As a customer base grows, subscription billing processes can make or break the average finance team—previously manageable workloads can quickly spiral out of control. Given the subscription economy’s growth, many accountants struggle to handle floods of new accounts, recognize revenue appropriately and produce accurate, timely invoicing. Teams often launch SaaS pricing models without first putting the financial tools and processes critical for efficient billing in place. In short, few undergo the financial transformation that subscription billing requires.

With so many moving parts to consider, accounts teams soon become swamped by the administrative burden of accelerated growth. Many of the tactics used in popular pricing strategies can lead to an unprecedented influx of new subscribers. For instance, limited free trials can cause administrative hiccups when teams need to upgrade to billing once the special offer is over. If only ten users subscribe, this is relatively easy, but if the campaign is successful, this might mean hundreds or even thousands of new accounts require updating. Companies will struggle to retain even the happiest subscribers if the transition to billing is not efficient and reliable.

Billing is at the heart of any good subscription pricing strategy, and several core processes are critical for success. The average customer expects a lot of autonomy when managing payments. Below is a list of some of the common expectations.

What customers expect from your billing processes:

Though the anatomy of the ideal subscription billing process can vary from company to company, there are universal best practices and considerations. This blog breaks down the core elements that successful processes have in common.

This statement may bring out the contrarian in some, others may feel personally attacked, and thoughts may run through the mind such as we’ve always managed it that way before, and of course, we can scale! These are all understandable attitudes toward the constant call for automation. But the truth is that manual billing is not tenable for building a healthy subscriber base.

There are often more time-draining activities in processes than teams think, and they add up. Finance teams need to assess manual tasks, which, if eliminated, could save them time every month. Many billing tasks can be automated, and creating a custom ERP checklist that includes those manual tasks, which are the most time-consuming, will be a decisive step forward for overwhelmed teams.

Ask lots of questions of your team. Do you input data manually? Do even minor updates lead to someone having to adjust each account manually? Is revenue recognized automatically? Are there lots of errors in your system, and why? By closely examining the problems that commonly arise, you can easily trace where the bottlenecks or issues originate. These pain points are the perfect place to begin the automation process.

One of the significant process changes with subscription billing management is that the sales and accounts team should only sometimes need to set up new customers. Most people are now used to subscribing and managing billing in contactless environments, where they feel in control of their usage and the platform. Although with more complicated products where it’s impossible to display custom pricing, there may be other options.

Still, with more straightforward offerings, it’s wise to empower subscribers to sign up without worrying about talking to someone on your team. A registration page that links to common FAQs, displays pricing and information in conversion-friendly copy, and walks the customer through each step, is the ideal way to sign up more subscribers without adding to the team’s workload. Enabling sign-ups frees the accounts team to focus on critical billing strategy rather than troubleshooting.

Sign-up billing process should include:

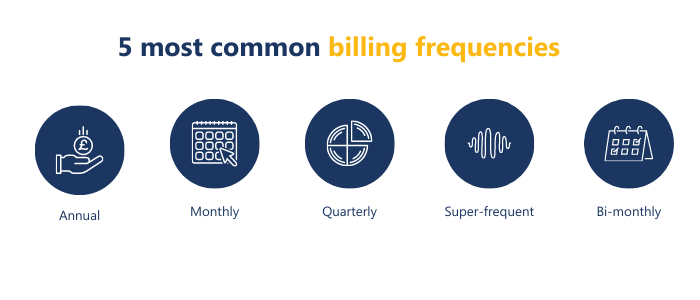

Usually, with subscription billing, customers can sign up at any time and choose various payment frequencies and tiers. The more complex the pricing options, the harder it can be to manage. If your team is responsible for scheduling and tracking invoices and payments over the phone or email, they will quickly become overwhelmed when your services get popular.

Payment gateways are the perfect solution to this challenge. The majority of your customers will be able to log in and manage their payments. Not only this, but the best recurring billing software will integrate with a payment gateway, often expanding the number of payment options you can accept. These gateways are significant as the customer base grows, allowing you to handle more complex customer issues and let customers take care of standard billing procedures such as updating credit card details and activating payments in a secure environment.

Subscription billing presents the challenge of proving compliance with accounting standards such as ASC 606 and IFRS 15. Those still implementing manual processes will need help to produce error-fee audit trails and may spend a significant amount of their labour simply combing through data to fix mistakes—time better spent on strategic initiatives.

Accuracy is vital to proving compliance. With the right solution, automation is possible, and companies can keep up. Just think, competitors may already be investing in better billing processes saving themselves valuable time and money. This global movement leaves only one question for today’s finance leaders: why not free up critical budget and personnel with automation, so you can reallocate resources and drive strategy?

It’s worth calculating the time your accounts team sinks into collections, revenue recognition and dunning for subscription billing. Once you’ve got this information, it will be easy to establish an ROI on recurring billing software.

The three key subscription billing processes to automate

There can be a steep learning curve for teams transitioning to subscription billing. If your accounts team has spent most of their careers managing manual, traditional billing, they may need to gain the expertise to handle complications presented by newer pricing strategies.

These teams may be the most reluctant to change the way they do business simply because they need the training to feel comfortable with the new processes. That’s why financial transformations and SaaS migrations require training, education and communication. Your team will need dedicated time to upskill to meet the demands of handling the growth in recurring billing accounts and experts to call on to ask those tricky accounting questions.

The nuances presented by advanced subscriber management mean that processes should be put in place so that even your most senior accountants can ask questions and discover practical ways to streamline billing. Invest in hiring a specialized expert on contract, or if you intend to invest in software, look for teams that offer a high degree of customer care, support and training.

How are you storing billing information? What systems are in place to protect your customers from data breaches or attacks? Security is so important in the billing world that it needs consideration at every step. Even if this isn’t top of mind for you, it will be for your subscribers, who will likely look for safe, encrypted environments. Manual invoicing can be a red flag to those used to more robust billing solutions where their information is stored safely and securely by familiar payment partners through a gateway. Check out this blog on the security features to look for in your payment gateway.

One of the failures of most overwhelmed accounting teams is the need for more reliable customer communication. Customers want to know when changes are being made to their billing, when a payment has failed, or if a free-trial or special offer is about to end. Erring on the side of over-communicating is preferable when it comes to matters of payment.

Often teams are so consumed with rolling out updates across relevant accounts that the communication piece becomes haphazard and inconsistent. With robust software, it’s possible to automate notifications (for instance, a new billing cycle, a failed payment, etc.) and roll out bulk updates—giving teams plenty of time to consider the strategy for best-communicating changes.

Critical pieces of communication around billing

As SaaS continues to rise in popularity and recurring billing models move from niche to normal, many businesses are migrating to modern pricing models and finding ways to expand their billing options. This transition often involves implementing new subscription billing processes and may even require the adoption of new solutions to help manage more demanding workflows.

Automated recurring billing software is a fantastic tool that will help position your finance team to handle the back end of rigorous expansion while keeping overhead to a minimum. Let’s explore seven ways recurring billing automation saves your company time and money.

Subscription pricing models and recurring billing options are incredibly agile, variable, and customizable. These advantages allow businesses to thrive in a fast-paced market but can increase the workload for your finance team. Accounting needs to be primed for the intense workload with an investment in automation. Invoicing is no longer straightforward—variable amounts, tiered pricing, and multiple billing frequencies are common factors that can quickly complicate your billing system.

Recurring billing automation is vital to achieving rigorous expansion and optimizing your recurring payment management. Spreadsheets won’t cut it when your finance department needs to process thousands of invoices each month. Augmenting human productivity with software automation to handle routine accounting processes allows your team to comfortably manage an expanding customer base without missing critical deadlines or making costly mistakes.

Leadership requires access to timely reports to act on financial insights and sustain a high degree of business agility. Therefore, accounting teams must achieve faster closes during period-ends. Automated recurring billing software accelerates these processes, and some solutions are built with real-time reporting, empowering team members to access performance insights from a single source of truth.

Real-time reporting was a critical value-add for OTC Markets Group. The business relied on a complex jigsaw of three decentralized systems that confused external auditors and potential shareholders. After implementing an automated recurring billing solution, they’ve reduced the time spent compiling month-end financial statements by 50%, saving over 120 hours of work per month. To read more about how OTC Markets Group minimized time spent on month ends, download the case study here.

Businesses dependent on manual data entry tend to suffer from unclear, messy, and error-riddled data, resulting in poor financial visibility. Gartner found that poor data quality costs companies $12.9 million annually on average. Yet, while teams sacrifice many hours entering information into systems, they often spend even longer fixing mistakes. Research has shown that 40% of workers spend up to a quarter of their week on manual data entry and related repetitive tasks.

QTS Data Centers (QTS) struggled to scale their operations appropriately due to a significant number of core processes being redundant and time-consuming. Prior to implementing automated recurring billing, they operated 33 separate databases across multiple entities and manually processed 38,000 unrecognized deferral entries. The new software automated recurring billing activities across all entities, accounting for a 30% reduction in redundant processes and saving 11 days on end-of-month close cycles. To read more about how QTS regained control over their data management systems, download the case study here.

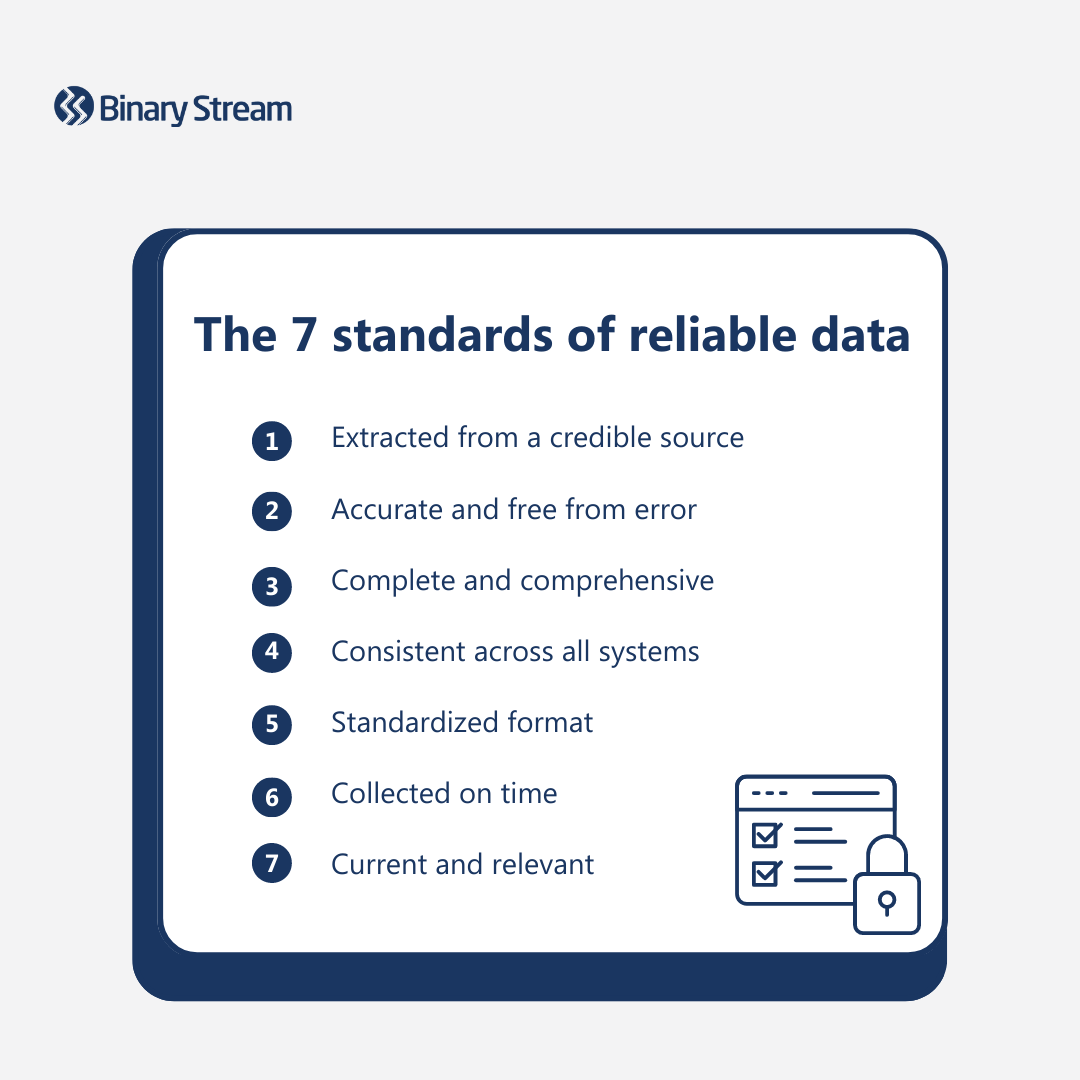

Automated recurring billing software streamlines workflows, liberating teams from obsolete, repetitive tasks and minimizing clerical errors. Real-time reporting and historical invoicing empower leadership with contextualized insights based on the most up-to-date information at any given time. The software also makes it simpler for finance teams to maintain best practices in data management and uphold the seven standards of reliable data.

Mistakes can cost your team hours, if not days, of extra work. These losses quickly add up, resulting in entire weeks lost to checking and correcting errors in the system. Missing a critical deadline, billing the wrong amount, invoicing the wrong customer—these are all examples of errors that contribute to customer churn. According to a recent study by PWC, 32% of all customers surveyed reported they would stop doing business with a brand they loved after one bad experience.

Automated recurring billing saves your business from these unnecessary blunders, helping maintain a loyal base of happy recurring customers and improving cash flow. For example, Sunshine 811 lacked complete visibility of their billing processes and, due to an immense amount of labour-intensive administrative work, frequently sent out invoices that were inaccurate and/or late.

By adopting automated recurring billing software, they recouped $15,000 annually and now accurately bill over a thousand members each month. For the complete story of how Sunshine 811 took back control over their billing system, download the case study here.

Subscriber churn is one of the costliest challenges that subscription businesses face. Subscription services lose approximately 2% of customers monthly due to expired credit cards, and failed payments account for $278 million in lost revenue for the subscription industry over the past twelve months.

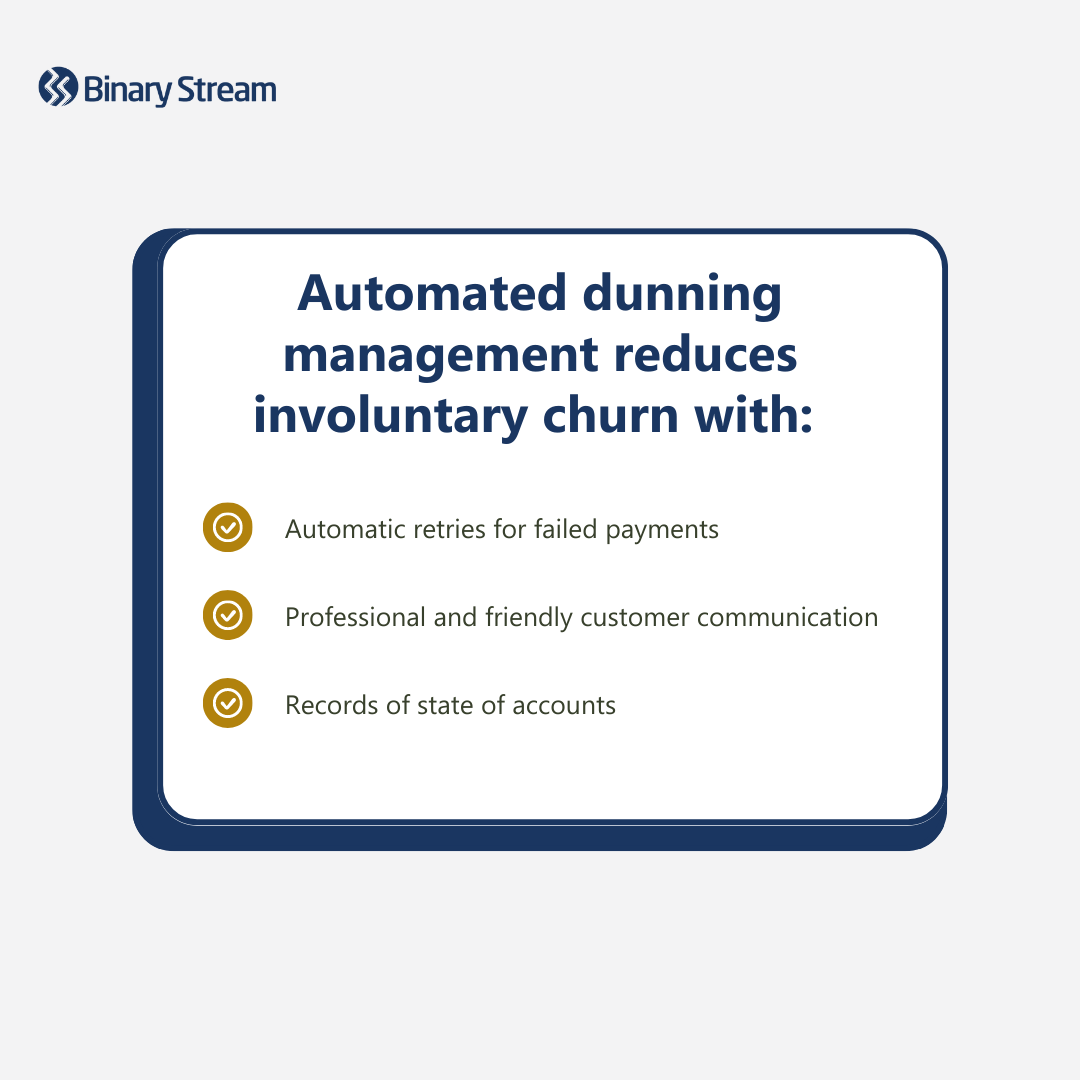

Companies stand to regain a huge chunk of their monthly recurring revenue (MRR) by communicating with their customers and implementing modern dunning processes. An automated recurring billing solution will enable you to master dunning and collections management to prevent subscription revenue leakage by automating credit card updates, dunning emails, and collection re-attempts. Your accounts receivable (AR) team will also recoup time to follow up with high-priority customers who need a more human touch.

Calculating taxes can quickly become overwhelming, particularly when companies expand operations into various regions. Managing multiple currencies and languages while complying with local tax requirements can take up a lot of resources, ultimately getting in the way of company growth targets.

Recurring billing automation saves time for your finance team when overseeing complex taxation requirements—instantly applying changes based on taxability rates and rules and accounting for exceptions. Depending on the software, your team can even automate other redundant or repetitive tax-related tasks, accelerating reporting for month-ends.

MoxiWorks was able to save 80 days annually by automating their recurring billing processes. The real estate software provider employed a team of 150 employees to manage over 340,000 active users, totalling $150 million annual recurring revenue (ARR). After implementing an automated recurring billing solution, they now save 15 days preparing taxes per year. To read more about how MoxiWorks cut down time spent on month ends, download the case study here.

ASC 606 and IFRS 15 protocols require companies to recognize revenue as they fulfil performance obligations, like delivering goods or services, rather than at the initial time of sale. However, it’s nearly impossible to manually track deferred revenue, especially when deferrals span many months and are distributed unevenly.

An automated recurring billing solution helps to organize your ledgers, maintaining tidy and accurate records that are audit-ready year-round. This saves your company from fines and penalties for non-compliance, as well as frees up your finance team to focus on more strategic tasks.

BT Conferencing greatly benefitted from adopting automated recurring billing software and now effortlessly manages 10,000 deferral accounts. The business struggled to keep up with rigorous requirements imposed by their parent company’s overall financial compliance team. However, the new solution reduced the labour required to complete month-ends to just 10% of one full-time employee’s workload. To read more about how BT Conferencing converted days’ worth of effort into the click of a button, download the case study here.

Advanced Subscription Management is a recurring billing solution that leverages automation to streamline workflows, support complex pricing models, and maintain compliance with international accounting standards. Fully embedded within Dynamics 365 Business Central, Finance, and Dynamics GP, you can accelerate your business’ agility and start saving. If you have any further questions or would like to book a demo with our experts, feel free to contact us anytime.

Payment gateways are an essential tool for processing e-commerce transactions securely. That’s why you need to understand how they work and what sets the best ones apart from the glut of options on the market. As businesses undergo exponential growth, many finance teams require help to manage the sheer volume of invoices. Without a solution to augment their productivity, bottlenecks form and errors creep in, damaging overall efficiency and leading to customer churn.

Empowering your customers to take ownership of their payment details allows them to play an active role in transactions. This takes some of the heat off accountants and enables them to focus on more strategic roles while building customer trust. Payment gateways also provide an extra layer of data protection, establishing a secure environment to process payments without compromising customer experience.

If you’re interested in a specific question about payment gateways, skip ahead by clicking on the topic below.

A payment gateway is an online payment solution that verifies credit card details and transfers funds for e-commerce transactions. It acts as an intermediary between the customer and the merchant, creating a secure environment to send and receive payment details between the merchant’s website, the customer’s financial institution, and the merchant’s financial institution.

There are three types of payment gateways:

1.) Redirect

2.) On-site

3.) On-site checkout and off-site payment

Redirect, or hosted, payment gateways forward the customer to a different website to complete their purchase. Therefore, the payment gateway does not integrate into the merchant’s website, which can result in fewer conversions.

On-site payment gateways mean the merchant’s server completes the payment process. Large enterprises typically implement these because they offer maximal control over the process and have the resources to manage higher complexity and responsibility.

Finally, some payment gateways offer a hybrid approach where the customer completes checkout on the merchant’s website, but a third-party redirect website processes the payment. This type of gateway is convenient and straightforward, like redirect gateways, but lacks the total control offered by on-site gateways.

A registered merchant account is a type of bank account required of all businesses to accept debit or credit cards and receive payment. Payment service providers typically provide these accounts for merchants.

A payment service provider (PSP) is a third-party company that offers payment services, including payment gateways. These businesses allow companies to accept online payment methods and remain compliant with industry security standards. You’ve probably already heard of some prominent companies, like PayPal or Stripe. SK Global Software offers a premier add-on solution facilitating payments through Microsoft Dynamics 365.

A payment portal refers to the front-end technology that collects customer payment information. Some common types of payment portals include:

A payment gateway will transfer data retrieved from the payment portal during a transaction.

A payment processor transfers a customer’s credit card information between the merchant’s point-of-sale system and the customer’s card network or bank. A payment gateway will request authorization of sensitive information from a payment processor during a transaction.

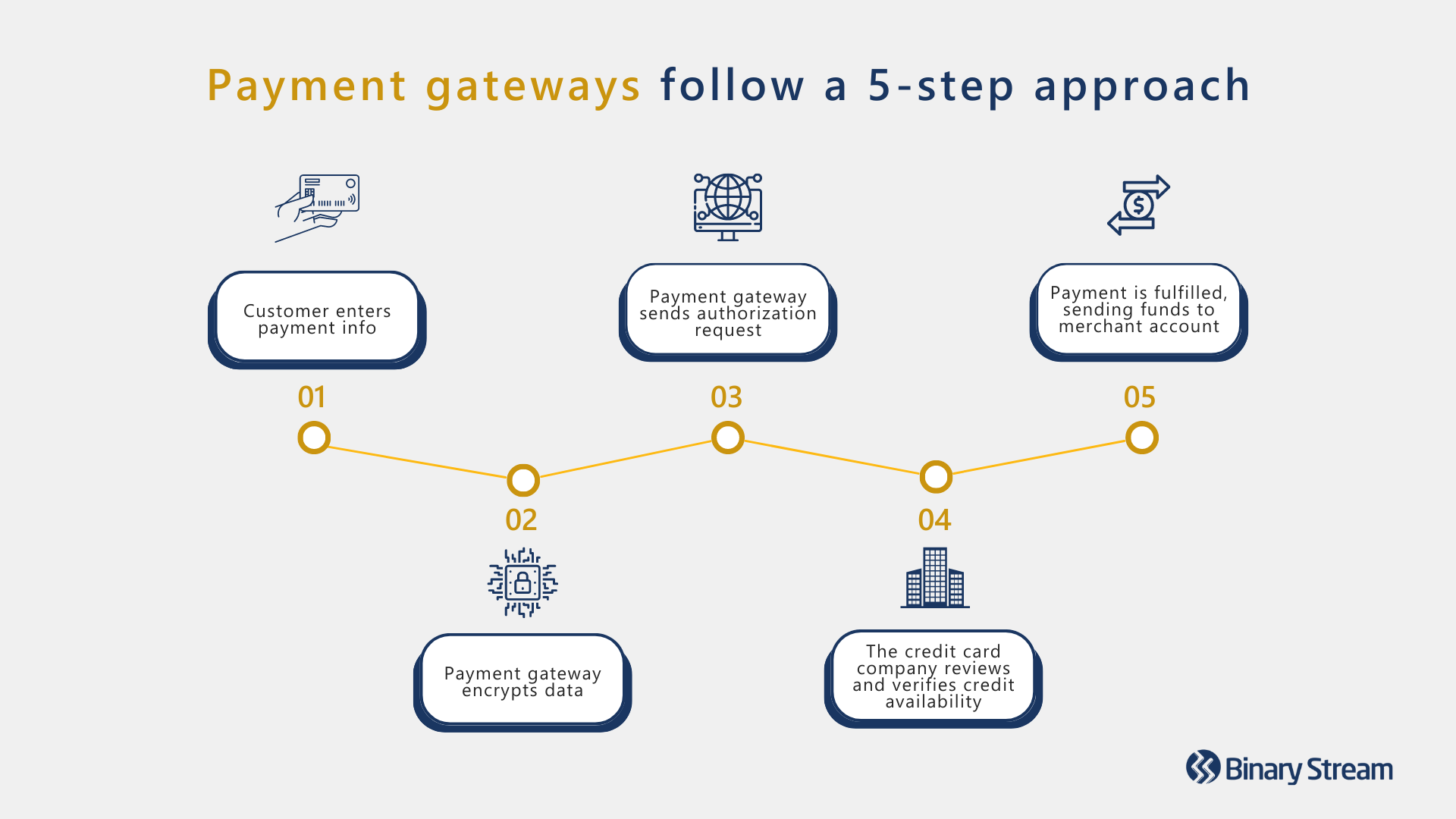

Payment gateways process transactions by following a five-step approach:

1.) The customer enters their payment information on the payment portal.

2.) The payment gateway encrypts their payment details and secures the connection between the portal, gateway, and processor.

3.) The payment gateway sends a transaction authorization request to the payment processor.

4.) The credit card company reviews and verifies credit availability. If sufficient funds exist, the payment processor authorizes the transaction request.

5.) Once the payment gateway receives authorization, the payment can be fulfilled, transferring funds to the merchant account.

Failed online payments are an unfortunate but relatively common occurrence. FlexPay research revealed that nearly half of all subscriber churn is due to failed payments. Therefore, make sure to carefully read the agreement with your provider, as it will include several warranties for the merchant (and sometimes the customer!), as well as a detailed breakdown of the liability of the payment gateway.

Depending on the agreement, PSPs may assume partial to full responsibility for failed transactions, owing the merchant compensation for financial damage. Nevertheless, PSPs are not liable for damages caused by third-party services.

In the event of a failed payment best practice is to directly communicate the error to the customer, then follow up with dunning email automation and payment retry cycles.

The three most common reasons payments fail include system downtime, payment technology errors, and compromised security. However, the transaction can also be unsuccessful because,

Some payment gateways route transactions to multiple payment processors to avoid these issues. With more options available, the system can attempt to resolve errors and downtime before sending the customer a failed payment notification.

Payment gateways are the perfect tool to help manage e-commerce transactions and receive payments online. While finance teams might keep up with a reasonable number of monthly payments, it’s common for workloads to spiral out of control as your customer base expands.

The right payment gateway seamlessly fits into your everyday business operations to support exponential growth while protecting brand reputation and revenue. Modern customers crave convenience and a user-friendly payment process that they can trust. Empowering them to take an active role will build their confidence in online purchases with your company.

If you want more information, check out this blog for an in-depth look at five of the biggest benefits of payment gateways.

Providing a secure shopping experience is a non-negotiable component of successful e-commerce. Breaches could endanger your brand’s reputation and lead to costly fees. PSPs can fine companies $5,000–$100,000 monthly for non-compliance with the PCI DSS.

That’s why it’s vital to maximize the tools and protocols in place that are safeguarding customer information. Below lists five must-have security features for your payment gateway:

The Payment Card Industry Data Security Standard (PCI DSS) is a set of international standards advising businesses on best practices for processing payments securely. The volume of annual transactions your company achieves determines which level of compliance you must meet. The PCI DSS uses a four-level scale to classify businesses:

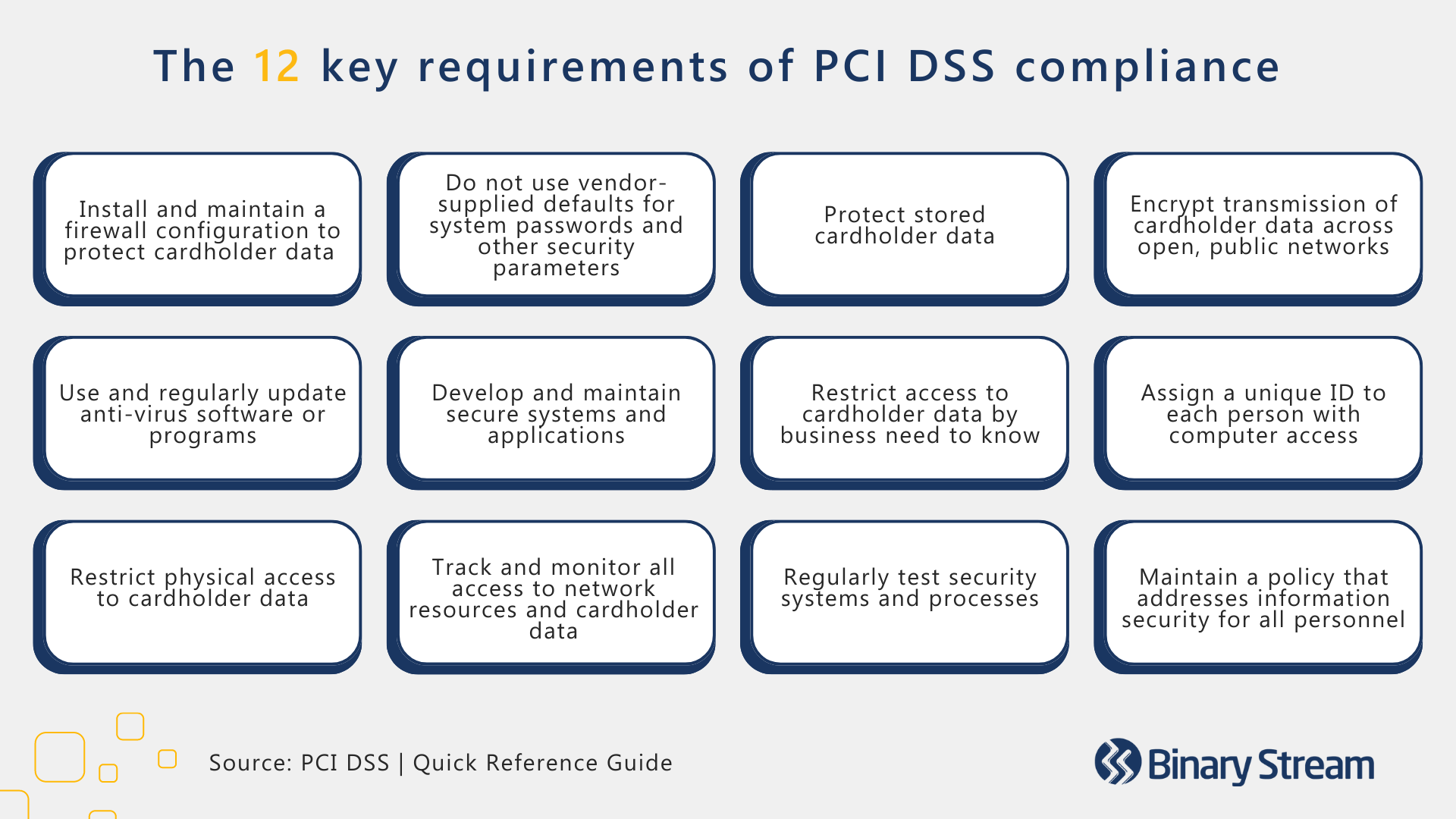

However, any company that accepts credit or debit card purchases must satisfy twelve essential requirements. While all products and services offered by PSPs must comply with the PCI DSS, understanding the basics will help to protect your company against fees and infractions.

There are many factors to consider when determining which payment gateway is the best fit for your business. While payment gateways tend to follow the same five-step approach, they each have limitations. Investing in software that meets all your business requirements is vital.

The following seven questions can help you narrow your search and define the hallmarks of a top-notch payment gateway:

1.) How many types of cards and payment methods does it support?

2.) Can it handle multiple currencies?

3.) Does it offer advanced security protocols, covering encryption and fraud protection?

4.) Is there clear and transparent communication around vendor fees?

5.) Does it integrate with your payment portal and e-commerce software?

6.) Is the front-end convenient and user-friendly?

7.) Will customers have access to 24/7 comprehensive customer support?

It depends. Using multiple payment gateways is more expensive and can muddle an otherwise clean UX, but there are some instances where it’s a beneficial strategy. Implementing more than one gateway expands customer payment options and allows you to assess whether one generates more conversions.

Finding one solution that meets all your business requirements and adequately addresses customer concerns can be tricky, especially for companies growing into international markets. Ultimately, you’ll likely need to experiment to determine the optimal arrangement for your business.

If you’re still feeling lost or are looking for more information, we’re here to help. Feel free to contact our experts with any lingering questions you may have. We can’t wait to meet you!

Many companies depend on payment processing companies to manage their online payments. However, completely relying on a third party can lead businesses to underestimate their payment gateway security risks and requirements, opening them up to data breaches and cybercrime. This issue only becomes magnified when companies undergo changes like expanding operations or migrating to a subscription billing model.

A study by PWC, Global Economic Crime and Fraud Survey 2022, found that 52% of companies with global annual revenues exceeding $10 billion experienced fraud in the past 24 months, with 18% losing over $50 million in their most disruptive incident. Among smaller companies earning less than $100 million annually, 38% experienced fraud; of those affected, 22% faced a total impact of over $1 million.

Therefore, online payment security must be a top priority to safeguard your business. Keep reading to discover five payment gateway security features every business needs to process transactions securely.

A payment gateway is an e-commerce merchant service that collects customers’ payment information to authorize a transaction, ensuring that the payment is legitimate. Payment gateways read, encrypt, and transmit data between the merchant’s website, the customer’s financial institution, and the merchant’s financial institution.

Further reading: Online payment gateways bring these 5 benefits

Payment gateway security is vital to guarding your customers’ personal data and protecting your company. Security breaches, fraud, and compliance violations are all costly mistakes that not only sacrifice your hard-earned revenue but jeopardize your brand’s reputation.

Under the European Union General Data Protection Regulation (GDPR), breach or theft of cardholder data can result in penalties of up to €20 million or 4% of annual global turnover, whichever is greater.

Additionally, payment providers can fine companies who breach the Payment Card Industry Data Security Standard (PCI DSS) $5,000–$100,000 per month for non-compliance.

Therefore, as more customers embrace e-commerce for their purchasing needs, companies must be ready to provide a secure shopping experience.

Continuous learning is foundational to creating a culture of data security, so it’s critical that your team remain updated on the latest safety strategies and regularly evaluate whether it’s time for an upgrade. Below you’ll find five payment gateway security features that are necessary in today’s business climate.

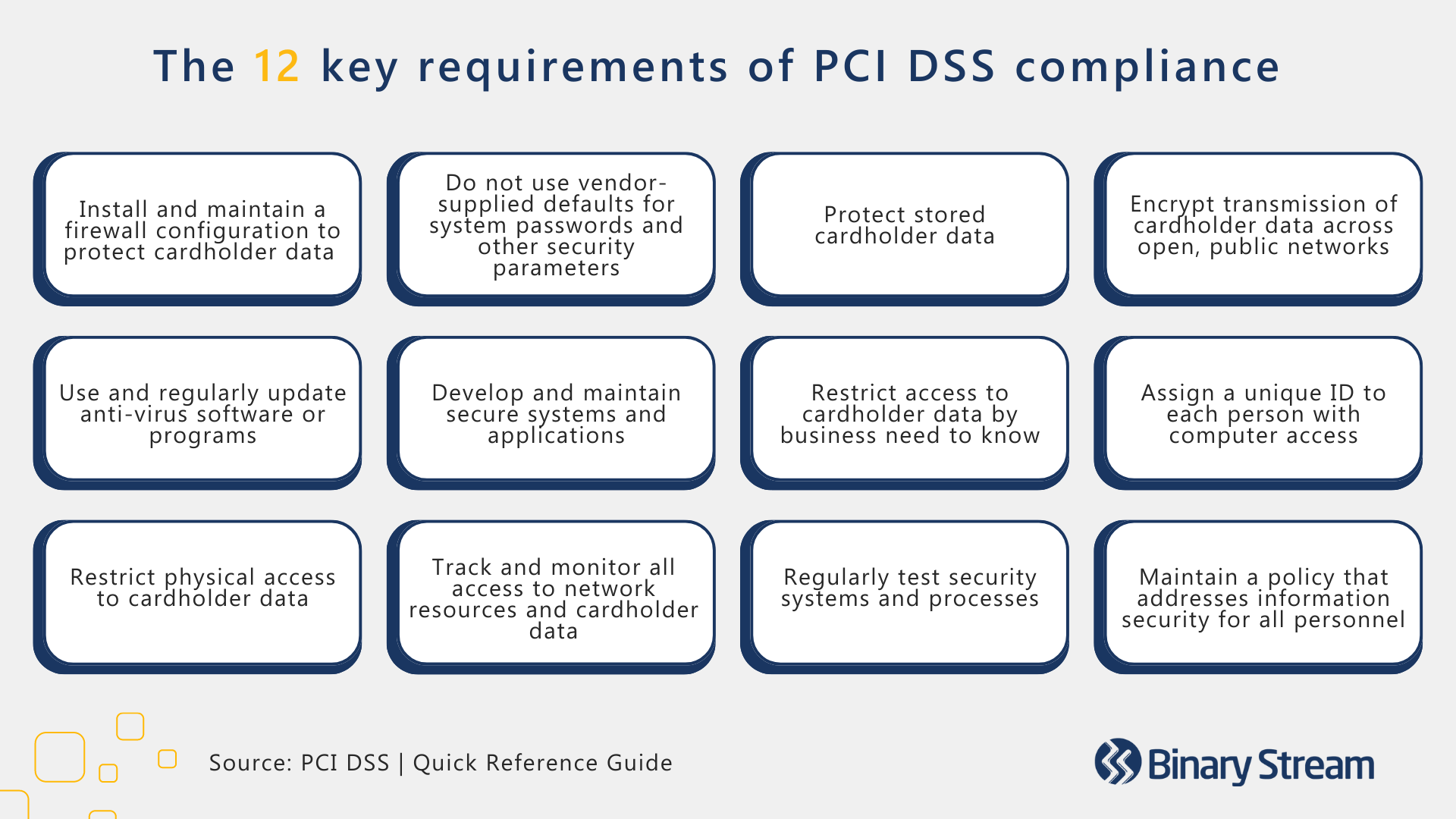

Any company that processes credit or debit card purchases must comply with the international rules and regulations stated in the Payment Card Industry Data Security Standard (PCI DSS). The main role of the PCI DSS is to provide businesses with a standardized approach to rigorous, secure transaction processes while retaining a smooth customer experience.

Maintaining PCI compliance is essential to avoiding penalties and improves your reputation with payment brands, builds customer trust, and bolsters your systems to prevent data breaches and credit card fraud. The PCI DSS has 12 key requirements, further broken down into 78 base requirements and 400 test procedures. The 12 key requirements are outlined in the image below:

Companies must adhere to different compliance levels based on their size. The PCI classifies businesses on a four-level scale by the number of transactions they process per year:

All legitimate processing providers are required to offer PCI-compliant services; however, it’s still worth investigating the PCI DSS as your business will be on the line for any non-compliance. When determining which payment processor to invest in, make sure it can manage credit card processing, transaction history, and credit card data management while complying with the PCI DSS.

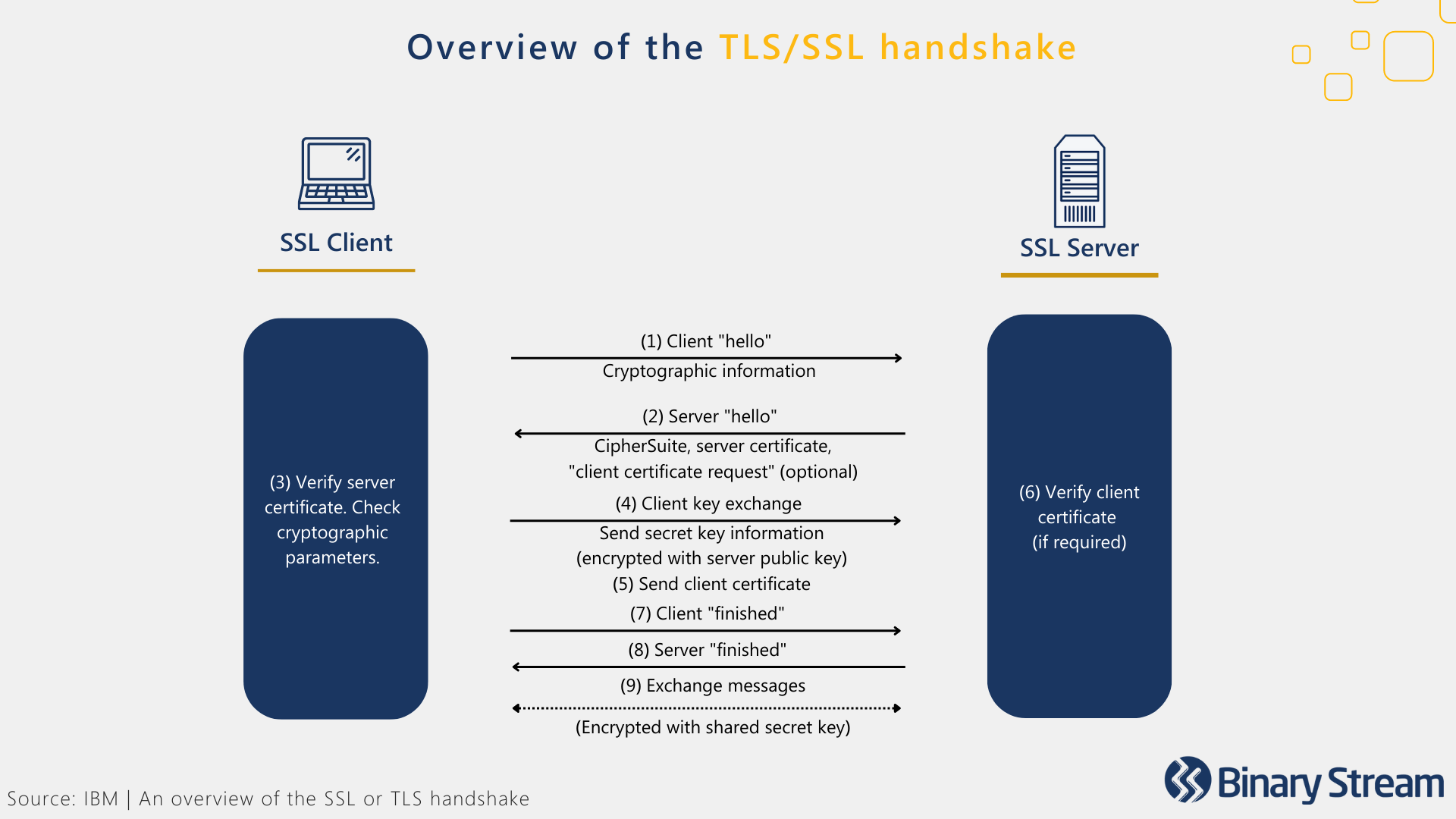

Secure Sockets Layer (SSL) and Transport Layer Security (TLS) protocols encrypt the online connection between the browser and the server, creating end-to-end protection for sensitive information. These security measures ensure the secure transmission of customer data collected by a payment gateway.

Here’s an overview of how the encryption process, nicknamed the “TLS/SSL handshake,” works:

If you’ve ever visited a website where the URL begins with HTTPS or has a padlock symbol next to it, then you’ve encountered TLS/SSL encryption. These hallmarks signify that the website is TLS/SSL certified and that your customers can trust your company with their payment information.

3D Secure (3-domain structure) or payer authentication, is a security feature that addresses issues of fraud in online debit or credit card transactions. Customers are required to complete an extra step of verification with their card issuer at checkout, engaging all three domains of payer authentication:

The most recent iteration, 3D Secure 2, allows for different methods of verification other than a password, including:

Tokenization secures customer payment details by replacing sensitive data with a string of randomly generated numbers, referred to as a ‘token.’ The PCI DSS promotes the adoption of payment tokenization with good reason.

Tokens provide one-to-one replacements for primary account numbers kept outside the merchant’s server. The merchant does not need to be responsible for storing sensitive information, protecting the merchant and customer against fraudulent activity.

This extra layer of protection renders confidential information meaningless and useless in a breach. If a hacker were to gain access to the tokens, their efforts would be wasted because they would have no way to decrypt them.

The address verification service (AVS) is another commonly used method to prevent credit card fraud. After a customer enters their billing address, AVS will check if it matches the one on file with the credit card provider. If it’s a match, then the transaction will be approved.

AVS can be an effective protocol for minimizing chargebacks. Verifying details about the cardholder provided during the purchasing process can help flag suspicious transactions and protect the company before fraud occurs.

Further reading: The ultimate checklist for the best recurring billing payment gateways

Payment gateways present considerable benefits in a market where many finance teams need help managing exponential growth. Where they were once responsible for monitoring a manageable number of monthly payments, these days, many find themselves swamped with an ever-growing user base and face overwhelming workloads. It can become hard to track (particularly when dealing with varying billing frequencies), process, and promptly follow up on missed payments. Resulting in a perfect storm—causing many customers to jump ship and companies to leak considerable revenue.

As a result, payment gateways have become necessary for recurring revenue. They offer a window through which customers can securely manage their recurring billing and update details. Those investing in modern subscription billing must ensure all the puzzle pieces are in place to reap the benefits of their efforts. Below are five payment gateway benefits that will give your finance team peace of mind.

The most significant advantage of a payment gateway is speedier, safer, and smoother transactions. From a customer experience point of view, this is a must. Nothing sews distrust faster than botched payments or a lack of transparency about where billing details are stored. Rather than subject your customers to the administrative backlog, payment gateways give peace of mind, giving users a straightforward, familiar interface to manage their billing without waiting for customer care or wondering when their payment will be processed.

Traditionally, many customers may have shared their payment details in person, over the phone, or through email. However, the modern customer may be receiving your services from anywhere. Physical proximity is no longer necessary, and with so many companies rolling out virtual services, they will likely be engaging clientele from different regions. Those without gateways risk bottlenecking payment processing and inundating teams with customer complaints as users try to get in touch to change account details, query discrepancies, and confirm receipt of payments.

One can never overestimate the importance of security tools and fraud detection in today’s payment landscape. With cyber crimes on the rise, it’s critical to protect customers from data breaches. One of the key advantages of payment gateways is that the onus of payment security is on the provider.

They’ve entire teams dedicated to keeping their systems up to date with the most advanced features and security compliance. The best gateways are equipped with the most up-to-date security features, such as fraud detection tools, PCI-DSS compliance, and advanced data encryption.

The simplification of every stage of the payment process means that both the customer and your finance team save a considerable amount of time. With phone lines no longer clogged, teams can focus on strategic planning and investigating discrepancies. By automating the process, you can meet customers’ expectations with ease. And with a portal through which they can easily access and update information, customers feel more in control and no longer must make time to resolve simple issues.

It’s no surprise that a frustrating billing process can lead recurring customers to leave, as it’s simply not worth the ongoing hassle. Gateways can reduce customer churn, as those who regularly interact with your payments department no longer face the usual frustrations. Instead, by giving them the tools they need to manage payments with just a few clicks, you will improve their experience, and they will be more likely to base their loyalty on the quality of your products and services.

Declined transactions and missed payments are a considerable strain on resources. If you add up the hours spent chasing down card details and trying to implement effective dunning processes, you might be surprised at how much energy your team could spend elsewhere. Payment gateways automate this process, checking the availability of funds in real time and reducing the likelihood of a build-up of failed payments that your team needs to follow up on.

It is also possible to automate notifications for missed or declined payments if the gateway integrates with your recurring billing system, so that customers can log on to the gateway and quickly update their information.

Customers are no longer confined to purchasing products and services within their market, and it’s common for users to shop online until they find the best possible deal. This means you may have users who use different payment methods than the most common ones available in your region. Payment gateways enable you to accept a much more comprehensive array of payment types and cards. They also allow your customers to pay in the currency of their preference. As a result, you can quickly grow your market share in international markets.

When managing complex recurring billing payments, many focus on the nuts and bolts of invoicing and give little thought to the importance of payment gateways or portals. Companies need to streamline the billing process from head to toe, including payments. Giving your clients secure access to their payment information is essential to a successful strategy.

Ignoring the importance of payment gateways may not impact teams immediately, but most will eventually feel the pressure. As the number of users grows, finance teams need to manage more than a handful of clients, a previously serviceable customer base can quickly become unmanageable. Standards start to slip. Human errors creep in, dunning rises, and coordinating billing becomes increasingly tricky.

It’s not uncommon for overwhelmed teams to send out late or incorrect invoices and fail to update billing information. But how can a payment gateway change that? The answer is simple: by giving clients access to a secure, trusted platform where they can update their payment information, you encourage them to take ownership of the payment process.

There will always be exceptions, but gateways and portals, significantly reduce the time teams need to spend chasing down monthly payments, freeing up your team to focus on more strategic initiatives or to assist customers who might need assistance. If you’re serious about implementing modern pricing models, then payment gateways are critical to your go-to-market strategy.

In a world where customers are used to logging their details in various portals and automating payments, companies that do not offer an adequate gateway or portal may seem obsolete, low-tech, or old-fashioned. It can lead to customer frustration as they need to call or email you directly to update information, and it can increase the stress for a finance team that is ill-equipped to deal with calls and emails from a growing user base. Most customers are also inclined to feel more secure sharing payment details in a trusted portal than over email or phone.

The pushback we often hear about implementing payment gateways is that it’s a lot of bother when teams can call up or email customers directly about billing. This attitude fails to account for the pressures of scaling operations and the preferences of many users. In essence, it’s an attitude that dismisses the importance of serving the customer first.

Your payment gateway must offer you and your users the ability to manage recurring billing in all its complexity. The software used to manage billing processes needs to link directly to the payment gateway to avoid bottlenecks; this is called an integrated payment gateway. It’s better to avoid hosted payment gateways where finance teams must transfer data between multiple systems as they’re separate. As you can imagine, this quickly leads to problems and errors over time.

Users may only see the gateway, but the background engines must be in tune to ensure that billing is accurate across all systems. That way, payments can be safely automated once the invoice is sent out (weekly, monthly or annually, depending on the billing frequency) without having to double- and triple-check details between systems.

Companies must consider the kinds of cards a payment gateway supports, particularly for cross-border customers. Supporting Amex, Visa, and Mastercard transactions is the bare minimum, and it’s worth investigating what payment types are most common where you do business.

It’s essential that recurring billing is as convenient as possible for your users. For instance, do customers in a territory frequently use a debit or prepaid card? What other kinds of payments are common? Though it might only be possible to service some payment methods or cards, companies should seek to strike a balance by at least covering the more popular options in a region.

A merchant account is a temporary retailer account where payments are stored pending approval. Most payment gateways will use this security measure before transferring the payment to the final bank account. This gives the customer’s bank time to run any checks for unusual payments and helps banks cancel out errors like accidental double payments. It’s a payment portal feature that provides an extra level of security. Some gateways process payments immediately, and this can lead to a higher processing fee.

Even if you do not do business internationally, you need to know who your customers might be. Many companies may receive cross-border payments even if they do not necessarily sell into other markets. We live in a world where many people live and work away from their home countries; many of these people end up paying for services and products in their home countries—whether that’s trying to cover medical bills for a loved one or sending a birthday gift.

Your payment gateway or portal should support various currencies so that users can understand their bills quickly and without any hidden surprises. It could be shocking for users in other countries to see the final payment if they thought the currency was their own. This is particularly true for Canadians shopping on US sites that appear to be in dollars. They may assume that these are Canadian dollars if they don’t check. They might leave the payment gateway once they realize the actual cost or cancel the subscription. This is partly because of anchoring or referencing, a concept in pricing psychology, which means that the perceived value of your product has been assigned to the initial assumed cost, and they’re no longer willing to pay more. It’s easy to avoid this by simply displaying the correct currency throughout the payment process.

Some payment gateways offer little customer support, which means your users don’t get the customer care they need when they most need it. Users are often anxious when trying to sort payment errors, so you need to make sure there’s a team on hand that will be ready to help when issues arise. Sending emails or submitting support tickets can add a layer of frustration when customers are already stressed. Look for gateways that offer meaningful technical support, such as 24/7 chat or a helpline, so your users can resolve any issues that might arise.

If you plan to invest in a recurring billing payment gateway, you must consider each option’s usability. The more frequently a customer needs to access your payment gateway, the more likely it is that any failures in UX will become an ongoing frustration. We all know the pain of trying to make payments on systems that are not up to industry standards, and if we had to do so frequently, we might likely abandon ship and find a new service provider. Retaining happy subscribers means you need to pay more for better functionality. For instance, double check it’s easy to download invoices or change billing information.

Providing a payment gateway for your customers will cost, but there should be no hidden fees or charges. Any vendor you partner with should be open and transparent about all expenses that might arise, and you should receive a clear overview of the costs you will incur by investing.

The standard fees you should expect are interchange fees and transaction fees. Other expected costs may include everything from flat fees to chargebacks and IRS reports fees to non-sufficient funds (NFS). If you’re unfamiliar with payment processing charges, this could become an overwhelming list, so it’s essential to communicate directly with your vendor and get clear answers about costs and fees.

Deferred revenue is an essential accounting practice for any scenario where a customer prepays for goods or services. Any team operating a subscription-based business needs to understand its nuances. Whether you’re an established SaaS enterprise or migrating your business to a subscription-billing model, you must understand how to navigate complex revenue recognition while maintaining compliance with accounting standards. Deferred revenue is a critical piece of that puzzle, and this blog clarifies what it is and why it’s reported as a liability.

Deferred revenue refers to advance payments made by a customer for goods and services the company will provide in the future. It’s also known as unearned revenue; since the obligation has yet to be delivered, the payment hasn’t been ‘earned. Deferring revenue appropriately is a key component of revenue recognition for subscription billing.

Following US GAAP guidelines for accounting conservatism, companies must defer revenue anytime there is a delay between when the customer pays and when the obligation is fulfilled. If the good or service is then undelivered or cancelled, the company may owe the money back to the customer.

It’s best practice to recognize revenue as it’s earned and track customer behaviour with a customer aging report. When customers pay in advance, it’s particularly important to keep accurate reports of unearned revenue, so that your company does not invest or use more of its resources than are strictly available.

Deferred revenue and accrued expenses both appear under liabilities on a company’s balance sheet. While deferred revenue refers to money that the business has received in advance of providing goods and services, accrued expenses are money the business owes for goods and services it has already received. One way to think of it is that the two are inverses of each other.

Deferred revenue is commonly held by any business where customers pay in advance for goods and services. Popular examples of businesses with deferred revenue include:

Further reading: The complete guide to 8 SaaS pricing models to grow subscriptions

According to the US GAAP standards regarding revenue recognition, when customers pay for products or services in advance, companies must record the income as a liability on their balance sheet rather than revenue on their income statement. This accounting treatment demonstrates that the company still owes the customer and protects the company from overstating its value.

In the event that the order is cancelled or cannot be delivered according to the original plan (ex. natural disaster, supply chain shortages, bankruptcy), the company must repay the customer their prepayment. Revenue is also taxed in the same period that it’s recognized, so if there’s even a slight chance you’ll have to repay the customer, it’s best to defer the revenue until the goods/services are delivered.

Deferred revenue is a liability until the products or services are delivered, so you will make an initial credit entry under current or long-term liability, depending on whether the sale is under twelve months. You will debit the sales account and credit the deferred revenue account as you earn the revenue.

This process may seem simple, but it can become complex when applied to recurring revenue. If you’re looking for more information, our blog also covers best practices for recognizing revenue under ASC 606 and IFRS 15 and has a special primer for SaaS companies on ASC 606.

Assigning a specific adjustment account to track deferred revenue enables you to record unearned income as a liability and accurately recognize revenue as you fulfil the performance obligation(s) in your contract.

For this example, let’s assume that you’ve secured an annual subscription with a client at a flat rate of $18000. The client pays the full amount upfront; however, you cannot recognize the full $18000 until the service has been provided. You must evenly divide the total across one year, which is the duration of the contract, and recognize the revenue in increments.

For the first month, you recognize $1500 and defer the remaining $16500 to an adjustment account. For each month after that, you’ll credit the deferred revenue account and debit the sales account $1500.

Complex revenue recognition is unavoidable in any business model that employs subscription billing, but it doesn’t have to be complicated. A robust subscription management solution like Subscription Billing Suite can simplify the process by automating deferred revenue and enabling you to remain compliant with accounting guidelines such as ASC 606 and IFRS 15. Your accounting team can focus less on repetitive, mundane tasks and redirect their attention to what matters.

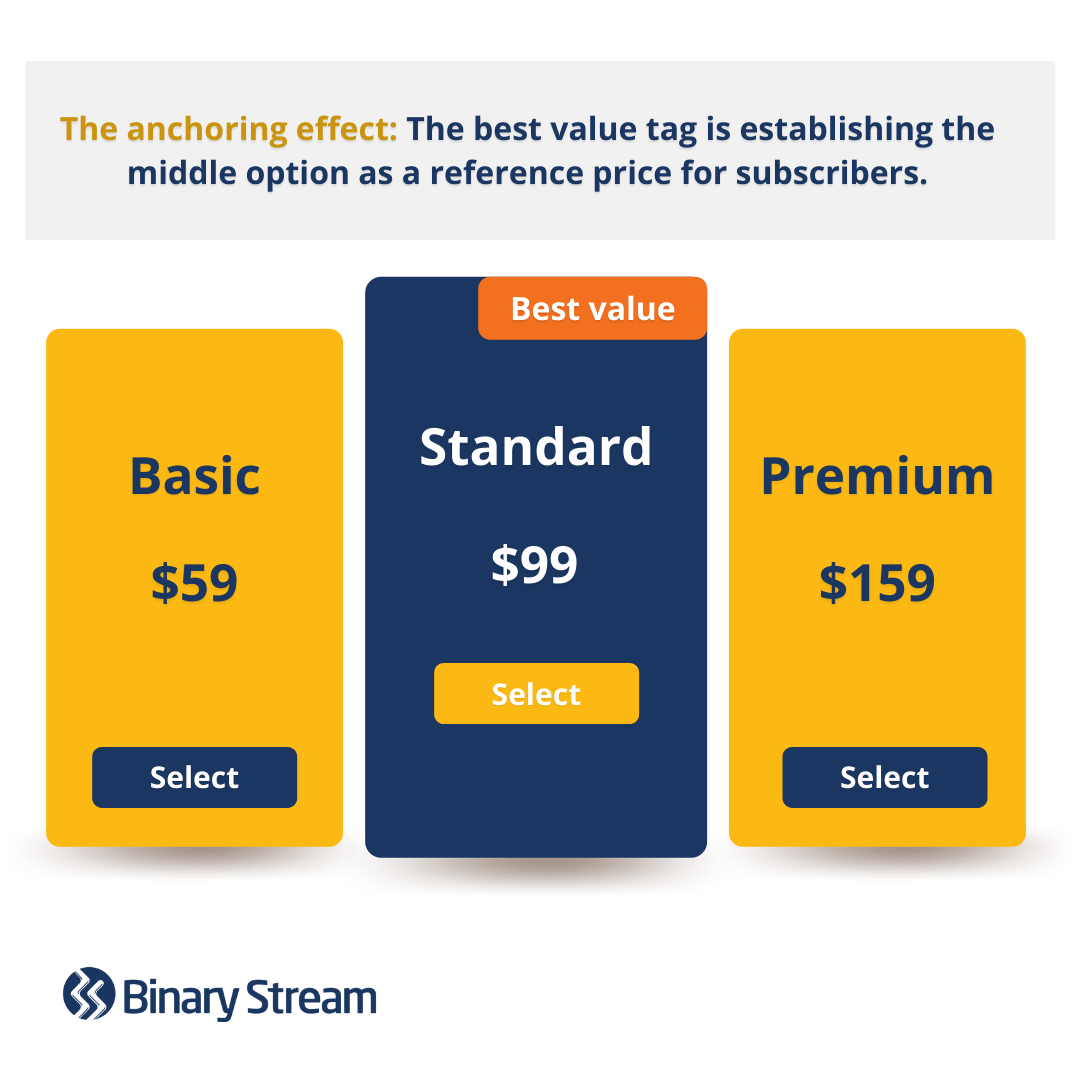

Premium pricing strategies pair well with many of the common subscription billing models and are most often used to establish a perception of higher quality in the marketplace. Traditionally, luxury brands tend to opt for this pricing strategy; however, these days, it’s used in every industry to denote better quality services and products. SaaS companies that have built a solid brand reputation often use this pricing approach in the advanced tiers that offer access to the most features.

Those hoping to implement premium pricing will want to evaluate their market position and make an informed decision by weighing the pros and cons. This blog breaks down the advantages and disadvantages, offering examples of the strategy in action, so you can make an informed decision about whether it will work for you.

Premium pricing is best used where there is brand recognition, and a company has garnered a reputation for high quality in a specific market. Newer brands might start with lower pricing, implementing higher price points as reputation grows, and there’s a strong foundation of social clout, reviews, recommendations, and recognition. It may be premature to implement higher price points without first developing a demand for your products and services.

Premium pricing strategies can also be used effectively in tiered offerings to help increase the perceived value of more affordable tiers. It’s well-known in pricing psychology that many customers will gravitate towards mid-tiers, and higher price points on the final tier can make mid-level options more attractive. At the end of the day, choosing whether premium pricing is the way to go will require comprehensive market research, a close analysis of subscriber churn metrics, and a solid understanding of your costs. You can learn more about choosing the right strategy for your company here.

The SaaS industry is a notoriously competitive market, but one in which Microsoft has built an incredible reputation. There’s no question that most of us can quickly recognize the brand. They offer numerous affordable options, and the level of service and quality associated with Microsoft means they can implement premium pricing on select services and products. For instance, Xbox Series X builds on Microsoft’s reputation, giving gamers access to the console they know and the games they’ve come to love at a premium monthly rate. Alternatively, users can buy the console outright, but they will not have access to the Xbox Game Pass.

The retail industry is a place where premium pricing is associated with high-quality brands. Canada Goose prices its coats above the average cost, confident in the reputation and recognition it’s built over the years. It’s an interesting example as many of the premium-priced retail brands are designer options, but the pricing here is based on the known warmth and durability of the products. These coats are everywhere in colder North American cities, with consumers happy to pay more for the perceived value.

Nowhere does premium pricing come with higher expectations than in the hospitality industry. Brands like Fairmont invest in exceeding standards at every level of their offering. The entire experience caters to premium tastes, from luxury suites to fine dining. Customers expect to be whisked away from the real world into the lap of luxury.

Successfully implementing premium pricing strategies will require flexibility in your accounting department. Teams may need to run multiple pricing experiments and require a subscription billing solution that can effectively handle the complexity of pricing models, billing frequencies, and deferral schedules. Get the basics right by investing in a solution that automates even the most complex billing schedules and empowers you to conduct as many pricing experiments as you like without causing unnecessary work for the accounting team.

With the advent of SaaS migration taking the world by storm, it’s no surprise that many companies are asking questions about handling recurring payments better. Many accounting teams are struggling to keep up with the increased usage of subscription billing models, failing to put in place the software and best practices they need to handle the sheer volume of invoices generated by offering a variety of billing cycles.

The management of recurring payments requires a firm grounding in compliance standards, the automation of time-sensitive and repetitive tasks, and a solid understanding of revenue recognition and deferral schedules. It’s a lot to master. The complexity of introducing a new payment strategy is simply part of keeping up with evolving customer expectations.

The growth of SaaS migration and billing options across industries means that few companies can afford not to put the right tools and best practices in place. Below you’ll learn nine best practices to help you manage recurring payments.

Modern billing models can introduce different revenue streams at varying frequencies. Some customers may pay for a year upfront, requiring you to defer the recognition of that revenue until you earn it. In contrast, others may spread the cost of their subscription over time so that you earn and recognize revenue in synch.

Flexibility is the key to success. Chances are that the more options you offer, the more users you will be able to sign up. However, it’s worth noting that introducing various options can strain the accounting department. Brief the entire team on revenue recognition for subscription billing to optimize their efforts and reduce manual labour.

With the rise of cyber-attacks, companies cannot underestimate the importance of protecting customers’ information (particularly regarding payments and billing) from any threat. Nobody is immune, so it would be remiss not to invest in security measures enabling you to collect and store billing information for recurring payments while maintaining your data integrity.

Many savvy customers will check the ratings of the payment portals and systems you implement, so be sure to consider the reputation of your partners. Partnering with established brands that customers recognize makes it easier for them to entrust their payment information to your system. Users will differ in their prioritization of this measure, but many will never sign up if the early stages of the payment cycle do not feel secure.

Have you ever signed up for a subscription service, only to find yourself wondering about a few things later? Maybe you aren’t sure about the service and want to double-check the cancellation terms, or you’re not entirely sure how refunds work, or perhaps you need to update your credit card information. Chances are the payment policies you ticked when you signed up covered all this, but you didn’t have time to read through them thoroughly.

It’s best practice to make payment terms and processes transparent on your website. The reality of today’s world is that there aren’t always enough customer agents on hand to answer all our customers’ questions. Building out knowledge bases, particularly around critical information like payments, will reduce the workload on your team by making most of the information customers require transparent. Measures like this help build customer confidence because they don’t have to suffer long wait times or engage with a defective chatbot.

Often, there’s a disconnect when communicating effectively with our customers concerning minor changes. With so much automation at the heart of SaaS migration best practices, it can sometimes be easy to forget the human aspect of things.

Significant shifts will occur as you hone your SaaS pricing strategies and respond to outside forces such as inflation. Every time there’s any billing or payment process change, you must invest in clearly communicating this to your user base. Inform them of tweaks regardless of how “inconsequential” you think these might be, for instance, security improvements, cancellation policy updates, new billing options, or a change of payment processor.

Failed payments are a fact of doing business. Whether the case is expired cards or a technical error, it still impacts your bottom line. Particularly with subscriptions, it’s critical to recoup as much revenue leakage as possible to bolster monthly recurring revenue (MRR). An effective dunning strategy enables your team to protect against revenue losses more effectively.

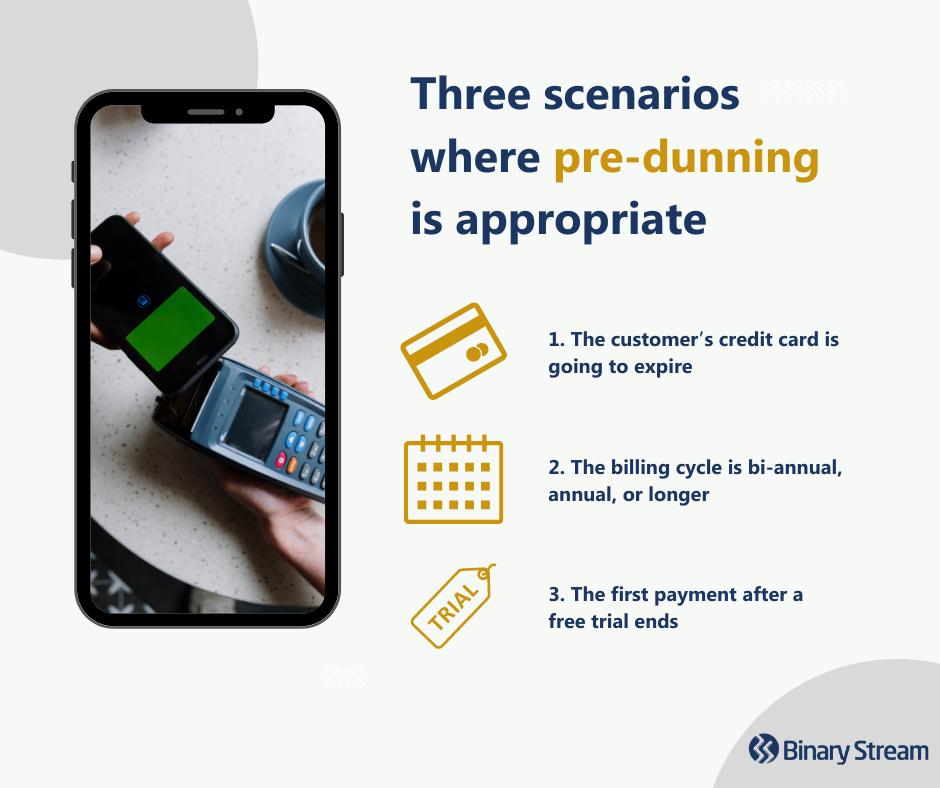

Modern billing requires effective dunning management to boost revenue and prevent involuntary subscriber churn. Solid strategies should include pre-dunning communications strategies to remind customers that upcoming payments might fail due to expiring cards. Check out this guide to mastering dunning management for a thorough breakdown of how it prevents revenue leakage and helps bolster your subscriber base against churn.

Effective reporting is a crucial component of successfully collecting recurring payments. With extensive user bases, it’s easy to lose track of subscriber churn, so companies should invest in software that automatically generates reports that reflect key churn metrics.

These numbers are essential for understanding growth and financial health and can be valuable tools for customer acquisition and retention. It’s possible but time-consuming to report on these metrics manually, although, for scaling companies, it may not be feasible to keep track this way. Are you seeing a sharp increase in churns after your free trial? Get curious and find out why. Chances are the churn rate is pointing to something your team has the power to fix.

One of the most significant improvements most companies need to make to their recurring payments is increasing the flexibility around billing frequency. Users will often be subject to different restrictions in terms of cash flow. For instance, smaller companies or individuals might struggle to pay an annual fee upfront, preferring to spread the payment over the year. More prominent companies might work with a fixed quarterly or yearly budget and choose to pay upfront.

The point is that your customers not only like but expect to choose. Offering flexible payment terms and frequencies allows customers to decide which day their payments occur. It is as much about reducing failed payments as it is about increasing customer satisfaction. It is also one of the best ways to ensure customers have enough funds available when the bill arrives.

Compliance with GAAP is one of the main concerns of most accountants. The introduction of ASC 606 and IFRS 15 concerning revenue recognition for recurring revenue may make some companies reluctant to take the plunge. Critical to achieving success is keeping track of earned and deferred revenue, and plenty of guidelines are available to ease your team into the transition. With transparent, auditable reporting in place, compliance doesn’t have to be complicated. Check out this guide to ASC 606 for a primer on the expectations for recurring payments.

It’s almost impossible to keep pace with modern billing without implementing subscription management software. Even the most agile teams will struggle to meet month ends if they stick to older accounting processes and systems. Your software should allow customers to pause payments easily, update billing information or upgrade to a different tier of services. All this functionality must integrate with the backend to update accounts automatically without causing unnecessary confusion.

Look for solutions that speak to the nuances of frequent recurring billing. Make sure you invest in software that enables dunning, streamlined reporting, flexibility around payment frequency, and automation of time-consuming processes that slow your team down. Check out the essential features to look for in subscription management software here.

In recent years, the hospitality industry has weathered massive disruptions. To stay afloat, businesses leapt into the subscription economy and adopted recurring billing strategies. Welcoming these innovations introduced a fundamental shift to relational business models, which allowed organizations to retain a steady stream of income even during lean months.

The hospitality industry is comprised of four different sectors: lodging, food and beverage, recreation, and travel and tourism. The most successful businesses centre on novel subscriptions that serve a specific niche within their sector and are taking full advantage of the benefits of a subscription business model, including increased customer lifetime value (LTV) and greater return on customer acquisition costs (CAC).

This blog explores the creative ways leading companies have incorporated hospitality subscription services by analyzing a modern-day example from each of the four sectors.

Interested in a specific sector of hospitality? Click on the example below to skip ahead.

When you think of hospitality, lodging is likely the first sector to come to mind. From hotels to vacation rentals, overnight accommodations for guests are an integral part of the industry. However, a lesser-known fact about this sector is that the pool of potential customers is expanding.

With the increasing prevalence of work-from-home options, some telecommuters have transitioned to a nomadic lifestyle. These “digital nomads” work remotely out of a new city every few weeks to months, necessitating frequent temporary accommodations. Extended stay hotels and multi-location hotel subscriptions are increasingly in demand.

Inspirato is a luxury travel club and one of a few emerging companies that are designed with the digital nomad in mind. The Inspirato Pass allows customers to choose a hotel from over 100 locations and stay for up to two months, replacing nightly hotel rates, taxes, and extra fees with the subscription fee of $2,500/month. Founded in 2010, the enterprise’s estimated value is $1.1 billion and boasts over 13,000 subscribers with 18% growth in the past year alone.

Often confused with the food services industry, the main components of the food and beverage sector include the preparation, transportation, and service of food or beverage to customers. These businesses tend to be some of the most successful and are frequently categorized into the overlapping industries of franchising and retail.

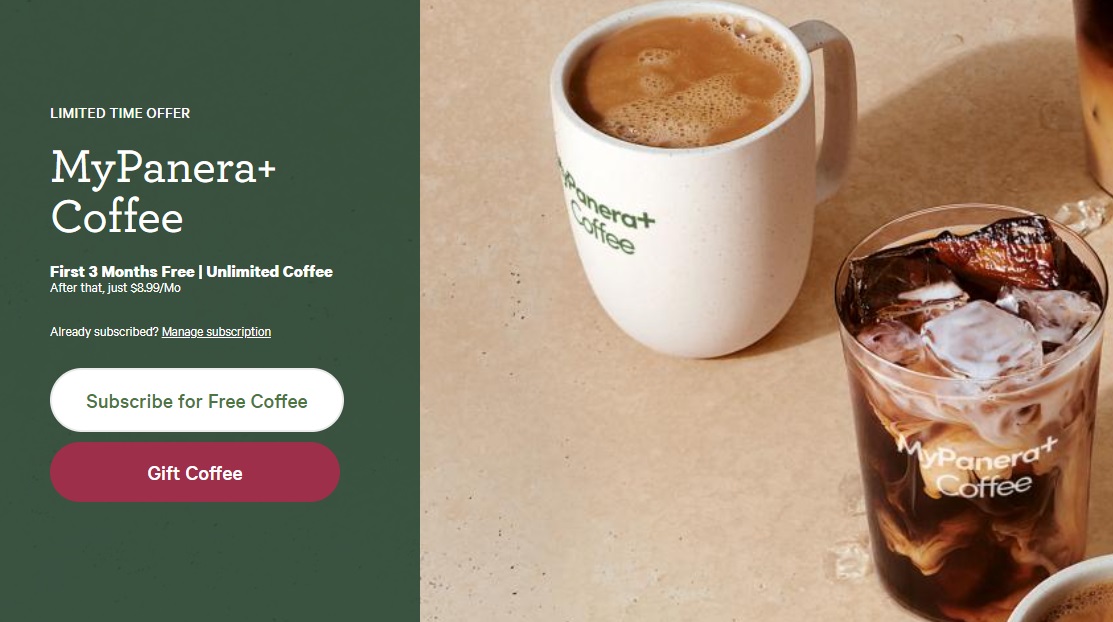

Hotel breakfast bars, catering companies, fast food establishments, cafes, pubs, and five-star restaurants all fit within this sector; however, paired with this ample opportunity is abundant competition. Panera’s coffee subscription is a notable success story within the food and beverage sector.

For context, Burger King attempted to get a leg up on other fast-food giants, like McDonald’s and Starbucks, by offering a daily small, hot coffee for $5/month. Unlike its one-cent whopper strategy, this one completely backfired, and the company discontinued the service shortly after it was introduced in 2019.

So, expectations were low when Panera launched its coffee subscription service for $8.99/month one year later, in 2020. However, Panera’s subscription included hot drip coffee, iced coffee, and hot tea once every two hours with unlimited refills while customers were in the cafe.

These bold differences expertly applied principles of pricing psychology, yielding wildly successful results. In May 2022, Panera unveiled a second subscription service, the Unlimited Sip Club, that offers an expanded variety of beverages for $10.99/month.

The recreation sector is key to the hospitality industry. Local attractions and entertainment play a vital role in providing memorable customer experiences and contributing to the region’s culture. The most common businesses in this sector include amusement parks, museums, art exhibits, zoos, and campgrounds.

These companies rely on admission tickets, merchandise, and concessions sales to generate revenue, which can be a tricky balancing act to pull off through the wax and wane of tourists. Therefore, many of these businesses offer hybrid subscriptions to bolster their income from locals, returning visitors, or guests who want to explore multi-location establishments.

Universal Orlando’s annual amusement park passes start at $23/month after down payment. These subscriptions cover admission and, depending on the tier, a benefits package that includes perks like preferred parking, merchandise and concessions discounts, and early park admission. Florida residents can also benefit from reduced rates for all tiers of annual passes.

Travel and tourism allow customers to experience destinations beyond their hometowns. This sector has the most crossover with its counterparts because it encompasses the entire experience of the trip, not just the transportation to get there.

Travel agencies are one of the most well-known organizations within this sector, often taking on the logistics and reservations for everything from booking flights to choosing a hotel to scheduling business meetings. The endurance of these businesses is attributed to a fact all too familiar to frequent flyers: coordinating travel plans can quickly become an arduous task.

Hotels that partner with Tripadvisor have the opportunity to tap into new customer bases and potentially increase their bookings. For $99/month, travellers can enrol as a member with Tripadvisor Plus and gain access to an array of bundled savings on hotels, food and beverages, and experiences. According to their website, customers save on average $350 the first time they use their membership.

Managing a subscription service can quickly get out of hand without the proper tools in place to handle huge amounts of data, adjustments to complex pricing strategies, and data-driven reporting. Unless you invest in the appropriate technological foundation, it will be nearly impossible to meet the goals of your growth journey. A robust subscription management solution, like Subscription Billing Suite, takes care of the nitty-gritty, freeing up your team to strategize. It’s available as an embedded extension in Microsoft Dynamics 365 Finance, Business Central, and GP.