Subscriber churn metrics are essential for any SaaS company hoping to scale as they give insight not only into where you’re going wrong but how you can fix it. Traditionally, churn rates were hard to calculate. If you think of the average bricks and mortar set up, it’s easy to see that getting reliable data and churn metrics could be tricky.

In contrast, today, you’re equipped with more than enough data to easily track churn metrics and use this information to make adjustments where needed. The benefit of knowing your churn rate, it being able to try and reduce it.

Your churn metrics are a good litmus test for business health and viability. Happy customers will continue their subscriptions, but if you have a high churn rate, there may be elements of your service that need tweaking.

It’s easy to overlook churn metrics, and often companies wait until it’s too late before they focus on it (i.e., churn rates are soaring, and so they start to worry). Arguably, it’s better to focus on reducing churn rates even when they are low. Trying to figure out why customers are leaving is valuable information, as it allows you to find ways to keep customers and tweak your services before more subscribers jump ship.

Many SaaS companies have ignored churn metrics to their detriment. It’s not hard to do. When funding is skyrocketing, and the scale of your operations is expanding, it may feel unnatural to focus on a few losses, but those losses can start to accumulate.

Blue Apron is a cautionary tale for any business that thinks they can ignore subscriber churn metrics. They experienced phenomenal growth, but 72% of their customers cancelled subscriptions within the first six months. If they had focused on reducing those churn metrics, perhaps they would have found ways to make their business model more sustainable.

What is subscriber churn?

Subscriber churn is the rate at which customers cancel their subscriptions with a service. It is often expressed as a percentage and given a time constraint. For example, an average monthly subscriber churn would be the number of subscribers who discontinue their use of a service on average per month.

The two types of subscriber churn

What is voluntary subscriber churn?

Voluntary subscriber churn is when a customer chooses to end their subscription. Subscribers might decide to cancel a subscription in this manner for any number of reasons, perhaps their perception of the value of your product has changed, or they have experienced poor customer care. If possible, it’s essential to try and find out why so that you can build a strategy to reduce voluntary churn.

Involuntary subscriber churn

Involuntary subscriber churn is when the subscription terminates without the customer’s awareness. It may be a failed payment due to insufficient funds, expired credit card details, or the bank’s fraud prevention system.

How is subscriber churn calculated?

There are several subscriber churn metrics you should keep an eye on, which we will detail in full below. However, the short answer is that to find out your monthly subscriber churn. You need to subtract your monthly recurring revenue from recurring subscriptions at the beginning of the month and divide it by the number of subscribers lost that month. However, this is perhaps too simplistic and will not give you a full understanding of your subscriber base and predictable recurring revenue.

Five metrics you should know if you want to lower subscription churn:

- The number of subscribers you have

- The average customer lifecycle

- The average customer lifetime value (CLV)

- Churn rate from your last billing period

- Churn rate for the same billing period the previous year

If you want to know how to calculate the customer acquisition cost (CAC) or lifetime value (LTV), read our blog on SaaS acquisition and retention metrics for sustainable growth.

Calculating subscriber churn metrics (with examples)

The four subscriber churn metrics we will show you how to calculate below are:

- Subscriber churn rate

- MRR churn rate

- Gross MRR churn rate

- Net MRR churn rate

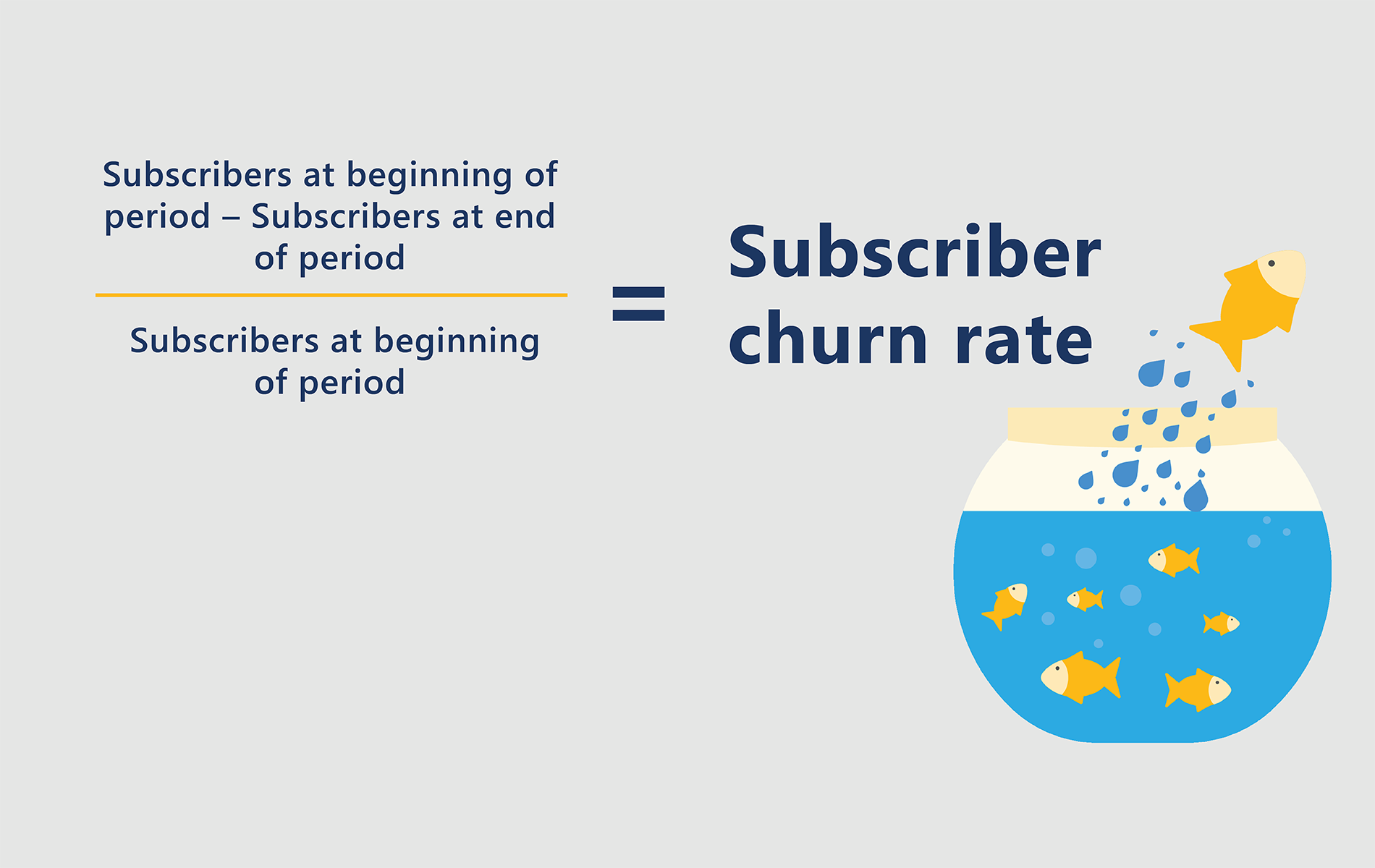

Metric one: calculating subscriber churn

When calculating subscriber churn, you need to know:

a) Number of subscribers at the beginning of a billing period

b) Number of subscribers at the end of the billing period

You need to subtract the subscribers at the end of the billing period from those at the beginning. Then, divide this figure by the number of subscribers at the beginning of the period.

Let’s take a look at an example. You have 500 subscribers at the beginning of the payment period, and 15 customers unsubscribe, leaving you with 485 subscribers at the end of the period.

Calculate subscriber churn rate with the following sum: (500-485)/500

So, the churn rate in this instance is .03%

What is a sustainable subscriber churn rate?

Generally, 2-4% customer churn per month is healthy if the business is offsetting this loss with new revenue or expansion. If not, the churn rate will grow over time, and if the revenue is not replaced, churn rate could become as hefty as 24% annually. Monthly churn is a good indicator of health but must be balanced out with new business to avoid this occurrence.

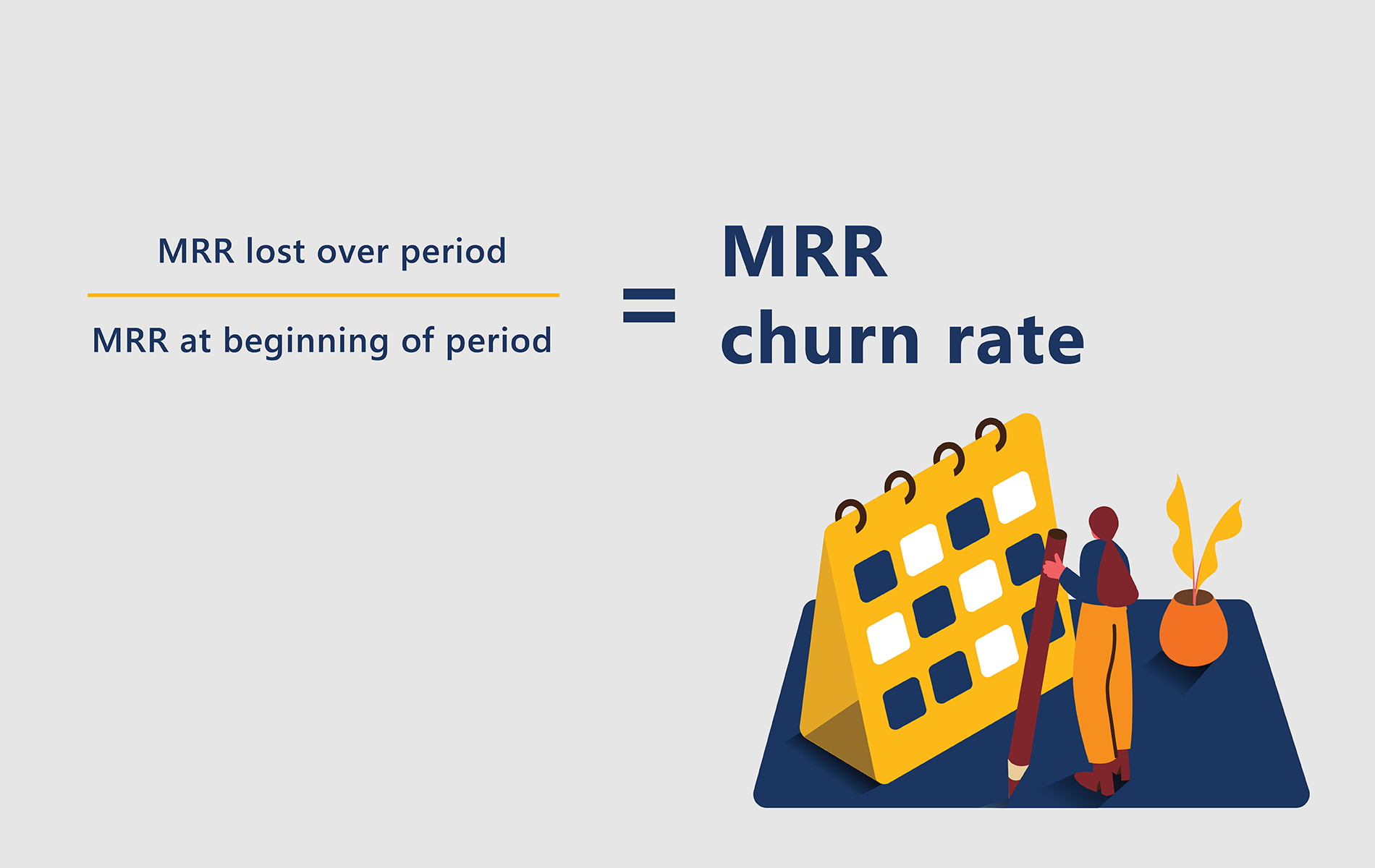

Metric two: calculating monthly recurring revenue (MRR) churn rate

MRR churn is the sum of cancelled contracts within a certain period. It might sound familiar to subscriber churn, but there is a difference. MRR churn is a financial measurement, whereas subscriber churn is a calculation of customer’s lost. MRR churn is critical as it measures monetary deficits through delinquent payments or lost revenue.

When calculating MRR churn, you need to know:

a) Monthly recurring revenue (MRR) lost over the period

b) Total MRR from the previous period

c) Do not include any new business acquired in the period

You then need to divide the lost MRR with the MRR from the previous period.

Let’s take a look at an example. You have $54,000 of MRR in January, but in February, you have $745 of lost MRR.

Calculate MRR churn with the following sum: 745/54,000

So, the MRR churn rate in this instance is .01%

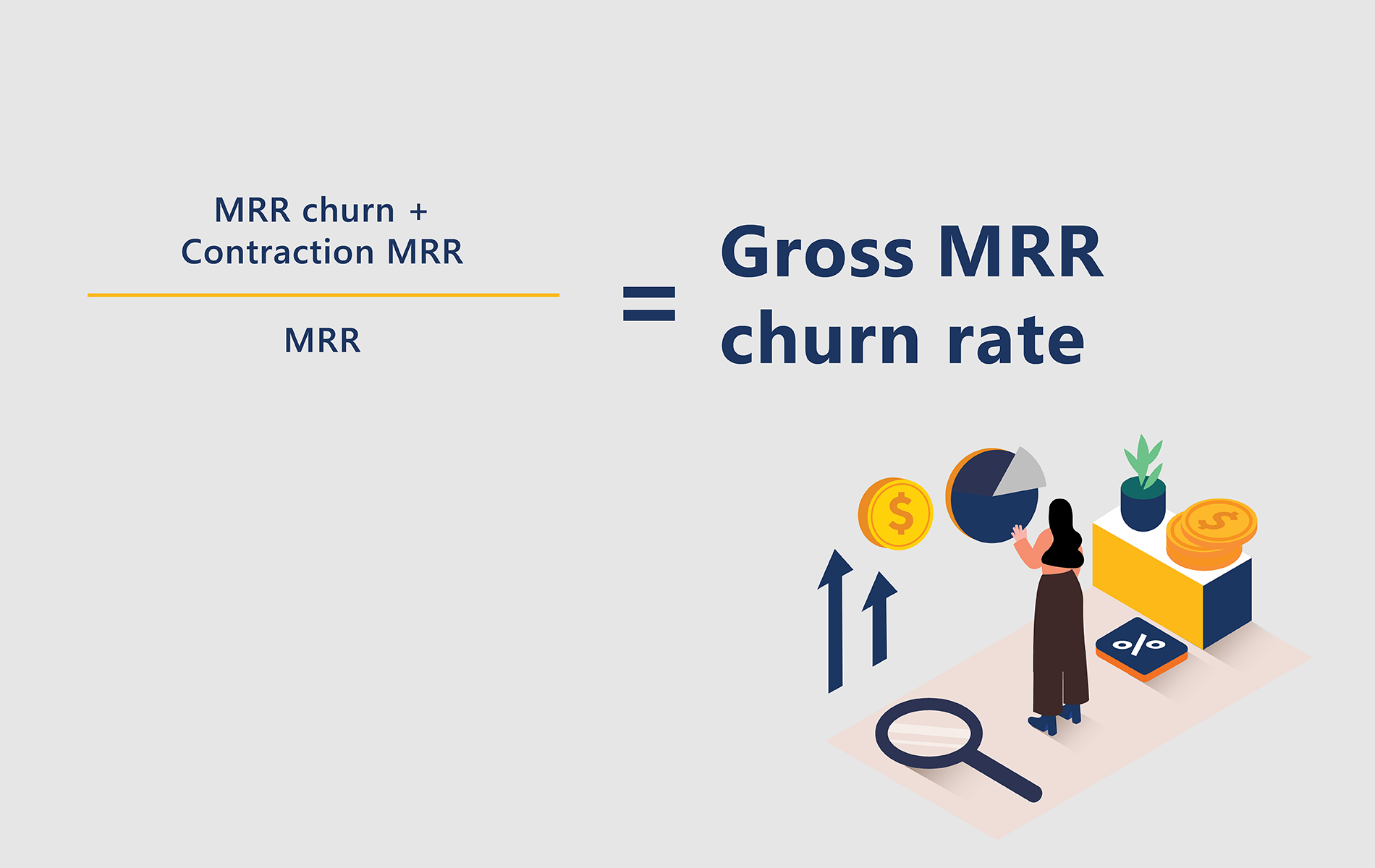

Metric three: gross MRR churn rate

Gross MRR churn rate gives you a full view of lost revenue from your customer base. It combines the total amount of revenue lost from contracts cancelled with revenue lost from contracts downgraded over a specific period.

When calculating the gross MRR rate, you need to know:

a) The MRR churn (i.e. MRR lost in a period from cancelled contracts)

b) The contraction MRR (i.e. MRR lost in a period from downgraded contracts)

c) The MRR within that period

You then need to add the MRR churn and contraction MRR to give you the gross MRR churn. Then, divide the gross MRR churn by the MRR from that period.

Let’s take a look at an example. Your MRR for the period is $65,000. You have $7,500 downgraded subscriptions and $900 cancelled subscriptions.

Calculate gross MRR churn with the following sum: (900 + 7500)/65,000

So, the gross MRR churn in this instance will be: 0.13%

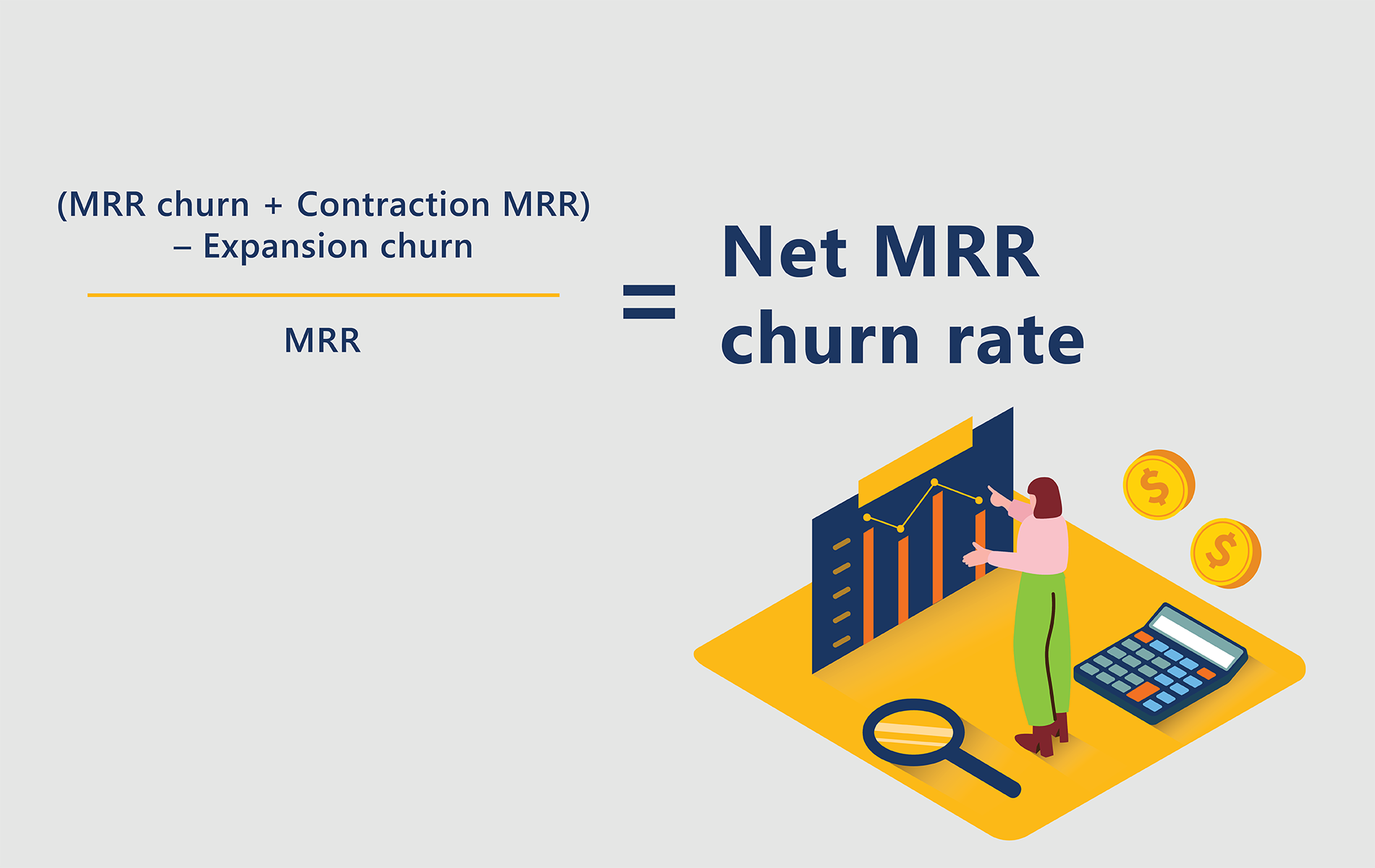

Metric four: Net MRR churn rate

Perhaps the most comprehensive subscription churn metric, Net MRR churn, considers total loss from terminated contracts alongside other factors like revenue from expansions, upgrades, or other contract modifications. It is the best metric for predicting income from your current subscriber base.

When calculating the net MRR rate, you need to know:

a) MRR churn from period

b) Contraction MRR from period

c) Expansion MRR from period (i.e. revenue generated from upgrades)

d) MRR at the beginning of the period

This calculation requires the most steps. First, you need to get the gross MRR churn by adding together the MRR churn and contraction MRR. From this figure, you need to subtract the expansion MRR. Then, divide this number by the MRR at the beginning of the period.

Let’s take a look at an example. Your MRR at the beginning of the period is $64,000. You lose $500 in MRR churn and $300 in contraction MRR. You gain $960 in expansion MRR.

Calculate net MRR churn with the following sum: [(500 + 300) – 960]/64,000

So, the net MRR churn in this instance will be: 0.003%