solutions to help them on their financial transformation journey. Partnering with companies that understand the unique demands of your industry and who specialize in assisting companies to implement their solutions is preferable to jumping into a partnership with a quick-fix solution.

Taking the time to build out a custom ERP requirements checklist will be critical. As will, familiarizing your team with our ERP buying guide for financial transformations. Both these resources aim to assist you in figuring out precisely what you need from your technology and build checklists that ensure you get the tools you need.

One of the core goals of any financial transformation is to help companies scale quickly in today’s climate. It’s hard to achieve this goal if the solutions implemented cannot manage fast growth. In the previous point, we talked about the importance of deciding what you need from your technology.

In this step, you should use those lists to invest in technology that meets your requirements while also considering scalability and how the technology integrates with your current workflows. For instance, companies that rely on the Microsoft Dynamics ecosystem may want to invest in fully integrated technology that speeds up the implementation process.

Mckinsey reported that one of the issues concerning quick-fix solutions is that companies rarely look past their current year and work in a “hand to mouth” manner, fixating on annual budgets and performance. This kind of approach means they may fail to understand the long-term benefits of financial transformation and the ROI they can expect on more expensive, fully integrated solutions over time. Shifting the mindset can be as simple as remembering that any solution will be central to workflows for the best part of the next decade.

Agile methodologies can seem complicated, but leadership can speak to peers and study what the shift should entail before trying to go agile themselves. Talking to those who’ve already implemented an excellent agile strategy (scalable technology, rapid testing, learning cycles, etc.) can significantly benefit those in the early stages of the process.

Agile processes can look different across industries, and what works for a SaaS company may not cover some of the healthcare data management regulations. Looking for industry-specific mentors and insights will be vital in choosing the workflows that make the most sense for your team.

Even outside of financial transformation, one of the core challenges companies face today is data management. It isn’t always easy to know what to focus on with a literal ocean of data at most of our fingers. When various teams are responsible for collecting data and sending it to finance, errors occur. Managing data in disparate systems before consolidating it in reports creates unreliable insights based on often inaccurate information.

Companies should implement a centralized, real-time database to quickly and effectively pull the insights needed to make strategic decisions. It’s not uncommon for end-of-month close cycles and reports to require at least a week of administrative work, a speed that is too slow for the pace at which strategic decisions happen. You have a wealth of financial information at your disposal, but it’s unlikely your company will ever have the capacity to use it without centralized data management.

Unsurprisingly, some teams can spend so much time and energy implementing a financial transformation that many of the best practices fall by the wayside over the years. Leadership should prepare to continue driving change until all new processes are integrated into the workflow (think in months and years, rather than weeks). They should pay specific attention to data governance, day-to-day workloads, and continually educate and train teams on tools and agile practices.