The process of retail lease administration has evolved from a support function to a strategic role. Retailers face an array of demanding challenges brought on by a volatile and uncertain market, while striving to optimize profitability and add value through lease restructuring and management. When equipped with effective tools and processes, companies can facilitate better data management to support profitable decisions for both lessors and lessees. Unfortunately, many lack the technological infrastructure to achieve these goals.

Most commercial businesses depend on legacy technology systems, which can hamper their ability to innovate and progress. In fact, 80% of retailers lack a fully modernized core system that could incorporate emerging technologies, handle complex lease restructuring, and maintain compliance with global leasing standards ASC 842, GASB 87, or IFRS 16, as well as advanced cybersecurity protocols. After a careful audit of their systems and processes, many brands determine that they require financial transformation.

This blog explores seven of the most pressing challenges facing commercial lessors and lessees, and how to address these issues with a robust lease administration solution.

Challenge 1 | Negotiating lease renewals

Lease renewals create an opportunity for lessees and lessors to negotiate for a more suitable lease agreement. Proactively engaging the other party and researching up to date comparables from the commercial real estate market can help prepare your company for a successful dialogue. Unfortunately, the process is not always so straight forward, especially if you need to negotiate multiple lease renewals. There are a host of details and deadlines to keep track of and any missteps can jeopardize your chance to improve your lease agreement.

Lease management software streamlines complex lease administration, so you can handle operating and finance leases with confidence. A centralized system stores all information in one place to allow you to stay on top of deadlines and negotiate from a proactive position. You can even automate notifications or routine time-sensitive tasks to ensure nothing slips through the cracks.

Challenge 2 | Accounting for a tenant improvement allowance

A tenant improvement allowance is a fund to pay for improvements to a leased space. These allowances often cover expenses that would provide additional value to the lessor. For example, a new lessee moves into a new property; renovations and updates like new flooring, HVAC, windows, framing, and doors would be covered. However, alterations that cater to the lessee’s specific needs or are removable are not covered by a tenant improvement allowance, such as electronic equipment, fixtures, furniture, or cabling for the Internet.

Tenant lease improvements are considered assets, and accounting for them is crucial to remaining compliant with accounting standards, especially if you’ve multiple properties. For commercial properties where renovations are typically more expensive, visibility and completion tracking are essential. Failure to adequately record and depreciate these values can be detrimental to your company’s financial health. That’s why it’s advisable to invest in property lease management software. Purpose-built software can help to eliminate data-entry mistakes and administrative bottlenecks while empowering your team with full visibility of all funds.

Challenge 3 | Accessing data efficiently and accurately

Lease administrators are often stuck navigating decentralized systems; locating spreadsheets riddled with errors due to manual data entry or wasting hours waiting for data to be emailed insecurely between teams. A problem that is only compounded when a retailer has thousands, or even millions, of data points about their stores, store locations, and leases from all over the world. Without the capability to adequately house that information, extracting relevant and accurate data is made nearly impossible.

With lease, deal, and comparables available in a centralized system, you can better evaluate available opportunities and make data-driven decisions. Comprehensive lease management enables both lessees and lessors to improve risk management, optimize profitability, and effectively evaluate liabilities. The high level of visibility afforded by modern technology could mean the difference between setting up in a prime business district and attracting the talent you want or being eclipsed by your competitors.

Challenge 4 | Establishing clear lines of communication

As a company scales its properties, it can become daunting to keep track of all vendors, brokers, and contracts. Not to mention coordinate multiple departments and teams within your organization. Relying on an ad-hoc system of emails, spreadsheets, and physical documents can lead to miscommunications and missed deadlines due to bottlenecks.

When everyone can access and collaborate on contracts within the same platform, the extended real estate team can establish clear lines of communication and work on projects in real time. Lease management software reduces the amount of time spent administrating, so your team is freed up to focus on building relationships with vendors and brokers while maintaining enough visibility to leverage opportunities as they arise.

Challenge 5 | Handling co-tenancy clauses

A co-tenancy clause provides lessees with some measure of protection by allowing lessees to reduce their rent if key lessees or a certain number of lessees leave the retail space. Malls, shopping centres, and strip mall owners frequently encounter co-tenancy clauses; however, these are trickier to manage these days with unprecedented impacts on the brick-and-mortar retail experience.

To avoid breaching co-tenancy clauses and accommodating concessions, lessors must be able to coherently restructure existing leases and utilize force majeure clauses. In other words, all parties need access to accurate and up-to-date granular data. Robust lease administration smooths the path for lessors and lessees to find a creative and viable solution to disruptions and unforeseen circumstances. Complete visibility into existing portfolios enhanced with real-time analytics is an essential component of this process.

Challenge 6 | Managing complex lease structures

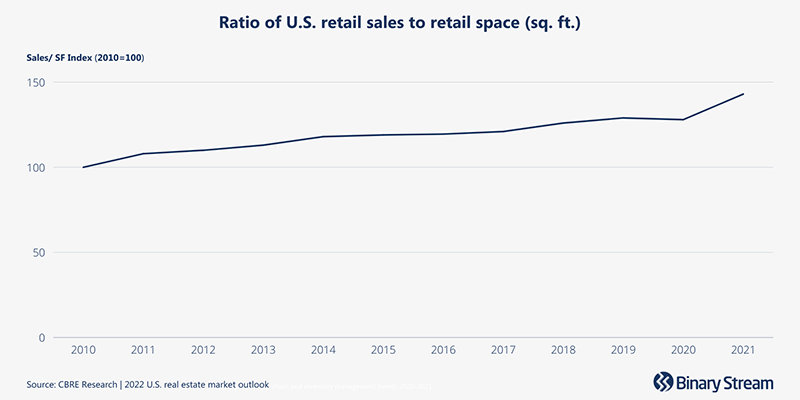

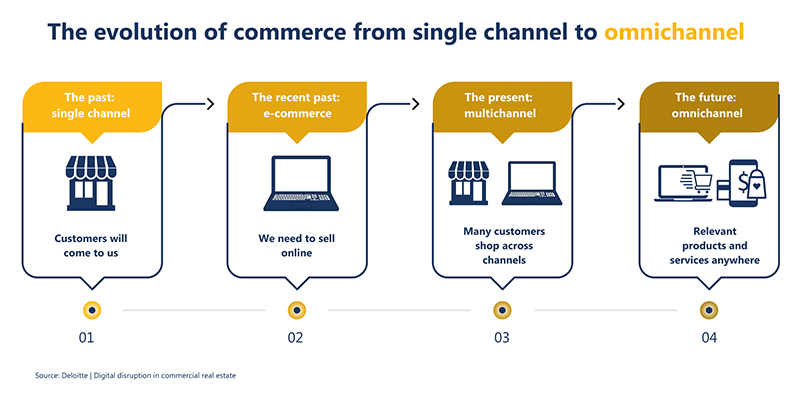

By 2023, it’s estimated that over 300 million US shoppers will be doing their purchasing online. However, 55% of shoppers visit a retail store before purchasing online, and only 10% of US consumer spending is done online. The trajectory of online shopping and its relationship to brick-and-mortar stores is introducing a host of new store concepts.

Some retailers are expanding their online presence and right sizing their locations, while some online-only retailers are seeking in-person store placement to better compete with existing products and create a space for face-to-face interaction with their customers. Some retailers are even experimenting with miniature, in-store concepts by leasing small areas of large footprint stores or trying out pop-up shops.

Adapting to consumer trends necessitates you provide subleasing and dynamic leasing options. As retailers embrace online shopping and omnichannel commerce, lessors must seek out unique ways to lease out their spaces. Unconventional lessees, mixed-use spaces, and subleases for online retailers are just a few emerging practices lessors need to understand to stay competitive in the market.

Challenge 7 | Maintaining regulatory compliance

It can be difficult to maintain compliance under new lease structures and ever-changing accounting standards. Regardless of which standards your company needs to comply with (ASC 842, GASB 87, or IFRS 16), lease management software reduces risks your company faces and streamlines the process of proving compliance. Your team can save weeks (and sometimes even months) that would otherwise be spent double-checking entries and accounting for errors.

Introducing Property Lease Management

A robust lease management solution is an essential tool for modern retailers. Property Lease Management is a complete solution for property, plant, and equipment lease management with all the flexibility needed to suit your unique business model. It enables you to digitalize your lease portfolio, manage lease revenue and expenses, as well as handle complex charges and reconciliation. It’s available as an extension directly embedded into Microsoft Dynamics 365 Finance and Operations, Business Central, and GP.