Compliance can be tricky at the best of times and trying to implement GASB 87 is no exception. Although deadlines have been postponed by up to 18 months due to COVID-19, organizations may still struggle to prepare in time. In this blog, we shed light on the requirements, give you a step-by-step process, and provide the critical dates and information you require.

In a hurry? Click on a topic below to jump to the section you’re looking for:

- What is GASB 87

- GASB 87 exceptions

- New effective dates for GASB 87

- Implement now regardless of postponement

- Steps to enable you to implement GASB 87

- Lease management software makes compliance easier

What is GASB 87

GASB 87 is a lease accounting standard that defines a lease as:

- “A contract that conveys control of the right to use another entity’s nonfinancial asset (the underlying asset) as specified in the contract for the period of time in an exchange or exchange-like transaction.”

- It holds that “all leases are financings of the right to use a capital asset.” As a result, all leases must be accounted for as financing leases unless they are among the exceptions (see below).

- One significant implication of this standard is how for-profit and not-for-profit entities, including state and local government. Not-for-profit hospitals and universities will follow FASB guidelines for lease accounting, whereas government hospitals and universities will follow GASB guidelines for lease accounting.

GASB statement 87 exceptions

- Intangible assets (e.g. software licenses)

- Sales with leasebacks for nominal amounts

- Arrangements with blended components

- Concession service and cost-recovery arrangements

- Leases of inventory

- Other (e.g. mining rights, biological assets)

What is the effective date of GASB 87?

Due to COVID-19, many organizations and governments experienced disruption to their operations, making it difficult to allocate the required time and resources to GASB 87 implementation. In response to appeals for postponing the implementation dates, GASB released the following dates:

“Statement No. 87, Leases, along with any related implementation guides, are postponed by 18 months until fiscal years beginning after June. 15, 2021, or fiscal year 2022 for all June and September year-ends.”

Implement GASB 87 now regardless of COVID-19 postponement

The new dates came as welcome relief for many organizations, and many decided to delay GASB 87 implementation. However, shelving the product may not be wise, compliance is complicated, and it’s better to leverage this extra time to address GASB 87 requirements. Postponing action will only mean that organizations end up back in the same situation in a few months.

Before COVID-19, organizations were already worried about meeting the demands of implementing GASB 87. The complexities and challenges inherent in the guidelines mean that the sooner organizations start the steps to implementation, the more likely they are to prove compliance.

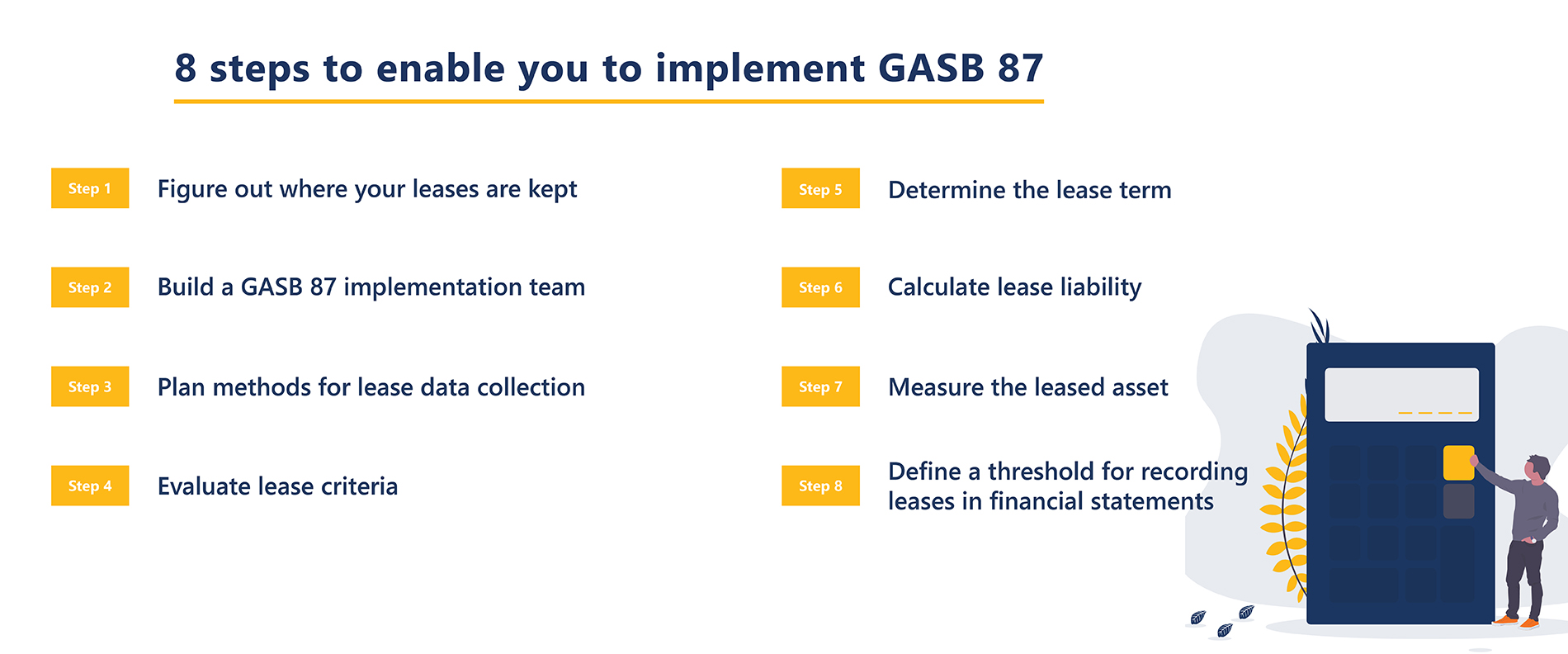

8 steps to enable you to implement GASB 87

Step 1. Figure out where your leases are kept

Particularly in larger organizations, leases may be centralized in a financial department or decentralized in many different departments (and possibly even in other entities). Before GASB 87, many of the leases you will need to identify will previously have been treated as operating leases.

It will be necessary to do a full inventory to define all leases’ locations for your organization. To do this properly, you will need to evaluate:

- The general ledger

- Any contract files

- Purchasing and operating departments

Step 2. Build a GASB 87 implementation team

It’s essential to build a team that is responsible for the successful implementation of GASB 87. It is perhaps wise to include accounting experts and legal staff on this team as they are often already familiar with compliance demands. It will be their job to assess the requirements and decide if you need additional tools or resources for long term implementation of the accounting standards. For example, the operational costs of complying with GASB 87 may mean that using lease management software will save considerable time and money.

Step 3. Plan methods for lease data collection

If your lease data is located in multiple departments or entities, compiling it will be challenging. You will need a system to store all files, but if you’re currently operating in a decentralized environment, this could be extremely challenging to achieve. It may require the translation of data from hard copy leases to digital versions, and data entry errors may occur. Another concern is the security of the lease data. As you’re dealing with financial information, your team will need to plan a method for data collection that is secure.

The best practice would be to use lease management software that automates the collection of lease data and integrates fully with your current systems. This way, you can easily access the lease data and have full visibility.

Step 4. Evaluate lease criteria

Familiarize your team with the GASB 87 guidelines and ensure everyone is familiar with the requirements and the lease exceptions. It will be essential to return to this document as you continue as it will help you evaluate which leases meet the criteria and which do not. It should be used as an ongoing resource to ensure compliance.

Step 5. Determine the lease term

GASB defines a lease term as the period during which a lessee has a noncancelable right to use an underlying asset, plus any extension periods and options that are reasonably certain to be exercised. You will need to identify the term for each of your leases to prove compliance with GASB 87.

Step 6. Calculate lease liability

GASB requires organizations to measure the lease liability based on the present value of payments expected to be paid during the lease term, including fixed payments, variable payments, lease incentives, etc. For a full list of payment types, please review the GASB 87 guidelines. It’s also best to review these guidelines for leases that involve multiple assets with different terms as this introduces increased complexity.

Step 7. Measure the leased asset

The measure of the leased asset is based on the associated lease liability. Measuring liability may not be straightforward in contracts with multiple components, as the value of underlying assets may not always be stated. Where this is the case, it may be possible to use the value of comparable assets in the market as a benchmark.

Step 8. Define the threshold for recording leases in financial statements

Although GASB provides thresholds for capital assets, it does not make the same specifications for lease obligations. It may be wise to set a threshold to avoid recording leases that are immaterial and too small to be capitalized. Some companies will use the capitalization thresholds established for their organization as a jumping-off point. Once you set a threshold, it can always be revised if you find that it excludes significant leases from being recorded.

Lease management software makes GASB 87 compliance easier

When applying GASB 87 guidelines, there are many things to be cognizant of without having to worry about the accuracy and security of your lease data. Standard accounting software simply won’t be built to handle compliance complexities, particularly for larger organizations with multiple departments or entities. Your team may want to assess lease management software solutions. Although no software can guarantee compliance, it will give you the tools to manage and streamline your leases so that compliance will require less time and resources from your team. Check out our blog on the cost of using lease accounting versus outsourcing lease administration processes for a clear picture of how software may be the best answer.