A strategic new partnership between Binary Stream and Express Information Systems empowers companies to streamline complex lease administration within Microsoft Dynamics GP (GP). This partnership will build on a 30-year legacy of helping CFOs streamline and manage lease accounting processes.

Attempting to scale operations while remaining compliant with standards like ASC 842, IFRS 16, and GASB 87 presents a challenge for companies worldwide. Some solve the complexity by overhauling their current ERPs at great expense. Lak Chahal, CEO of Binary Stream, points out that GP can handle scaling lease management without increasing overheads with the right upgrades.

“A lot of lease management solutions require companies to invest in a brand-new ERP rather than working with them to improve capabilities of the system they’re already using. This approach is an expensive mistake to make, often requiring a lengthy implementation and integration process and a lot of training on new processes and tools. It’s possible to manage the complexity of many leases within GP, and we’re here to help companies do that.”

Property Lease Management is full of features that CFOs need to simplify lease management. Here are some of the critical advantages of the upgrade:

One of the most significant advantages of Property Lease Management is that it allows companies to operate from within the familiar interface of GP. Making integration and implementation a lot quicker than if companies were to invest in a brand-new ERP.

Express Information Systems commented on the future of this partnership.

“Working with companies to realize the full potential of GP is what we do. We’re excited to work with Binary Stream and look forward to seeing where this partnership takes us.”

If you would like to find out more about how Property Lease Management can help you, you can read more about the solution here.

The demand for medical facilities continues to grow as the number of patients and their healthcare spending increases. In data published by the Centers for Medicare and Medicaid Services in the United States, it’s projected that national healthcare spending will grow to 6.0 trillion USD by 2027, a trend reflected by the increase in healthcare spending across the world.

As demand surges, many healthcare providers will have to negotiate leases for medical facilities. Some may end up repurposing officers or commercial properties for healthcare units. Setting up the lease agreement for medical facilities is not without complications, and landlords (particularly those whose previous tenants may have used the space for retail units or offices) may not always be fully aware of all requirements.

Although the leasing process for medical facilities is like other commercial leases, there are some variations. Healthcare is a highly regulated industry, and those setting up facilities need to be aware of the requirements and the risks involved. You need to make sure they can adequately care for patients and that the lease agreement mitigates any chance of unpleasant surprises for both tenant and landlord, establishing a roadmap for long-term success.

Below, you’ll find a checklist to guide you through lease negotiations and a breakdown of each point to help you ask the right questions so that you can lease a medical facility and avoid the burden of unexpected costs.

A breakdown of the 8 steps to successfully negotiate medical facility leases

A breakdown of the 8 steps to successfully negotiate medical facility leasesNot all square footage is created equal, and you should accurately measure the usable space in a unit. A 2,500 square foot office may only have 1,700 square feet of usable space. Most commercial rentals have a unit lease price which is the price per square foot, so if there’s unusable space, it may help you to negotiate the price down to price per usable square foot. This tactic may knock thousands of dollars off your annual rent.

Most of us know to research the unit price for similar properties in the market. However, it can be easy to fixate on a single location. It’s best to keep an open mind and research several possibilities within your target area rather than hyper-focusing too early. Knowledge is power, and shopping around may lead you to discover unexpected units at lower prices.

Don’t just pay attention to rental prices. Consider building traffic, other tenants, the neighbourhood’s prospects or growth plans, and the landlord’s reputation. Knowing this kind of information about several potential locations can help you negotiate more favourable lease terms.

Although these may seem like unnecessary costs (particularly if you’re inspecting multiple properties), it’s best to get a professional inspection of the property and lease terms. Medical facilities have little room for error, and conducting due diligence inspections will help you tackle any red flags before signing any contracts. Hiring professionals specializing in medical facility leases and property inspections will help you avoid structural issues (e.g., inadequate ventilation, inability to remove medical waste in keeping with regulations) and allow your negotiations for a substantial tenant improvement allowance.

It’s vital to include specifications regardless of what purpose the building served before. However, it’s essential that you do so if repurposing a non-medical space. Healthcare facility managers need to weigh up the costs and benefits of repurposing spaces and ensure all this is accounted for in the lease agreement. In some cases, renovations may be minor, but it may be necessary to tear down and rebuild parts of the existing structure in others. Many of the changes made will be to meet medical spaces regulations, so ignoring this step may lead to lawsuits over negligence. The lease must spell everything out clearly so that there are no misunderstandings between landlords and tenants.

Contain clause for the appropriate storage and destruction of medical records

5. Evaluate exclusivity clauses as they may not be beneficial

5. Evaluate exclusivity clauses as they may not be beneficialAlthough it can seem like an exclusivity clause is beneficial, you may not want to be the only medical practitioner in your building or a commercial centre. Medical facilities are rarely chosen by people wandering from door to door, and people tend to do a lot of online research before committing to a healthcare practitioner. It may be wise to look for a location that lends credibility to a new medical facility’s services due to the established reputation of healthcare providers already present at that location.

A landlord familiar with other healthcare tenants may already have some of the extra amenities you need. For instance, accessibility and waste removal may be taken care of, and adequate power generators for specialized equipment. Another benefit of a location with other practitioners is that there may be a medical lab, allowing you to refer patients for additional testing conveniently. It’s best to carefully weigh up the pros and cons of exclusivity when you negotiate medical facility leases.

Most medical lease agreements will have longer terms than typical commercial leases due to the cost of installing equipment and other necessary improvements. Healthcare providers should approach them as long-term commitments, writing the terms for renewal into the initial agreement. Lease negotiations should include a longer lease term (you may need at least a 10-year agreement), lease extension and renewal options, as well adequate time to negotiate renewals.

Paying close attention to clauses is a key component of negotiating medical facility leases. Most leases will specify that the tenant must remove all alterations before the end of the lease term. It’s wise to include details in the lease of any alteration that the tenant does not need to take responsibility for removing at the end of the lease term. For instance, lead shielding can be costly to remove, and if the landlord is planning on installing another medical tenant, it could be beneficial for them to keep this alteration.

Another standard clause in commercial leases is the right to relocate a tenant. If this exists in the lease agreement, it’s wise to include that the landlord is responsible for covering the time and expense involved in relocating the medical facility.

If you plan to grow the number of medical facilities in your practice, you need to worry about more than how to negotiate medical facility leases. It’s wise to consider a lease management solution sooner rather than later. Often companies can put this off, resulting in costly mistakes (e.g., missing renewal negotiation dates or failing to account for improvements to all locations adequately). The right software automates all this, enabling you to focus on scaling operations so that your practice can provide the best care for as many patients as possible.

Choosing lease accounting software without much consideration can lead to unexpected pitfalls in the future. The biggest mistake most companies will make is rushing into a contract without first thoroughly assessing their needs. This can lead to a situation where your software is not adequately supported with proper training and software that does not perform all the functions you require over time.

To help you avoid investing in the wrong software, this blog details seven of the questions you need to consider when looking for the right solution. Equip yourself with the criteria and questions required to assess each system and find one that will work best for your team.

Purchasing lease accounting software is an investment, and before you choose which solution to invest in, you need to analyze how it will meet key business requirements. The first step toward this is to document your lease administration processes, including the time and resources required to perform critical functions.

Likely, you will quickly identify numerous ways the software will benefit your team. If you’re curious about building a comprehensive list of requirements, check out our blog on how to make a requirements checklist.

Once you know what requirements you need to meet with your lease accounting software, it’s easier to think about essential features. Property lease management software is varied, and not all solutions are equal.

By prioritizing your “must-have”, “nice-to-have”, and “unnecessary” features, you can quickly identify solutions built to meet your specific needs. For instance, if you plan to scale operations in the coming years, it’s essential to find a solution that can handle the administrative burden as you grow.

For inspiration, why not check out our blog on the eight essential commercial lease management software features.

When it comes to the new lease accounting standards (ASC 842, IFRS 16 and GASB 87), many companies struggle to prove compliance, keep track of changes to regulations and implement them effectively across all leases. Weeks (and sometimes even months) of time are spent double-checking entries and spotting errors.

One of the most important ways to determine whether or not you need to invest in new software is to check the time and resources spent on achieving these standards. Does your current solution slow down the processes? Does your team struggle to provide auditable records? How quickly can you consolidate your information into financial statements?

Regardless of what software you purchase, your team will be using it for many years to come. Because of this, it’s wise to make a comprehensive list of solutions that you can research, checking which solutions have the features you need to meet your business requirements.

Your team is one of your most important resources, so pool their knowledge in your search for the right leasing software. It’s likely that they’ve worked with multiple solutions during their careers and will easily be able to list their preferences.

Don’t just rely on your team. Try speaking to similar companies, checking out online forums and partnering with technology experts. This way, you will get a broader sense of your options and may discover solutions that offer everything you require.

Once you’re aware of what’s out there, you can narrow down your options to a shortlist. At this point, it’s wise to schedule demos. Make sure you bring along team members to help you ask the right questions and have a thorough understanding of lease accounting and compliance.

Once you’ve narrowed down your options, it’s time to start considering the fine print. It will be essential to establish how each software provider will help you in your integration journey. Do they have a support team or self-serve training tools like a thorough knowledge base? Preferably, they will have both.

If the software provider is unclear about how you will be trained or how the software is implemented, you may want to remove them from your shortlist. It’s easy to be side-tracked by impressive features in a demo, but ask yourself if they can answer your questions quickly and adequately? Does the software provider respond promptly to your request for a demo or emails? Did they send follow-up emails with answers to outstanding questions?

Even in the early stages of the acquisition journey, it’s easy to separate supportive software providers from the rest, so pay close attention to every interaction and consider the software provider as a partner when making your final decision. Is this a team you trust? Do you feel confident in their ability to address any problems that arise promptly?

Companies are continually growing, so you need to purchase your lease accounting software with flexibility in mind. For instance, how many users can access the platform and do costs increase as the user base increases? Does the software work across different lease types with varying complexities? How many leases can the software handle? Is it possible to consolidate multiple locations in one central place?

These are all questions that require you to consider how you use the software over time. How you use the software today is likely to be very different from how you will use it in five years, and you need a solution that can handle your company’s future growth.

It’s possible to find lease accounting software for almost any budget. However, if you’ve answered all the previous questions, you will be well aware that not all solutions are created equal. Many bare-bones solutions will not provide the same support level as more robust solutions, and the cost of integrating them with your current software and processes can quickly add up.

Other software may already be accounting for many of the costs you will encounter in their pricing plans. For instance, project management, integration, training and set-up fees will all be included, and you should be able to understand their licensing costs comprehensively. It’s vital to assess the value in terms of features, but it’s equally important to consider contracts closely and place adequate value on support and training when making your decision.

Most companies are aware of lease accounting software benefits and invest knowing they will reduce admin costs, automate labour-intensive tasks, and enable compliance with GAAP accounting standards. All these are compelling reasons, but they’re not the only advantages that the right software brings to your team.

This blog will look beyond the most common lease accounting software benefits and explore the lesser-known benefits the software can bring.

As a company scales its properties, one of the most significant issues they face is keeping track of all vendors and contracts. Lease management software provides you with a 360-degree view of all contracts at all times and alerts you of all critical dates. By enabling you to spend less time administrating, you will have more time to maintain and build vendor relationships and enough visibility to leverage any opportunities that might arise.

The more time your team has to focus on who you work with, the better the relationships you will build with various vendors, which will likely create more potential to expand your leasing/buying power over time. It also means you can harness the software’s insights and reports, in addition to the insights gained by better managing your vendor relationships.

Without the right tools, collaboration can become a headache for bigger companies with multiple departments. Perhaps your teams use Excel or a decentralized system with limited access? All this can lead to bottlenecks which discourage those who might otherwise be more engaged in the lease management process.

Multiple teams are involved in managing lease contracts, and all these teams must have access to a centralized system so that they can efficiently work together. Each department has concerns and challenges which need to be taken into consideration. Often teams are so busy inputting data manually to spreadsheets that they don’t have time to collaborate and develop interdepartmental processes.

By automating many of these labour-intensive tasks, one of the main secret benefits of lease accounting software is that it gives teams the time they need to collaborate. A centralized system also allows teams to create a chart of accounts that is maintained across all leases and standard processes that ensure it’s easier to audit and find consistent information regardless of which team inputted it.

By giving you access to your data in real-time and full visibility of spending and costs, lease management software gives you the power to create accurate budgets that take full advantage of all your resources. Without a centralized system, it’s easy to end up with inaccurate or misleading financial information, resulting in risky business decisions.

By giving you a clear picture of all moving parts, the right software makes it possible for stakeholders to make better leasing decisions, reduce risks and negotiate leases based on performance. Without this information, companies may find themselves without the relevant information to make a good lease agreement, the results of which can have long-lasting ramifications for financial performance.

With the pace of today’s world, we all know the benefits of moving quickly when opportunities arise. Unfortunately, many companies are unable to act fast when it comes to leasing decisions and opportunities because it takes them so long to analyze data, correct that data due to manual entry issues, and then, eventually, make forecasts.

Leadership teams can use lease management software to immediately access the data they need to make better investment decisions. It also provides automated reports that keep stakeholders aware of leases and allows them to check for growth opportunities and monitor costs and spending regularly.

Continued reading: Using lease management software vs outsourcing your lease administration processes

As your lease portfolio grows, the need to reduce risks becomes key. The more leases you manage, the easier it is to miss critical dates and fail to spot mistakes in payments or lease terms. Over time, these mistakes can accumulate and cause harm to your company’s bottom line.

If you’re serious about scaling your lease portfolio or have multiple entities already, you should be aware of lease management’s administrative demands. Many companies try to meet this demand by outsourcing lease administration, but this is not a long-term solution and can be more costly over time. If you’re curious about the differences, check out our previous blog, which compares outsourcing complex lease admin and lease administration software.

In this blog, we focus exclusively on how lease administration software reduces your risks. We will touch on obvious risks like compliance and the need for full visibility and error-free data to make viable business decisions.

One of the significant risks of managing multiple entities (often resulting in hundreds of leases) is that the administrative burden of pulling financial information can mean your team spends weeks trying to get visibility of your company’s financial health. At the pace business decisions are made today, real-time access to your leases is essential if your operations are to grow or even just remain viable.

Managing leases requires full visibility of your contracts—including terms, due dates, renewals, obligations and costs—at a moment’s notice. The more leases you have, the harder this can be to achieve, and so processes and systems that once allowed for full visibility can become quickly obsolete as your operations grow.

The more leases you acquire, the more complex lease administration can become. Many companies struggle to realize the administrative burden that the wrong software can create. Pulling reports, double-checking lease terms, or even just lease renewals can become a nightmare if not managed properly.

It’s essential to find a lease management solution that combines lease administration and accounting to have full visibility and quickly and effectively check payments, and analyze costs. You need full visibility of financial health to give you the information you need to make informed business decisions.

One thing we can be sure of in life, as well as business, is that change is inevitable. Any good business strategy accounts for the possibility of change, and lease administration should be no different. Approaching your leases with an agile mindset will be vital to surviving uncertain times.

The COVID-19 pandemic is one example of how an unpredictable event can have unforeseen implications for leases. Companies with property lease management software were able to implement changes across their systems. In contrast, companies without effective software struggled to handle the burden of changes to leases during this time. Some of those changes included modifications to lease terms, lease terminations, lease impairments, and variable payments due to rent deferrals.

Trying to locate and update every lease manually is a time-consuming process. With wide-ranging changes at this scale, it will undoubtedly have resulted in numerous errors and mistakes that will have to be corrected when creating financial statements.

Recommended reading

Data errors and obsolete processes can lead to errors that may inadvertently lead to poor business decisions. If you’re acting on manually entered data, it may be time to consider how accurate the information you’re using might be.

When it comes to lease administration software, it’s easy to manage the bulk of processes through automation, saving your team time, so they’ve time to double-check leases and reports before you act on them. Often, teams are pushed to their limits just trying to consolidate information into a report. The right software facilitates best practices in data management so teams are freed up to focus on higher priorities.

Similarly, in the rush to get reports finished each month and payments processed, critical dates can be overlooked (a costly mistake!). Lease management software gives you the power to create alerts when important dates for your leases are due to recur.

Accounting standards are always changing. Regardless of which accounting standard your company needs to comply with (ASC 842, GASB 87, or IFRS 16), lease administration software reduces risks your company faces when it comes to proving compliance. No software can guarantee compliance, but they should be built to enable it, and with expert knowledge of the demands of the lease accounting on hand.

If you’re thinking of purchasing property lease administration software, it’s wise to jump on a call with the various companies and make sure they’re aware of the demands of these accounting standards on your leases. If they’re not, it’s unlikely their software will be suitable for companies who need to prove compliance across multiple entities.

Many companies are looking for ways to improve their property lease management strategy. In many cases, “strategy” might not even seem like the right word, as lease management is often relegated to the sidelines, only arising as a cost of doing business when paying bills.

The introduction of new lease accounting standards IFRS 16 and GASB 87 makes lease management a fundamental part of any growth strategy in today’s world. It’s no longer possible to treat lease management as a basic cost of doing business and simply pay the bills.

The scrutiny leases are now subject to means companies need to invest in optimizing their property lease management strategy to prove compliance and foster sustainable growth.

In this blog, we will explore ways to optimize your property lease management strategy, but first, let’s take a quick look at some of the benefits of doing just that.

One of the easiest ways to maximize property lease management is to house all your leases in a centralized system. A cloud-based, centralized environment allows teams to access lease data anytime, anywhere, reducing bottlenecks and increasing productivity.

Unfortunately, many companies manage their leases in separate systems. Separate systems can lead to disparate data and errors in reporting, as not everyone has access to reports, and processes are not as easy to streamline as in a centralized system. Retrieving data or reports can be a time-consuming process, involving a back and forth of emails. Separate systems lead to an inability to access information in real time and slow down decision making during crucial times.

By centralizing reporting and data management, key stakeholders do not need to wait to get the information they need to make time-sensitive strategic decisions. A centralized system also allows for a clear audit trail, making compliance with ASC 842, IFRS 16 or GASB 87 much more straightforward.

One of the most significant issues any team will face when it comes to property lease management strategy is establishing standard controls and processes. Procedures must be in place for every stage of the lease life cycle, from documenting to terminating leases.

Standard practices must go beyond the accounting team and include every team involved at any stage of lease maintenance and acquisition. The accounts team needs to be able to trust the data being fed to them by others. So, automating processes where possible and implementing an approvals system will ensure more accurate reporting and forecasting.

Because lease accounting standards tend to change, it may be wisest to select a software solution that automates lease modifications. That way, your team can quickly implement new accounting standards across all leases as they arise.

Essential reading: Using lease management software vs outsourcing your lease administration processes

Pay close attention to the leasing market if you want to understand how your strategy is performing. If you’re unaware of market trends or changes in property value over time, you will not stay on top of your company’s potential for growth or spot areas where issues may arise.

For instance, leasing hot spots are subject to change, and desirable locations fluctuate. Knowing the current market data can help you make better decisions about future locations, occupancy costs, and new projects.

It is impossible to analyze your lease portfolio without taking into account the market. Commercial leasing requires a keen eye on the market, so make sure you invest in research and market awareness. Regularly tapping into market data will often create opportunities and give you better insights for future strategizing.

Companies often make the mistake of treating lease management as merely a nuts-and-bolts operation. However, it’s better to look at leases with a growth mindset. Spaces are subject to change, and a strategic approach should consider all possible changes to the property’s value over time.

For instance, it’s essential to consider that you might outgrow a space, so requesting a first refusal right on adjacent properties may be wise. It may also be wise to invest in spaces that are easy to divide or to look for shorter-term tenants if a property is likely to become more valuable due to planned infrastructure changes. For instance, offices in an area where new transport options are planned to open in the next couple of years.

In addition, global expansion can bring with it another set of considerations. Perhaps you’re adept at handling compliance regulations within your own country, but is your company GAAP compliant? You may find yourself struggling to implement ASC 842 or IFRS 16 as you expand, in this situation, a property lease management solution will enable you to meet global accounting standards and gain full visibility of your numbers across all locations.

One of the quickest ways to maximize your property lease management is to invest in property lease management software. There are a number of different things to consider when you start researching solutions that will work for you.

For instance, finding software that integrates with your current systems is crucial and so too will be looking for a centralized, cloud-based option. It should also enable you to implement processes and controls, create real-time reports and reliable financial statements. Read this blog for a full list of features that you should look for in your property lease management software.

Compliance can be tricky at the best of times and trying to implement GASB 87 is no exception. Although deadlines have been postponed by up to 18 months due to COVID-19, organizations may still struggle to prepare in time. In this blog, we shed light on the requirements, give you a step-by-step process, and provide the critical dates and information you require.

In a hurry? Click on a topic below to jump to the section you’re looking for:

GASB 87 is a lease accounting standard that defines a lease as:

Due to COVID-19, many organizations and governments experienced disruption to their operations, making it difficult to allocate the required time and resources to GASB 87 implementation. In response to appeals for postponing the implementation dates, GASB released the following dates:

“Statement No. 87, Leases, along with any related implementation guides, are postponed by 18 months until fiscal years beginning after June. 15, 2021, or fiscal year 2022 for all June and September year-ends.”

The new dates came as welcome relief for many organizations, and many decided to delay GASB 87 implementation. However, shelving the product may not be wise, compliance is complicated, and it’s better to leverage this extra time to address GASB 87 requirements. Postponing action will only mean that organizations end up back in the same situation in a few months.

Before COVID-19, organizations were already worried about meeting the demands of implementing GASB 87. The complexities and challenges inherent in the guidelines mean that the sooner organizations start the steps to implementation, the more likely they are to prove compliance.

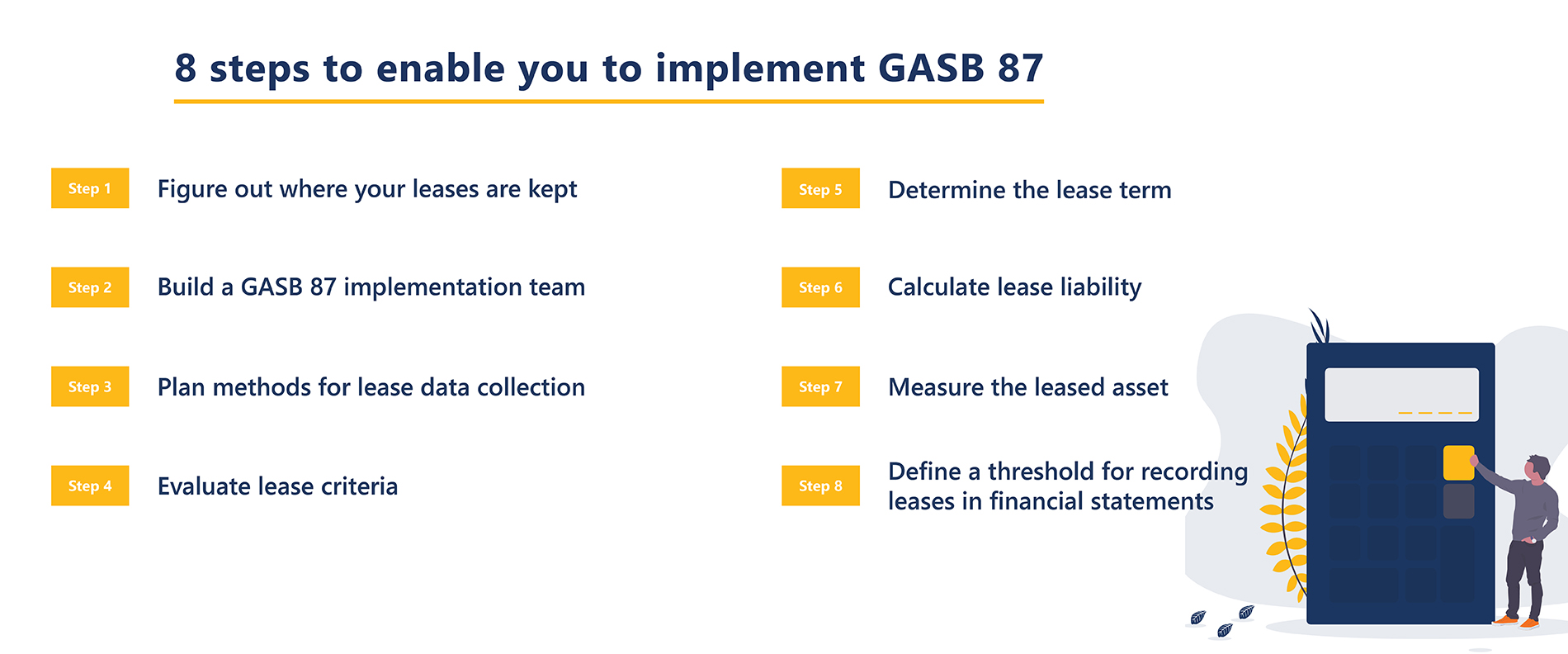

Particularly in larger organizations, leases may be centralized in a financial department or decentralized in many different departments (and possibly even in other entities). Before GASB 87, many of the leases you will need to identify will previously have been treated as operating leases.

It will be necessary to do a full inventory to define all leases’ locations for your organization. To do this properly, you will need to evaluate:

It’s essential to build a team that is responsible for the successful implementation of GASB 87. It is perhaps wise to include accounting experts and legal staff on this team as they are often already familiar with compliance demands. It will be their job to assess the requirements and decide if you need additional tools or resources for long term implementation of the accounting standards. For example, the operational costs of complying with GASB 87 may mean that using lease management software will save considerable time and money.

If your lease data is located in multiple departments or entities, compiling it will be challenging. You will need a system to store all files, but if you’re currently operating in a decentralized environment, this could be extremely challenging to achieve. It may require the translation of data from hard copy leases to digital versions, and data entry errors may occur. Another concern is the security of the lease data. As you’re dealing with financial information, your team will need to plan a method for data collection that is secure.

The best practice would be to use lease management software that automates the collection of lease data and integrates fully with your current systems. This way, you can easily access the lease data and have full visibility.

Familiarize your team with the GASB 87 guidelines and ensure everyone is familiar with the requirements and the lease exceptions. It will be essential to return to this document as you continue as it will help you evaluate which leases meet the criteria and which do not. It should be used as an ongoing resource to ensure compliance.

GASB defines a lease term as the period during which a lessee has a noncancelable right to use an underlying asset, plus any extension periods and options that are reasonably certain to be exercised. You will need to identify the term for each of your leases to prove compliance with GASB 87.

GASB requires organizations to measure the lease liability based on the present value of payments expected to be paid during the lease term, including fixed payments, variable payments, lease incentives, etc. For a full list of payment types, please review the GASB 87 guidelines. It’s also best to review these guidelines for leases that involve multiple assets with different terms as this introduces increased complexity.

The measure of the leased asset is based on the associated lease liability. Measuring liability may not be straightforward in contracts with multiple components, as the value of underlying assets may not always be stated. Where this is the case, it may be possible to use the value of comparable assets in the market as a benchmark.

Although GASB provides thresholds for capital assets, it does not make the same specifications for lease obligations. It may be wise to set a threshold to avoid recording leases that are immaterial and too small to be capitalized. Some companies will use the capitalization thresholds established for their organization as a jumping-off point. Once you set a threshold, it can always be revised if you find that it excludes significant leases from being recorded.

When applying GASB 87 guidelines, there are many things to be cognizant of without having to worry about the accuracy and security of your lease data. Standard accounting software simply won’t be built to handle compliance complexities, particularly for larger organizations with multiple departments or entities. Your team may want to assess lease management software solutions. Although no software can guarantee compliance, it will give you the tools to manage and streamline your leases so that compliance will require less time and resources from your team. Check out our blog on the cost of using lease accounting versus outsourcing lease administration processes for a clear picture of how software may be the best answer.

COVID-19 continues to impact many aspects of our lives, and IFRS 16 compliance is no exception. Companies across the globe are finding new and innovative ways to work remotely. Many have also had to introduce new processes for managing cash flow, assets, and expenses during this pandemic.

The last thing any company wants to face is legal action over rental payments, which is why the IASB introduced new guidelines to help both lessees and lessors renegotiate the terms of their leases. It’s important to note that a lease is a legally binding contract, so both parties must agree to rent concessions.

The IASB has reported that an unprecedented number of lessors are providing concessions at this time for lessees. There are several options open to companies trying to renegotiate lease terms at this time. Possible concessions for those looking to change the terms of a lease include:

Traditionally, under IFRS 16, each concession would trigger a modification to the lease terms if the situation does not appear in the initial agreement.

IASB realizes that lessees may struggle to evaluate and account for these concessions under the modification framework set out under IFRS 16 on time. As a result, the IASB created an amendment in May 2020, which permits lessees to bypass assessment for rent concessions that occur as a direct consequence of COVID-19.

Under this amendment, companies can choose to apply for an expedient, which allows them to account for rent concessions as if they were accounted for in the original contract and not have to recognize them as lease modifications. The expedient is optional for lessees, and if used, will need to be applied consistently across all similar lease contracts.

If both parties agree to a rent reduction, then the lessee can account for this as a negative variable lease payment. They should record the reduced payments as negative lease expenses in the months when the original full rent payments would have been due. The benefit of this method is that it won’t impact the ROU asset, lease liability, or the amortization schedule.

If both parties agree to a rent deferral, then the approach for IFRS 16 would be re-measurement consistent with resolving the contingency. By pushing the timing of payments to a later date, there is no change to the total cash flow over the lease term, i.e. rent deferral. The new timing is accounted for as a resolution of the contingency specified in the original lease. They then remeasure the lease’s liability based on the updated payment timings, i.e. recognizing the liability at the deferred date. The lessee must also make a corresponding adjustment to the ROU asset.

Managing all the moving parts of IFRS 16 compliance is simple when you invest in the right property management software. Look for solutions that have robust accounting features so that you can handle the complexities of deferred or reduced rents. Trying to keep track of all your expenses and requirements at a time like this may otherwise become overwhelming for the accounts team. Binary Stream’s Property Lease Management is built to enable you to remain IFRS 16 compliant.

ERP software helps compliance regardless of whether you’re running multiple branches, a smaller start-up, or a company looking to streamline processes post-merger. No matter what stage you’re at, it’s critical to invest in software built to deal with the complexities of compliance in today’s competitive landscape.

With technology accelerating growth at such a rapid rate, you may feel that regulatory compliance is an almost impossible feat with constantly changing standards. Accounting standards, regulations, and privacy legislation keep changing in a race to keep up with the advancements.

This is likely just the beginning, and trying to manage, track and adhere to regulations will require dedicated teams, as well as dedicated software. Failing to comply with regulations or data protection legislation—and industry-specific rules and accounting standards—can result in financial penalties that can have crippling effects on companies. It’s not worth the risk.

Traditionally, smaller organizations could track compliance through databases and spreadsheets. However, these systems are rarely properly centralized. The process of extracting and consolidating data from spreadsheets can span months rather than days. Industry-specific ERPs centralize much of this administration, automating the consolidation of information needed to prove compliance.

ERP software helps compliance in many different ways. In this blog, we will take an in-depth look at the three most important:

To prove compliance, you need visibility and control of your admin processes. The easiest way to do this is with centralized ERP software. Many people focus on time and money saved by using an ERP (for a good reason!), but the visibility it grants companies is just as important. Implementing an effective solution means that you can control data with ease and accuracy. Also, it is possible to access reports and show compliance in real time.

Most ERP software will come equipped with a range of reports. If you want to ensure you have the right insights and visibility, it’s best to partner with software providers who work in your industry. For instance, if you currently work in the healthcare industry and use Microsoft Dynamics, then look for supply chain software that builds on this functionality rather than starting from scratch. The main advantage of using industry-specific software is that reports and processes are designed with your industry’s compliance standards in mind.

Other elements you should look for when it comes to visibility and control are built-in dashboards that are easy to understand and navigate. It’s also possible to get software that creates forecasts that may change the way you do business. Because the ERP connects to so many aspects of your business, it can make accurate forecasts which would otherwise be impossible to attain.

There’s no magic formula to remaining compliant, and the software can’t achieve it independently. However, having the software is a step in the right direction, making the rest of your journey towards compliance that much more pain-free. Before you purchase your ERP, it may be wise to check out our blog on building a comprehensive ERP checklist, which gives you a step-by-step outline of how to make a list specific to your requirements (compliance is, after all, just one of those requirements).

Discussions around data security and the protection of that data are not going away anytime soon. Companies will have to invest in software that can securely manage the information they use daily. Canada looks set to introduce new privacy legislation, and this follows in the footsteps of legislation such as GDPR in Europe. As technology advances, data control and security will grow rather than shrink in priority for those trying to prove and maintain compliance.

It should be possible to tailor the security features to meet your requirements. There are standard security features you should look for:

The supply chain is a critical component of business for many businesses, but it’s incredibly crucial for compliance within the manufacturing and health care industries. In the worst-case scenario, inventory tracking issues within healthcare facilities can lead to lost lives, so it’s no wonder an ERP plays such an essential role in this industry.

Traceability is similar to visibility and transparency, but we have separated them because it deserves a special mention of compliance-regulated supply chains. Most ERPs provide solid visibility and transparency of data and processes but can’t always manage the inherent complexities of supply chain dependent industries. It’s best to invest in software that is built to handle supply chains in your industry. Preferably, look for a provider who can show you case studies that prove their software’s functionality in your industry.

The sheer range of options open to those grappling with complex lease administration can be overwhelming, particularly when you consider the introduction of accounting standards IFRS 16 and ASC 842, which have made thorough accounting crucial for compliance.

Implementing these accounting standards can be an arduous process. As companies deepen their understanding of the time and effort required to implement them successfully, outsourcing may begin to sound tempting.

Relying on others to do what your team is capable of may be considered just as short-sighted as implementing a single-source software over a best-in-breed integration. Depending on other companies to implement your lease administration may have some longer-term implications, which are not necessarily worth the short-term gains.

Before we get into the nitty-gritty of why this is the case, let’s do a quick rundown of the core benefits that drive companies to outsource their lease administration in the first place. Please note, the very things which make outsourcing attractive can be what will cost your team the most in the long run, but more on that below.

If you’re stuck for time, and the deadline is fast approaching, perhaps outsourcing is the way to go. However, as with most situations that lend themselves to outsourcing, you’re giving up all the control and power over your administration processes.

Over time, it will cost you more to have a third-party team do the work for you. If possible, you should look at investing in software and the training needed to implement it. By doing so, you will empower your team to handle the process year in year out.

Outsourcing comes with the advantages of a quick turnover. Still, many of us will be familiar with the cost over time of relying on third-party vendors to provide services your team is perfectly capable of achieving once given the right software and guidance.

Lease management software saves you the expense of outsourcing. By choosing a best-in-breed solution, you can be confident that compliance is enabled within your system. There are many software options out there that have built-in the tools you need to maintain compliance. For instance, if you already work with a Microsoft Dynamics ERP, it makes sense to invest in integrated software built specifically to help you manage the inherent complexities of lease administration.

Many outsourcing companies will be using a system like this to manage your lease administration anyway, so why not take back control of your processes and implement a system yourself. At first, you will have the implementation and training costs. However, five years from now, your team will be reaping the rewards of a fully integrated system that allows them to access centralized lease data, run reports in real time, and confidently achieve compliance standards.

Only you can know the answer. Companies who cannot afford to invest in the right software may initially prefer to outsource complex lease administration. Although it costs more long term, it can save them money when they’ve yet to scale operations. However, it’s important to note that they should do this with a plan to move in-house eventually.

For larger-scale leasing operations, investing in the capacity to handle complex lease administration in-house will be essential over time. Not only will it help you optimize the process and streamline reporting, but give you the ability to gain complex insights into your lease performance so that you’re poised to make strategic decisions when needed.