When landlords are securing lease contracts for properties, they often include an allowance for the tenant to improve the property. Generous allowances often help landlords secure longer-term leases that benefit both parties throughout the rental period.

However, as with all aspects of property lease management, if not handled appropriately, these allowances can cause difficulties when it comes to accounting and proving compliance with accounting standards. This blog will cover all the most asked questions about tenant improvement allowances and how to account for them.

If you’re looking for the answer to a specific question, select one of the topics below and jump ahead:

- What are leasehold or tenant improvements?

- What is a tenant improvement allowance?

- What qualifies for the tenant improvement allowance?

- What doesn’t qualify for the tenant improvement allowance?

- How much is the typical tenant improvement allowance?

- What is a turn-key agreement?

- Does the tenant improvement allowance count as a loan?

- What is an amortized tenant improvement allowance?

- Are tenant improvements tax deductible?

- Who owns the tenant improvements?

- How do you account for tenant improvement allowances?

- How do you track tenant improvement allowances?

What are leasehold or tenant improvements?

Leasehold improvements or tenant improvements refer to the renovations or customizations made to a property to benefit the tenant. To be considered a tenant improvement, the modification must have the following characteristics:

- The alterations are made to assets that have been leased. Therefore, building improvements apply if they’re made in the rented space (e.g. the office), and don’t apply if they’re outside of that space (e.g. communal areas like the elevator, stairs, or other common areas).

- The tenant must pay for the improvements unless it is agreed upon that the expenses are the responsibility of the landlord. In that case, the landlord will account for the expenses in their own records.

- The tenant improvements should be durable and benefit the tenant or future tenants for more than one year.

- The improvement cannot be detached from the leased property.

- The improvement reverts to the landlord at the end of the lease.

What is a tenant improvement allowance?

A tenant improvement allowance is a fund the landlord provides to pay for improvements to the leased space. These allowances often pay for costs incurred when a tenant moves to the new property, such as updating floors or windows.

What qualifies for the tenant improvement allowance?

Landlords allow tenant improvement allowance to cover both hard and soft costs of any renovation to the rented space. Hard costs are improvements to the property that the tenant will leave behind that benefit the landlord. Examples of hard costs include new flooring, electrics, HVAC, windows, framing, and doors. Soft costs include things like management fees.

What doesn’t qualify for the tenant improvement allowance?

The tenant improvement allowance doesn’t cover projects or expenses incurred due to the following reasons:

- Improvements that cater to the tenant’s specific needs

- Improvements that fail to provide additional value for the landlord

- Removable alterations (e.g. electronic equipment, furniture, cabling for the internet)

- Alterations outside of the rented space that benefit the entire building, known as building improvements (e.g. repaving outdoor walkways, upgrading the elevator, replacing the roof, renovating the lobby)

How much is the typical tenant improvement allowance?

The amount available through a tenant improvement allowance varies and depends on the amount of work required and the specific renovation plans. Some properties may need very little work, and others will require a complete transformation. Without a detailed outline of the renovation, the allowance can be as low as $10–20 per square foot, which is unlikely to be adequate funding for new offices or commercial units.

Landlords decide on the exact allowance with the tenant funding any desired improvements that fall outside this budget. Usually, they will decide on an amount by assessing the real estate market, the client value, and the added value of the proposed renovations. For example, landlords may be willing to give a larger allowance to companies converting a warehouse into a modern workspace.

Additional reading: Top 8 essential commercial lease management software features

What is a turn-key agreement?

A turn-key agreement or a turn-key build-out occurs when the landlord solely oversees the construction process of tenant improvements and delivers the completed space to the tenant. Turn-key agreements protect the landlord from budget overruns via contingency costs.

However, tenants may be wary of this arrangement because it removes their ability to maximize the benefit of the tenant improvement, especially if the landlord is under budget. For example, if a landlord estimates $40 per square foot during the lease-signing process, but completes the project for $35 per square foot, the tenant has lost $5 per square foot in potential improvements.

Does the tenant improvement allowance count as a loan?

No. Tenant improvement allowance are not considered loans and do not need to be repaid by the tenant—unless it’s an amortized tenant improvement allowance.

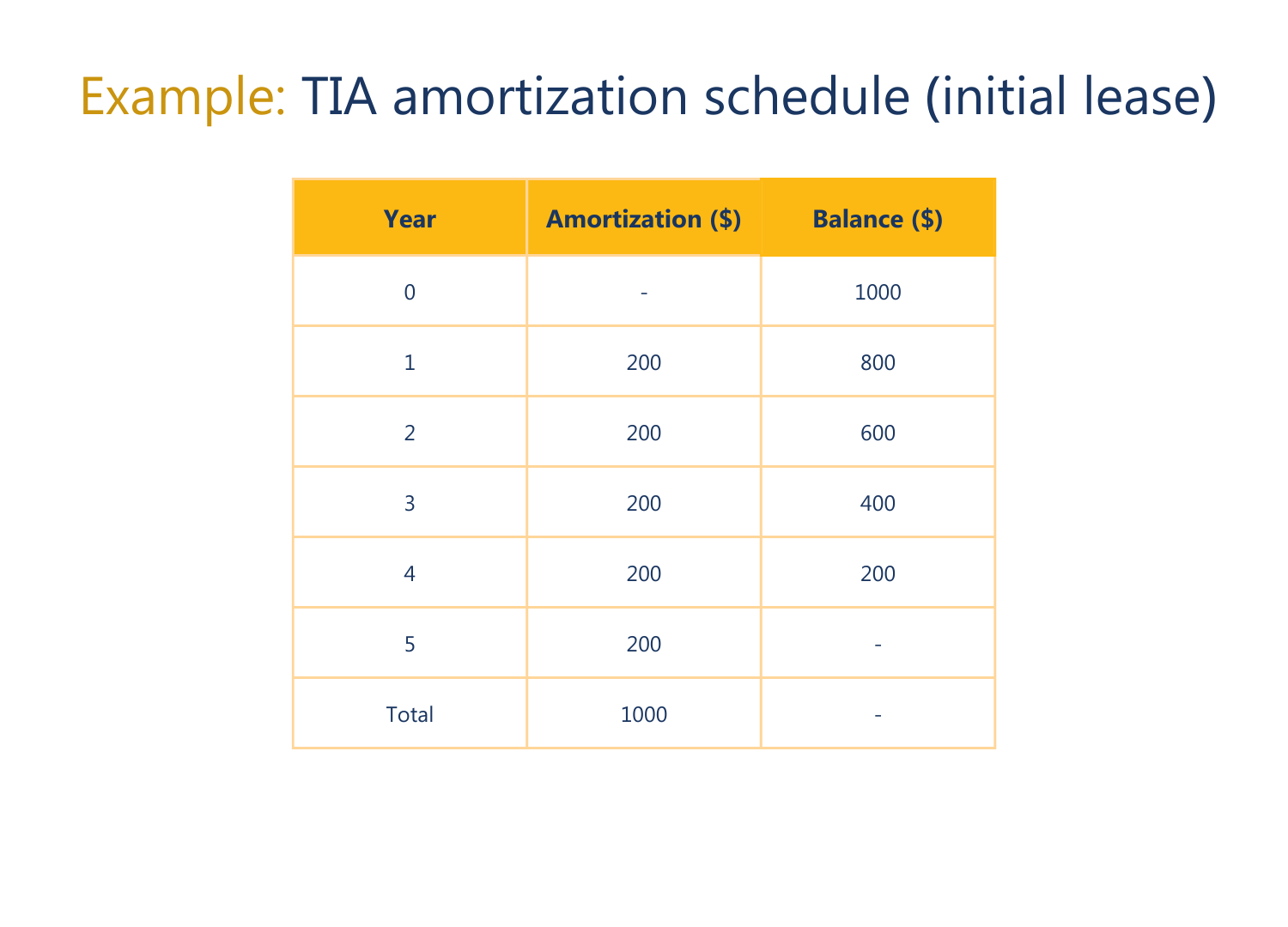

What is an amortized tenant improvement allowance?

The tenant improvement allowance can be combined with a loan from the landlord to create an “amortized tenant improvement allowance”. Amortization is an accounting technique that reduces the book value of a loan or intangible asset over a set period. Typically, the amortization is repaid in instalments over the term of the lease, usually with interest.

Accounting experts suggest that if the total expenses incurred for tenant improvements exceeds the tenant’s capitalization limit during the same period, the total should be capitalized and amortized over the term of the lease or the life of the improvements. Nevertheless, this is something that’s negotiated on a case-by-case basis and agreed upon by both parties.

Are tenant improvements tax deductible?

No. However, landlords can account for depreciation of tenant improvements because they are considered part of the building. Whoever oversees the improvements, tenant or landlord, can claim the depreciation deduction.

Who owns tenant improvements?

More often than not, the landlord will own the tenant improvements. Even if the tenant funds and oversees the renovations, that does not guarantee that they will own the improvements.

While payment of tenant improvements is a negotiated deal, ownership is usually determined by the terms of the lease agreement. Nearly all commercial net leases state that the tenant improvements become the landlord’s assets upon completion.

Additional reading: 7 questions you should ask before choosing lease accounting software

How do you account for tenant improvement allowances?

Accounting for tenant improvement allowances depends on whether the landlord or the tenant funds, oversees, and owns the improvements. Below, offers a quick overview of accounting for these allowances based on whether the landlord or the tenant owns the improvements.

Tenant improvement allowance accounting if the landlord owns the improvements

When the landlord owns the renovations, they must record tenant improvements as fixed assets and account for the depreciating value of these assets over a specified period. The depreciation period for tenant improvements is either the useful life of the renovation or the term of the lease, whichever is shorter.

For example, if carpeting is installed that’s expected to be replaced in five years, and the remaining lease term is for seven years, the depreciation period should only be for five years. However, if the lease term is two years instead of seven, then the depreciation period should be for two years because it is shorter than the useful life of the new carpeting.

In some cases, the tenant may have a high expectation of renewing a lease and will consent to extending the depreciation period to cover the additional term of the lease, capped at the useful life of the asset.

When a new tenant moves in during the period in which the asset’s depreciation is being accounted for, as long as they do not require any additional improvements, the landlord can continue to account for the previous depreciation schedule. If there’s destruction or damage to the property, the remaining balance is recorded as a loss on the income statement.

Tenant improvement allowance accounting if the tenant owns the improvements

When the tenant owns the improvements, they should record the TIA as an incentive or tenant inducement, treat it as a capital expenditure, and amortize the amount spent over the rental term. Salvage value is not included in the depreciation calculation, since the landlord will take over any remaining assets. In cases where the rental period is too short, the tenant must write off the outstanding balance.

How do you track tenant improvement allowances?

Tenant lease improvements are considered assets, and accounting for them is crucial to remaining compliant with accounting standards like GASB 87, IFRS 16, and ASC 842. If you’ve multiple properties, keeping track of TIAs and making sure they’re appropriately accounted for can become complicated fast. Visibility and tracking of improvements are essential for commercial properties where renovations are expensive. Failure to adequately record and depreciate these values can be detrimental to your company’s health.

Rather than worry about keeping track of all these figures manually, it’s advisable to invest in property lease management software. Purpose-built software will enable your team to make sure you’ve full visibility of all funds and have the tools to track and depreciate the value of assets over time without having to worry about data-entry mistakes and administrative bottlenecks.

Additional reading: Using lease management software vs outsourcing your lease administration processes