Not all financial transformations involve the same level of complexity, but many companies misjudge the workload and are surprised by how quickly underlying problems can derail their best-laid plans. What initially seems like a straightforward process becomes much more involved, leaving teams frustrated and struggling to meet expectations. All this is avoidable if you prepare adequately for the core challenges financial transformations will inevitably present.

Preparation is vital, and it’s critical to treat this list as a guideline for posing the right questions rather than a one-size-fits-all template. It will help you identify the core challenges that may prevent your company from achieving the full benefits of financial transformation. Identifying and discussing the issues encountered internally and externally across multiple industries makes it easier to build a roadmap towards success.

A quick overview of the 7 core financial transformation challenges

This overview gives a quick insight into the main challenges covered in this blog. If you’re concerned with a particular challenge, you can quickly skip ahead by clicking the relevant link below.

- Data management practices can be inconsistent and difficult to correct

- Investors and stakeholders impose constraints that cause roadblocks

- Misalignment between short- and long-term goals

- Compliance standards and regulations constantly shifting the goalposts

- Evolution of the workforce makes it difficult to retain appropriate talent

- Lack of agility and coordination between various departments

- Clash between the risk-averse mindset and the need for innovation

A breakdown of the 7 core financial transformation challenges

1. Data management practices can be inconsistent and difficult to correct

Companies have unprecedented access to customer and transaction data, yet you may struggle to know what to do with it. The sheer number of insights at the fingertips of various teams can feel overwhelming if good data management practices are not in place. According to a report by Deloitte, often, companies aren’t looking at external data like customer insights because they’re still trying to fix internal accounting practices. Because many of their processes are still manual, they spend more time moving data around―via email, spreadsheets and between various systems―than analyzing it.

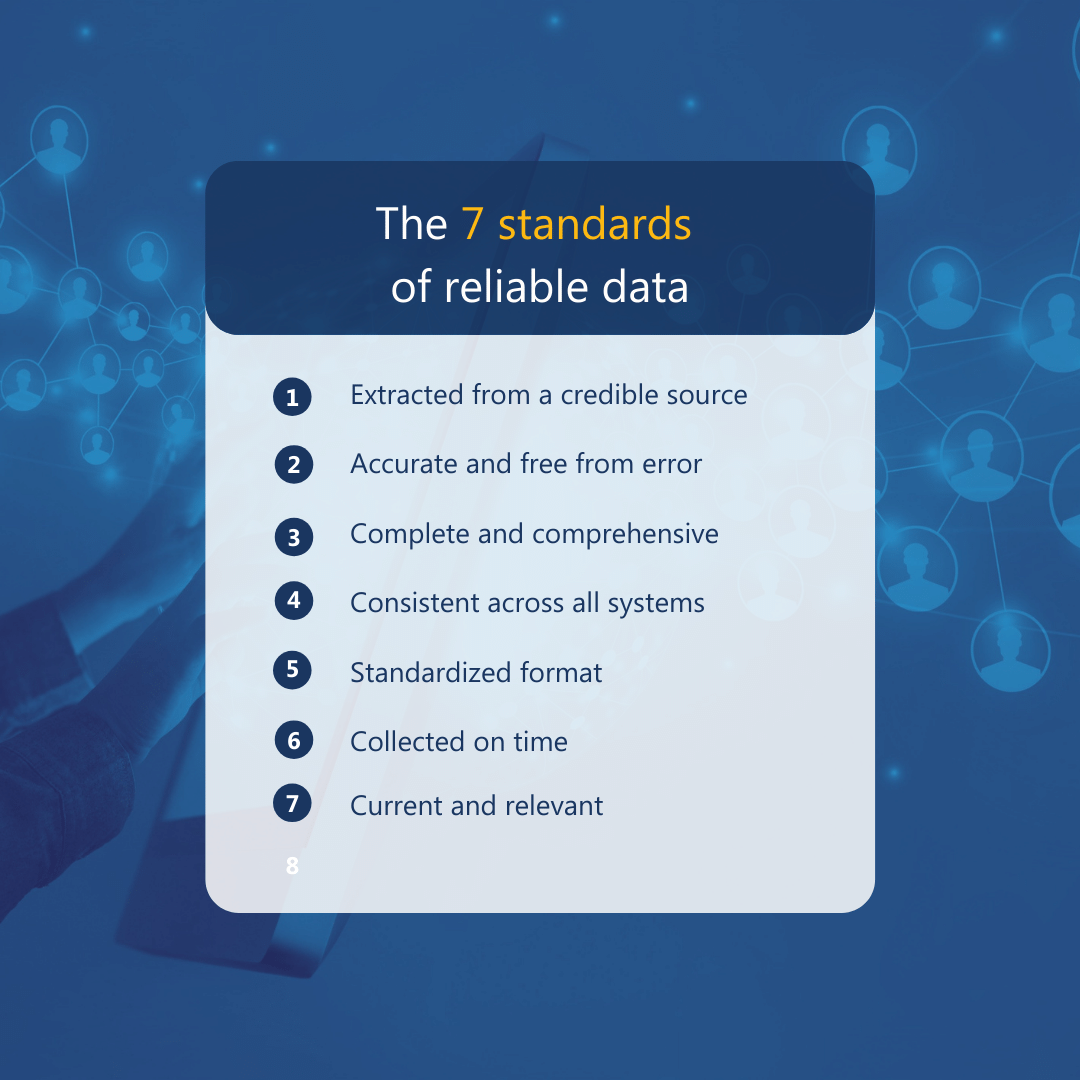

Although data management may seem like a minor issue stacked up against some of your other strategic initiatives, this is because you’ve not unleashed your data’s full potential. Taking the time to establish good data management practices will influence all future strategic decisions. Whether you’re mining churn metrics for product improvement insights or consolidating financial statements, companies should focus on the seven standards of good data management to ensure they can act on the information available.

McKinsey revealed that data-driven organizations are 23 times more likely to outperform their competitors in new customer acquisition and nine times more likely to surpass them in customer loyalty. To remain competitive, everyone will need to embrace data management practices, and the bigger your company grows, the more critical it will become. For instance, in the case of mergers and acquisitions and consolidated financial statements, it’s recommended that you follow these data management tips.

Financial transformation is about harnessing your data so that you can reduce risk and increase your return on investment. Smaller companies sometimes find the cost of transformation prohibitive, but it’s quickly becoming the cost of doing business.

2. Investors and stakeholders impose constraints that cause roadblocks

A study by Deloitte found that investors can strain resources like time and money when it comes to financial transformation. In more traditional, highly regulated industries, stakeholders and investors can be risk-averse, and the upfront costs can make it challenging to secure their support.

Convincing more traditional investors and stakeholders of the benefits will require setting expectations, predicting ROI, and painting an accurate picture of the risk of being left behind. Invest time and energy in persuading all parties. After all, it’s a process that will change how your company does business, allowing you to think and act rather than react in uncertain times.

3. Misalignment between short- and long-term goals

The pressure of immediate goals can impact how your team approaches transformation. Executives responsible for reaching shorter-term targets and whose performance is measured by achieving these goals may not see much alignment between their role and longer-term goals like financial transformation.

Drilling down to the individual level, particularly those in middle-management who you will need to spearhead your goals, will require reassessing how you measure their success and accounting for the alignment of their duties with longer-term goals. Leaders need to incentivize teams by changing key performance metrics to reflect the importance of financial transformation.

According to the Harvard Business Review, managing innovation requires a company to invest at three levels of operations: 70% to enhancing core business, 20% to expanding into adjacent businesses or markets and 10% to developing breakthrough innovations. Often, enhancements to the core business will reap results in months, but financial transformation may take anywhere from 5-10 years before companies realize all benefits. Therefore, leaders must consider the best ways to motivate executives to achieve longer-term goals and find new ways to measure overall performance.

4. Compliance standards and financial regulations constantly shifting the goalposts

As companies grow and scale operations across the globe, compliance standards and regulations can become a roadblock. Teams can worry that change will eat up valuable resources that should first focus on achieving compliance standards. Again, this is putting short-term goals ahead of long-term solutions.

Without appropriate technology, it will become impossible to manage the complexity of compliance over time. Regardless of whether or not you expect growth, regulators continue to tweak and introduce new accounting standards to govern the constantly shifting economic environment. Widespread adoption of recurring billing models and the introduction of ASC 606 to account for recurring and deferred revenues is just one example of the kinds of regulations coming into effect.

The cost of non-compliance can come as a shock to growing companies, and regulators can impose hefty fines on those failing to meet global accounting standards. A recent article broke down the actual cost of non-compliance, estimating it exceeds an average of $14 Million and covers five main areas: fines, penalties, and other fees; business disruption; revenue loss; productivity loss; and reputation damage.

5. Evolution of the workforce makes it difficult to retain appropriate talent

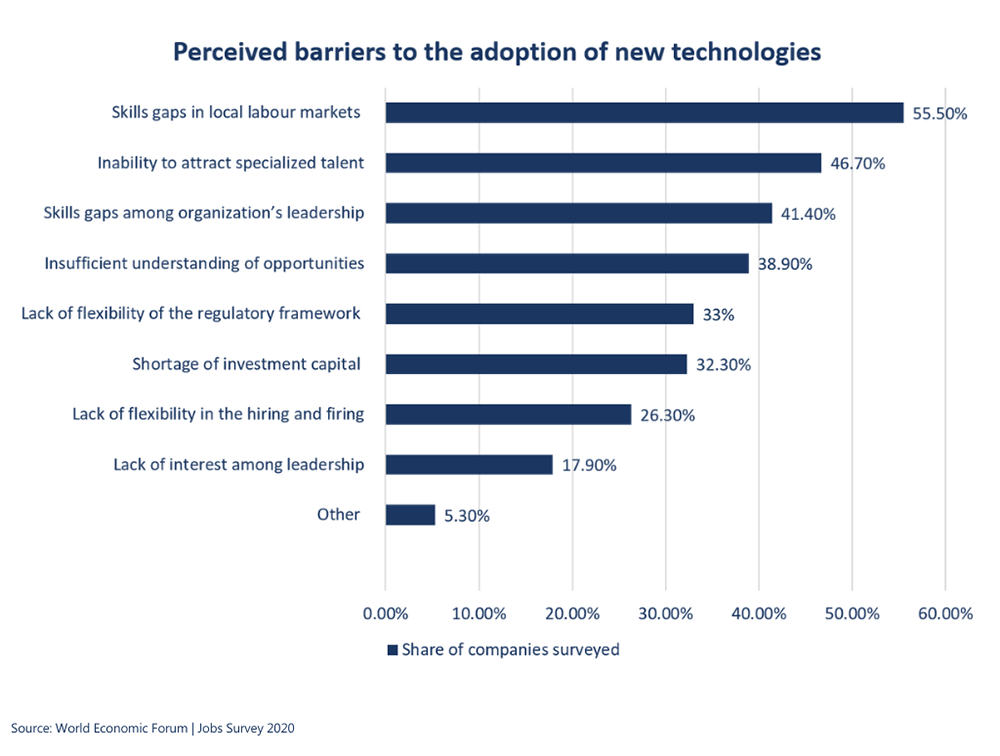

Financial transformation requires more than just technology and involves highly skilled teams with technical skills to help drive and maintain the changes. One of the main challenges being that uncertainty and change can lead to top talent leaving. That does not mean leaders should stay put in fear of losing their best employees, but it does mean that roadmaps need to include strategies for recruiting and retaining the right people to drive the changes you need. Deloitte published a helpful guide which details how best to approach retaining talent during a financial transformation.

6. Lack of agility and coordination between various departments and entities

An agile mindset is at the heart of financial transformation. Teams will need to adopt a level of agility and coordination that may not always come naturally. If legacy standards and processes are in place, it can take time and convincing to introduce coordination and agility between departments. Centralizing data helps, but it’s only part of the puzzle. The emotional impact of large-scale transformation means that a failure to communicate changes effectively can be damaging.

Teams may not have the training or experience required to adhere to new processes or handle the latest technology. In periods of high growth, companies need to bring their employees with them and equip all teams with appropriate training on agility, new processes, expectations, and comprehensive support when integrating and implementing any new technology. Effective transformation requires clear and constant communication and a map to integration that helps employees navigate the choppy waters of change

7. Clash between risk-averse mindsets and the need for innovation

Particularly in highly regulated industries like finance and healthcare, risk-averse mindsets present a significant challenge. It can be an emotional journey for those who’ve relied on always doing things a certain way.

According to Forbes, clashes can occur when teams fear being replaced by technology. It can be difficult for those bogged down in manual processes to imagine their duties when this workload is alleviated. Automation is only a scary word if people feel they will lose their jobs to technology. It’s important to communicate that humans will remain at the heart of operations and shift mindsets to understand how their roles will evolve.

Managing the clashes requires investing in change management and communications and having empathy and compassion for those transitioning. There are many ways to support change management. Within the Microsoft community, both ProSci and the ADKAR model come highly recommended.

Conclusion: communication, technology and change management core to the future of financial transformation

As you can see from the core challenges outlined above, technology is rarely the leading roadblock companies need to overcome. Leadership teams need to take a step back and present their vision to convince everyone of the benefits. Scaling operations is as much a human problem as it is a technological one, and building a roadmap to meaningful success will include accounting for both.