Digital innovations are transforming the role of today’s finance department. Industries across the board are feeling the push to evolve with 85% of finance teams undergoing or planning a financial transformation. Modernization paves the way for finance departments to become better business partners and transcend their role from data collectors to data analysts who build out a 360-degree view of their clients.

Although some worry that the process is too expensive, refusing to go digital is an even costlier mistake, rising demands and exponential volumes of data mean that it’s now impossible for companies to scale without the assistance of technology. Nearly 70% of finance and accounting (F&A) leaders report manual processes as the biggest bottleneck in financial close and accounting operations.

Financial transformation gives your organization the opportunity to realign the function of the finance department with your overall business goals. In this blog, we break down the 8 benefits of financial transformation.

Increases agility with data-driven decisions

Business decisions are more informed now than ever before as customer data can be quantified and analyzed for patterns. AI-based predictive analytics and rolling forecasts empower you to assess the health of your business, improve financial controls, and optimize cash flow so your business can make quick pivots to adapt to a rapidly changing landscape.

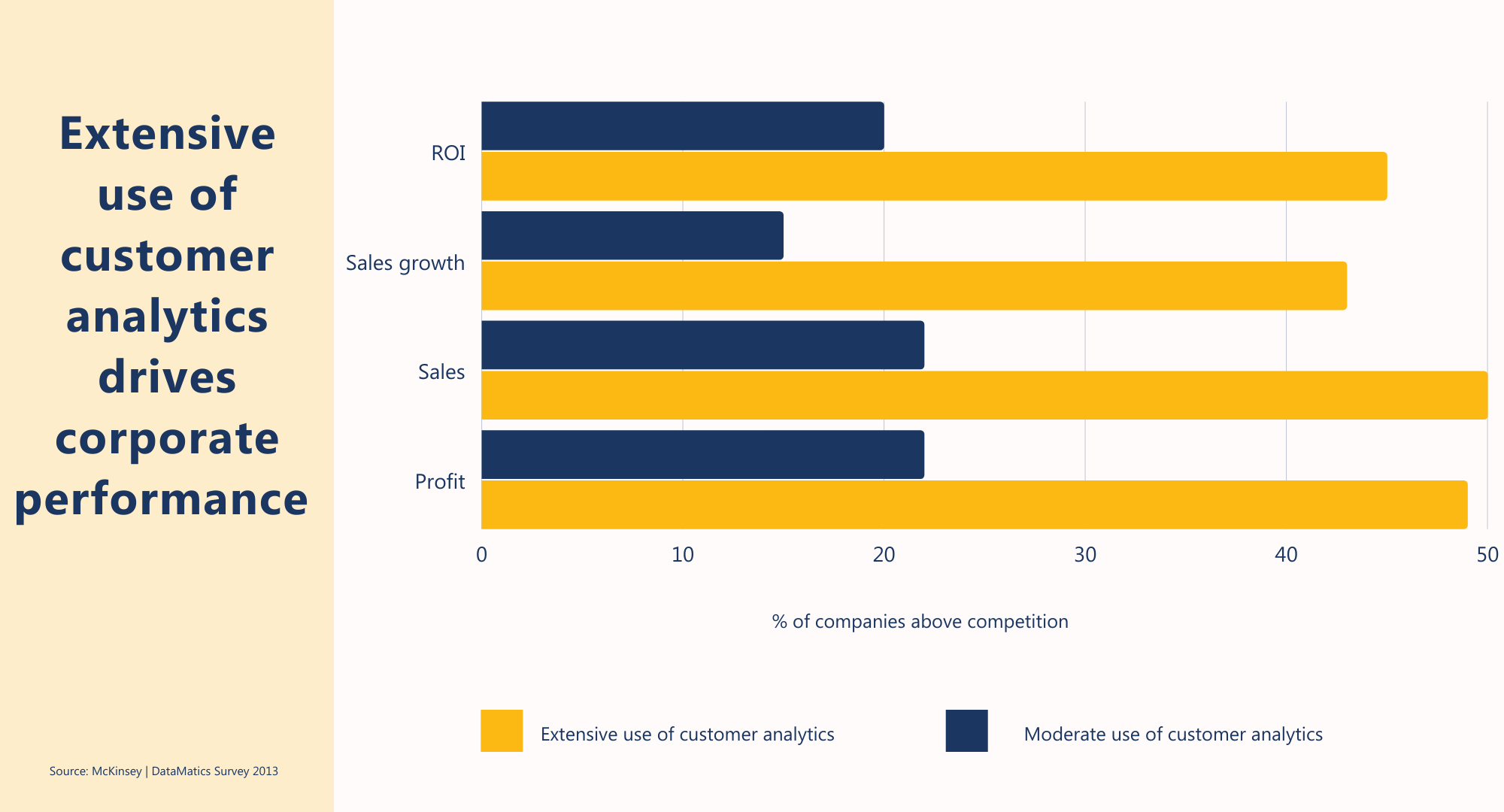

McKinsey reported that data-driven organizations are 23 times more likely to outperform their competitors in terms of new customer acquisition and nine times more likely to surpass them in customer loyalty. Easy access to accurate insights keeps your organization agile and prepared to thrive in the face of market disruptions.

Better customer service with real-time reporting

All businesses need to focus on growth, but successful companies place equal emphasis on ensuring their practices are sustainable. Real-time reporting helps you mitigate risk to protect your business’ health and viability while empowering your team to hone services for optimal customer satisfaction and loyalty.

48% of consumers expect specialized treatment for being a good customer, but only 22% acknowledge that companies tailor their experiences based on a deep understanding of their needs, preferences, and past interactions. Streamlining your revenue recognition process and calculating your churn rate are two important metrics that can help identify potential issues before they spiral out of control.

Expands financial capabilities due to process automation

By 2025, it’s anticipated that the global amount of data will reach 175 zettabytes. To put that into perspective, if one byte were equal to one grain of rice, you would need to fill the entire Pacific Ocean with rice to get the equivalent of just one zettabyte.

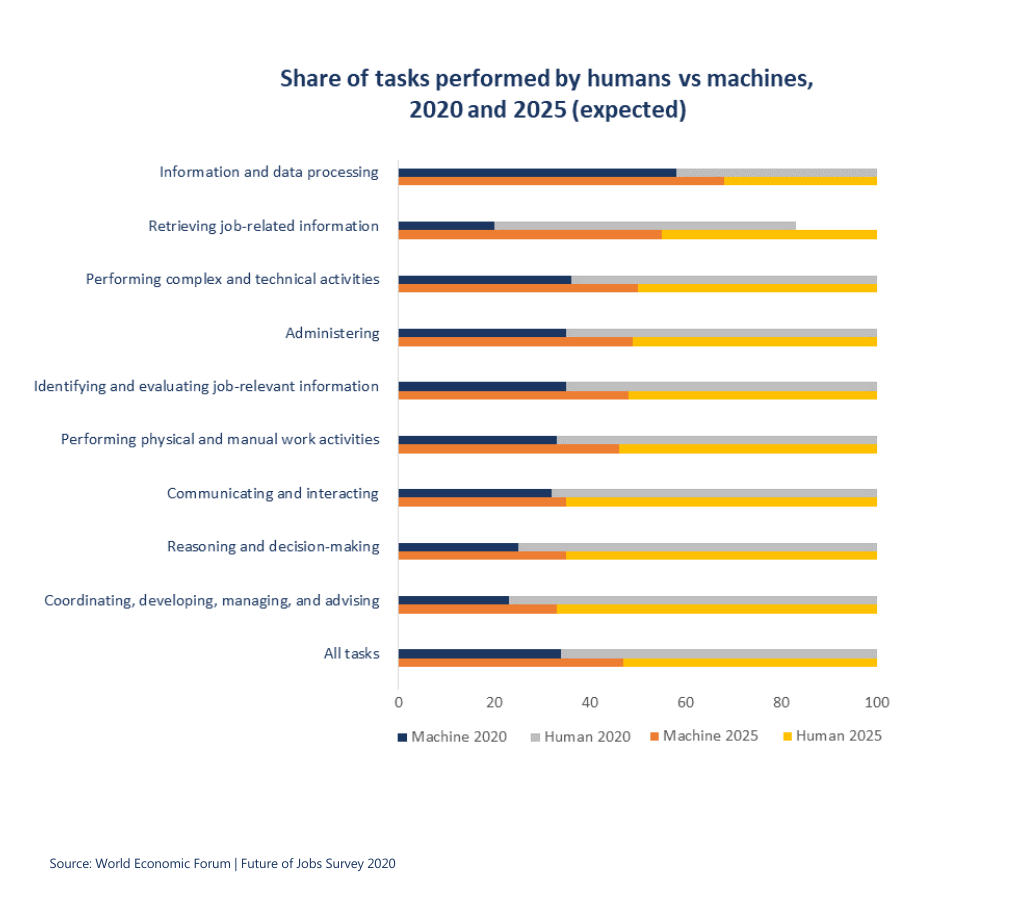

Modern finance departments combat this onslaught of data with process automation. AI-based processes enhance financial capabilities and facilitate proactive credit management, bank management, and revenue recognition.

Automating tasks also reduces human errors from manual data entry and headcount, which both significantly decrease overhead. The department can save time, money, and stress by being less shackled to traditional accounting cycles while still outperforming your competitors.

Strengthens information security

Your finance department handles a lot of sensitive information. From details about vendors to customer transaction records, it’s important to store your data securely. Contrary to popular belief, analogue methods often do not provide the best protection against security breaches. Even paper files can be disposed of incorrectly or stolen, as was seen in 2015 when a Florida-based medical clinic lost over 480,000 patient records due to paper documents falling out of a truck hired by a third-party waste disposal company.

A financial transformation provides you with the opportunity to upgrade your systems and invest in the gold standard for security. There are even options available that will scale with your organization as it grows. Robust security protocols along with SSL encryption, two-factor authentication, advanced firewalls, and automated notifications for new sign-ins are a few essential features to look for if you’re considering upgrading your system.

Simplifies regulatory compliance

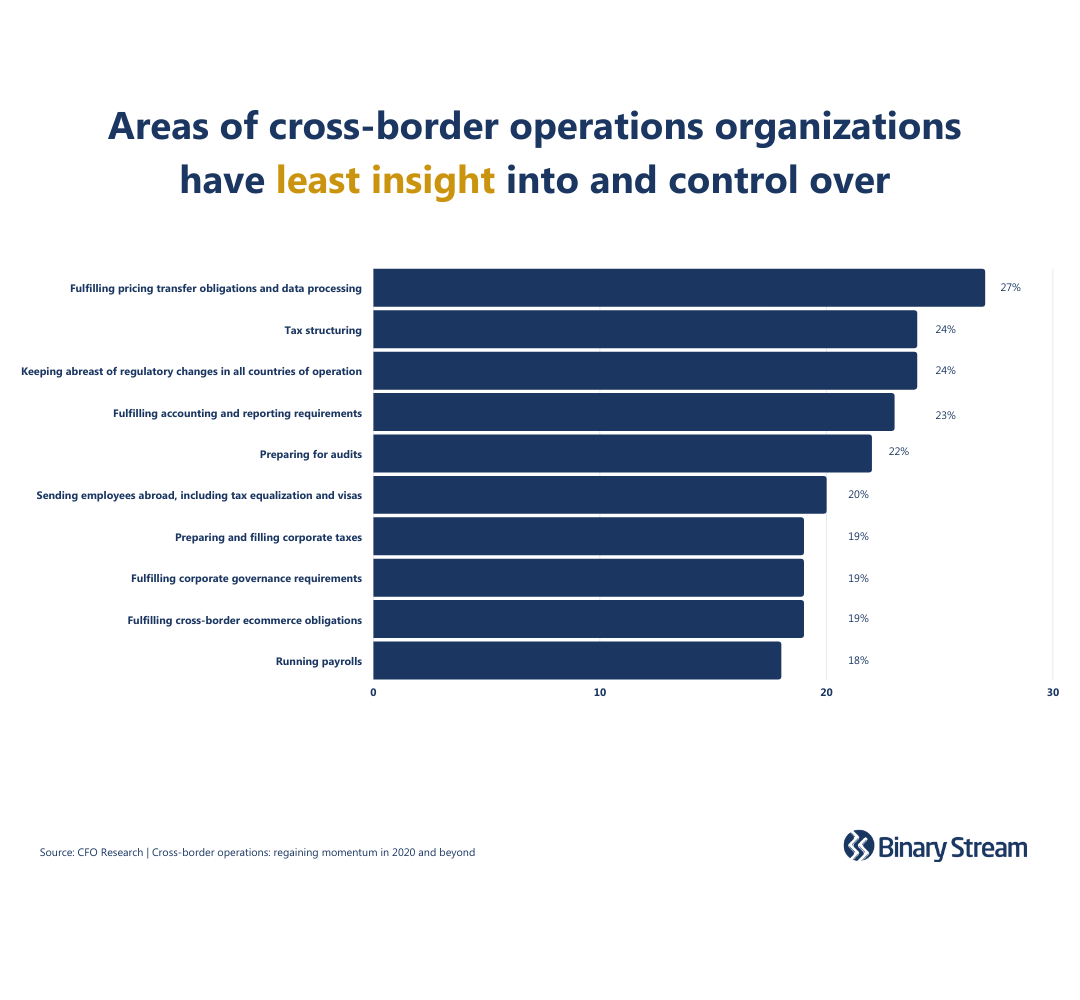

Staying on top of regulatory compliance can be tricky, given regulations are constantly changing and vary widely across industries and regions. Trends in new business practices demand updates to compliance standards. The rise in popularity of recurring billing models and operating leases has led to the introduction of ASC 606 to account for recurring deferred revenue and ASC 842 to resolve off-balance sheet expenses, respectively.

Fortunately, modern financial management features such as globalization and tax configuration, e-invoicing, centralized payments, and electronic reporting formats make it much easier to stay compliant. Tools that help to maintain compliance are indispensable, given the average cost of non-compliance is almost $15 million.

Increases intercompany collaboration

Data accessibility and management have never been easier. Collaborations across departments are smoother when there’s one unifying source of information, and ultimately it becomes quicker to perform operations, including time to close. By consolidating information across departments into a centralized database, you can avoid bottlenecks and ensure your team performs to the highest standards.

The move to digital will also allow your team to work from anywhere in the world, whether that’s at home or halfway across the globe. Collaboration becomes a continuous process where your employees are no longer dependent on traditional accounting cycles, nor must they work odd hours to accommodate different time zones.

Facilitates globalization initiatives

World gross domestic product (GDP) grew from $50 trillion in 2000 to almost $85 trillion in 2020. By expanding into new territories, businesses can realize greater profits by tapping into previously untouched markets and taking advantage of lower local costs.

However, there are a host of complexities associated with entering new geographic regions. You may have to coordinate product lines across borders or entities located in different countries—not to mention respectfully manage cultural differences, overcome language barriers, adapt to market disruptions, and keep track of multiple currencies and inflation rates.

Internal readiness is key to a successful globalization strategy, which is why a financial transformation will shore up your operations and lay the groundwork for sustainable expansion. Having technology on your side will make it easier to manage your company as it continues to grow.

Freedom to innovate

One of the biggest, overarching advantages of financial transformation is that it moves your business from the passenger seat to behind the wheel. You can regain control of the company’s direction and take action to become a leader of innovation. When technology is set up to do the heavy lifting of data management, your team is free to explore new strategies.

Resources to inspire your innovation journey:

- Choosing the right subscription pricing strategy to grow your company

- 5 ways to maximize your property lease management strategy

- A comprehensive guide to SaaS pricing models (with examples)

- 4 secrets to better subscription pricing psychology